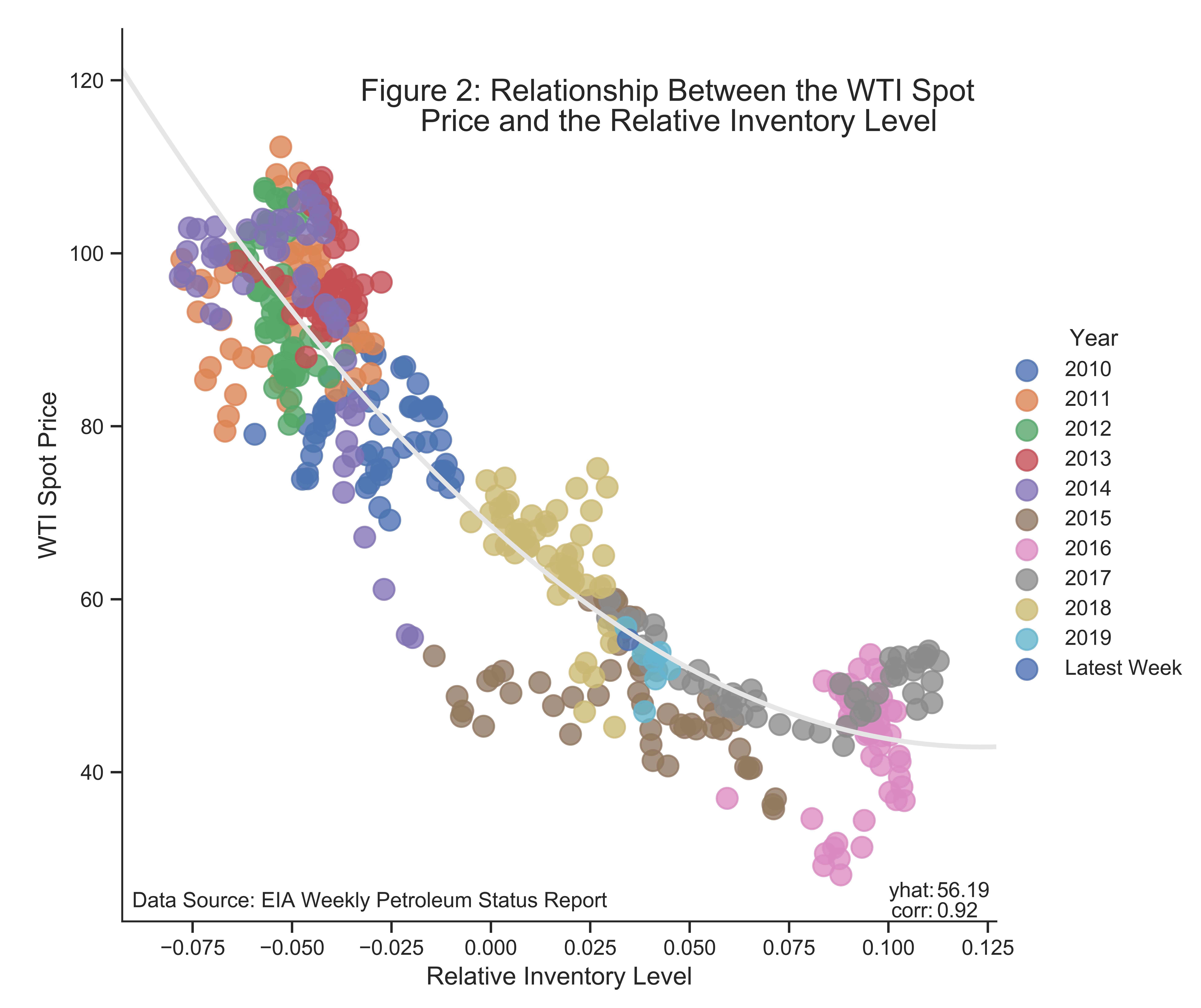

This jupyter notebook proposes a long-run forecasting model of the West Texas Intermediate (WTI) crude oil spot price using the United States petroleum inventory level. The inventory data used in the forecasting model is updated each wednesday at 10:30 AM EST; in conjunction with the Weekly Petroleum Status Report published by the U.S. Energy Information Administration (EIA). Applying the forecasting model between January 2010 to date, I find that the model delivers persistent long-term performance. The model is useful for those who are interested in forecasting future oil prices or for those who wish to understand and interpret historical price fluctuations.

Any individual who chooses to invest in any asset class should do so with caution. The information contained in this notebook should be viewed as commercial advertisement and is not intended to be investment advice.

- Always do your own due diligence.

- Please research before investing.

- Past performance is not indicative of future returns.