FinOps is an evolving cloud financial management discipline and cultural practice that enables organizations to get maximum business value by helping engineering, finance, technology and business teams to collaborate on data-driven spending decisions.

Once you have adopted FinOps, you will find that to maximize the benefits you realize from Cloud you must also continually mature your FinOps practice, in a journey toward FinOps excellence.

This playbook is designed to be used in conjunction with the FinOps Framework to assist you with a measurable, meaningful analysis of your current operating maturity as you travel that journey. Understanding your current situation leads to a clearer understanding of the key areas you must next focus closely on, in order to progress in a meaningful way.

This playbook provides a set of concepts and measurements to support that analysis. These measurements can be applied to virtually all levels of an organization, from detailed and granular specific workloads / services / functional teams, through to the macroscopic analysis of organizational divisions or entire business units. It is designed to measure your operational maturity in consistent and well-understood terms whether you are measuring one application team or the whole organization.

This playbook is organized into four stages which are designed to create a consistent, clear process to analyze your current Framework Adoption.

This assessment is not intended as an exhaustive and comprehensive analytics solution covering an entire FinOps practice at every level. Rather, the intent is to provide a high-level overview of the current state and to identify further targeted areas of investigation or development. This assessment does not (perhaps should not) need to be done for every Capability at once. Targeting a single capability, or perhaps capabilities in a single domain may allow for deeper analysis on a per-capability level. This can be especially useful when those capabilities are highlighted by an earlier assessment for further improvement.

For each assessment, be very clear in establishing your

- Target Scope - which capability(ies) are you going to be assessing, and your

- Target Group - on which part of the organization will you be assessing this scope

Include those who will have a primary impact on the Scope and Group selected. Consider including those who might be targets for later assessments as well to give them some experience with the process.

We use the concept of a Lens to talk about how you inspect and analyze a FinOps Practice. These lenses are essentially different functional inspection views through which to consider any given Framework Capability, each requiring different effort, and evidence to support.

A functional component contributing to the overall functionality of the FinOps Foundation Framework. A capability may sit within one or more Domains, and may encompass a variety of related specific skills and specializations in order to execute successfully.

An aggregated and themed grouping of FinOps Capabilities within the FinOps Framework, geared towards a fully functional aspect of overall FinOps practice delivery.

An end-to-end structural view of the entire delivery model of a FinOps Practice, incorporating the Domain / Capability structure, lifecycle and principles of FinOps.

A consistently applied measure of experience, breadth of ability and success in the delivery of a specific granular element of the Framework. Maturity is not something to attain for the sake of being mature but rather something one develops in response to the need to handle more complexity of cloud use or of organizational need when it produces value.

Preamble questions that form the basis of understanding to build a clear picture of the maturity level being set in the assessment.

How good is “Good enough”? Within this assessment process, we use the term “Target Score” to illustrate our intended current goal within the overall scale. If there is a maximum assessment score of 20 within a capability (5 x lenses, each max score of 4) then how perfect do realistically expect that capability to become at this stage in our journey? How important is that capability? Perhaps a score level of 12 out of 20 is “good enough” for our present roadmap - especially if it is a new muscle(capability) we are building, and our assessed score is around the 4 or 5 mark.

The lenses provide insight into five key aspects of successfully performing each FinOps Capability. Each will help you identify potential strengths or areas for development in how you perform the Capability, and what steps you can focus on next.

Understanding each of these lenses is key to effectively applying a consistent analysis, which is critical to compare your improvement over time by performing subsequent assessments.

Each lens has five descriptive levels of performance, with examples of what would be expected at each level. Compare these descriptions to how you currently operate, and use the descriptions as a way to understand what more mature organizations need to do when their environments become complex. There is no need to be operating at higher levels in all cases. By reading the next higher level description, you can assess whether your organization would see value in that more advanced operating model. By understanding how you are operating from the perspective of each lens, it will be more clear where you might focus on improving your practices overall.

