my Retirement calculator in JQuery and Bootstrap

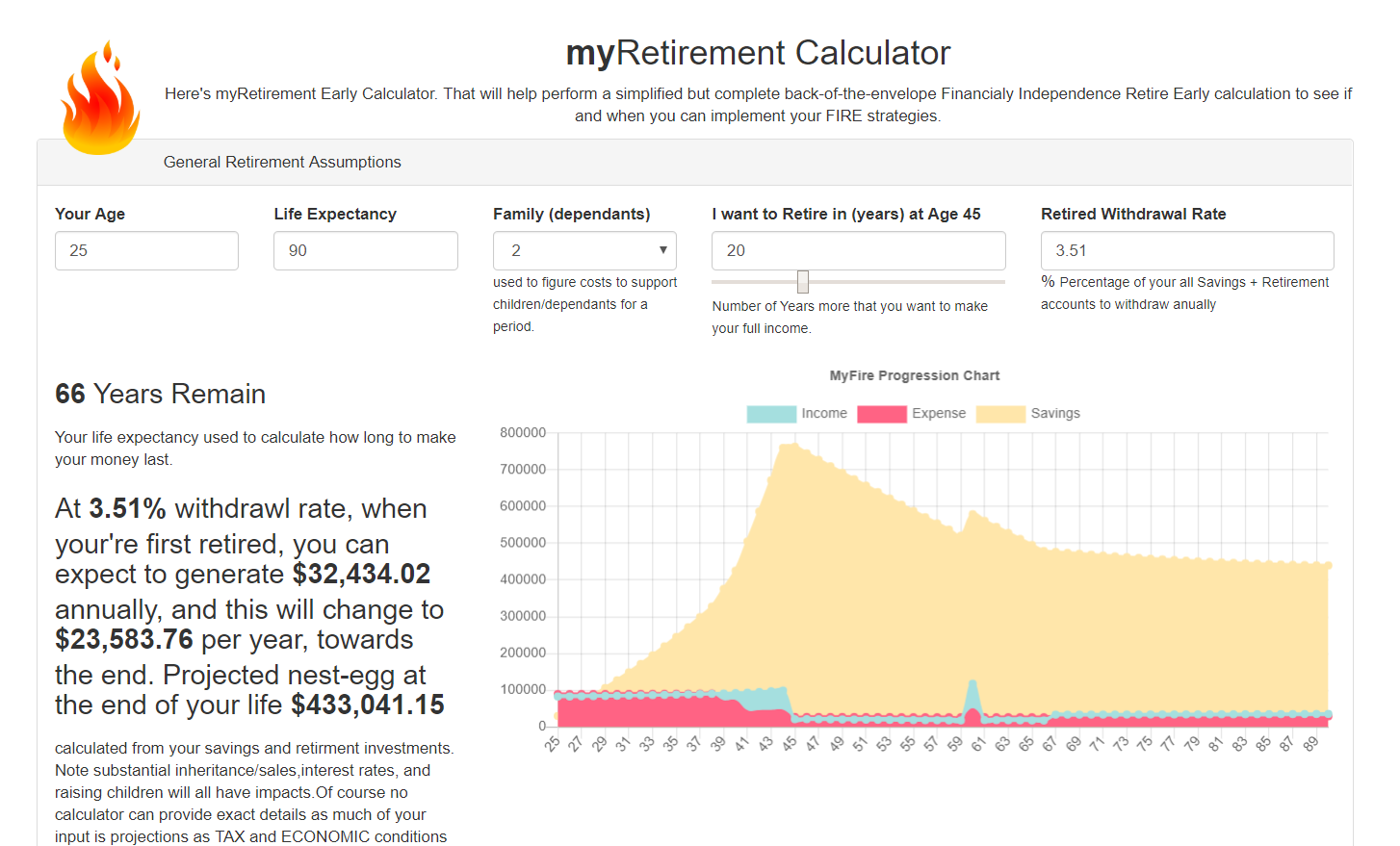

I decided to create a modern, easy to use and practical on-line retirement calculator, and I open-sourced it too! This retirement calculator comes from the FIRE ( Financially Independent Retire Early) perspective , where you're goal is to save as much as possible , then after a certain number of years, you can retire and live off your savings and investments. I tried to take into account all the major factors affecting your earning and retirement years, incomes, savings, retirement, kids, housing, healthcare, taxes , inflation etc..

I decided to create a modern, easy to use and practical on-line retirement calculator, and I open-sourced it too! This retirement calculator comes from the FIRE ( Financially Independent Retire Early) perspective , where you're goal is to save as much as possible , then after a certain number of years, you can retire and live off your savings and investments. I tried to take into account all the major factors affecting your earning and retirement years, incomes, savings, retirement, kids, housing, healthcare, taxes , inflation etc..

- Complete detailed description here: http://www.abrandao.com/2019/04/retirement-calculator/

- Like what you see? 👍 share the love with some **git stars ⭐ **

Demo

- Link to Live calculator : http://www.abrandao.com/retire

Getting Started

Clone this repo .. or just download the source code to the index.html file. All the calculation logic is located there..

