Synthetic assets are collateral-backed assets whose value fluctuates depending on a reference price. We propose a scheme where anyone can lock collateral on the Liquid Network to issue assets that track the price of a chosen real-world asset, such as dollars or stocks. The Elements enhanced scripting capabilities allow non-interactive redemption and liquidation when the collateral's value is underwater, with the possibility to top up the collateral to prevent liquidation.

Detailed description document is published with each release.

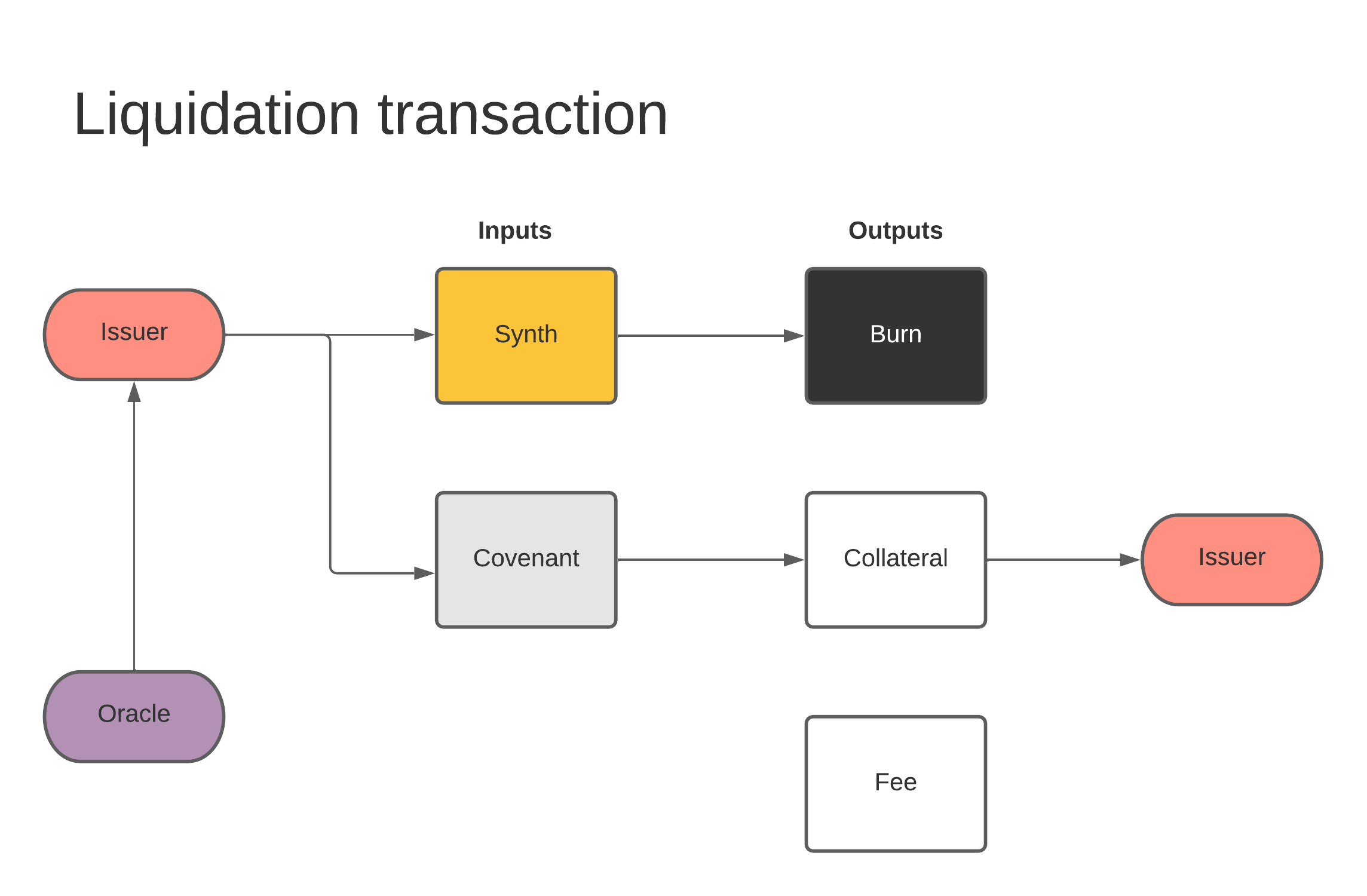

- Issuer/Liquidator

- Sponsor

- Oracle

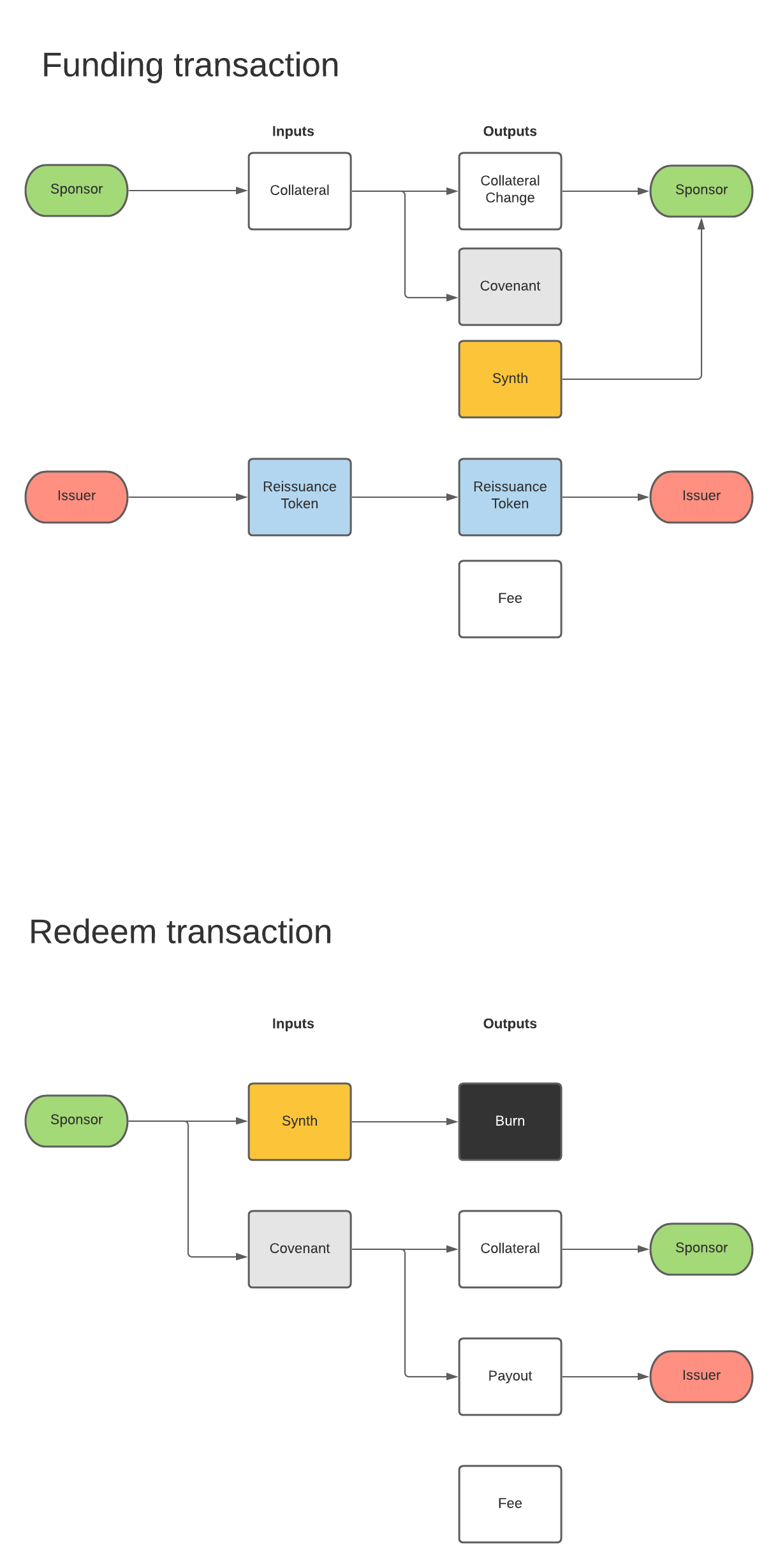

- Issuer mints an asset with zero supply (ie.

sTSLA) - Sponsor locks collateral (ie.