The KNOWLEDGE lens considers the scope of understanding and awareness of this capability across the target group. When responding to this lens, consider how clearly this capability is communicated? How broadly is this concept, its mechanisms terms and processes known?

| Maturity | Heading | Description |

|---|---|---|

| FinOps 0 | No Knowledge | At this level, knowledge of the capability as defined by the framework is effectively non-existent within the target group. There are no discussions happening about this capability, and nobody is actively involved in developing any further knowledge. |

| FinOps 1 | Partial Knowledge | Preliminary knowledge of the Capability being assessed is now beginning to spread amongst key stakeholders and individuals, but the capability is not yet common knowledge across the target group. |

| FinOps 2 | Developing Knowledge | Basic knowledge of the Capability is understood by a limited number of key stakeholders but information is limited in unscaled disbursements. |

| FinOps 3 | Full Knowledge | Strong knowledge of the assessed capability is known throughout the target group, incorporated with starter onboarding and periodic reinforcement via training or other appropriate communication methods. |

| FinOps 4 | Knowledge Leader | The target group is now driving awareness of this capability beyond itself to other peer groups and the wider industry. Leveraging deep awareness across individuals in the group, working to improve awareness and build new insights into the capability. |

PROCESS relates to both the set of actions being performed in order to deliver the capability being assessed, and the artefact defining and documenting those actions. Consider the efficacy, validity and prevalence of such processes.

| Maturity | Heading | Description |

|---|---|---|

| FinOps 0 | No Process | There are no described, consistent processes in place governing any aspect of the assessed capability within the target group. |

| FinOps 1 | Implementing Process | Processes to standardise this assessed capability are being formed, defined and possibly tested. Processes are not yet formalised as BAU for the target group. |

| FinOps 2 | Developing POC Process | Relevant, functional processes are now in place, agreed upon and being followed by at least some of the teams. |

| FinOps 3 | Scaled Process | Scaled processes are now in place, documented and you’ve implemented periodic feedback loops. |

| FinOps 4 | Mature (Agile) Process | Clearly defined, transparent, and fully integrated processes are now universally established and consistent. This does not necessarily mean there is one process for each task but that processes in place are all in this state. Processes are being iterated on with key stakeholder feedback and ongoing agile refinement. |

Is this capability measured? Is there a way to measure and prove progress over time? How are those measurements obtained, and how relevant are they?

| Maturity | Heading | Description |

|---|---|---|

| FinOps 0 | No Metrics | There are no measurements being taken at this point. No direct insight is available concerning the progress or current state of this capability. |

| FinOps 1 | Identified Metrics | Identified key metrics the business finds valuable for this capability to make trade-off decisions. |

| FinOps 2 | Baselined Metrics | Initial, manually generated metrics are in place providing rudimentary traffic-light (eg: Red/Yellow/Green) measurement of this capability. |

| FinOps 3 | Established & collecting Metric Targets data | KPIs are now in place covering at least some of this capability and cadence has been established for collection |

| FinOps 4 | Mature, Global KPIs | S.M.A.R.T. KPIs are now globally in place, automated and refined/iterated on with a regular cadence. Direct links to business goals. Direct link to business performance. |

How broadly are the knowledge, processes and KPIs you are using to govern this capability being used in your organization? Has the capability being assessed been adopted and accepted by the business as part of its integral and critical functions? Consider the prevalence and presence of this capability across the entire scope group being assessed.

| Maturity | Heading | Description |

|---|---|---|

| FinOps 0 | No Adoption | The capability is not in place anywhere within the target scope group. |

| FinOps 1 | Siloed Adoption | Elements of the capability are being adopted by a siloed group, lacking standardization and evidence best practices. |

| FinOps 2 | Initial Standardized Adoption | Early elements of the capability are being standardized and vetted by a few individuals within the target group. |

| FinOps 3 | Key Adoption | Fully established standardized elements of the capability as a part majority target groups BAU (Business As Usual) behaviors. |

| FinOps 4 | Full Adoption | The capability now exists in totality across all elements of the target group, and is being actively engaged with and worked on. |