- this repository, mainly the index.html file

- knowledge of HTML5, very basic understanding Jquery and some understanding of Bootstrap CSS/HTML

Web Technology choices...

This calculator runs entirely in your’re web browser, its uses the following web technologies.

- Jquery

- Bootstrap (Css/HTML/layout)

- ChartJS (Charting)

Keeping it simple , yet at the same time modern looking and attractive.

I choose to keep the technologies as simple as possible. I’m aware some techies and web developers may pooh-pooh these simplistic technologies, and why didn’t I write this in Angular or React or VueJs (btw I would have chosen VUE.js ) ?, but my rationale was that because I wanted to make this as accessible and easily modifiable by other folks, I wanted to give the broadest possible access to anyone , even those who aren’t super-technical can just go to my Github clone the page, and begin making edits to the calculation model easy-peasy..

I also used external CDN links to the above supporting libraries, and keep the entire code in one index.html page, again trying to keep everything self-contained and compact. See details below.

Dependencies

This is a single web-page calculator with minimal dependencies. All the calculation code is contained in the index.html file. All the depedencies are supplied via links to CDN .

The following links are required

- BootStrap · The most popular HTML, CSS, and JS library in the world .

- Jquery. jQuery is a fast, small, and feature-rich JavaScript library.

- Chart.js Simple yet flexible JavaScript charting for designers & developers

Inside the tag

<!-- Latest compiled and minified CSS -->

<link rel="stylesheet" href="https://maxcdn.bootstrapcdn.com/bootstrap/3.3.7/css/bootstrap.min.css" integrity="sha384-BVYiiSIFeK1dGmJRAkycuHAHRg32OmUcww7on3RYdg4Va+PmSTsz/K68vbdEjh4u" crossorigin="anonymous">Then the corresponding JQuery and ChartJS links be sure to reference Jquery library

<!-- jQuery library -->

<script src="https://ajax.googleapis.com/ajax/libs/jquery/3.3.1/jquery.min.js"></script>

<!-- then Bootstrap JS -->

<script src="https://maxcdn.bootstrapcdn.com/bootstrap/3.3.7/js/bootstrap.min.js" integrity="sha384-Tc5IQib027qvyjSMfHjOMaLkfuWVxZxUPnCJA7l2mCWNIpG9mGCD8wGNIcPD7Txa" crossorigin="anonymous"></script>

<!-- Charting ChartJS.com from CDN -->

<script src="https://cdn.jsdelivr.net/npm/chart.js@2.8.0"></script>You can of course download the dependencie files and modify the above src links to point all to your local folders.

Installing

Just clone this repository and open index.html in your web browser. For off line use , modify the src for dependencies listed above.

Calculation Model Approach

Essentially all your Income and SAVINGS are added up during the years, your working (working income) , and savings+retirement accounts + other income over the course of your lifetime. Then these various forms of income are calculated against entered Annual Percentage Yield to give your annual compound interest growth. Here’s a sample of the calculation code for this section:

for (i = 1 ; i < years+1; i++) {

var ai = {} ; //define a Income blank object

var exp={} ; //define an Expense object

//create an Annual Income object

ai.i=(i);

ai.age=(+i + +currentAge);

ai.income_earned= ( i <= work_years ) ? parseInt( $("#income").val() ) : 0 ;

ai.income_saved = ( i <= work_years ) ? $("#income").val() * parseFloat( $("#income_savings_rate").val()/100 ) : 0 ;

ai.savings= parseFloat( $("#savings").val() ) ;

ai.savings_Int= +$("#savings").val()* parseFloat ( $("#savings_apy").val()/100 );

ai.retirement=parseFloat( $("#retirement").val() ) ;

ai.retirement_Int= parseInt( $("#retirement").val() ) * parseFloat( $("#retirement_apy").val()/100 ) ;

ai.one_time=(ai.age==inheritance_age) ? parseInt( $("#income_inheritance").val() ) : 0 ;

ai.rents= parseFloat( $("#income_realestate_rentals").val() ) ;

ai.pension=(ai.age>= ssn_year_eligible ) ? parseFloat( $("#income_pension").val() ) : 0 ;

ai.misc= parseFloat( $("#income_misc").val() ) ;

ai.ssn= ( ai.age >= ssn_year_eligible ) ? parseFloat( $("#income_ss").val() ) : 0 ;On the other side we have your EXPENSES . Expenses are more linear over your lifetime, income taxes are calculated based on 2018-2019 tax bracket, and applied to against your annual income. Housing expenses have a term if you’re a home owner, with a separate field for perpetual costs like property taxes, insurance, maintenance etc. The number of dependents count as an expense, based on current pricing models of how much it costs to raise a child to 18. The other expense are pretty self-explanatory, adjust the default values to better suit your particular circumstances.

