This is an example of how Modern Portfolio Theory can be used to generate optimal risk-adjusted returns. There are a few scripts which can be run:

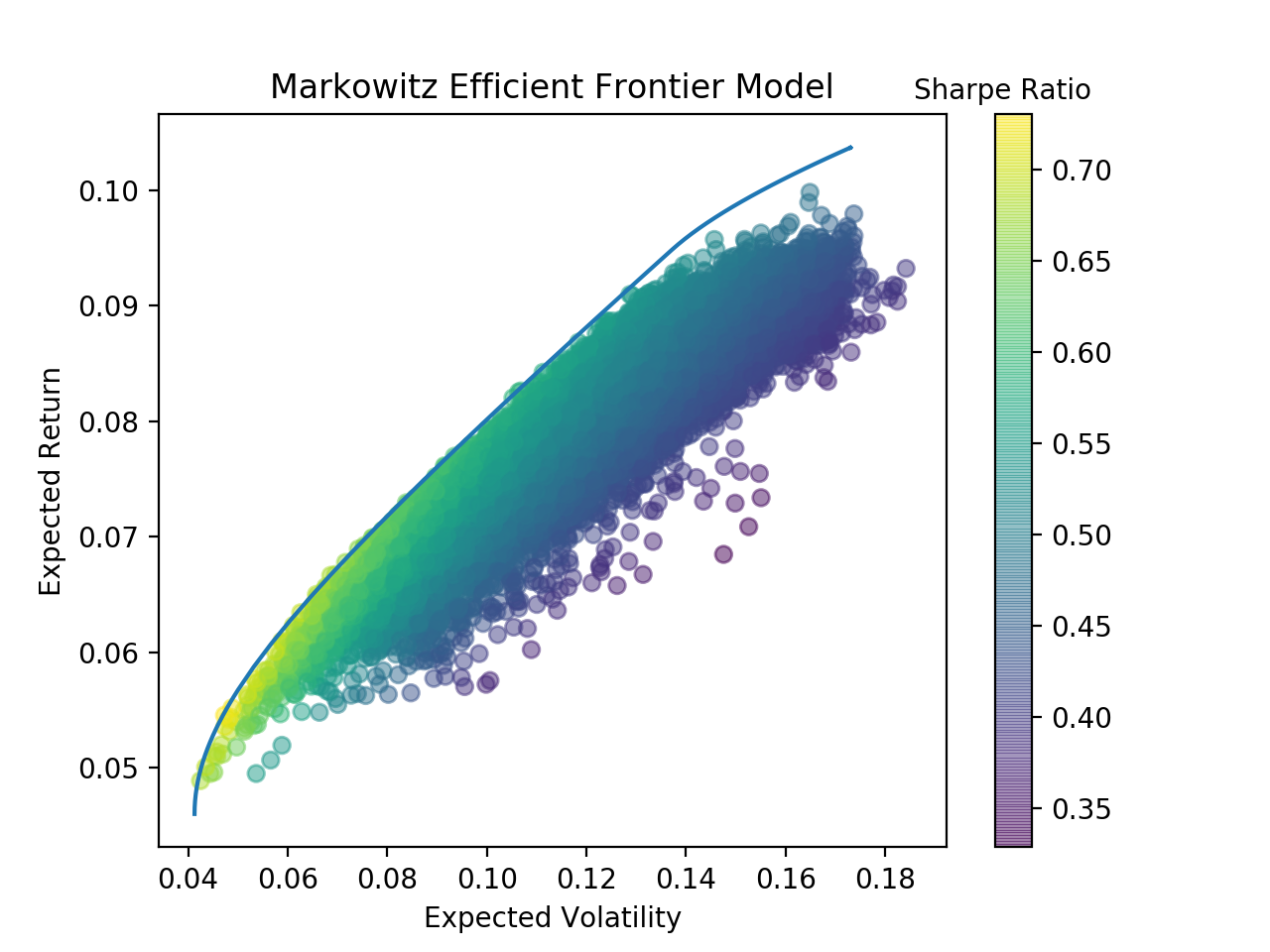

- Frontier: Plots efficient frontier and calculates best mix of given investment options.