Why spend valuable time executing a repeatable task with specific decision points and iterations? Automation drives consistency, speed and scalability across your Cloud landscape.

| Maturity | Heading | Description |

|---|---|---|

| FinOps 0 | No Automation | Virtually all of the required actions within the Capability are being executed manually at this stage. |

| FinOps 1 | Identified Automation Opportunities | Starting to identify and map your automation requirements for a solution that will reduce labor and time toil. |

| FinOps 2 | Experimental Automation | Early adoption of some key actions are beginning to be optimised through automated workflows and solutions. |

| FinOps 3 | Primary Automation | Primary or most demanding actions have now been offloaded to automation solutions. |

| FinOps 4 | Full Automation | All material, repeatable tasks within this capability are now automated, any new tasks are reviewed for automation potential or implemented as automation as the capability evolves |

When choosing the scope of an assessment we will define two key parameters:

- Target Group - which part of our organization will we assess?

- Target Scope - which Capabilities will we assess?

- Lens Weighting - how important are each of the different assessment lenses?

- Target Score - How close to a perfect score do we realistically want to be at this stage?

Establish your target group by focusing on groups that stand out in some way. Again, better to focus on one or a few groups than to try to obtain average scores across many groups who are at vastly different levels of maturity in their practice.

When you are considering a target group and scope, look at some of these attributes to pick a meaningful and useful group. Consider the following attributes as examples of defining scope parameters:

- Cloud Cost allocation grouping

- Engineering team/teams

- Product / service

- Project / Initiative

- Business Owner

- etc...

If you intend to repeat assessments over time for trending / baselining purposes, then be sure to use the same Target Scope and Target Group when you reassess to maintain the validity and trust placed in the data by the wider business. Maintain a record of the scope along with all instances of baseline and analysis of the framework, to ensure consistency and context.

Once the environment scope has been defined, target scope needs to be considered. Trying to analyze all of the (currently 18) capabilities within the FinOps Framework is a tall order.

When defining your target scope, focus on the capability or capabilities in areas where you believe there will be high business value in spending some FinOps team time building out. This will oftentimes be in domains such as Understanding Cloud Usage & Cost or Organizational Alignment if you are just starting out, or maybe in the Optimize domains, Real Time Decision Making or Performance Tracking & Benchmarking if you are a little more established. It is likely better to assess fewer capabilities to keep the assessment more focused than to do too many. Remember, like FinOps itself, we benefit from starting small and growing in scale and complexity once we have established some muscle memory from repetitive practice.

