| ID | As a | I want to... | So that I can... |

|---|---|---|---|

| 1 | Customer | be welcomed to AwesomeGIC Bank when I launch the application | know I am interacting with the bank's system |

| 2 | Customer | have the option to deposit money into my bank account | increase my account balance |

| 3 | Customer | have the option to withdraw money from my bank account | access my funds when needed |

| 4 | Customer | receive confirmation when I deposit or withdraw money from my bank account | know the transaction was successful |

| 5 | Customer | receive appropriate error messages when the transaction is unsuccessful | understand the reason for the unsuccessful transaction, then respond accordingly |

| 6 | Customer | print a statement of my bank account transactions | keep track of my financial activities |

| 7 | Customer | have the bank statement display the date, amount, and current balance for each transaction | have complete information about my account history |

| 8 | Customer | be able to quit the banking application when I am done with my transactions | exit the program gracefully |

| 9 | Customer | receive a farewell message when I quit the banking application | feel appreciated as a customer of AwesomeGIC Bank |

Prerequisite: Have Java correctly installed on your machine, and added to PATH.

Identify the AwesomeGICBank.jar file located in the root directory. cd into the root directory. Then, run the command:

java -jar AwesomeGICBank.jar

│ BankTeller.java

│ Main.java

│

├───bank_accounts

│ BankAccount.java

│ DepositService.java

│ PrintStatementService.java

│ WithdrawService.java

│

├───bank_account_operations

│ BankAccountOperation.java

│ BankAccountOperationFactory.java

│ DepositOperation.java

│ PrintStatementOperation.java

│ QuitOperation.java

│ WithdrawOperation.java

│

├───exceptions

│ BankAccountOperationException.java

│ DepositAmountNonPositiveException.java

│ NegativeBalanceTransactionException.java

│ TransactionException.java

│ WithdrawAmountExceedDepositException.java

│ WithdrawAmountNonPositiveException.java

│

└───transactions

DepositTransaction.java

Transaction.java

TransactionHistoryManager.java

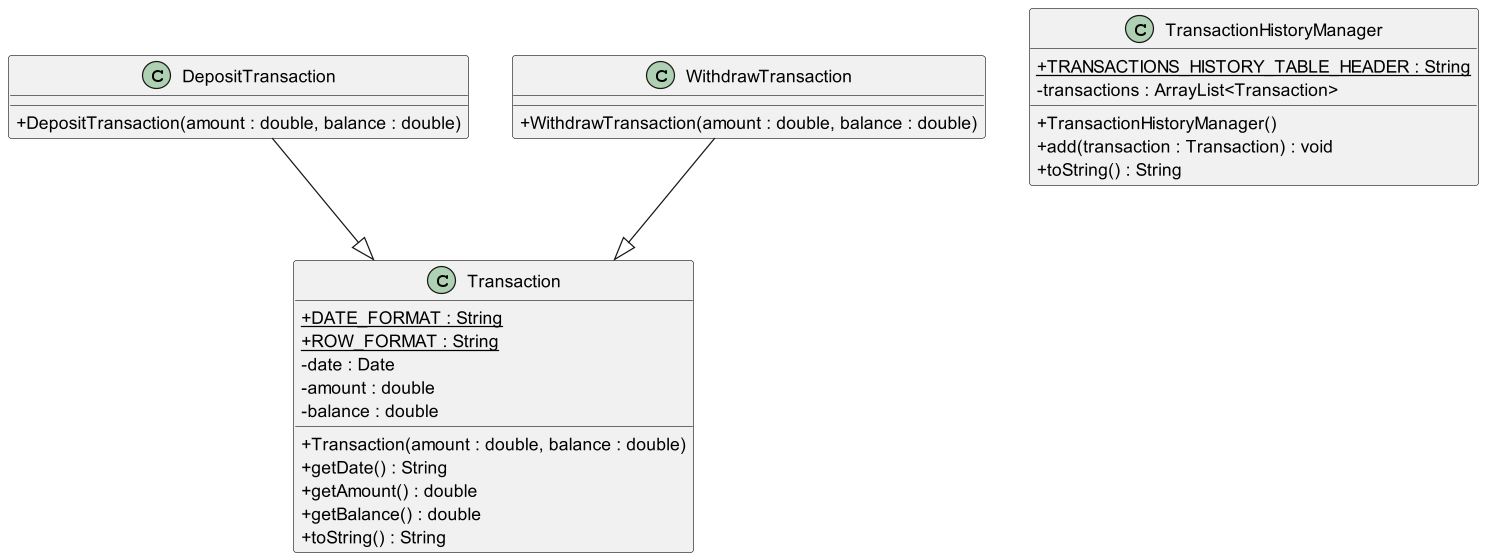

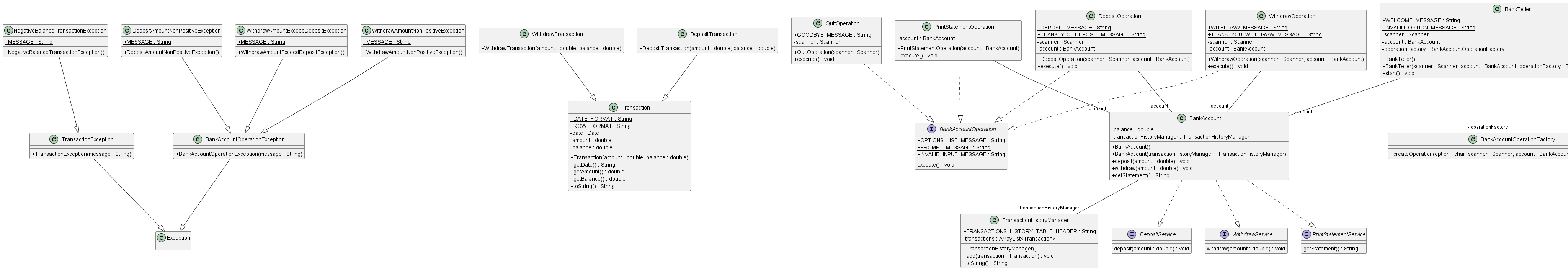

WithdrawTransaction.javaThe abstract class Transaction keeps track of the details of a single transaction, such as date, amount, and balance. There are 2 types of Transactions, which are WithdrawTransaction and DepositTransaction. TransactionHistoryManager keeps track of the transaction history, ordered by transaction date, using an ArrayList.

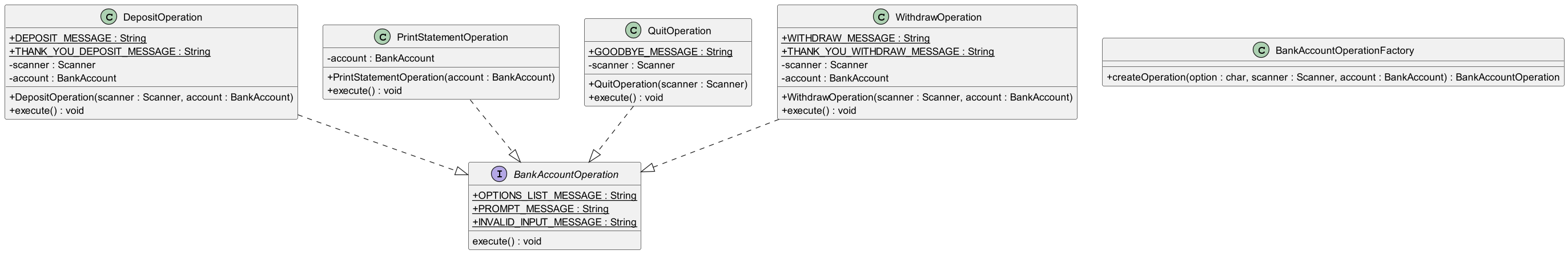

The 4 main operations, Deposit, Withdraw, PrintStatement, and Quit, all implement the execute() method from the BankAccountOperation interface. BankAccountOperationFactory is a factory class that creates operations of type ****BankAccountOperation for the bank account. It applies the Command and Factory Method design patterns.

