A powerful tool for analyzing news sentiment on both national and local stories, allowing users to correlate these stories with their own uploaded metrics, starting with stock market price data. Stay ahead of the curve and make informed decisions with SentimentSync.

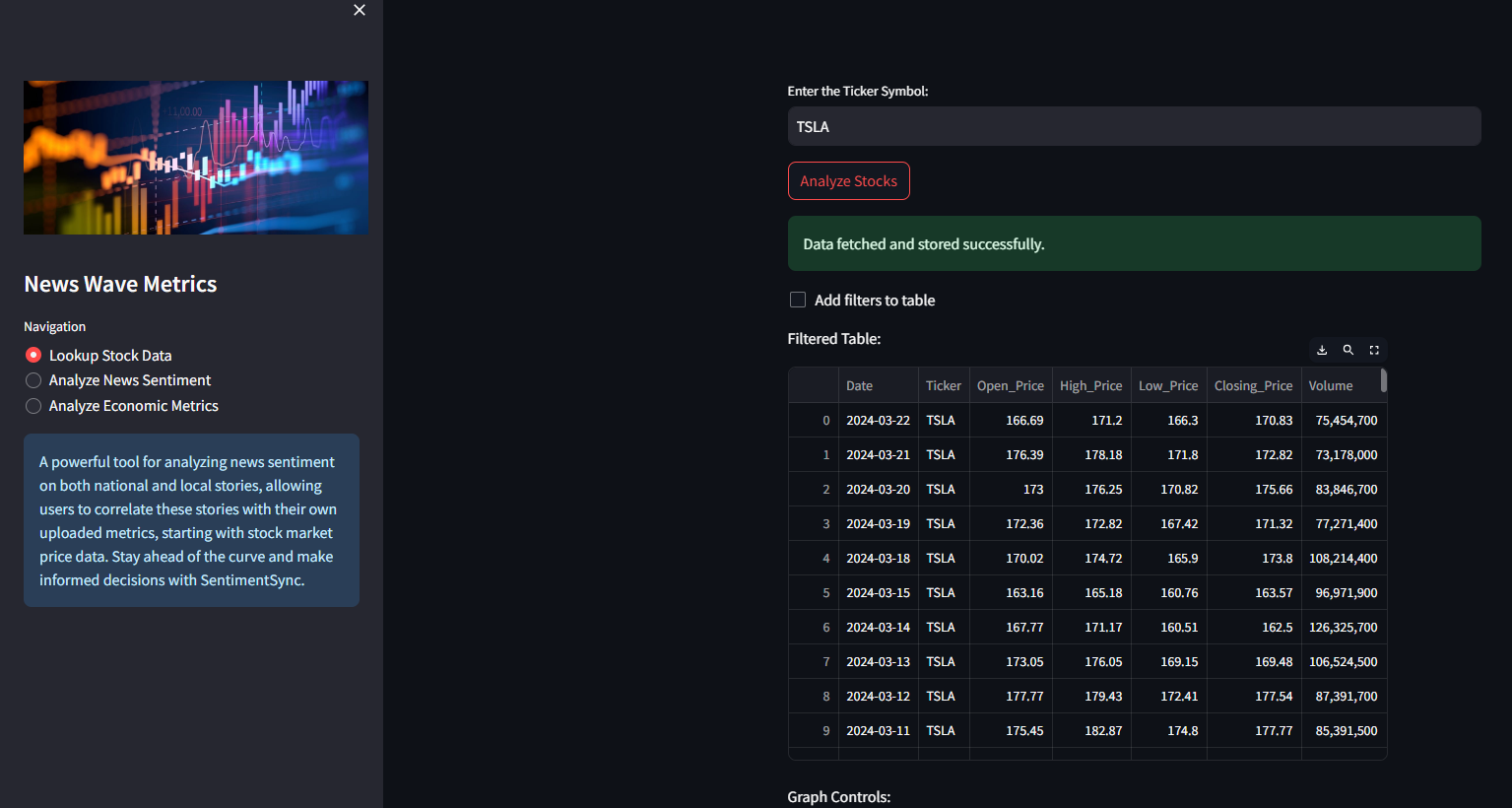

An automated procedure is implemented to fetch daily stock data for a specified ticker, storing the information in a database over the last 10 years. The system also includes visualization capabilities to display the stock data with corresponding buy/sell signals.