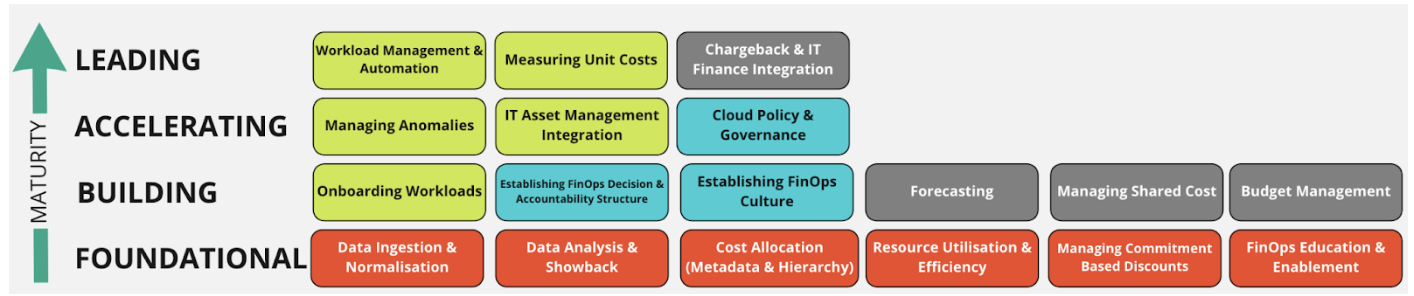

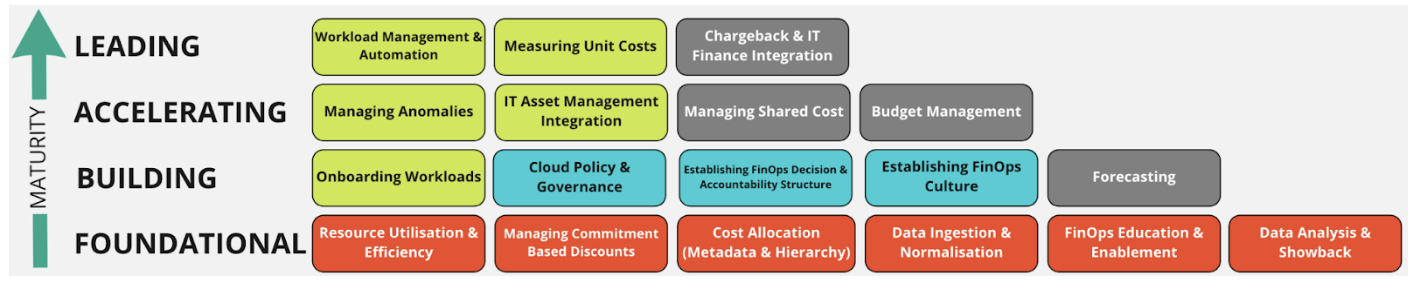

Depending on the nature and strengths of the business, different capabilities will interact and support one another in different ways. Therefore, consider which capabilities are most material to track at that time on the FinOps Adoption journey. Two different possible examples of how the dependencies / layers might look are given here. Within the context of the business being assessed, take the time to consider which capabilities make the most sense to assess within the context of that assessment target at that stage. This exercise should form the basis of an Adoption Roadmap that the Framework Assessment will work to support.