Once we have all that information we calculate your INCOME – EXPENSES we get a yearly surplus (or deficit), which we will apply to your SAVINGS, hopefully and this is the premise of this calculator. You can work just long enough to grow your SAVINGS to the point where you can retire and only need to take a small percentage and live off that. Sample Code:

// Now calculate SURPLUS OR DEFICIT for the year

var diff=(incomes[i-1].total_annual_income.toFixed(2) - expenses[i-1].total_annual_expenses.toFixed(2) );

// any money left over place in savings for that year.

if ( i > 1 )

incomes[i-1].savings =( incomes[i-1].savings + diff );Finally we calculate what you’re withdrawal rate is and how it will affect your savings over time after your retire. . The conventional wisdom of 4% withdrawal works out pretty well and is the default withdrawal rate. Adjusting this withdrawal rate. and the number of years you are working will have some of the largest impact as to what you can take out in retirement. Because you’ll have a larger nest egg at the beginning , your withdrawal percentage will likely yield a larger income than in your later years , which is why I display two retirement income values. Here’s a sample:

//Now calculate how much to withdraw from savings and retirement accounts AFTER we're RETIRED

if (i > work_years) //now we're withdrawing

{

ai.retirement_income=(withdraw_rate*ai.savings) + (withdraw_rate*ai.retirement );

ai.savings = ai.savings-(withdraw_rate*ai.savings); //subtract % from savings

//TODO: adjust retirement withdraw only after AGE 60 (USA time when no penalty)

ai.retirement= ai.retirement - (withdraw_rate*ai.retirement ) ; //subract % from retirment investments

//console.log(i+" > workyears+2 "+(+work_years+2)+" withdraw:"+withdraw_rate+ " on savings "+ai.savings);

if ( (+work_years+1)==i ) //Show first and last year how much retirement income we get.

$("#retirement_income_start").text(formatUSD(ai.retirement_income));

else

$("#retirement_income_end").text(formatUSD(ai.retirement_income));

$("#retirement_savings_end").text(formatUSD(ai.savings));

}There are a few one-time events, such as inheritance or sale (of a primary residence or business) which you choose how much and at what time point it occurs. Also Social Security you decide when to take it. If you have a pension , annual pension disbursements begin when social security begins. Code for inheritance looks like this.

ai.one_time=(ai.age==inheritance_age) ? parseInt( $("#income_inheritance").val() ) : 0 ;Verifying values and calculation code

Right now I simply send to the console.log a year-by-year summary of the income and expense javascript objects, you can use this to debug in your browser by pressing F12 developer mode. and see something like.

''' {"i":30,"tax_bracket":0.37,"income_tax":-1741.82,"healthcare":4358,"housing":0,"property_tax":2000,"dependants":0,"food":4500,"utilities":2060,"transport":9500,"optional":0,"inflation_rate":0.015,"total_annual_expenses":20986.3227,"inflation_costs":314.7948405} Annual Income: -4707.63 - 20986.32 Expenses = -25693.95 {"i":31,"tax_bracket":0.37,"income_tax":-1892.8,"healthcare":4358,"housing":0,"property_tax":2000,"dependants":0,"food":4500,"utilities":2060,"transport":9500,"optional":0,"inflation_rate":0.015,"total_annual_expenses":20833.078,"inflation_costs":312.49617} Annual Income: -5115.69 - 20833.08 Expenses = -25948.77 '''

Installing and Testing

- Download and open index.html in your web browser.

Contributing & Future enhancements (possible)

If you're interested in updating this script or have some ideas feel free to get in touch. Use Github to report issues and suggest enhancements.

If there's enough interest, here are some ideas that would make this calculator a bit more full featured.

- ability to download CSV (or excel compatible) data file of year by year projections calculations

- ability to save link with associated data and share with others. Like sending your financial planner a link to your data, right now because all data is save locally this is not possible.

- More time event fields for more granular calculations of certain events.

Versioning

- April 3, 2019 - Initial release version

Authors

License

MIT License

Copyright (c) 2019 Tony Brandao tonybrandao@outlook.com

Permission is hereby granted, free of charge, to any person obtaining a copy of this software and associated documentation files (the "Software"), to deal in the Software without restriction, including without limitation the rights to use, copy, modify, merge, publish, distribute, sublicense, and/or sell copies of the Software, and to permit persons to whom the Software is furnished to do so, subject to the following conditions:

The above copyright notice and this permission notice shall be included in all copies or substantial portions of the Software.

THE SOFTWARE IS PROVIDED "AS IS", WITHOUT WARRANTY OF ANY KIND, EXPRESS OR IMPLIED, INCLUDING BUT NOT LIMITED TO THE WARRANTIES OF MERCHANTABILITY, FITNESS FOR A PARTICULAR PURPOSE AND NONINFRINGEMENT. IN NO EVENT SHALL THE AUTHORS OR COPYRIGHT HOLDERS BE LIABLE FOR ANY CLAIM, DAMAGES OR OTHER LIABILITY, WHETHER IN AN ACTION OF CONTRACT, TORT OR OTHERWISE, ARISING FROM, OUT OF OR IN CONNECTION WITH THE SOFTWARE OR THE USE OR OTHER DEALINGS IN THE SOFTWARE.

Acknowledgments

- Hat tip to all the folks that gave us Bootsrap library and Jquery and ChartJS for makinng it infinitately easier

- Inspiration: 2Cents Youtube video here: https://youtu.be/8si7cqw9wm0 and the general FIRE movement..

- etc