exchange-core

Exchange-core is an open source market exchange core based on LMAX Disruptor, Eclipse Collections (ex. Goldman Sachs GS Collections), Real Logic Agrona, OpenHFT Chronicle-Wire, LZ4 Java, and Adaptive Radix Trees.

Exchange-core includes:

- orders matching engine

- risk control and accounting module

- disk journaling and snapshots module

- trading, admin and reports API

Designed for high scalability and pauseless 24/7 operation under high-load conditions and providing low-latency responses:

- 3M users having 10M accounts in total

- 100K order books (symbols) having 4M pending orders in total

- less than 1ms worst wire-to-wire target latency for 1M+ operations per second throughput

- 150ns per matching for large market orders

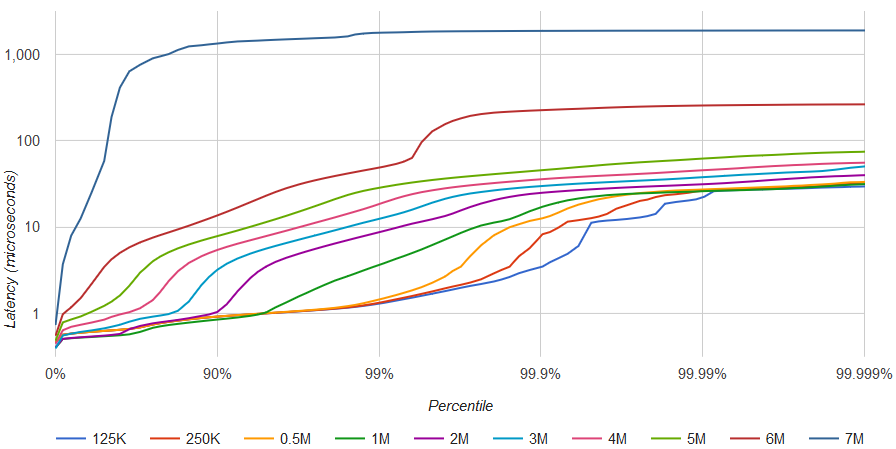

Single order book configuration is capable to process 5M operations per second on 10-years old hardware (Intel® Xeon® X5690) with moderate latency degradation:

| rate | 50.0% | 90.0% | 95.0% | 99.0% | 99.9% | 99.99% | worst |

|---|---|---|---|---|---|---|---|

| 125K | 0.6µs | 0.9µs | 1.0µs | 1.4µs | 4µs | 24µs | 41µs |

| 250K | 0.6µs | 0.9µs | 1.0µs | 1.4µs | 9µs | 27µs | 41µs |

| 500K | 0.6µs | 0.9µs | 1.0µs | 1.6µs | 14µs | 29µs | 42µs |

| 1M | 0.5µs | 0.9µs | 1.2µs | 4µs | 22µs | 31µs | 45µs |

| 2M | 0.5µs | 1.2µs | 3.9µs | 10µs | 30µs | 39µs | 60µs |

| 3M | 0.7µs | 3.6µs | 6.2µs | 15µs | 36µs | 45µs | 60µs |

| 4M | 1.0µs | 6.0µs | 9µs | 25µs | 45µs | 55µs | 70µs |

| 5M | 1.5µs | 9.5µs | 16µs | 42µs | 150µs | 170µs | 190µs |

| 6M | 5µs | 30µs | 45µs | 300µs | 500µs | 520µs | 540µs |

| 7M | 60µs | 1.3ms | 1.5ms | 1.8ms | 1.9ms | 1.9ms | 1.9ms |

Benchmark configuration:

- Single symbol order book.

- 3,000,000 inbound messages are distributed as follows: 9% GTC orders, 3% IOC orders, 6% cancel commands, 82% move commands. About 6% of all messages are triggering one or more trades.

- 1,000 active user accounts.

- In average ~1,000 limit orders are active, placed in ~750 different price slots.

- Latency results are only for risk processing and orders matching. Other stuff like network interface latency, IPC, journaling is not included.