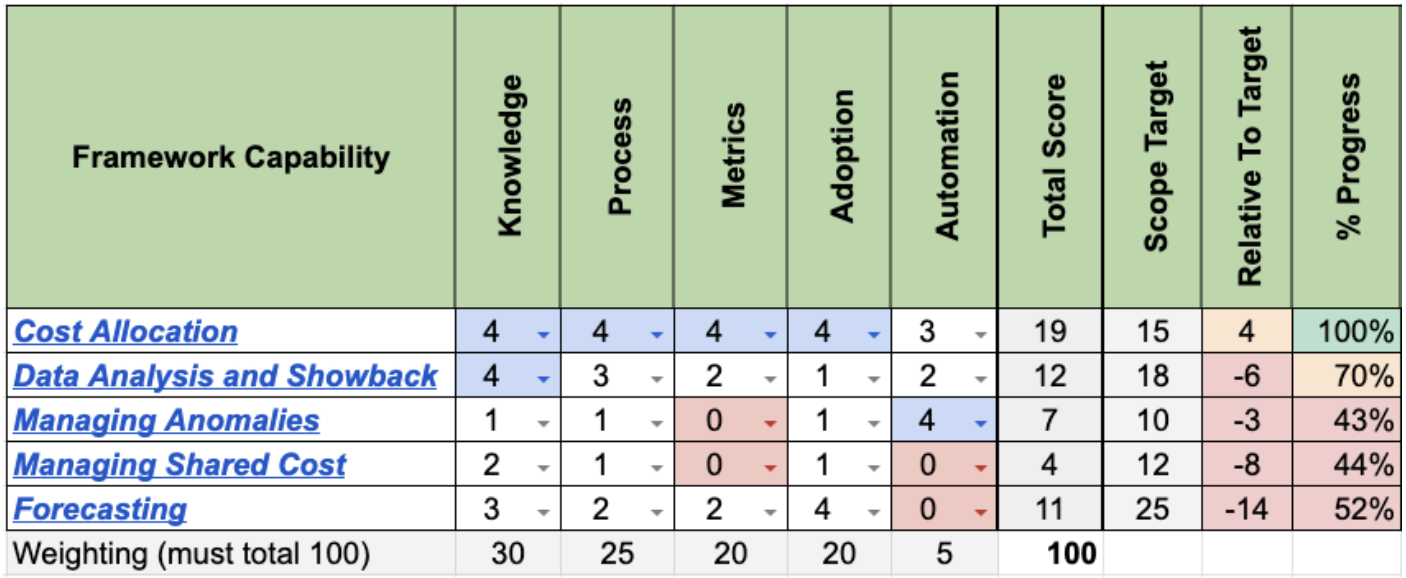

Consider the priorities of Knowledge, Process, Metrics, Adoption and Automation across your Target Scope and Target Group. Bear in mind what is currently a realistic achievement, and what is most important to improve. For example: Is there a minimal level of knowledge and process likely to be in place currently? You might want to consider weighting that higher in your assessment - whilst reducing the impact of the Automation score, which is likely to be low if there is no existing knowledge or process. Think within the context of what you are trying to promote efforts towards.

As these examples show, the key idea here is to identify the right capabilities to review at the right time - and to understand the dependency hierarchy of the involved capabilities. Whilst conceptually possible to assess all of the (currently 18) framework capabilities, that would result in a significant amount of time and work. In order to produce a repeatable, meaningful, targeted assessment - you need to ensure a tight focus on the specific areas you are looking to progress at that stage in the FinOps Adoption journey.

The target scope and target group will help to identify the relevant stakeholders and SMEs required. Remember that different capabilities may well necessitate different stakeholders and adjacent personas, and likely different targeted discussions in order to reach the most accurate answers for analysis. Record the stakeholder details and their evidence / data contributions within the assessment data, ensuring that the context is retained for future baseline analysis.

Once Scope has been defined, Capability Targets have been selected and Stakeholders / SMEs are identified, you are fully prepared to execute an iteration of the framework assessment. For each selected capability across the scope, you can now plan your conversations. Consider grouping capabilities covered by the same subset of SMEs / stakeholders.

It is likely a wise idea to begin analyzing a capability by ensuring that everyone present has an awareness of what that capability is, and where it fits within the overall business. Then confirm the defined scope, and ensure that context has been clearly communicated before beginning. Use this overview as an opportunity to broaden education about FinOps and ensure that all involved parties are at a good level of knowledge about what is being assessed.

Before diving into the 5 lenses proper, explore some Discovery Questions. It is recommended to develop and curate a library of capability-specific discovery questions that you will begin gathering evidence and data to further support a decision on scoring for each lens within the assessment proper. Where possible, gather documented evidence to support answers to these questions, and ensure this evidence is associated with the rest of the assessment information to ensure context and support confidence in an accurate outcome.

For each of the lenses defined above, use the input from the evidence gathering discussions along with overall consideration of the performance of that lens within the context of that capability and scope, to decide upon a suitable maturity score for that lens. Try to be as consistent and fair as possible when scoring, and keep in mind the overall realistic FinOps goals held for that capability within that context.

If there is disagreement among the stakeholders you are interviewing, this is good. It means you have identified an area where there is likely a lack of common understanding, or a lack of common experience, so you have an opportunity to correct these a bit right away. This may also indicate that the people involved in your assessment are involved and focused, another good indicator. Use this opportunity to educate, enable, and align.

Score each capability as a percentage of a potential maximum, for example if your rating scale goes from 0 to 4, you have 5 lenses - giving a total maximum score of 20 for a capability. Each assessed lens can also then be given a weighting, according to business priorities for focus at that stage in the journey. That scoring might look a bit like this, for a subset of 5 capabilities:

Once you have these metrics, if you have chosen to assess multiple capabilities you can aggregate scores to provide an overall evaluation outcome - as well as highlight areas of low (or zero) scoring, which will contribute to your outcome analysis.