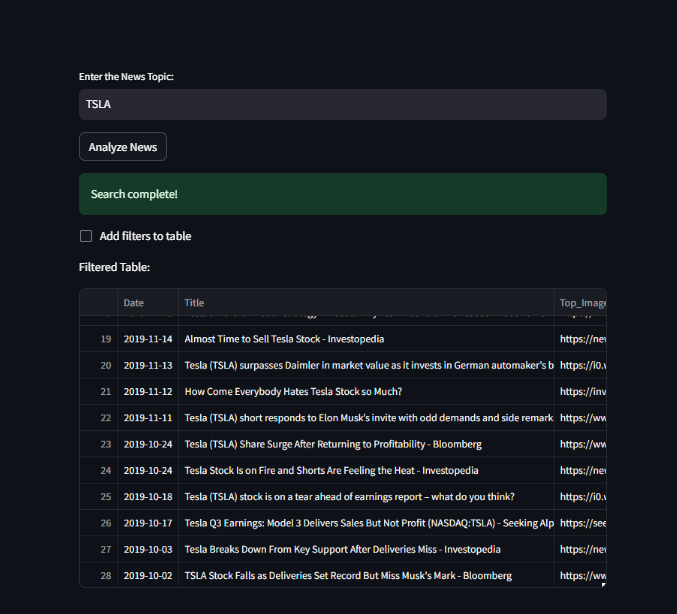

An automated procedure is implemented to retrieve daily news data on a designated topic, storing it in a database spanning the past decade along with sentiment analysis. Additionally, the system incorporates visualization features to depict the percentage of sentiments per year and the average sentiment value per date.