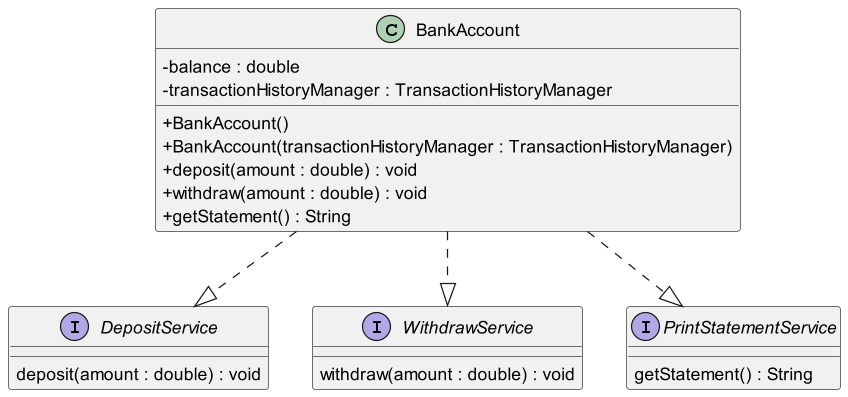

The BankAccount class implements the logic to support the main functionalities of a bank account, through the deposit(), withdraw(), and getStatement() methods. It keeps track of the current balance of the bank account and a historical list of Transactions, using the TransactionManager.

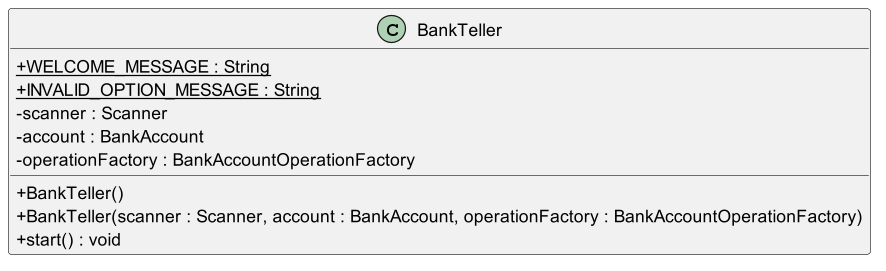

The BankTeller class plays the role of a bank teller in a real-world scenario, handling user requests and bank responses through I/O operations. It is the sole entry point to interact with a bank account.

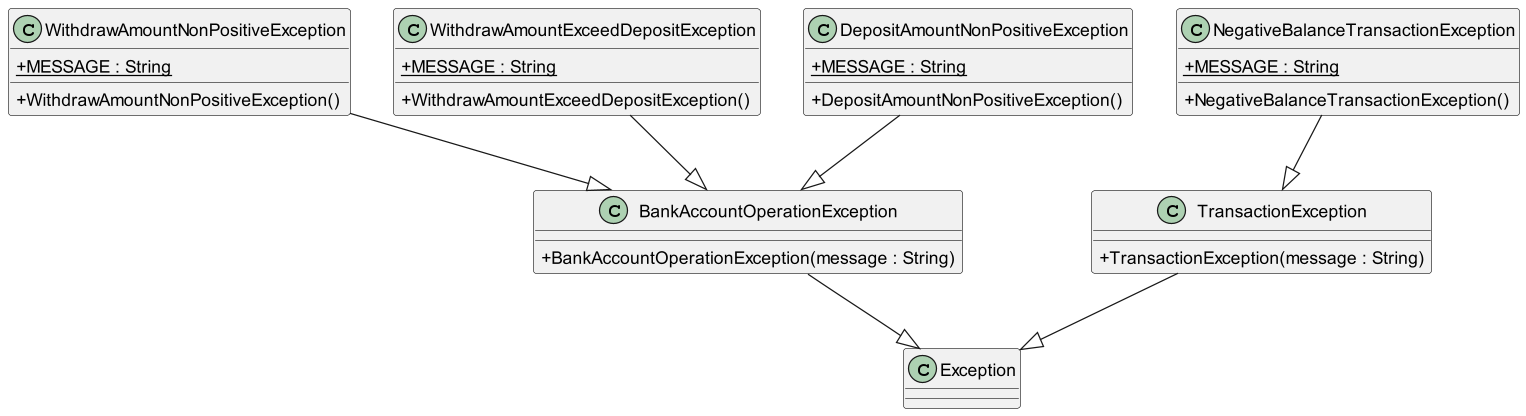

The exceptions focus on responding to scenarios where the user input will result in an invalid state for the bank account, for example, depositing or withdrawing a non-positive amount of money, or withdrawing more than the existing deposit (we do not support loans yet!). These exceptions extend the abstract class BankAccountOperationException, which itself extends the Exception class. The NegativeBalanceTransactionException is used to respond to the case of negative balance supplied during the instantiation of a Transaction class.

