Copyright (c) 2019, Digital Asset (Switzerland) GmbH and/or its affiliates. All rights reserved.

SPDX-License-Identifier: Apache-2.0

This library has been superseded by an updated Daml Finance library.

You can read more about it on Digital Asset's website or jump straight into the code.

The new library is built on Daml interfaces, which improves composability and facilitates contract upgrades. Moreover, it offers additional features such as a powerful instrument modeling framework.

The FinLib is a collection of pure functions, DAML templates and triggers that can be used as building blocks to speed up application development and to increase code reuse, standardisation and compatibility across solutions.

Currently, it contains code for:

Additional functionality will be added over time based on user feedback and demand. Thanks to its modular design, it's straightforward to use all the workflows of the FinLib or to selectively replace certain steps depending on the requirements of the solution.

This Readme provides a conceptual overview of the FinLib. The individual contracts, fields and choices are described in the more detailed model reference documentation. Corresponding triggers are described in the trigger reference documentation.

- DAML SDK to work with the DAML code

Digital Asset is working on adding a DAML package management system to the DAML SDK. This will allow to reference the FinLib package from a a project and to import FinLib modules as usual, for example:

import DA.Finance.Fact.Asset

In the meantime, a pragmatic way to use the FinLib is to copy its source code into a project.

The FinLib addresses data with the following versioned identifier that is backed by a set of signatories:

data Id = Id

with

signatories : Set Party

label : Text

version : Int

deriving (Eq, Show)

The signatories are the parties that need to sign a contract with this id

and that are responsible to ensure uniqueness of the label. The version

allows to model multiple revisions of the same contract.

Using a set of signatories allows the FinLib to support various trust models.

For example, an AssetDeposit might be signed by (i) both the provider and

the owner, (ii) just the provider or (iii) a third party agent. All approaches

are valid depending on the desired level of trust between participants or the

required flexibility to force upgrades.

The AssetDeposit represents a deposit of a generic, fungible asset in an account.

The account.id and asset.id fields can be used to link the contract to other contracts

that provide further information such as the type of the asset or reference data for it.

This allows new asset classes to be added without having to modify business processes that

operate on generic asset deposits.

A deposit is allocated to an account and backed by the account.id.signatories. The

deposited asset is specified by the asset.id. The asset.id.signatories are

the parties that publish reference data for the asset and hence define what

it is and how it can be lifecycled.

The AssetDeposit is fungible by design as it includes the choices how to Split a single

deposit into multiple and Merge multiple deposits into a single one.

Note that the library does not model positions. Positions can be derived e.g. client side by aggregating all asset deposits or a trigger that periodically updates a position contract by looking at all asset deposits.

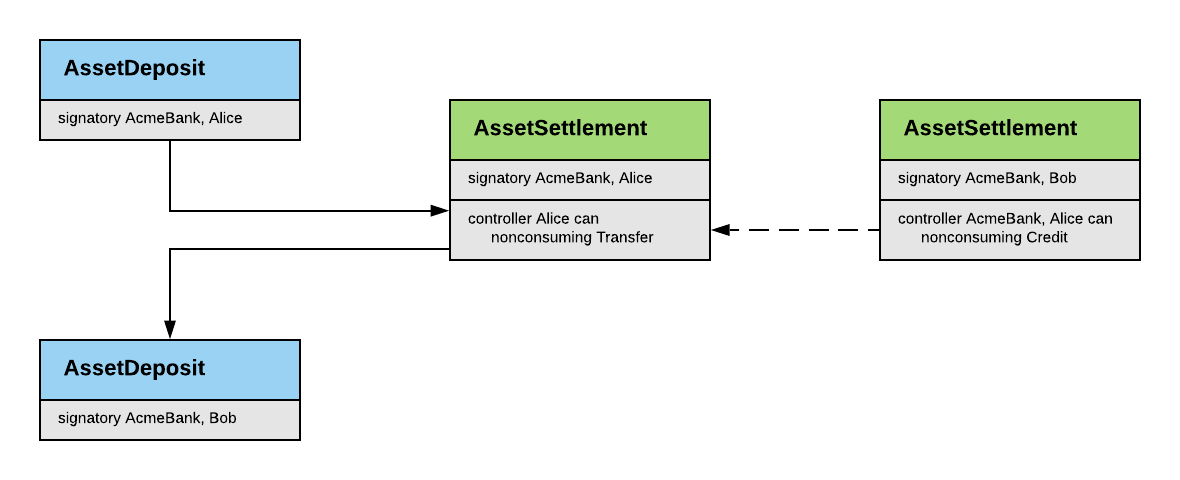

The AssetSettlement template allows to transfer AssetDeposits from one account

to another by consuming a deposit and then crediting the asset to the receiver`s

account. This requires that the sender is allowed to Credit in the receiver's

account through his AssetSettlement contract.