- Test data is not bursty, meaning constant interval between commands (0.2~8µs depending on target throughput).

- BBO prices are not changing significantly throughout the test. No avalanche orders.

- No coordinated omission effect for latency benchmark. Any processing delay affects measurements for next following messages.

- GC is triggered prior/after running every benchmark cycle (3,000,000 messages).

- RHEL 7.5, network-latency tuned-adm profile, dual X5690 6 cores 3.47GHz, one socket isolated and tickless, spectre/meltdown protection disabled.

- Java version 8u192, newer Java 8 versions can have a performance bug

Features

- HFT optimized. Priority is a limit-order-move operation mean latency (currently ~0.5µs). Cancel operation takes ~0.7µs, placing new order ~1.0µs;

- In-memory working state for accounting data and order books.

- Event-sourcing - disk journaling and journal replay support, state snapshots (serialization) and restore operations, LZ4 compression.

- Lock-free and contention-free orders matching and risk control algorithms.

- No floating-point arithmetic, no loss of significance is possible.

- Matching engine and risk control operations are atomic and deterministic.

- Pipelined multi-core processing (based on LMAX Disruptor): each CPU core is responsible for certain processing stage, user accounts shard, or symbol order books shard.

- Two different risk processing modes (specified per symbol): direct-exchange and margin-trade.

- Maker/taker fees (defined in quote currency units).

- Two order books implementations: simple implementation ("Naive") and performance implementation ("Direct").

- Order types: Immediate-or-Cancel (IOC), Good-till-Cancel (GTC), Fill-or-Kill Budget (FOK-B)

- Testing - unit-tests, integration tests, stress tests, integrity/consistency tests.

- Low GC pressure, objects pooling, single ring-buffer.

- Threads affinity (requires JNA).

- User suspend/resume operation (reduces memory consumption).

- Core reports API (user balances, open interest).

Installation

- Install library into your Maven's local repository by running

mvn install - Add the following Maven dependency to your project's

pom.xml:

<dependency>

<groupId>exchange.core2</groupId>

<artifactId>exchange-core</artifactId>

<version>0.5.3</version>

</dependency>

Alternatively, you can clone this repository and run the example test.

Usage examples

Create and start empty exchange core:

// simple async events handler

SimpleEventsProcessor eventsProcessor = new SimpleEventsProcessor(new IEventsHandler() {

@Override

public void tradeEvent(TradeEvent tradeEvent) {

System.out.println("Trade event: " + tradeEvent);

}

@Override

public void reduceEvent(ReduceEvent reduceEvent) {

System.out.println("Reduce event: " + reduceEvent);

}

@Override

public void rejectEvent(RejectEvent rejectEvent) {

System.out.println("Reject event: " + rejectEvent);

}

@Override

public void commandResult(ApiCommandResult commandResult) {

System.out.println("Command result: " + commandResult);

}

@Override

public void orderBook(OrderBook orderBook) {

System.out.println("OrderBook event: " + orderBook);

}

});

// default exchange configuration

ExchangeConfiguration conf = ExchangeConfiguration.defaultBuilder().build();

// no serialization

Supplier<ISerializationProcessor> serializationProcessorFactory = () -> DummySerializationProcessor.INSTANCE;

// build exchange core

ExchangeCore exchangeCore = ExchangeCore.builder()

.resultsConsumer(eventsProcessor)

.serializationProcessorFactory(serializationProcessorFactory)

.exchangeConfiguration(conf)

.build();

// start up disruptor threads

exchangeCore.startup();

// get exchange API for publishing commands

ExchangeApi api = exchangeCore.getApi();Create new symbol:

// currency code constants

final int currencyCodeXbt = 11;

final int currencyCodeLtc = 15;

// symbol constants

final int symbolXbtLtc = 241;

// create symbol specification and publish it

CoreSymbolSpecification symbolSpecXbtLtc = CoreSymbolSpecification.builder()

.symbolId(symbolXbtLtc) // symbol id

.type(SymbolType.CURRENCY_EXCHANGE_PAIR)

.baseCurrency(currencyCodeXbt) // base = satoshi (1E-8)