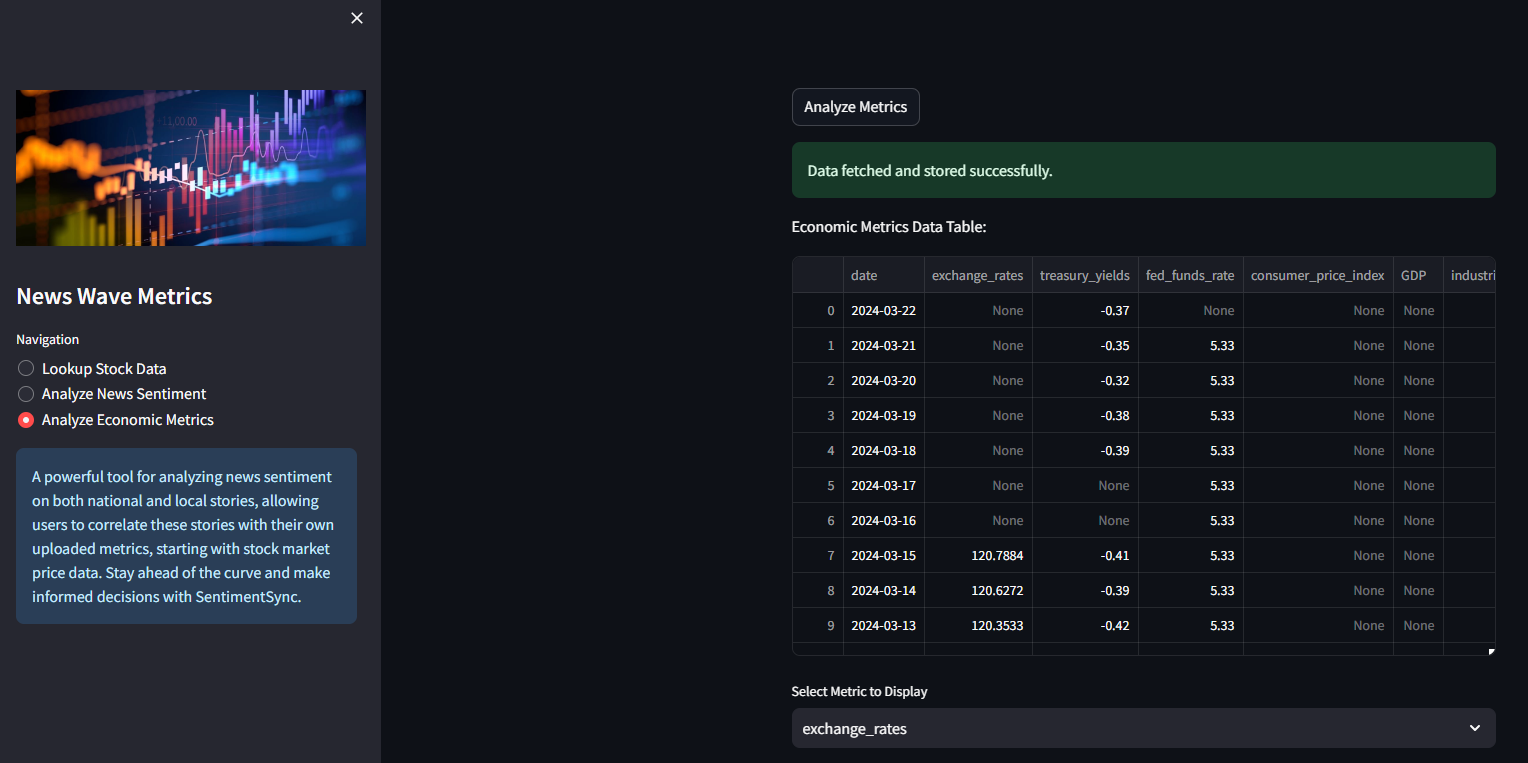

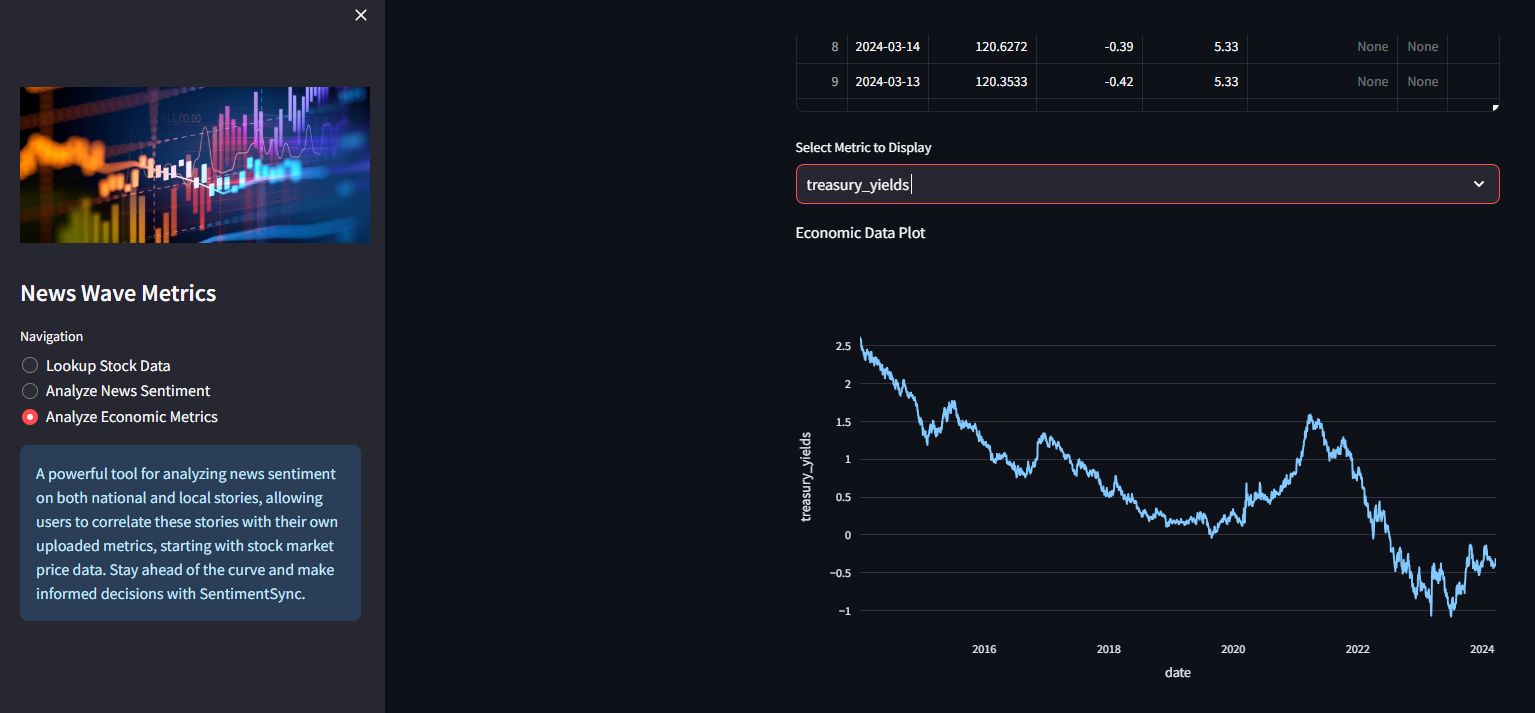

An automated procedure has been implemented to retrieve daily or monthly data on the following metrics: exchange rates, treasury yields, fed funds rate, consumer price index, GDP, industrial production, unemployment rate, consumer sentiment, and producer price index. This data is stored in a database spanning the past decade. Additionally, the system incorporates visualization of the metrics data.

