This repository is home to a High-Frequency Trading (HFT) framework, developed using Java and Python, primarily for research applications. The framework is engineered to interface with live markets through the use of Connectors , which can be integrated within the same process or remotely via the ZeroMQ networking library.

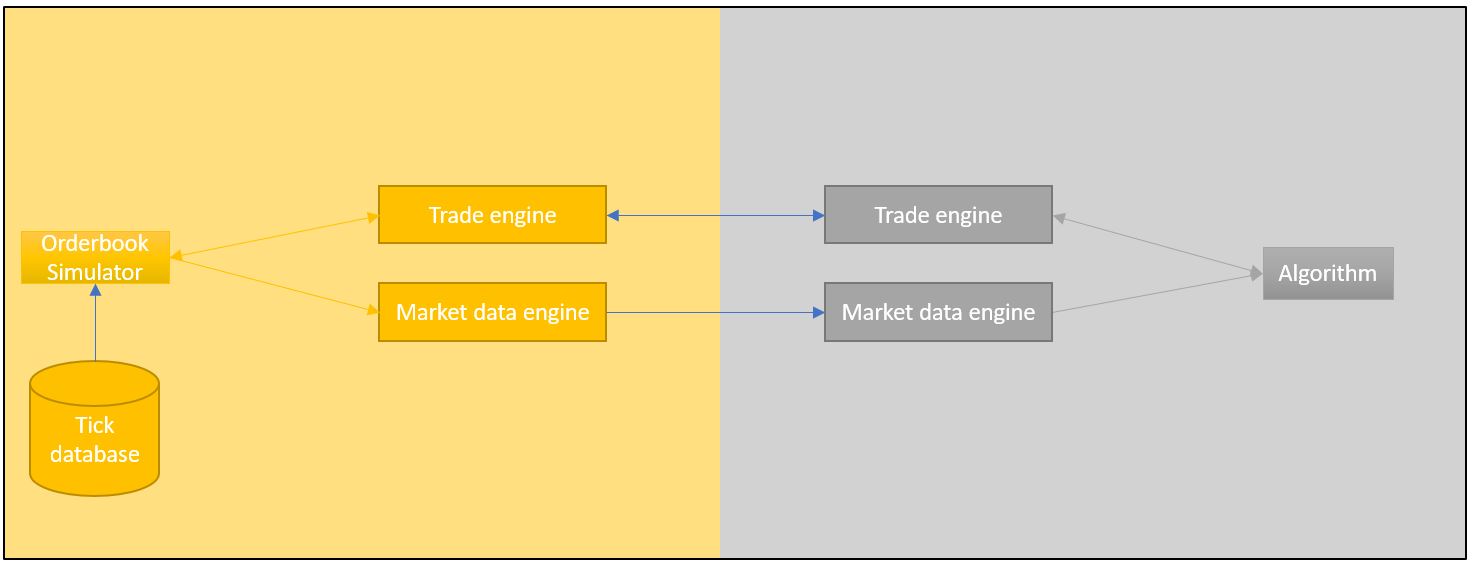

A significant feature of this framework is its ability to perform backtesting at the L2 tick data level, utilizing the same codebase as that used for live market interfacing. This capability allows for a detailed and granular analysis of trading strategies, providing valuable insights into their potential performance in live markets.

Feedback, suggestions, and modifications are welcomed and appreciated.

Please note: This framework has not been validated in a live trading environment. Proceed with caution and assume all

associated risks.

