# Code runs on python 3 or up

# Install required packages

pip install -r requirements.txt

#run the following file to create sqlite3 database and populate it with required data

#database file already added in project, ignore following file to run app directly

python3 processdata.py

# Visualize date

python3 app.py

-

Section 1: Read data from yfinance api: refer to get_historical_info_single in dataprep.py

-

Section 2: Extract, Load and Transform Data

- processdata.py handels all ETL process needed to load, transform and extract data to database.db (SQLite3 Database we will be using for the rest of the process)

-

Section 3:

- Calculate daily value for index, refer to create_daily_index_open_close function in dataprep.py

- Weighted Sector view for given date, refer to function return_sector_open_close_volume in apphelper.py

-

Section 4 Visualize: Run app.py to run Dash Application

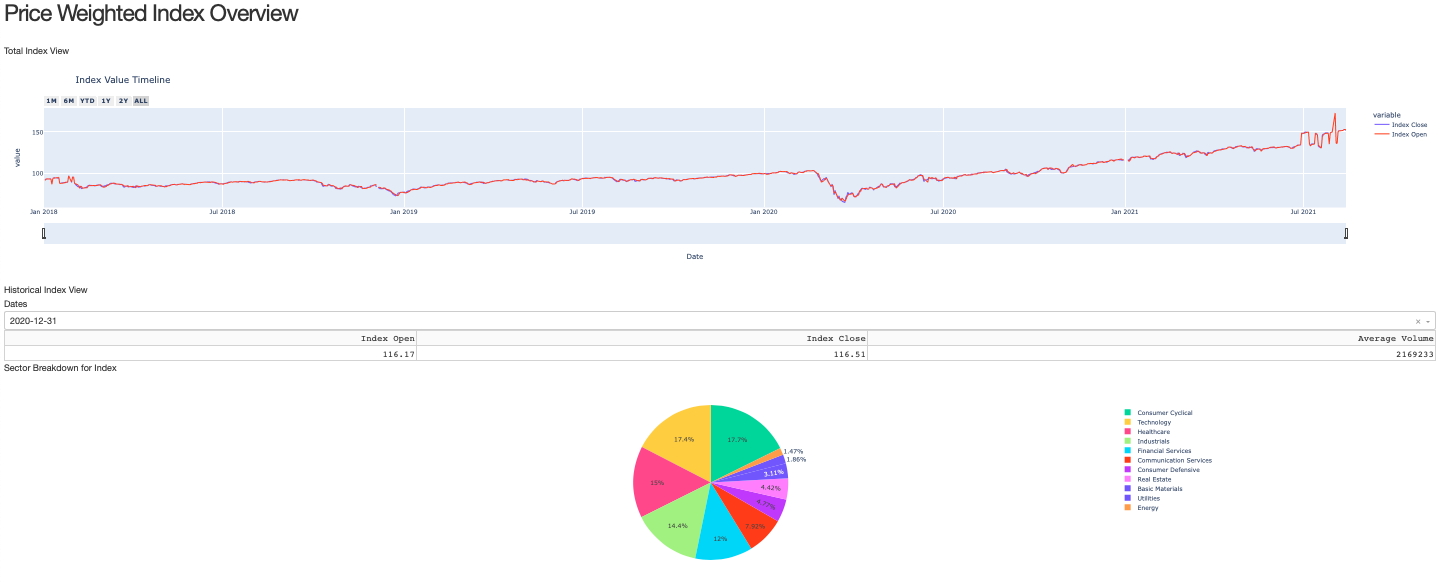

- App supports following visulization: Total index view from 2018 - August 2021, Given input date, sector distribution on relative weight basis

-

dbutils.py: Database utility function to query and write against database. Current code hardcodes database location in class, should be modified to pass another location

-

dataprep.py: Utility functions used to clean up data. Methods included:

- getting historical pricing data from yfinance api [Extract]

- processing historical pricing information for given ticker to preserver required information [Transform]

- Function to create required tables in database with appropriate schema [Load]

- Wrapper class to process and write data to database [ETL]

- Function to populate database with index value calculation [Load]

-

apphelper.py: Utility functions used to query data from database and pass information to app server for display. Contains the following queries:

- get_index_open_close: return the price weighted value of index open and close for input date

- return_sector_open_close_volume: returns the percent weight of a sector contributing to the total index value for open and close on the given date, along with sector wise average volume

- get_total_index: returns close value of index across all the dates present in the database

- ticker_info: Table to store attributes relating to a given ticker

| Column | Datatype | Constraint |

|---|---|---|

| ticker | text | Primary Key |

| isin | text | Primary Key |

| sector | text | |

| company_name | text |

- historical_price: Table to store historical price of tickers starting 2018-present

| Column | Datatype | Constraint |

|---|---|---|

| ticker | text | Primary Key |

| date | text | Primary Key |

| open | real | |

| close | real | |

| volume | real |

- index_value: Table to store calculated historical index open and close

| Column | Datatype | Constraint |

|---|---|---|

| date | text | Primary Key |

| index_open | real | |

| index_close | real |

In order to check if constituents_history.pkl contains stock tickers, we use company_ticker.json file available at https://www.sec.gov/files/company_tickers.json. This file contains all companies traded on the US stock exchange along with their company names and tickers.

Delisted Tickers: RHT, TIF, CXO, GWR, PE, ZAYO, LOXO, ELLI, USG, TCF, CLGX, CMD, CTB

- Since we do not have visiblity into index constituents for a given day, all valid tickers present in original file are assumed to make up the index (Price weighted Total stock index from the universe of all valid stocks)