Work in progress

Certain countries have been suffering inflation for decades. As a first approach, the possibility for their citizens to save using a Stablecoin backed and pegged by a stronger currency may seem a solution. However, on a large scale, such a solution probably will cause a domestic currency run and aggravate the inflation.

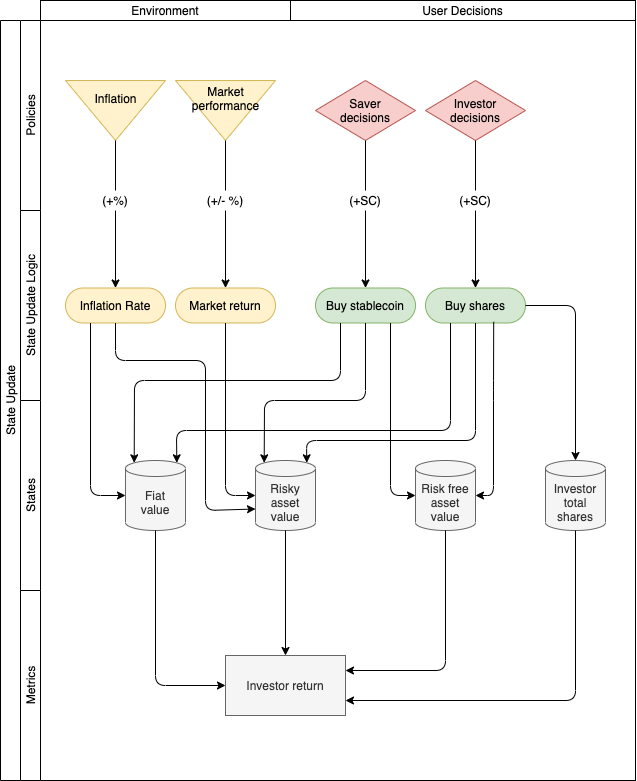

This model is a naive approach of how a Stablecoin composed of different domestic type of assets may behave.

For this first approach there are three type of assets pledged as a collateral and two different agents.

- Domestic currency: devaluates over time

- Risky asset: devaluates like the currency, increase in value depending on the market return (e.g. ETF tracking market index)

- Risk free asset: no devaluation, no returns (e.g. commodities contracts)

- Savers: no return expectations, expectation of not loosing purchasing power over time

- Investors: expecting profits if market return is higher than inflation. In general their return will be the market return leveraged

For clarification, a Stablecoin in this context is an asset that keep its purchasing power of a basket of goods over time.