Command

python fetch_yfinance.py --helpOutput

uusage: fetch_yfinance.py [-h] [--data_type {info,history,actions,financials,holders,recommendations}] ticker

Fetch stock data from Yahoo Finance.

positional arguments:

ticker Stock ticker symbol.

options:

-h, --help show this help message and exit

--data_type {info,history,actions,financials,holders,recommendations}

Type of data to fetch.Command

python fetch_yfinance.py "AAPL" --data_type recommendationsOutput

{

"recommendations_summary": [

{

"period": "0m",

"strongBuy": 11,

"buy": 21,

"hold": 6,

"sell": 0,

"strongSell": 0

},

{

"period": "-1m",

"strongBuy": 10,

"buy": 17,

"hold": 12,

"sell": 2,

"strongSell": 0

},

{

"period": "-2m",

"strongBuy": 10,

"buy": 17,

"hold": 12,

"sell": 2,

"strongSell": 0

},

{

"period": "-3m",

"strongBuy": 10,

"buy": 24,

"hold": 7,

"sell": 1,

"strongSell": 0

}

],

"recommendations": [

{

"period": "0m",

"strongBuy": 11,

"buy": 21,

"hold": 6,

"sell": 0,

"strongSell": 0

},

{

"period": "-1m",

"strongBuy": 10,

"buy": 17,

"hold": 12,

"sell": 2,

"strongSell": 0

},

{

"period": "-2m",

"strongBuy": 10,

"buy": 17,

"hold": 12,

"sell": 2,

"strongSell": 0

},

{

"period": "-3m",

"strongBuy": 10,

"buy": 24,

"hold": 7,

"sell": 1,

"strongSell": 0

}

]