In this application, each class only has one responsibility and one reason to change. For example, the BankAccount class fully handles the logic of a bank account, the BankTeller class handles all user requests, the Transaction classes are responsible for storing individual transaction data, the TransactionHistoryManager keeps track of the historical list of Transactions, and the Operationclasses each handle their respective scenario.

Classes in this application are designed such that they are open for extension but closed for modification. For example, the Transaction abstract class could be extended to model different types of bank account transactions, like PaymentTransaction and InterestTransaction. The BankAccount class could be extended to model different type of bank accounts, likeFixedDepositBankAccount, SavingsBankAccount, and SalaryBankAccount. This allows for flexibility and reduces the risk of introducing bugs when extending the system's functionality.

if class A is a subtype of class B, we should be able to replace B with A without disrupting the behavior of our program. In this application, this is achieved by correctly extending the behavior of the BankAccountOperation interface among its subclasses. The execute() method in DepositOperation and WithdrawOperation both throw the BankAccountOperationException that was defined in BankAccountOperation, while inPrintStatementOperation and QuiteOperation, execute() does not throw the BankAccountOperationException. In either case, the behavior of the execute() method is successfully extended and we could replace any instance of type BankAccountOperation with an instance of its subclass.

We split larger interfaces into smaller ones. This could be shown in the implementation of theBankAccount class, where it implements 3 interfaces, DepositService, WithdrawService, and PrintStatementService, each with their corresponding functions. By doing so, we can ensure that implementing classes only need to be concerned about the methods that are of interest to them.

For example, the BankTeller constructor takes in Scanner, BankAccount, and BankAccountOperationFactory such that it depends on the abstractions of these classes instead of directly depending on them. This way, we could achieve low coupling because instead of high-level modules depending on low-level modules, both will depend on abstractions.

- Application of Single Level of Abstraction Principle (SLAP).

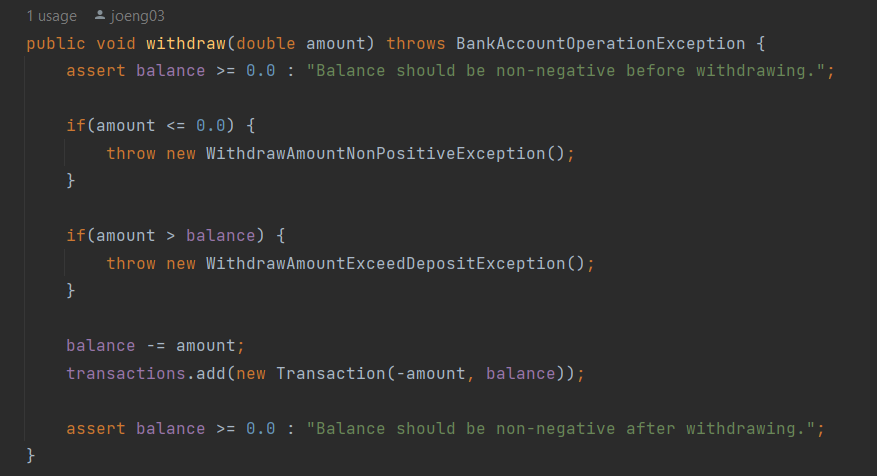

- Use of guard clauses to keep the happy path prominent.

- No magic numbers and string literals, abstracted them out as constants instead.

- Widespread coverage and correct format of Javadoc.

The representation invariant for the bank account is that balances must be non-negative at all times. This condition is asserted at the beginning and the end of every mutating function (deposit() and withdraw()), at the beginning of every non-mutating function (getStatement()), and at the end of the constructor (BankAccount()). Through the extensive use of assertions, we greatly reduce the possibility of introducing changes that violate the representation invariants (bugs) during the development process.

As opposed to using naive String concatenation, which results in a time complexity of O(N²) due to the immutability of String in Java, where N is the length of the final String, StringBuilder was used in the toString() method of TransactionHistoryManager to provide O(N) time complexity when building the transaction table.

