Optimizing a portfolio of stocks is a challenging problem that looks to identify the optimal number of shares of each stock to purchase in order to minimize risk (variance) and maximize returns, while staying under some specified spending budget.

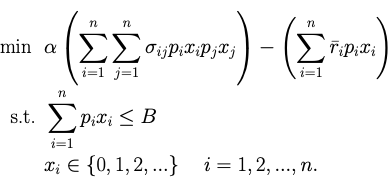

Consider a set of n types of stocks to choose from, with an average monthly return per dollar spent of ri for each stock i. Furthermore, let σi,j be the covariance of the returns of stocks i and j. For a spending budget of B dollars, let xi denote the number of shares of stock i purchased at price pi per share. Then, this portfolio optimization problem can be represented as

Here, α > 0 is the trade-off coefficient between the risk (variance) and the returns, also known as the risk aversion coefficient. Notice that while we are minimizing the variance, we are also minimizing the negative of the return (which is equivalent to maximizing the return).

There are two main demos included in this repository. For each demo, two models are showcased for the formulation of the portfolio problem:

- Discrete Quadratic Modeling (DQM)

- Constrained Quadratic Modeling (CQM)

The single-period demo determines the optimal number of shares to purchase from 3 stocks based on the historical price data provided. To run the demo, type:

python portfolio.py

This runs the single-period portfolio optimization problem, as formulated above, using default data

stored in basic_data.csv, builds the constrained quadratic model (CQM), and runs the CQM on

D-Wave's hybrid solver. The output of the run is printed to the console as follows.

Single period portfolio optimization run...

Loading data from provided CSV file...

CQM run...

Best feasible solution:

AAPL 45

MSFT 0

AAL 1

WMT 10

Estimated Returns: 14.37

Sales Revenue: 0.00

Purchase Cost: 998.43

Transaction Cost: 0.00

Variance: 1373.85The demo allows the user to choose among two additional CQM formulations for the portfolio optimization problem:

- The risk-bounding formulation solves the problem

maximize returns s.t. risk <= max_risk - The return-bounding formulation solves the problem

minimize risk s.t. returns >= min_return

Note that both of these formulations also include the budget constraint. To run the single-period demo with the CQM risk bounding formulation, type:

python portfolio.py -m 'CQM' --max-risk 1200

Single period portfolio optimization run...

Loading data from provided CSV file...

CQM run...

Best feasible solution:

AAPL 31

MSFT 3

AAL 3

WMT 12

Estimated Returns: 11.96

Sales Revenue: 0.00

Purchase Cost: 998.79

Transaction Cost: 0.00

Variance: 1196.06We can do similarly for the return-bounding formulation, with this command:

python portfolio.py -m 'CQM' --min-return 17.5

The demo allows the user to model transaction costs as a percentage of the total transactions value. For a transaction cost factor c and initial holdings x0, a new 0-1 variable yi is defined to indicate the transaction direction (1 for a sale and 0 for purchase) along with the following new constraints: xi ≥ yi xi0 xi0 ≥ xi(1 - yi) The balance constraint then becomes: Σi (pi(xi - xi0) + cpi(xi - xi0)(2yi - 1)) ≤ B

A default CQM run with a transaction cost factor of 1% can be done with the following command:

python portfolio.py -m 'CQM' -t 0.01

The user can select to build a disctrete quadratic model (DQM) using the following command:

python portfolio.py -m 'DQM'

This builds a DQM for the single-period portfolio optimization problem and solves it on Leap's hybrid solver. The DQM uses a binning approach where the range of the shares of each stock is divided into equally-spaced intervals.

The output of the default DQM run is printed on the console as follows.

Single period portfolio optimization run...

DQM run...

DQM -- solution for alpha == 0.005 and gamma == 100:

Shares to buy:

AAPL 43

MSFT 19

AAL 0

WMT 2

Estimated returns: 12.16

Purchase Cost: 991.39

Variance: 1939.62For the DQM single-period problem formulation, this demo gives the user the option to run a grid search on the objective parameters, α and γ. Note that α is the risk-aversion coefficient whereas γ is a penalty coefficient used in DQM to enforce the budget inequality.