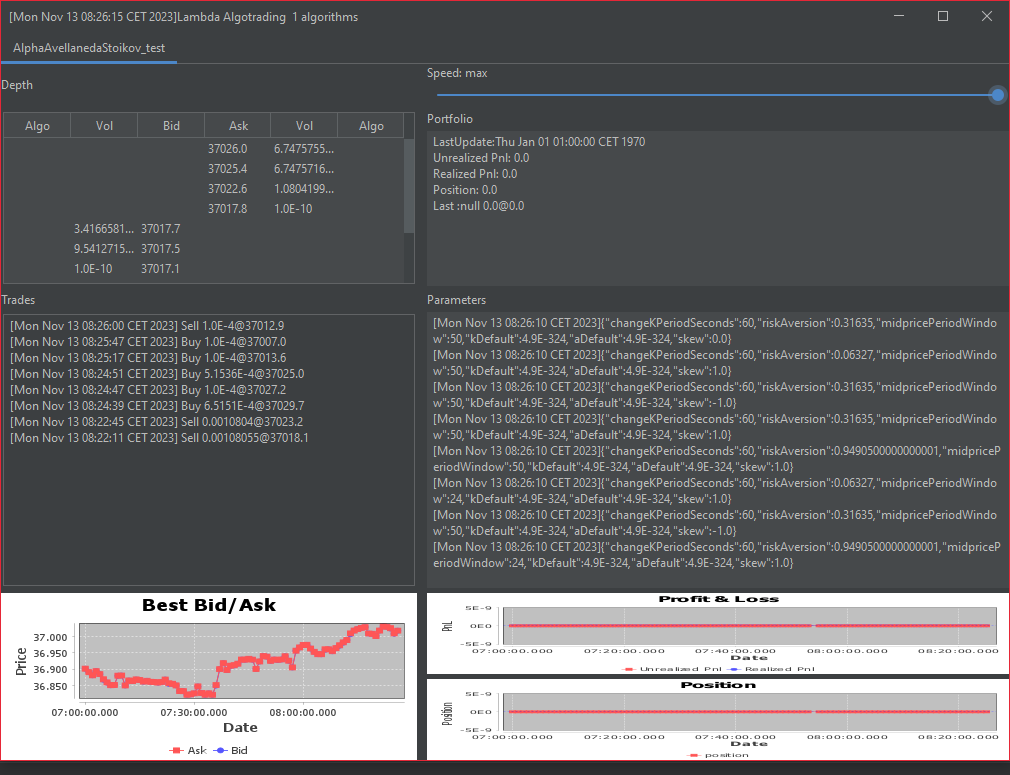

In this instance, we execute a backtest for the Java strategies ConstantSpread and LinearConstantSpread, as well as their Python counterparts ConstantSpread and LinearConstantSpread. These instructions pertain to the execution of pre-existing algorithms.

To develop a new algorithm, one must create a new class that extends from Algorithm.java and incorporate it into the algorithm builder method getAlgorithm in AlgorithmCreationTools.

- Execute the compilation and packaging process for the Backtest module, which will result in the generation of a JAR file. The target location for this file is java/executables/Backtest/target/Backtest.jar.

- Establish a reference to the aforementioned path in the environment variable denoted as LAMBDA_JAR_PATH.

- Ensure the data folder is prepared and contains the necessary Parquet files for the backtest. An example data set is provided for reference.

- Establish a reference to the data path in the environment variable denoted as LAMBDA_DATA_PATH.

- Initiate the backtest process. This can be achieved through one of the available options.

- Java: configuring json ConstantSpread backtest

java -jar Backtest.jar example_ConstantSpread.json - Python: like in the ConstantSpread example ConstantSpread

constant_spread = ConstantSpread(algorithm_info='test_main') output_test = constant_spread.test( instrument_pk='btcusdt_kraken', start_date=datetime.datetime(year=2023, day=13, month=11, hour=9), end_date=datetime.datetime(year=2023, day=13, month=11, hour=15), ) - Java: configuring json ConstantSpread backtest