}

Command

python fetch_yfinance.py "AAPL" --data_type holdersOutput

{

"major_holders": {

"Breakdown": {

"insidersPercentHeld": 0.05978,

"institutionsPercentHeld": 0.57474,

"institutionsFloatPercentHeld": 0.61129,

"institutionsCount": 6255.00000

}

},

"institutional_holders": [

{

"Date Reported": "2023-06-30",

"Holder": "Vanguard Group Inc",

"pctHeld": 0.0834,

"Shares": 1303688506,

"Value": 252876459508

},

{

"Date Reported": "2023-06-30",

"Holder": "Blackrock Inc.",

"pctHeld": 0.0665,

"Shares": 1039640859,

"Value": 201659137420

},

{

"Date Reported": "2023-06-30",

"Holder": "Berkshire Hathaway, Inc",

"pctHeld": 0.0586,

"Shares": 915560382,

"Value": 177591247296

},

{

"Date Reported": "2023-06-30",

"Holder": "State Street Corporation",

"pctHeld": 0.0370,

"Shares": 578897858,

"Value": 112288817516

},

{

"Date Reported": "2023-06-30",

"Holder": "FMR, LLC",

"pctHeld": 0.0196,

"Shares": 307066638,

"Value": 59561715772

},

{

"Date Reported": "2023-06-30",

"Holder": "Geode Capital Management, LLC",

"pctHeld": 0.0186,

"Shares": 291538165,

"Value": 56549657865

},

{

"Date Reported": "2023-06-30",

"Holder": "Price (T.Rowe) Associates Inc",

"pctHeld": 0.0145,

"Shares": 226650943,

"Value": 43963483413

},

{

"Date Reported": "2023-06-30",

"Holder": "Morgan Stanley",

"pctHeld": 0.0131,

"Shares": 204714950,

"Value": 39708558851

},

{

"Date Reported": "2022-12-31",

"Holder": "Norges Bank Investment Management",

"pctHeld": 0.0107,

"Shares": 167374278,

"Value": 21746939940

},

{

"Date Reported": "2023-06-30",

"Holder": "Northern Trust Corporation",

"pctHeld": 0.0105,

"Shares": 164536073,

"Value": 31915062079

}

],

"mutualfund_holders": [

{

"Date Reported": "2023-06-30",

"Holder": "Vanguard Total Stock Market Index Fund",

"pctHeld": 0.0298,

"Shares": 465990265,

"Value": 90388131702

},

{

"Date Reported": "2023-06-30",

"Holder": "Vanguard 500 Index Fund",

"pctHeld": 0.0225,

"Shares": 352024182,

"Value": 68282130582

},

{

"Date Reported": "2023-08-31",

"Holder": "Fidelity 500 Index Fund",

"pctHeld": 0.0108,

"Shares": 169378703,

"Value": 31821176932

},

{

"Date Reported": "2023-09-30",

"Holder": "SPDR S&P 500 ETF Trust",

"pctHeld": 0.0106,

"Shares": 165192563,

"Value": 28282618711

},

{

"Date Reported": "2023-09-30",

"Holder": "iShares Core S&P 500 ETF",

"pctHeld": 0.0089,

"Shares": 138984763,

"Value": 23795581273

},

{

"Date Reported": "2023-06-30",

"Holder": "Vanguard Growth Index Fund",

"pctHeld": 0.0081,

"Shares": 127130805,

"Value": 24659562245

},

{

"Date Reported": "2023-08-31",

"Holder": "Invesco ETF Tr-Invesco QQQ Tr, Series 1 ETF",

"pctHeld": 0.0080,

"Shares": 124293053,

"Value": 23350935867

},

{

"Date Reported": "2023-06-30",

"Holder": "Vanguard Institutional Index Fund-Institutional Index Fund",

"pctHeld": 0.0065,

"Shares": 100926716,

"Value": 19576755102

},

{

"Date Reported": "2023-08-31",

"Holder": "Vanguard Information Technology Index Fund",

"pctHeld": 0.0049,

"Shares": 76972129,

"Value": 14460753875

},

{

"Date Reported": "2023-09-30",

"Holder": "Select Sector SPDR Fund-Technology",

"pctHeld": 0.0041,

"Shares": 64568089,

"Value": 11054702517

}

]

}

Command

python fetch_yfinance.py "AAPL" --data_type financialsOutput

{

"income_statement": {

"2023-09-30": {

"Tax Effect Of Unusual Items": 0.0,

"Tax Rate For Calcs": 0.147,

"Normalized EBITDA": 129188000000.0,

"Net Income From Continuing Operation Net Minority Interest": 96995000000.0,

"Reconciled Depreciation": 11519000000.0,

"Reconciled Cost Of Revenue": 214137000000.0,

"EBITDA": 129188000000.0,

"EBIT": 117669000000.0,

"Net Interest Income": -183000000.0,

"Interest Expense": 3933000000.0,

"Interest Income": 3750000000.0,

"Normalized Income": 96995000000.0,

"Net Income From Continuing And Discontinued Operation": 96995000000.0,

"Total Expenses": 268984000000.0,

"Total Operating Income As Reported": 114301000000.0,

"Diluted Average Shares": 15812547000.0,

"Basic Average Shares": 15744231000.0,

"Diluted EPS": 6.13,

"Basic EPS": 6.16,

"Diluted NI Available to Com Stockholders": 96995000000.0,

"Net Income Common Stockholders": 96995000000.0,

"Net Income": 96995000000.0,

"Net Income Including Noncontrolling Interests": 96995000000.0,

"Net Income Continuous Operations": 96995000000.0,

"Tax Provision": 16741000000.0,

"Pretax Income": 113736000000.0,

"Other Income Expense": -382000000.0,

"Other Non Operating Income Expenses": -382000000.0,

"Net Non Operating Interest Income Expense": -183000000.0,

"Interest Expense Non Operating": 3933000000.0,

"Interest Income Non Operating": 3750000000.0,

"Operating Income": 114301000000.0,

"Operating Expense": 54847000000.0,

"Research And Development": 29915000000.0,

"Selling General And Administration": 24932000000.0,

"Gross Profit": 169148000000.0,

"Cost Of Revenue": 214137000000.0,

"Total Revenue": 383285000000.0,

"Operating Revenue": 383285000000.0

},

"2022-09-30": {

"Tax Effect Of Unusual Items": 0.0,

"Tax Rate For Calcs": 0.162,

...

},

...

},

"quarterly_income_statement": {

"2024-03-31": {

"Tax Effect Of Unusual Items": 0.0,

"Tax Rate For Calcs": 0.158,

"Normalized EBITDA": 30736000000.0,

"Net Income From Continuing Operation Net Minority Interest": 23636000000.0,

"Reconciled Depreciation": 2836000000.0,

"Reconciled Cost Of Revenue": 48482000000.0,

"EBITDA": 30736000000.0,

...

},

...

},

"balance_sheet": {

"2023-09-30": {

"Treasury Shares Number": 0.0,

"Ordinary Shares Number": 15550061000.0,

"Share Issued": 15550061000.0,

"Net Debt": 81123000000.0,

"Total Debt": 111088000000.0,

...

},

...