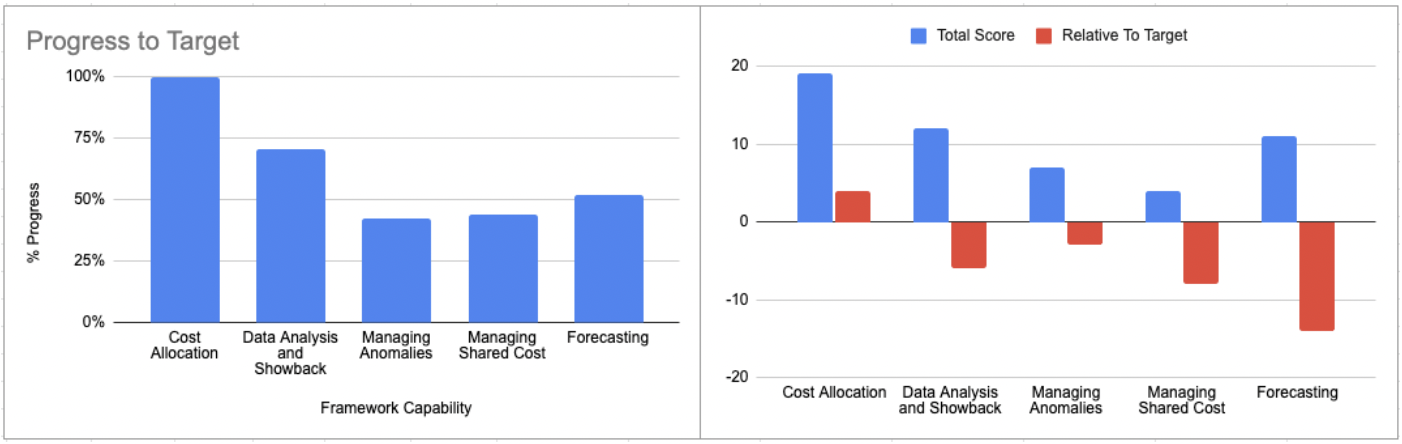

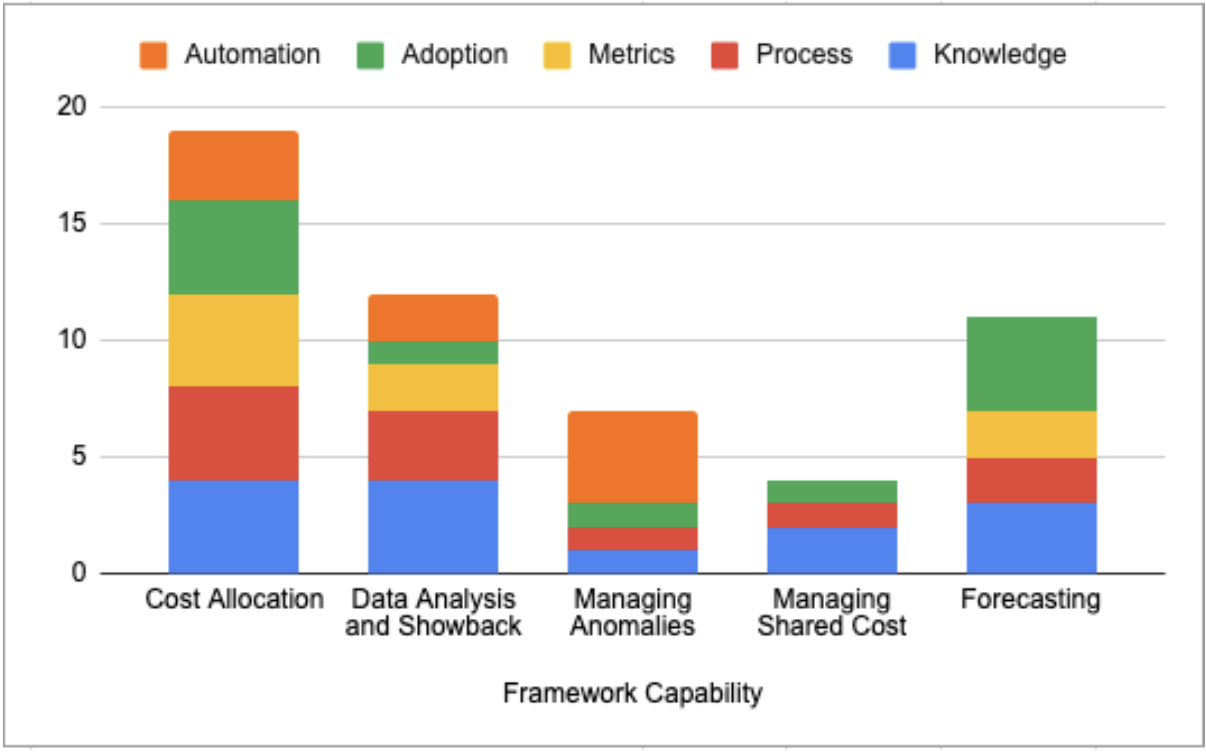

For the imaginary example shown below, the 5 assessed capabilities were broken down further into their stacked assessment components to highlight the strengths and weaknesses across the set - and to further highlight which areas had the most improvement needed (and associated effort).

You can see that Knowledge and Process are comparatively strong areas for most of this set of capabilities - with Adoption spreading as well. There are still improvements to be focused on for Metrics, and Automation has begun in some capabilities. It is clear that a number of other capabilities are yet to begin leveraging tooling to improve workflow efficiency and effectiveness. Previous efforts to drive an improvement in Data Analysis & Showback have resulted in a strong overall score for that capability, which provides a good grounding for other capabilities that depend heavily upon it - for example “Managing Anomalies” - to be further developed.

From this data, you can now clearly identify areas for improvement and further discussion using the provided evidence to uncover any potential blockers to address - and develop a roadmap to deliver a delta for the next assessment.

If you retain this data and repeat the assessment periodically using the same scope and criteria - you can easily highlight score changes on this grid, and trend improvements over time.

Now that you have analyzed the outcome data, you can then use all the data to guide your decisions to focus deeper into a specific area using the discovery questions you asked in the earlier "Gathering Evidence" section.