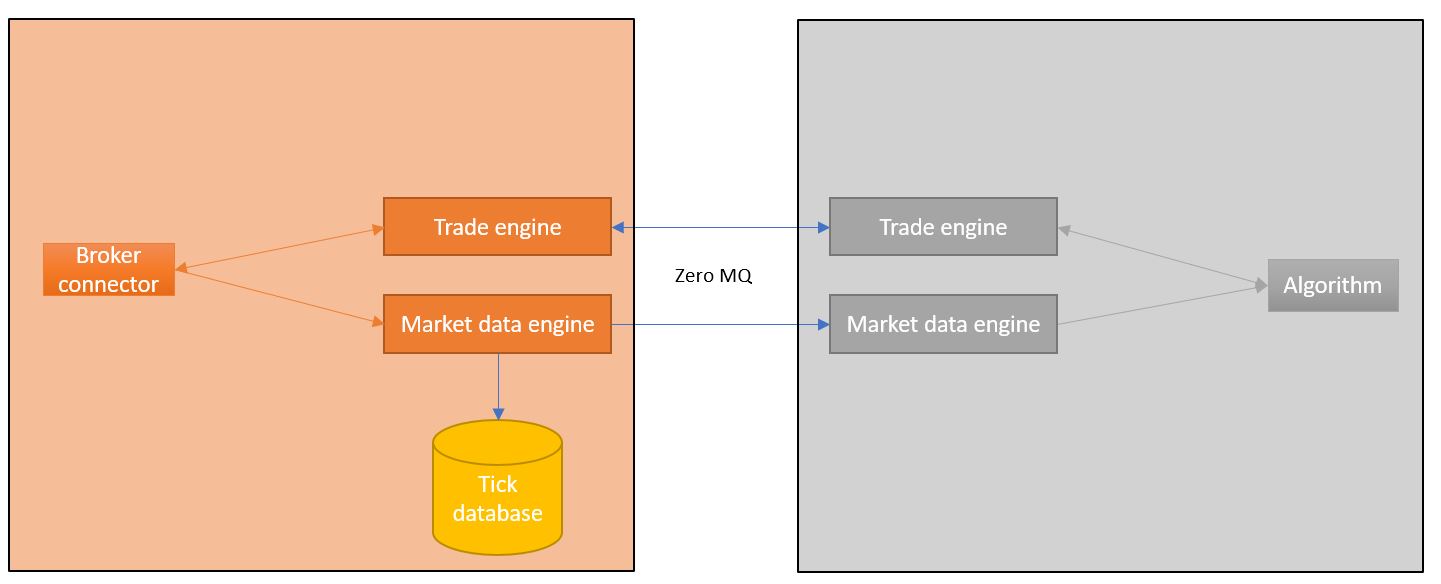

- Execute the compilation and packaging process for the AlgoTradingZeroMq module, which will result in the generation of a JAR file. The target location for this file is java/executables/AlgoTradingZeroMq/target/AlgoTradingZeroMq.jar.

- Establish a reference to the aforementioned path in the environment variable denoted as LAMBDA_ZEROMQ_JAR_PATH.

- Execute the compilation and packaging process for the Market Engine

- Launch the market engine ,configure market data engine and trading engine ports in

the application.properties

and application.properties

java -jar XChangeEngine.jarorjava -jar MetatraderEngine.jar - Configure algorithm json file parameters_constant_spread.json with the same port as in previous step

- Launch live trading using AlgoTradingZeroMq

- Java: configuring

json parameters_constant_spread.json

java -jar AlgoTradingZeroMq.jar parameters_constant_spread.json - Python: running the class AlgoTradingZeroMqLauncher

configuration_file = 'parameters_constant_spread.json' launcher = AlgoTradingZeroMqLauncher( algorithm_settings_path=configuration_file ) launcher.run() - Java: configuring

json parameters_constant_spread.json

This engines are though to be used in live trading and are going to be the connection with the market. They are going to be configured in the AlgorithmConnectorConfiguration and are in charge of translate market messages into the format our framework can understand and send orders to the market.

These engines possess the capability to archive data in a database, a feature that can be leveraged for the purpose of backtesting or analytical examination.

- MarketDataProvider : receive depth and trades . listen(TypeMessage.depth, TypeMessage.trade, TypeMessage.command)

- TradingEngineConnector: send request and listen to execution reports listen(TypeMessage.execution_report, TypeMessage.info)

The XChange library serves as a connector, establishing a link with the cryptocurrency exchange. This connection facilitates the reception of depth and trade data.

The Metatrader library serves as a connector, establishing a link with the exchange to receive depth and trade data for forex. Given that Metatrader does not offer a public API, we utilize the ZeroMQ connector to interface with the Metatrader terminal. A server Expert Advisor (EA) is employed to transmit depth and trade data to the ZeroMQ connector.

The server EA,

lambda_zeromq_gateway.mq5,

can be found within the project files. To install it in Metatrader 5,

the entire metatrader_ea folder should be copied into the

MQL5/Experts directory and compiled. Subsequently, the EA must be configured to match the ports specified in the

application.properties file.

metatrader.pub.port=32770

metatrader.push.port=32769

metatrader.pull.port=32768

- LAMBDA_JAR_PATH = path of the backtest jar path to run from python

- LAMBDA_ZEROMQ_JAR_PATH = path of the zeromq live trading jar path to run from python

- LAMBDA_DATA_PATH = Folder where the DB was saved

- LAMBDA_LOGS_PATH = where we are going to save the logs

- LAMBDA_PYTHON_PATH = Folder where python source code is,used in scripts( .../HFTFramework/python)

- LAMBDA_OUTPUT_PATH = base path where the ml models will be saved

- LAMBDA_INPUT_PATH = base path where the configuration of algorithms will be read automatically