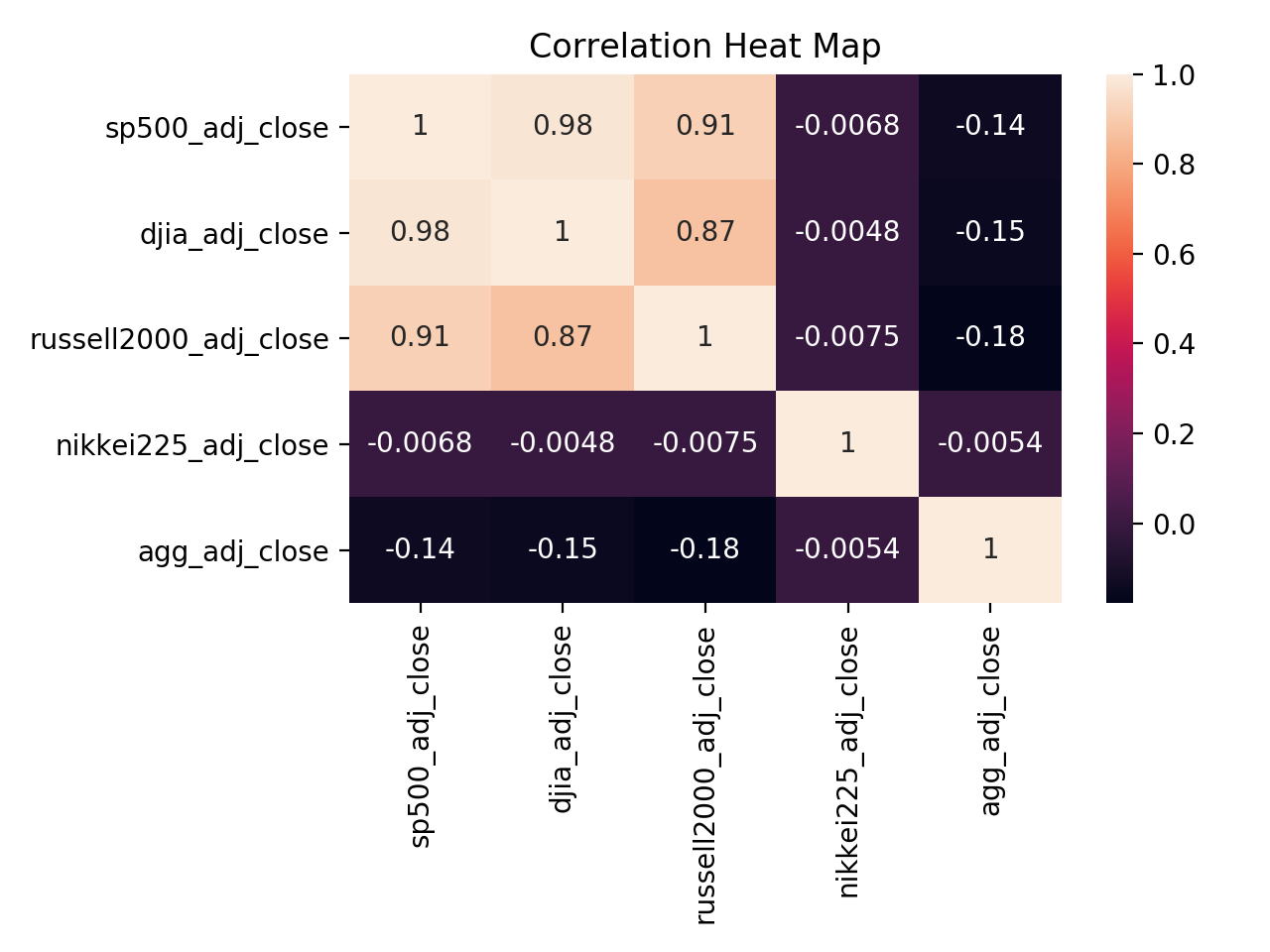

- Correlation: Plots a heatmap of correlation between each pair of investment options. This shows how different investment options move with respect to one another over time.

Note: The current scripts assume that all prices are adjusted (dividends and splits taken into consideration).