.quoteCurrency(currencyCodeLtc) // quote = litoshi (1E-8)

.baseScaleK(1_000_000L) // 1 lot = 1M satoshi (0.01 BTC)

.quoteScaleK(10_000L) // 1 price step = 10K litoshi

.takerFee(1900L) // taker fee 1900 litoshi per 1 lot

.makerFee(700L) // maker fee 700 litoshi per 1 lot

.build();

future = api.submitBinaryDataAsync(new BatchAddSymbolsCommand(symbolSpecXbtLtc));Create new users:

// create user uid=301

future = api.submitCommandAsync(ApiAddUser.builder()

.uid(301L)

.build());

// create user uid=302

future = api.submitCommandAsync(ApiAddUser.builder()

.uid(302L)

.build());Perform deposits:

// first user deposits 20 LTC

future = api.submitCommandAsync(ApiAdjustUserBalance.builder()

.uid(301L)

.currency(currencyCodeLtc)

.amount(2_000_000_000L)

.transactionId(1L)

.build());

// second user deposits 0.10 BTC

future = api.submitCommandAsync(ApiAdjustUserBalance.builder()

.uid(302L)

.currency(currencyCodeXbt)

.amount(10_000_000L)

.transactionId(2L)

.build());Place orders:

// first user places Good-till-Cancel Bid order

// he assumes BTCLTC exchange rate 154 LTC for 1 BTC

// bid price for 1 lot (0.01BTC) is 1.54 LTC => 1_5400_0000 litoshi => 10K * 15_400 (in price steps)

future = api.submitCommandAsync(ApiPlaceOrder.builder()

.uid(301L)

.orderId(5001L)

.price(15_400L)

.reservePrice(15_600L) // can move bid order up to the 1.56 LTC, without replacing it

.size(12L) // order size is 12 lots

.action(OrderAction.BID)

.orderType(OrderType.GTC) // Good-till-Cancel

.symbol(symbolXbtLtc)

.build());

// second user places Immediate-or-Cancel Ask (Sell) order

// he assumes wost rate to sell 152.5 LTC for 1 BTC

future = api.submitCommandAsync(ApiPlaceOrder.builder()

.uid(302L)

.orderId(5002L)

.price(15_250L)

.size(10L) // order size is 10 lots

.action(OrderAction.ASK)

.orderType(OrderType.IOC) // Immediate-or-Cancel

.symbol(symbolXbtLtc)

.build());Request order book:

future = api.requestOrderBookAsync(symbolXbtLtc, 10);GtC orders manipulations:

// first user moves remaining order to price 1.53 LTC

future = api.submitCommandAsync(ApiMoveOrder.builder()

.uid(301L)

.orderId(5001L)

.newPrice(15_300L)

.symbol(symbolXbtLtc)

.build());

// first user cancel remaining order

future = api.submitCommandAsync(ApiCancelOrder.builder()

.uid(301L)

.orderId(5001L)

.symbol(symbolXbtLtc)

.build());Check user balance and GtC orders:

Future<SingleUserReportResult> report = api.processReport(new SingleUserReportQuery(301), 0);Check system balance:

// check fees collected

Future<TotalCurrencyBalanceReportResult> totalsReport = api.processReport(new TotalCurrencyBalanceReportQuery(), 0);

System.out.println("LTC fees collected: " + totalsReport.get().getFees().get(currencyCodeLtc));Testing

- latency test: mvn -Dtest=PerfLatency#testLatencyMargin test

- throughput test: mvn -Dtest=PerfThroughput#testThroughputMargin test

- hiccups test: mvn -Dtest=PerfHiccups#testHiccups test

- serialization test: mvn -Dtest=PerfPersistence#testPersistenceMargin test

TODOs

- market data feeds (full order log, L2 market data, BBO, trades)

- clearing and settlement

- reporting

- clustering

- FIX and REST API gateways

- cryptocurrency payment gateway

- more tests and benchmarks

- NUMA-aware and CPU layout custom configuration

Contributing

Exchange-core is an open-source project and contributions are welcome!