- LAMBDA_TEMP_PATH = temp of java algorithms must be the same as application.properties

- JavaLOB

- Tablesaw

- Apache commons

- XChange

- Hudson Thames

- Pandas

- Numpy

- Seaborn

- Darwinex

- dwx-zeromq-connector

- Stable-baselines3

- Ray

- ...and so on

- Reduce/study live latency

- Add support to Ray for Reinforcement Learning

- Test with more exchanges

- Add more connectors

- Add more algorithms

- Add more tests

- Add more documentation

- ...

bibtex

@article{10.1371/journal.pone.0277042,

doi = {10.1371/journal.pone.0277042},

author = {Falces Marin, Javier AND Díaz Pardo de Vera, David AND Lopez Gonzalo, Eduardo},

journal = {PLOS ONE},

publisher = {Public Library of Science},

title = {A reinforcement learning approach to improve the performance of the Avellaneda-Stoikov market-making algorithm},

year = {2022},

month = {12},

volume = {17},

url = {https://doi.org/10.1371/journal.pone.0277042},

pages = {1-32},

abstract = {Market making is a high-frequency trading problem for which solutions based on reinforcement learning (RL) are being explored increasingly. This paper presents an approach to market making using deep reinforcement learning, with the novelty that, rather than to set the bid and ask prices directly, the neural network output is used to tweak the risk aversion parameter and the output of the Avellaneda-Stoikov procedure to obtain bid and ask prices that minimise inventory risk. Two further contributions are, first, that the initial parameters for the Avellaneda-Stoikov equations are optimised with a genetic algorithm, which parameters are also used to create a baseline Avellaneda-Stoikov agent (Gen-AS); and second, that state-defining features forming the RL agent’s neural network input are selected based on their relative importance by means of a random forest. Two variants of the deep RL model (Alpha-AS-1 and Alpha-AS-2) were backtested on real data (L2 tick data from 30 days of bitcoin–dollar pair trading) alongside the Gen-AS model and two other baselines. The performance of the five models was recorded through four indicators (the Sharpe, Sortino and P&L-to-MAP ratios, and the maximum drawdown). Gen-AS outperformed the two other baseline models on all indicators, and in turn the two Alpha-AS models substantially outperformed Gen-AS on Sharpe, Sortino and P&L-to-MAP. Localised excessive risk-taking by the Alpha-AS models, as reflected in a few heavy dropdowns, is a source of concern for which possible solutions are discussed.},

number = {12},

}ris

TY - JOUR

T1 - A reinforcement learning approach to improve the performance of the Avellaneda-Stoikov market-making algorithm

A1 - Falces Marin, Javier

A1 - Díaz Pardo de Vera, David

A1 - Lopez Gonzalo, Eduardo

Y1 - 2022/12/20

N2 - Market making is a high-frequency trading problem for which solutions based on reinforcement learning (RL) are being explored increasingly. This paper presents an approach to market making using deep reinforcement learning, with the novelty that, rather than to set the bid and ask prices directly, the neural network output is used to tweak the risk aversion parameter and the output of the Avellaneda-Stoikov procedure to obtain bid and ask prices that minimise inventory risk. Two further contributions are, first, that the initial parameters for the Avellaneda-Stoikov equations are optimised with a genetic algorithm, which parameters are also used to create a baseline Avellaneda-Stoikov agent (Gen-AS); and second, that state-defining features forming the RL agent’s neural network input are selected based on their relative importance by means of a random forest. Two variants of the deep RL model (Alpha-AS-1 and Alpha-AS-2) were backtested on real data (L2 tick data from 30 days of bitcoin–dollar pair trading) alongside the Gen-AS model and two other baselines. The performance of the five models was recorded through four indicators (the Sharpe, Sortino and P&L-to-MAP ratios, and the maximum drawdown). Gen-AS outperformed the two other baseline models on all indicators, and in turn the two Alpha-AS models substantially outperformed Gen-AS on Sharpe, Sortino and P&L-to-MAP. Localised excessive risk-taking by the Alpha-AS models, as reflected in a few heavy dropdowns, is a source of concern for which possible solutions are discussed.

JF - PLOS ONE

JA - PLOS ONE

VL - 17

IS - 12

UR - https://doi.org/10.1371/journal.pone.0277042

SP - e0277042

EP -

PB - Public Library of Science

M3 - doi:10.1371/journal.pone.0277042

ER -