This is a simple implementation of an oracle written in Solidity and JavaScript. There are two contracts, the Caller and the EthPriceOracle. There is a backend service hitting the Binance API for the current ETH/USD price and submitting that to the EthPriceOracle. The oracle contract then sets the price onchain and invokes the callback method from Caller, which handles the request queue.

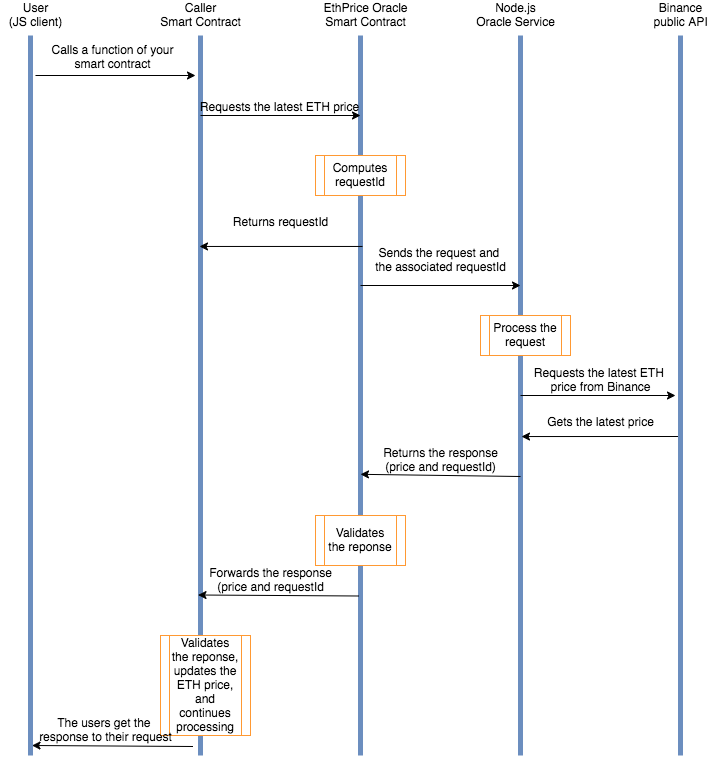

Requests to get the ETH price in USD is handled via the Caller contract. This maps all incoming requests to particular request IDs and processes them accordingly, ensuring that requests are tracked across both contracts.

The client sends an onchain request on an interval, and the backend service processes the requests in batches within a queue on an interval. This enables continual pinging of the Binance API and updating the value of ETH in USD onchain to stay in sync per this interval.

Here is a simple workflow for this oracle design for each client request:

You can read more about the Basic Request Model at the Chainlink docs.

The project are two truffle projects (one for each contract), with a backend and frontend in Node/JS. To run both the client and the server. Available commands are:

Install dependencies

npm i

Compile and deploy both contracts to the Loom network.

npm run deploy:all

_Note: the private keys are meaningless and generated via the loom-js package. You can choose to use new keys by running the following:

npm run keygen

Run both the client and the server, which will start pinging the caller contract for the current price every interval and process the queue accordingly, calling multiple oracles, computing the average price, and returning it to the client.