This repository uses time-series data from the S&P 500 to train a RandomForestClassifier to predict the probability of a stock price increasing or decreasing.

We will use the Yahoo Finance API to get historical data for the S&P500 (^GSPC). Yahoo Finance offers an excellent range of market data on stocks, bonds, currencies, and cryptocurrencies. It also provides news reports with various insights into different markets from around the world

We will use the Yahoo Finance API to get historical data for the S&P500 (^GSPC). Yahoo Finance offers an excellent range of market data on stocks, bonds, currencies, and cryptocurrencies. It also provides news reports with various insights into different markets from around the world

$ pip install yfinance

import yfinance as yf

sp500 = yf.Ticker("^GSPC")

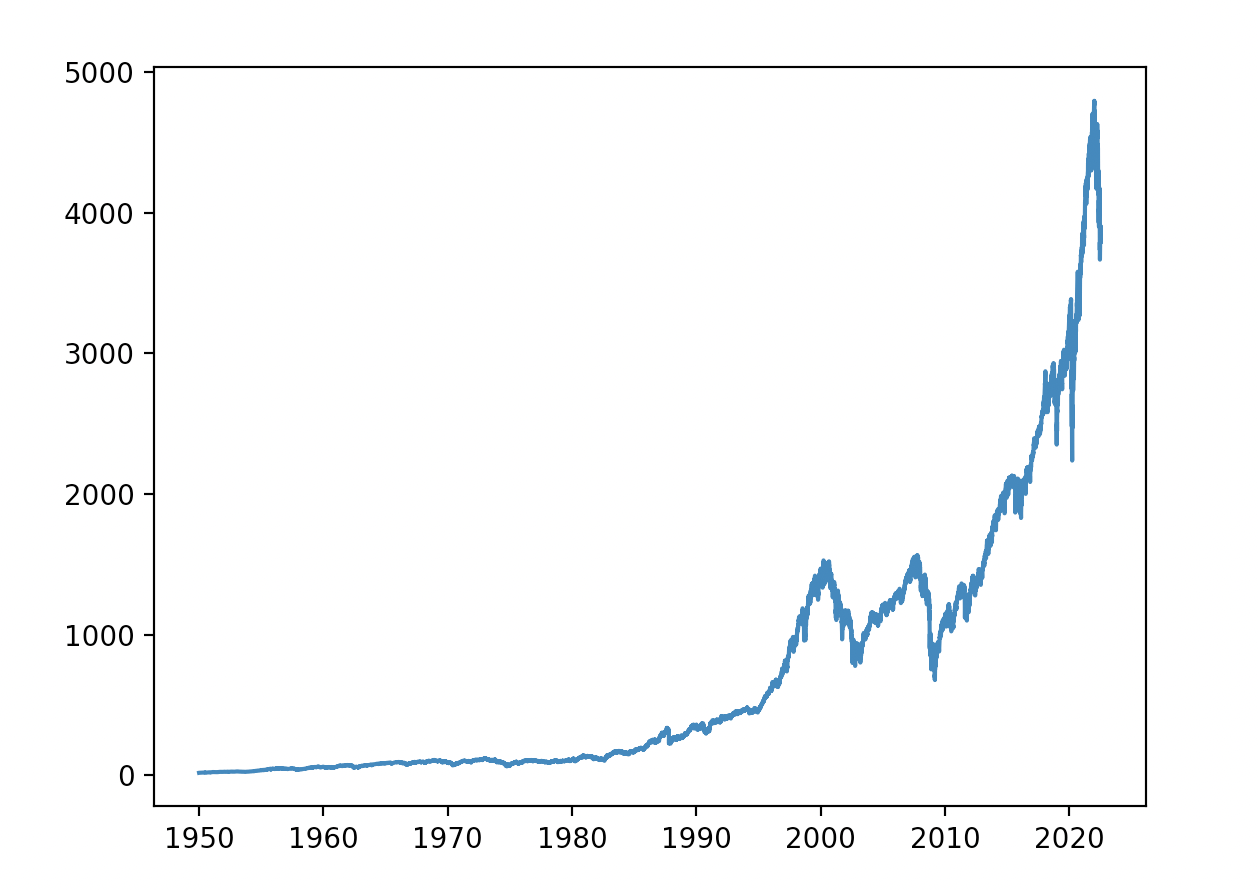

sp500 = sp500.history(period="max")$ pip install matplotlib

import matplotlib.pyplot as pltplt.plot(sp500.index, sp500["Close"])

plt.show()sp500["Tomorrow"] = sp500["Close"].shift(-1)

sp500["Target"] = (sp500["Tomorrow"] > sp500["Close"]).astype(int)

sp500 = sp500.loc["1990-01-01":].copy()$ pip install sklearn

from sklearn.ensemble import RandomForestClassifier

from sklearn.metrics import precision_scoremodel = RandomForestClassifier(n_estimators=200, min_samples_split=50, random_state=1)