Quantum Machine Learning for FinTech and Time Series Data

Quantum Neural Networks for FinTech Time Series Function Fitting

This repository is for developing quantum neural network models for fitting one-dimensional time series data and noisy signals. It is modified from the model presented in PennyLane Function fitting with a quantum neural network. We modify the code presented in the default notebook downloaded from PennyLane so that it works using synthetic data created by the user, and we train a model on several years worth of drug sales data.

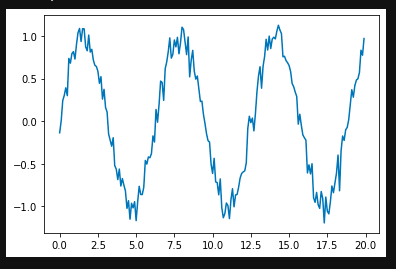

In this very basic setup, there were only 4-layers in the quantum neural network, initialized with random weights. The model went through 50 iterations and had the following training data:

Iter: 1 | Cost: 0.4366430

Iter: 2 | Cost: 0.4130995

Iter: 3 | Cost: 0.4401763

Iter: 4 | Cost: 0.4843044

Iter: 5 | Cost: 0.5272264

Iter: 6 | Cost: 0.5590949

Iter: 7 | Cost: 0.5756194

Iter: 8 | Cost: 0.5762956

Iter: 9 | Cost: 0.5631025

Iter: 10 | Cost: 0.5394853

Iter: 11 | Cost: 0.5095363

Iter: 12 | Cost: 0.4773198

Iter: 13 | Cost: 0.4463337

Iter: 14 | Cost: 0.4191397

Iter: 15 | Cost: 0.3972019

Iter: 16 | Cost: 0.3809405

Iter: 17 | Cost: 0.3699549

Iter: 18 | Cost: 0.3633300

Iter: 19 | Cost: 0.3599337

Iter: 20 | Cost: 0.3586456

Iter: 21 | Cost: 0.3584964

Iter: 22 | Cost: 0.3587285

Iter: 23 | Cost: 0.3588033

Iter: 24 | Cost: 0.3583769

Iter: 25 | Cost: 0.3572647

Iter: 26 | Cost: 0.3554029

Iter: 27 | Cost: 0.3528146

Iter: 28 | Cost: 0.3495813

Iter: 29 | Cost: 0.3458197

Iter: 30 | Cost: 0.3416648

Iter: 31 | Cost: 0.3372562

Iter: 32 | Cost: 0.3327294

Iter: 33 | Cost: 0.3282081

Iter: 34 | Cost: 0.3238007

Iter: 35 | Cost: 0.3195972

Iter: 36 | Cost: 0.3156676

Iter: 37 | Cost: 0.3120615

Iter: 38 | Cost: 0.3088088

Iter: 39 | Cost: 0.3059200

Iter: 40 | Cost: 0.3033888

Iter: 41 | Cost: 0.3011936

Iter: 42 | Cost: 0.2993004

Iter: 43 | Cost: 0.2976666

Iter: 44 | Cost: 0.2962437

Iter: 45 | Cost: 0.2949811

Iter: 46 | Cost: 0.2938298

Iter: 47 | Cost: 0.2927447

Iter: 48 | Cost: 0.2916878

Iter: 49 | Cost: 0.2906292

Iter: 50 | Cost: 0.2895481

Iter: 51 | Cost: 0.2884328

Iter: 52 | Cost: 0.2872799

Iter: 53 | Cost: 0.2860931

Iter: 54 | Cost: 0.2848812

Iter: 55 | Cost: 0.2836566

Iter: 56 | Cost: 0.2824333

Iter: 57 | Cost: 0.2812253

Iter: 58 | Cost: 0.2800452

Iter: 59 | Cost: 0.2789039

Iter: 60 | Cost: 0.2778094

Iter: 61 | Cost: 0.2767668

Iter: 62 | Cost: 0.2757787

Iter: 63 | Cost: 0.2748451

Iter: 64 | Cost: 0.2739643

Iter: 65 | Cost: 0.2731328

Iter: 66 | Cost: 0.2723465

Iter: 67 | Cost: 0.2716004

Iter: 68 | Cost: 0.2708895

Iter: 69 | Cost: 0.2702092

Iter: 70 | Cost: 0.2695549

Iter: 71 | Cost: 0.2689228

Iter: 72 | Cost: 0.2683099

Iter: 73 | Cost: 0.2677134

Iter: 74 | Cost: 0.2671316

Iter: 75 | Cost: 0.2665631

Iter: 76 | Cost: 0.2660070

Iter: 77 | Cost: 0.2654630

Iter: 78 | Cost: 0.2649310

Iter: 79 | Cost: 0.2644110

Iter: 80 | Cost: 0.2639034

Iter: 81 | Cost: 0.2634083

Iter: 82 | Cost: 0.2629260

Iter: 83 | Cost: 0.2624569

Iter: 84 | Cost: 0.2620009

Iter: 85 | Cost: 0.2615582

Iter: 86 | Cost: 0.2611285

Iter: 87 | Cost: 0.2607117

Iter: 88 | Cost: 0.2603074

Iter: 89 | Cost: 0.2599152

Iter: 90 | Cost: 0.2595346

Iter: 91 | Cost: 0.2591651

Iter: 92 | Cost: 0.2588059

Iter: 93 | Cost: 0.2584567

Iter: 94 | Cost: 0.2581168

Iter: 95 | Cost: 0.2577857

Iter: 96 | Cost: 0.2574629

Iter: 97 | Cost: 0.2571479

Iter: 98 | Cost: 0.2568405

Iter: 99 | Cost: 0.2565402

Iter: 100 | Cost: 0.2562468

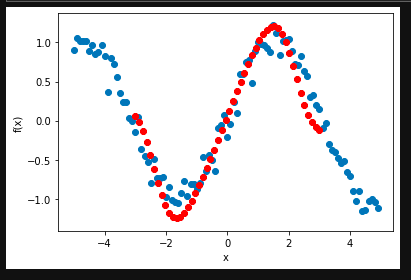

After training the quantum neural network learns to smooth the noisy sine function as can be seen in the red plots:

This example illustrates an implementation of optical quantum computing and training an optical based quantum neural network. For more information on photonic quantum computing see the Strawberry Fields documentation. Strawberry Fields is a full-stack library for design, simulation, optimization, and quantum machine learning of continuous-variable circuits that is fully integrated into PennyLane. For more information on more general quantum nodes, see the PennyLane documentation.

In later examples of applications of quantum machine learning to FinTech, we will also be investigating quantum walks. Quantum walks are a quantum analogue to random walks and have substantially reduced the time-consumption in Monte Carlo simulations for mixing of Markov chains as reported by Ashley Montanaro (2015). These quantum algorithms are applied for investment strategies in wealth management and trading.