Using Python and NLP, predicting stock themes with high potential based on news data

- Used news data from 'Naver'

- Gathered meaningful stock themes mentioned in everyday news over the last year

- Gathered 200 news data for each stock theme

- Trained with word2vec model

- Used cosine-similarity to predict theme

- Thematic investing is a form of investment which aims to identify macro-level trends, and the underlying investments that stand to benefit from the materialisation of those trends

- A stock theme is a particular group of stocks that share a similar trend or trait

- Individual investers are limited in obtaining information and therfore, rely on the news for such information. As a result, stock themes and the news have a strong correlation.

- When an event occurs in the news regarding a particular stock theme, some time must pass by for a noticable change to happen for that stock theme's price.

- If a particular stock theme is mentioned too much in the news, its price will already be affected.

Crawling Naver news data using Beautifulsoup

- Stock themes: Searched stock themes that were frequently mentioned in the news. Removed themes that were fewly referenced or were too specific in its meaning to be useful. A total of 168 themes were finalized. Each theme consists a list of corporations belonging to that theme.

- News data: 200 news data were crawled for each of the 168 themes. Unusable data(photo news, video news) were manually removed from the dataset.

KoBERT tokenizer + Word2Vec + cosine-similarity

Model train file (wv_model_train.ipynb)

KoBERT tokenizer: Developed by SKTBrain

Word2Vec: Represents words in vectors

Model parameters:

vector dimension = 300, window = 8

Model (Architecture.ipynb)

- Added all word vectors in a news data to make a news representation

- Generated each theme representations by adding all 200 news representations

- Normalization was not necessary since more information leads to accurate representations

- When a news data is given as input, the model will vectorize the data and use cosine-similarity to determine and return the most similar theme

Model

- Input: Today news(approximately 2000 data each for IT, economy, society, lifestyle, international, politics)

- Output: A list of themes and its subordinate corporations that are considered to have high potential

- The model finds a similar theme for each news data and counts the number of its appearance. However, it only counts when the similarity is higher than 95%.

- When all of the input data is processed, the model generates a list of themes, whose count is less than 5(hypothesis 3).

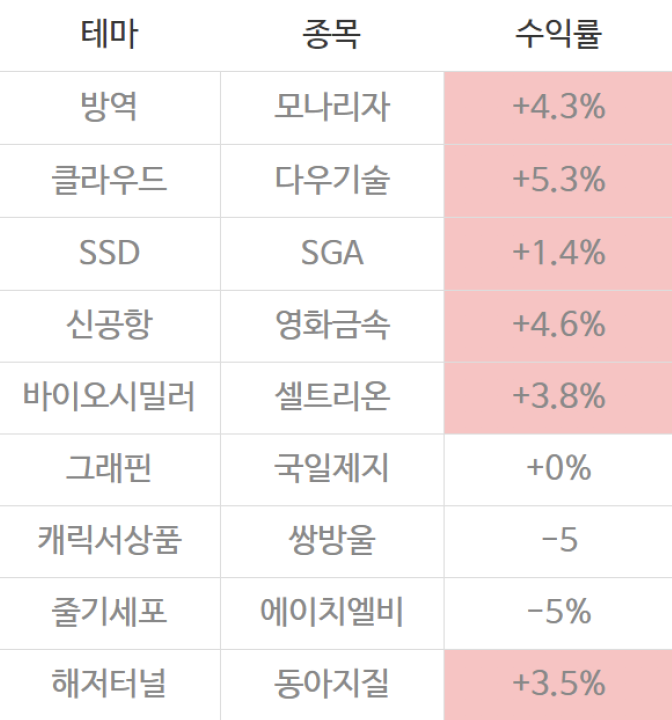

Market testing

- Select one corporation for each theme, whose fluctuation is less than 5% and has the highest market capitalization.

- Calculate profit with the following rules.

- Sell when a stock's price increases more than 10%

- Sell when a stock's price decreases more than 5%

- If neither of above, sell after 5 days of purchase

Result

7/1 news data

- profit after 5 days = 2.23%