},

"quarterly_balance_sheet": {

"2024-03-31": {

"Treasury Shares Number": null,

"Ordinary Shares Number": 15337686000.0,

"Share Issued": 15337686000.0,

"Net Debt": 71895000000.0,

"Total Debt": 104590000000.0,

...

},

...

},

"cash_flow": {

"2023-09-30": {

"Free Cash Flow": 99584000000.0,

"Repurchase Of Capital Stock": -77550000000.0,

"Repayment Of Debt": -11151000000.0,

"Issuance Of Debt": 5228000000.0,

"Issuance Of Capital Stock": null,

"Capital Expenditure": -10959000000.0,

"Interest Paid Supplemental Data": 3803000000.0,

...

},

...

},

"quarterly_cash_flow": {

"2024-03-31": {

"Free Cash Flow": 20694000000.0,

"Repurchase Of Capital Stock": -23205000000.0,

"Repayment Of Debt": -3148000000.0,

"Issuance Of Debt": null,

"Capital Expenditure": -1996000000.0,

"Interest Paid Supplemental Data": null,

...

},

...

}

}

Command

python fetch_yfinance.py "AAPL" --data_type actionsOutput

Dividends Stock Splits

Date

1987-05-11 00:00:00-04:00 0.000536 0.0

1987-06-16 00:00:00-04:00 0.000000 2.0

1987-08-10 00:00:00-04:00 0.000536 0.0

1987-11-17 00:00:00-05:00 0.000714 0.0

1988-02-12 00:00:00-05:00 0.000714 0.0

... ... ...

2023-05-12 00:00:00-04:00 0.240000 0.0

2023-08-11 00:00:00-04:00 0.240000 0.0

2023-11-10 00:00:00-05:00 0.240000 0.0

2024-02-09 00:00:00-05:00 0.240000 0.0

2024-05-10 00:00:00-04:00 0.250000 0.0

Command

python fetch_yfinance.py "AAPL" --data_type historyOutput

Open High Low Close Volume Dividends Stock Splits

Date

2024-04-15 00:00:00-04:00 175.122467 176.390751 172.266340 172.456085 73531800 0.00 0.0

2024-04-16 00:00:00-04:00 171.517359 173.524631 168.042077 169.150574 73711200 0.00 0.0

2024-04-17 00:00:00-04:00 169.380266 170.418850 167.772446 167.772446 50901200 0.00 0.0

2024-04-18 00:00:00-04:00 167.802400 168.411575 166.324409 166.813736 43122900 0.00 0.0

2024-04-19 00:00:00-04:00 165.984872 166.174602 163.857753 164.776505 67772100 0.00 0.0

2024-04-22 00:00:00-04:00 165.295798 167.033431 164.546814 165.615356 48116400 0.00 0.0

2024-04-23 00:00:00-04:00 165.126031 166.823726 164.696606 166.673920 49537800 0.00 0.0

2024-04-24 00:00:00-04:00 166.314410 169.070681 165.984870 168.791061 48251800 0.00 0.0

2024-04-25 00:00:00-04:00 169.300369 170.378908 167.922233 169.659882 50558300 0.00 0.0

2024-04-26 00:00:00-04:00 169.649895 171.107909 168.950831 169.070679 44838400 0.00 0.0

2024-04-29 00:00:00-04:00 173.135155 175.791556 172.865532 173.264984 68169400 0.00 0.0

2024-04-30 00:00:00-04:00 173.095225 174.752981 169.769734 170.099289 65934800 0.00 0.0

2024-05-01 00:00:00-04:00 169.350298 172.476063 168.880934 169.070679 50383100 0.00 0.0

2024-05-02 00:00:00-04:00 172.276324 173.185095 170.658523 172.795624 94214900 0.00 0.0

2024-05-03 00:00:00-04:00 186.397167 186.746699 182.412581 183.131607 163224100 0.00 0.0

2024-05-06 00:00:00-04:00 182.103015 183.950500 180.175621 181.463882 78569700 0.00 0.0

2024-05-07 00:00:00-04:00 183.201504 184.649537 181.074400 182.152924 77305800 0.00 0.0

2024-05-08 00:00:00-04:00 182.602329 182.822032 181.204216 182.492477 45057100 0.00 0.0

2024-05-09 00:00:00-04:00 182.312720 184.409882 181.863333 184.320007 48983000 0.00 0.0

2024-05-10 00:00:00-04:00 184.899994 185.089996 182.130005 183.050003 50759500 0.25 0.0

2024-05-13 00:00:00-04:00 185.440002 187.100006 184.619995 186.279999 72044800 0.00 0.0