The user can opt to run a grid search with DQM by providing a list of candidate values

for α (ie. [0.5, 0.0005]) and γ (ie.[10, 100]) as follows:

python portfolio.py -m 'DQM' -a 0.5 -a 0.0005 -g 10 -g 100

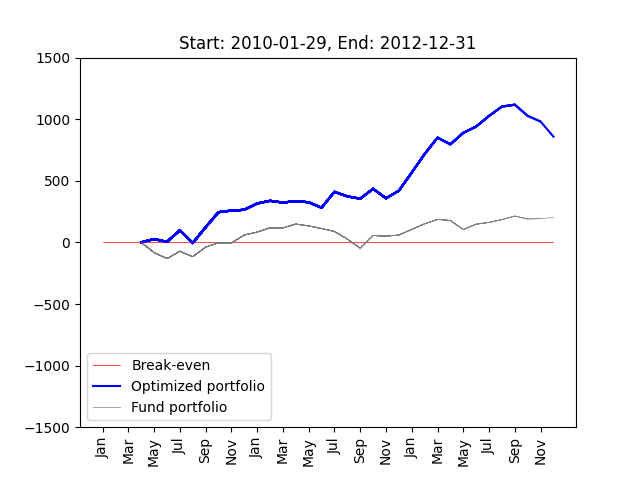

The multi-period demo provides an analysis of portfolio value over time: rebalancing the portfolio at each time period until the target time. To run the demo with default data and settings, type:

python portfolio.py -r

The program will pull historical data on four stocks from Yahoo! finance over a period of 3 years. For each month in the year, the optimal portfolio is computed and the funds are reinvested. A plot shows the trend of the portfolio value over time, as compared to a fund portfolio (investing all of the budget into a given fund, such as S&P500).

Note that this demo will take longer to run and will make many calls to the hybrid solvers, as it is running the model for each month over a 3-year period, resulting in optimizing over 30 different portfolios.

At the end of the analysis, the plot is saved as a .png file, as shown below.

The variance is the product of amount spent within each of two stocks multiplied by thecovariance of the two stocks, summed over all pairs of stocks (with repetition).

sum(stocks i and j) cov(i,j)*purchase(i)*purchase(j)

To compute the returns for a given purchase profile, we add up the expected returns for each stock: amount spent on the stock times the average monthly return of the stock.

sum(stock i) return(i)*purchase(i)

We cannot spend more than the budget allocated. This is a simple <= constraint (natively

enforced in CQM). This requirement can also be modeled as a double inequality with a lower

bound on spending (as we do in the case of DQM): minimum expenses <= expenses <= budget.

Here, the quantity minimum expenses can be selected to be a relatively close fraction of

the budget (e.g., 90% of the budget). This encoding of the budget requirement has practical

implications in that it allows the investor to specify a minimum amount to spend. In

addition, specifying a lower bound on the expenses will aid with the model formulation: the

higher the bound, the fewer slack variables needed for the DQM formulation.

The portfolio.py program can be called with these additional options:

- -b, --budget: problem budget

- -d, --dates: list of [start_date, end_date] for multi-period portfolio optimization problem

- -f, --file-path: full path of file with csv stock data

- -k, --num: number of stocks to be randomly picked to generate a random problem instance

- -n, --bin-size: bin size for dqm binning

- -s, --stocks: list of stocks for the problem

- -t, --t-cost: percentage transaction cost

- -v, --verbose: to turn on or off additional code output

- -z, --baseline: baseline stock for multi-period portfolio optimization run

The constant bin_size determines the number of different purchase quantity options every

stock will have. All variables will have a maximum number of cases less than or equal to

bin_size, and they are evenly spaced out in the interval from 0 to the maximum number of

shares possible to purchase given the price and budget.

For DQM, the budgeting constraint is added as a component of the objective function expression with an associated penalty coefficient γ. The DQM code contains the option to do a grid search in order to obtain the best values of the penalty coefficients γ and the risk-aversion coefficient α that result in the best objective value.

Each xi denotes the number of shares of stock i to be purchased.

All CQM formulations include the budget constraint described earlier.

This includes an upper bound on the risk as a quadratic constraint.

Such a constraint is supported natively by CQM.

This includes a lower bound on the returns as a linear inequality constraint.

There are 3 CQM formulations, each with a different objective:

- The bi-objective formulation corresponds to the original problem formulation where a combination of variance and mean is minimized.

- The risk-bounding formulation where only the returns are maximized.

- The return-bounding formulation where only the risk is minimized.

Ahmed, Shabbir. "The Optimization Process: An example of portfolio optimization." Georgia Tech University (2002). https://www2.isye.gatech.edu/~sahmed/isye6669/notes/portfolio.pdf

Mansini, R., Ogryczak, W., & Speranza, M. G. (2015). Linear and mixed integer programming for portfolio optimization. Springer International Publishing.