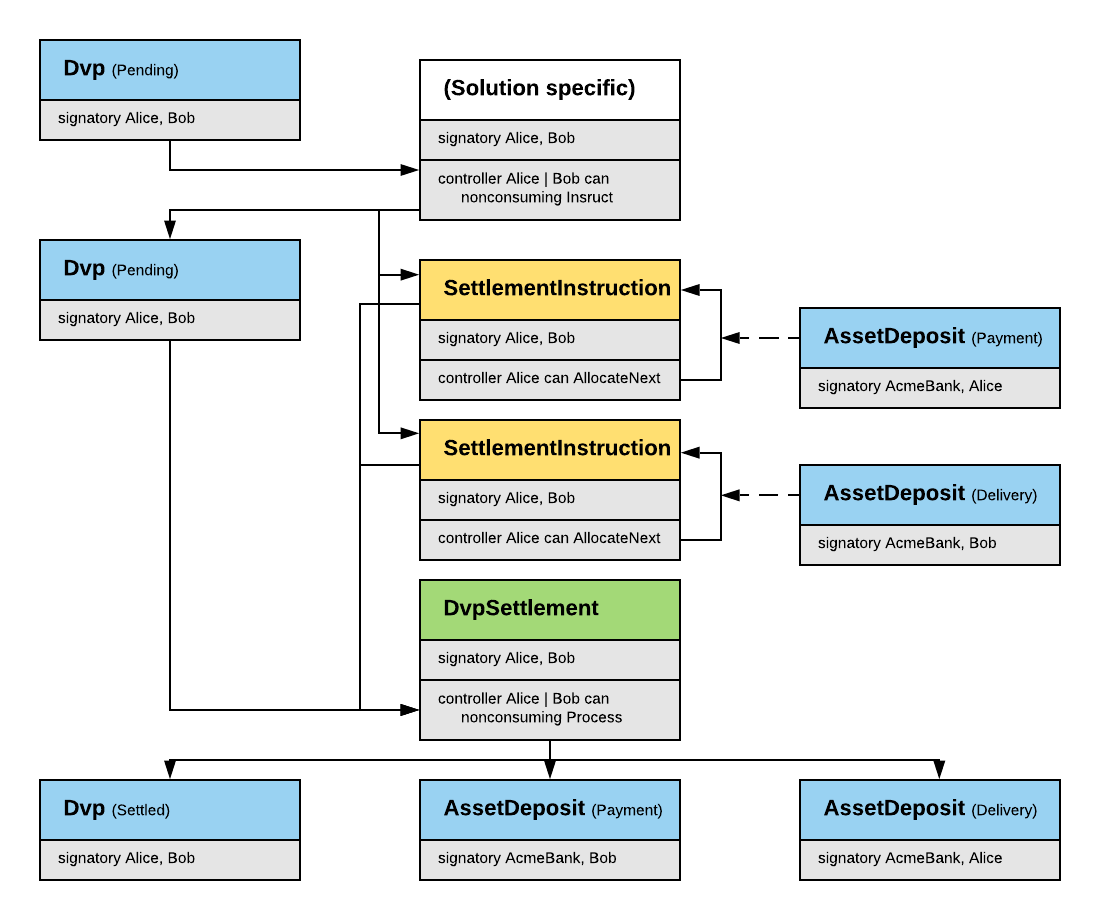

The Dvp is a trade that represents an obligation to exchange the payment assets

against the delivery assets at the agreed settlement date. A trade is allocated to

a master agreement and backed by masterAgreement.id.signatories. Depending on the

desired trust model this might be both counterparties or a third party agent.

Trades in general need to be settled. As part of instructing a trade a set of

SettlementInstructions should be created. The library does not include the logic

of how a DvP gets instructed because the process is often very bespoke to the

given use case.

Parties need to allocate deposits to SettlementInstructions. In

the easy case where both counterparties have an account with the same provider a

direct transfer from the sender to the receiver is possible, i.e. a single step

need to be specified. The SettlementInstruction can also handle more complex use

cases where assets are atomically transferred up and down an account hierarchy.

In these cases multiple steps corresponding to the hierarchy are required.

The trigger package includes an AllocationRule template that helps to allocate

deposits to settlement instructions and a trigger that eagerly allocates deposits.

The DvpSettlement template allows to settle a DvP by providing fully allocated

settlement instructions for each payment and delivery obligation.

The trigger package again includes a trigger that settles fully allocated DvPs.