2024-05-14 00:00:00-04:00 187.649994 188.300003 186.289993 187.429993 50462954 0.00 0.0

Command

python fetch_yfinance.py "AAPL" --data_type info Output

{

"address1": "One Apple Park Way",

"city": "Cupertino",

"state": "CA",

"zip": "95014",

"country": "United States",

"phone": "408 996 1010",

"website": "https://www.apple.com",

"industry": "Consumer Electronics",

"industryKey": "consumer-electronics",

"industryDisp": "Consumer Electronics",

"sector": "Technology",

"sectorKey": "technology",

"sectorDisp": "Technology",

"longBusinessSummary": "Apple Inc. designs, manufactures, and markets smartphones, personal computers, tablets, wearables, and accessories worldwide. The company offers iPhone, a line of smartphones; Mac, a line of personal computers; iPad, a line of multi-purpose tablets; and wearables, home, and accessories comprising AirPods, Apple TV, Apple Watch, Beats products, and HomePod. It also provides AppleCare support and cloud services; and operates various platforms, including the App Store that allow customers to discover and download applications and digital content, such as books, music, video, games, and podcasts. In addition, the company offers various services, such as Apple Arcade, a game subscription service; Apple Fitness+, a personalized fitness service; Apple Music, which offers users a curated listening experience with on-demand radio stations; Apple News+, a subscription news and magazine service; Apple TV+, which offers exclusive original content; Apple Card, a co-branded credit card; and Apple Pay, a cashless payment service, as well as licenses its intellectual property. The company serves consumers, and small and mid-sized businesses; and the education, enterprise, and government markets. It distributes third-party applications for its products through the App Store. The company also sells its products through its retail and online stores, and direct sales force; and third-party cellular network carriers, wholesalers, retailers, and resellers. Apple Inc. was founded in 1976 and is headquartered in Cupertino, California.",