Concurrent access from multiple clients is a critical scenario in a banking system. In a multi-client, concurrent environment, each client could be represented by a thread in the BankTeller thread pool. To achieve this, methods like deposit(), withdraw(), and getStatement() in the BankAccount class should be explicitly synchronized using the synchronized keyword. Outside synchronized blocks, shared data structures such as ArrayList, used to store transaction history, must be synchronized using the Java Collections library to avoid thread safety issues. By synchronizing access to these resources, we can safeguard against race conditions, thus maintaining the integrity of bank account data.

As a banking system which prioritises consistency over availability, an SQL database, which adheres to the ACID model, may be preferred over a NoSQL database. The database tables that may be needed are Customer, BankAccount, Transaction, and AuditLog. We could use JDBC (Java Database Connectivity) to interact with the database. ORM frameworks such as Hibernate or JPA could be used to map Java objects to the database tables.

To accommodate various types of bank accounts like FixedDepositBankAccount, SavingsBankAccount, and SalaryBankAccount, it's essential to abstract common attributes and methods from the current BankAccount class into an abstract class or multiple interfaces. This abstraction allows all bank account types to extend the behavior of the base class or implement the required interfaces, ensuring consistency across different account types while enabling specific functionalities unique to each account type.

Unit testing and integration testing are essential components of ensuring the reliability and correctness of the banking application.

Test Cases:

- Test depositing a positive amount updates the balance correctly.

- Test depositing a non-positive amount throws

DepositAmountNonPositiveException. - Test withdrawing a valid amount updates the balance correctly.

- Test withdrawing a non-positive amount throws

WithdrawAmountNonPositiveException. - Test withdrawing an amount exceeding the balance throws

WithdrawAmountExceedDepositException. - Test printing the account statement generates the correct output.

Test Cases:

- Test creating

DepositOperationreturns the correct instance. - Test creating

WithdrawOperationreturns the correct instance. - Test creating

PrintStatementOperationreturns the correct instance. - Test creating

QuitOperationreturns the correct instance. - Test creating with an invalid character returns null.

Test Cases:

- Test executing deposit operation updates the balance correctly.

Test Cases:

- Test executing withdraw operation updates the balance correctly.

Test Cases:

- Test executing print statement operation generates the correct output.

Test Cases:

- Test executing quit operation exits the application.

Test Cases:

- Test throwing

BankAccountOperationExceptionwith the correct error message.

Test Cases:

- Test throwing

DepositAmountNonPositiveExceptionwith the correct error message.

Test Cases:

- Test throwing

WithdrawAmountExceedDepositExceptionwith the correct error message.

Test Cases:

- Test throwing

WithdrawAmountNonPositiveExceptionwith the correct error message.

Test Cases:

- Test creating deposit transaction with the correct details.

- Test creating withdraw transaction with the correct details.

Test Cases:

- Test adding a transaction to the transaction history.

- Test retrieving transaction history for a specific account.

Test Cases:

- Test BankTeller start method initiates the banking application correctly.

Test Cases:

- Test Main class executes without errors.

- Prepare test data for deposit, withdrawal, and printing statement scenarios.

- Include positive cases, negative cases, and boundary cases to cover various scenarios.

- Execute each test case individually to verify its functionality.

- Ensure that all tests pass successfully.

- Use mocking frameworks like Mockito to mock external dependencies and isolate components for unit testing.

- Use code coverage tools to ensure that all lines of code are covered by unit tests.

By following this unit test plan, you can ensure comprehensive test coverage and validate the functionality of each component in the banking system.

Integration tests should simulate the entire user interaction flow from start to finish, including:

- Launching the application.

- Performing multiple deposits, withdrawals, and printing statements.

- Exiting the application.

- Error Handling: Integration tests should verify that the application handles errors gracefully, such as invalid user inputs or unexpected system behavior.

- Concurrency: If the application supports concurrent access, integration tests should ensure that concurrent operations do not result in data corruption or inconsistencies.

- Input/Output Validation: Integration tests should validate that the application correctly interprets user inputs and generates the expected outputs.

By conducting comprehensive unit and integration tests, developers can ensure that the banking application functions as intended, providing users with a reliable and seamless banking experience while maintaining the security and integrity of their financial transactions.