Consider how to surface key areas of focus and highlight missing capability components that could unlock success in both that capability and adjacent ones.

In the example given above, let’s look at the “Managing Shared Cost” capability. It is immediately clear that Managing Shared Cost has space for further development - particularly in both Metrics and Automation, where there is a zero score right now. Effectively, you have no insights into the progress or success within that area and there is no tooling in place to support the work. The capability is beginning to be understood however, and it is being actioned at some level, and adoption is growing. This might still result in successful delivery of the Capability outcome of actually distributing and managing the shared cost within the cloud platforms…

But are those results being delivered in the most optimal way?

Firstly, you have no idea how effective the shared cost efforts work is, because you have no metrics to prove one way or another. And secondly, because there is no automation you might reasonably assume that the success of that capability rests largely on human effort. Depending on what the business priorities are, that could be viewed as a risk. Building metrics and automation into that capability could increase the effectiveness, whilst freeing time for people to deliver greater value elsewhere.

Consider the Capability Hierarchy as discussed earlier in the "Target Scope" section, and look at which of the current Capabilities within the focus group are going to be heavily leveraged in the next stage of the roadmap. Use this insight, alongside the analysis delivered in stage 3, and the context provided within the Capability Discovery section, to formulate your priorities for your next primary adoption acceleration focus.