Short-term momentum trading strategy implemented for the lecture "Systematic risk premia strategies traded at hedge funds" at University of Zurich, FS 2018.

-

Implementation in R

-

In accordance to paper:

-

Monthly pricing data from the Center for Research in Security Prices (CRSP)

-

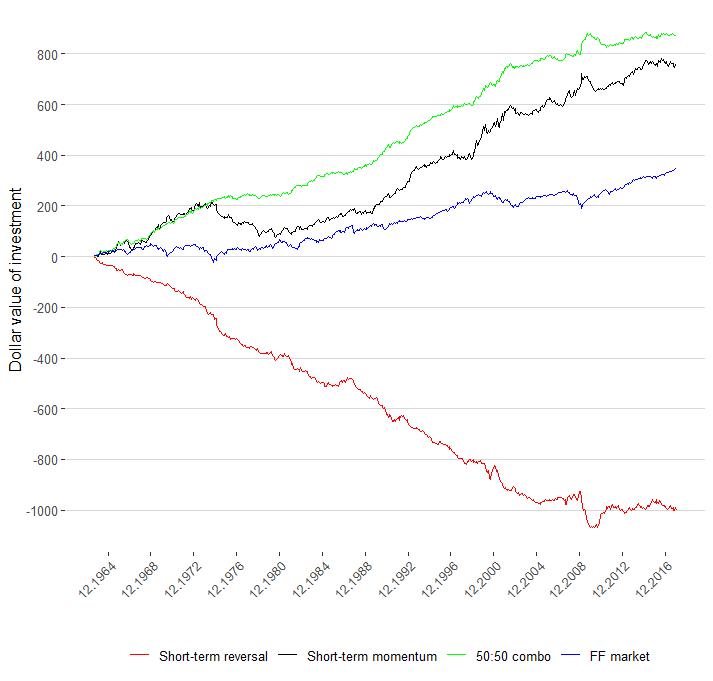

Sample starts in July, 1963 and ends in December, 2016

-

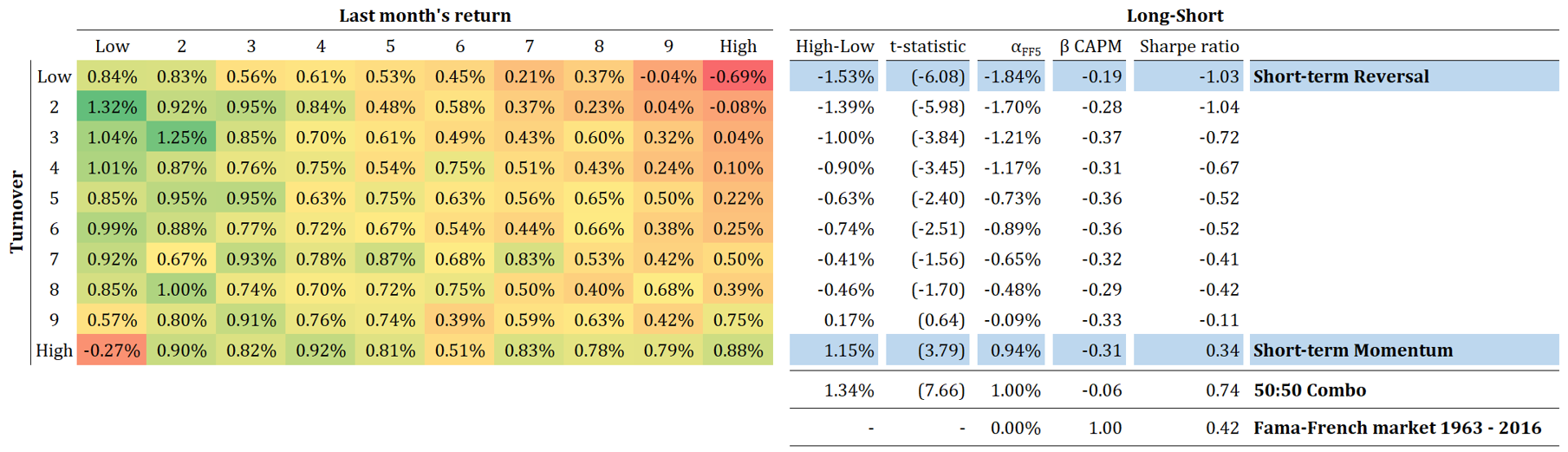

All common shares traded on NYSE, AMEX, and Nasdaq Measure short-term momentum using the return over the previous month: 𝑀𝑂𝑀_(𝑖,𝑡) = 𝑟_(𝑖,𝑡−1)

-

Measure short-term turnover using previous month volume and number of shares outstanding data: 𝑇𝑂_(𝑖,𝑡) = 𝑉𝑂𝐿_(𝑖,𝑡−1) / 𝑆𝐻𝑅𝑂𝑈𝑇_(𝑖,𝑡−1)

-

Portfolios are value-weighted by market capitalization and rebalanced at the end of each month

-