USDt) in the contract to mint the asset at the current reference price upon mutual agreement on liquidation target. - If the collateral's value is underwater, Issuer can liquidate after burning the asset and presenting Oracle's signature on the reference price.

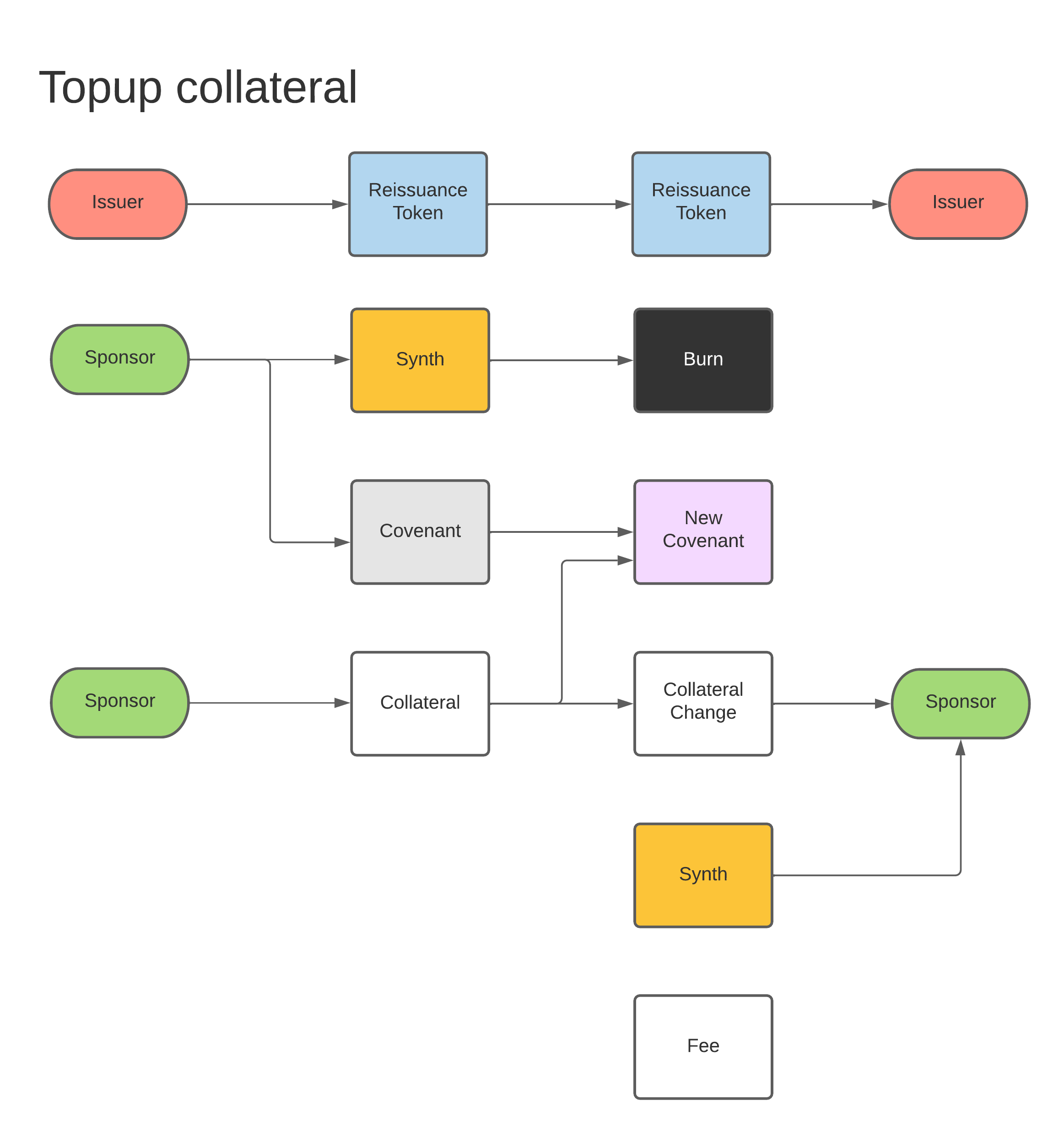

- Sponsor can prevent liquidation via collateral top-up in collaboration with the Issuer to create a new contract.

NOTICE: Sponsor can always redeem in a non-interactive fashion his collateral burning the asset and sending a payout fee to the Issuer.