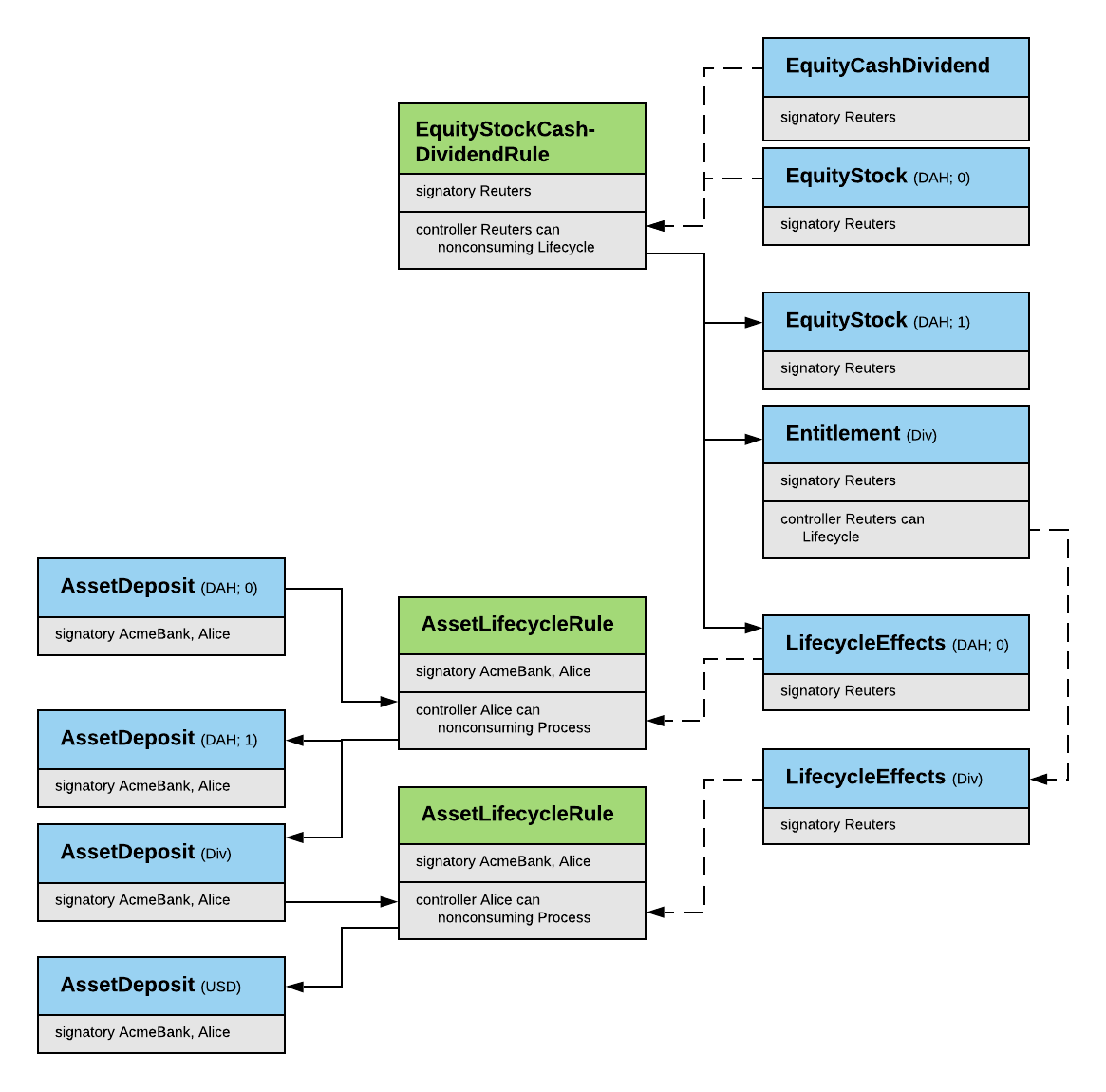

Similar like there is a generic asset deposit that can hold any asset, there

is a generic LifecycleEffects template storing the details of an asset's lifecycle

event by defining the outcome, i.e the effects. This avoids dealing with any type

of corporate action in the AssetLifecycle and DvpLifecycle rules. Those rules are

used to lifecycle AssetDeposits and DvPs based on LifecycleEffects contracts only.

Triggers are available to automate the process.

Details of corporate actions are captured in reference data contracts with the same

version number as the asset to which it applies, for example an EquityCashDividend.

The reference data provider can use such a specific reference data contract to create

the generic LifecycleEffects contract.

DA.Finance.Base includes a set of pure functions to deal with dates, holiday calendars, and schedules. See the reference documentation for all available functions.