"fullTimeEmployees": 150000,

"companyOfficers": [

{

"maxAge": 1,

"name": "Mr. Timothy D. Cook",

"age": 62,

"title": "CEO & Director",

"yearBorn": 1961,

"fiscalYear": 2023,

"totalPay": 16239562,

"exercisedValue": 0,

"unexercisedValue": 0

},

{

"maxAge": 1,

"name": "Mr. Luca Maestri",

"age": 60,

"title": "CFO & Senior VP",

"yearBorn": 1963,

"fiscalYear": 2023,

"totalPay": 4612242,

"exercisedValue": 0,

"unexercisedValue": 0

},

{

"maxAge": 1,

"name": "Mr. Jeffrey E. Williams",

"age": 59,

"title": "Chief Operating Officer",

"yearBorn": 1964,

"fiscalYear": 2023,

"totalPay": 4637585,

"exercisedValue": 0,

"unexercisedValue": 0

},

{

"maxAge": 1,

"name": "Ms. Katherine L. Adams",

"age": 59,

"title": "Senior VP, General Counsel & Secretary",

"yearBorn": 1964,

"fiscalYear": 2023,

"totalPay": 4618064,

"exercisedValue": 0,

"unexercisedValue": 0

},

{

"maxAge": 1,

"name": "Ms. Deirdre O'Brien",

"age": 56,

"title": "Senior Vice President of Retail",

"yearBorn": 1967,

"fiscalYear": 2023,

"totalPay": 4613369,

"exercisedValue": 0,

"unexercisedValue": 0

},

{

"maxAge": 1,

"name": "Mr. Chris Kondo",

"title": "Senior Director of Corporate Accounting",

"fiscalYear": 2023,

"exercisedValue": 0,

"unexercisedValue": 0

},

{

"maxAge": 1,

"name": "Mr. James Wilson",

"title": "Chief Technology Officer",

"fiscalYear": 2023,

"exercisedValue": 0,

"unexercisedValue": 0

},

{

"maxAge": 1,

"name": "Suhasini Chandramouli",

"title": "Director of Investor Relations",

"fiscalYear": 2023,

"exercisedValue": 0,

"unexercisedValue": 0

},

{

"maxAge": 1,

"name": "Mr. Greg Joswiak",

"title": "Senior Vice President of Worldwide Marketing",

"fiscalYear": 2023,

"exercisedValue": 0,

"unexercisedValue": 0

},

{

"maxAge": 1,

"name": "Mr. Adrian Perica",

"age": 49,

"title": "Head of Corporate Development",

"yearBorn": 1974,

"fiscalYear": 2023,

"exercisedValue": 0,

"unexercisedValue": 0

}

],

"auditRisk": 6,

"boardRisk": 1,

"compensationRisk": 2,

"shareHolderRightsRisk": 1,

"overallRisk": 1,

"governanceEpochDate": 1714521600,

"compensationAsOfEpochDate": 1703980800,

"irWebsite": "http://investor.apple.com/",

"maxAge": 86400,

"priceHint": 2,

"previousClose": 186.28,

"open": 187.65,

"dayLow": 186.29,

"dayHigh": 188.3,

"regularMarketPreviousClose": 186.28,

"regularMarketOpen": 187.65,

"regularMarketDayLow": 186.29,

"regularMarketDayHigh": 188.3,

"dividendRate": 1.0,

"dividendYield": 0.0054,

"exDividendDate": 1715299200,

"payoutRatio": 0.14930001,

"fiveYearAvgDividendYield": 0.73,

"beta": 1.264,

"trailingPE": 29.1493,

"forwardPE": 25.923927,

"volume": 50462954,

"regularMarketVolume": 50462954,

"averageVolume": 64714114,

"averageVolume10days": 74643010,

"averageDailyVolume10Day": 74643010,

"bid": 187.34,

"ask": 187.42,

"bidSize": 100,

"askSize": 200,

"marketCap": 2874070269952,

"fiftyTwoWeekLow": 164.08,

"fiftyTwoWeekHigh": 199.62,

"priceToSalesTrailing12Months": 7.5311766,

"fiftyDayAverage": 172.6406,

"twoHundredDayAverage": 180.8951,

"trailingAnnualDividendRate": 0.96,

"trailingAnnualDividendYield": 0.005153532,

"currency": "USD",

"enterpriseValue": 2893872889856,

"profitMargins": 0.26306,

"floatShares": 15306787334,

"sharesOutstanding": 15334099968,

"sharesShort": 94308265,

"sharesShortPriorMonth": 108782648,

"sharesShortPreviousMonthDate": 1711584000,

"dateShortInterest": 1714435200,

"sharesPercentSharesOut": 0.0062,

"heldPercentInsiders": 0.05978,

"heldPercentInstitutions": 0.57474,

"shortRatio": 1.66,

"shortPercentOfFloat": 0.0062,

"impliedSharesOutstanding": 15467299840,

"bookValue": 4.837,

"priceToBook": 38.749226,

"lastFiscalYearEnd": 1696032000,

"nextFiscalYearEnd": 1727654400,

"mostRecentQuarter": 1711756800,

"earningsQuarterlyGrowth": -0.022,

"netIncomeToCommon": 100389003264,

"trailingEps": 6.43,

"forwardEps": 7.23,

"pegRatio": 2.57,

"lastSplitFactor": "4:1",

"lastSplitDate": 1598832000,

"enterpriseToRevenue": 7.583,

"enterpriseToEbitda": 22.324,

"52WeekChange": 0.08258271,

"SandP52WeekChange": 0.2704494,

"lastDividendValue": 0.25,

"lastDividendDate": 1715299200,

"exchange": "NMS",

"quoteType": "EQUITY",

"symbol": "AAPL",

"underlyingSymbol": "AAPL",

"shortName": "Apple Inc.",

"longName": "Apple Inc.",

"firstTradeDateEpochUtc": 345479400,

"timeZoneFullName": "America/New_York",

"timeZoneShortName": "EDT",

"uuid": "8b10e4ae-9eeb-3684-921a-9ab27e4d87aa",

"messageBoardId": "finmb_24937",

"gmtOffSetMilliseconds": -14400000,

"currentPrice": 187.43,

"targetHighPrice": 250.0,

"targetLowPrice": 164.0,

"targetMeanPrice": 202.36,

"targetMedianPrice": 200.0,

"recommendationMean": 2.1,

"recommendationKey": "buy",

"numberOfAnalystOpinions": 39,

"totalCash": 67150000128,

"totalCashPerShare": 4.379,

"ebitda": 129629003776,

"totalDebt": 104590000128,

"quickRatio": 0.875,

"currentRatio": 1.037,

"totalRevenue": 381623009280,

"debtToEquity": 140.968,

"revenuePerShare": 24.537,

"returnOnAssets": 0.22073999,

"returnOnEquity": 1.4725,

"freeCashflow": 84726874112,

"operatingCashflow": 110563000320,

"earningsGrowth": 0.007,

"revenueGrowth": -0.043,

"grossMargins": 0.45586,

"ebitdaMargins": 0.33968,

"operatingMargins": 0.30743,

"financialCurrency": "USD",

"trailingPegRatio": 2.209

}