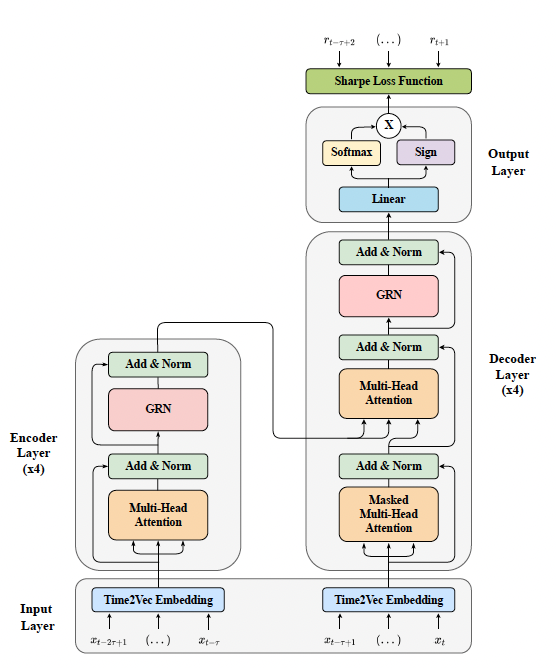

DeepFolio is a Python library for real-time portfolio optimization built on top of Google's TensorFlow platform. Its design and development is based on the Portfolio Transformer (PT), a novel end-to-end portfolio asset allocation framework, inspired by the numerous successes of attention mechanisms in natural language processing. With PT's full encoder-decoder architecture,specialized time encoding layers, and gating components, it has a high capacity to learn long-term dependencies among portfolio assets and hence can adapt more quickly to changing market conditions. Deepfolio combines optimization techniques (both convex and non-convex) with deep learning approaches to provide a powerful toolkit for investment professionals and researchers.

- Portfolio Transformer: Attention-Based Asset Allocation Framework

- Differentiable portfolio optimization

- Real-time optimization

- Robust and multi-period optimization

- Multi-asset class support

- Backtesting system

- Risk management tools

- Factor model integration

- Automated hyperparameter tuning (Backed by Optuna)

- Trade execution simulation

- Event-driven rebalancing

- Comprehensive reporting

- Sentiment analysis integration

- Tax-aware optimization

- Interactive visualization dashboard

pip install -U deepfoliofrom deepfolio.models import DiffOptPortfolio

from deepfolio.optimizers import CustomOptimizer

from deepfolio import Backtester

# Initialize the model

model = DiffOptPortfolio(input_dim=50, n_assets=10, hidden_dim=64)

# Create an optimizer

optimizer = CustomOptimizer(model.parameters())

# Load your data

features, returns = load_your_data()

# Create a backtester

backtester = Backtester(model, {'features': features, 'returns': returns})

# Run backtesting

backtester.run()

# Get results

results = backtester.get_results()

print(f"Sharpe Ratio: {results['sharpe_ratio']}")

print(f"Max Drawdown: {results['max_drawdown']}")from deepfolio.optimizers import portfolio_transformer

input_shape = (30, 10) # 30 time steps, 10 assets

d_model = 64

num_heads = 4

dff = 128

num_layers = 4

model = portfolio_transformer(input_shape, d_model, num_heads, dff, num_layers)

model.compile(optimizer='adam', loss='mse') # Adjust loss as per the paper's requirements

model.summary()from deepfolio.models import RealtimeOptimizer

from deepfolio.data import DataSource

data_source = DataSource(api_key="your_api_key")

optimizer = RealtimeOptimizer(model, data_source)

optimizer.start()from deepfolio.models import MultiAssetDiffOptPortfolio

asset_classes = ['stocks', 'bonds', 'commodities']

input_dims = {'stocks': 50, 'bonds': 30, 'commodities': 20}

hidden_dims = {'stocks': 64, 'bonds': 32, 'commodities': 32}

model = MultiAssetDiffOptPortfolio(asset_classes, input_dims, hidden_dims)from deepfolio.optimizers import TaxOptimizer

tax_optimizer = TaxOptimizer()

optimal_trades = tax_optimizer.optimize(current_portfolio, target_weights, prices, cost_basis, holding_period)from deepfolio.utils import PortfolioDashboard

dashboard = PortfolioDashboard(portfolio_data, benchmark_data)

dashboard.run()For detailed documentation, please visit our documentation site.

We welcome contributions! Please see our contributing guidelines for more details.

This project is licensed under the BSD-2-Clause License- see the LICENSE file for details.

[1] Damian Kisiel, Denise Gorse (2022). Portfolio Transformer for Attention-Based Asset Allocation arXiv:2206.03246 [q-fin.PM]

- This package leverages the power of TensorFlow for efficient portfolio optimization.

- Thanks to the financial machine learning community for inspiring many of the implemented methods.