This project won the 🥉3rd place at the Encode Club Solana 2024 hackathon. The finalist presentation is here.

See demo details anf video here.

A novel universal Flash Loan Facility is described and prototyped on Solana. With an unusual calling pattern, it allows for Flash Loans in multiple protocols that are agnostic to and unaware of Flash Loans. In addition, this facility allows for a novel mechanism in which unlimited non-existent funds can be borrowed for the duration of a single transaction, to achieve even more powerful results than the typical flash loans.

Flash loans are a new lending mechanism typical to Decentralized Finance (DeFi). Protocols are able to borrow funds for the duration of a single atomic transaction. The transaction can succeed only if the flash loan is repaid within the same transaction along with the associated fee.

Flash loans have allowed arbitrage, timely liquidations and other very useful operations to be performed by parties with no sizable funds making DeFi a plain field available to anyone and more fair. This availability is making the associated DeFi protocols more nimble and thus more stable, more liquid and price-adjusted against other markets.

Flash loans have been a tool for abuse as well, but that has generally occurred with protocols that are poorly written and as such, subject to manipulation of price oracles. In addition, flash loans have been used to amplify exploits in buggy protocols and maximize the attack effects.

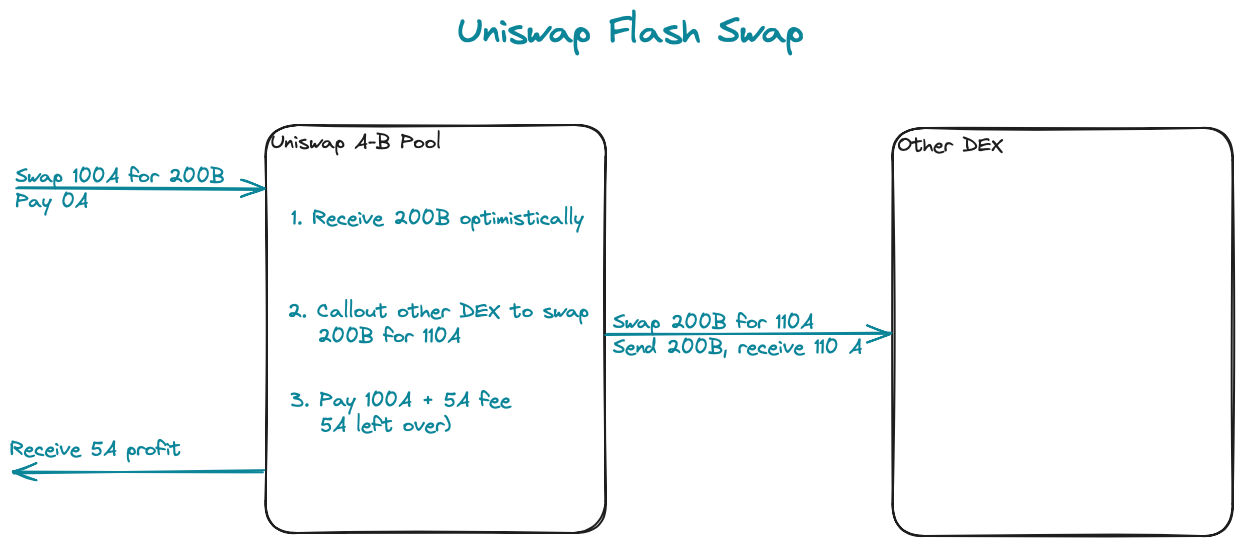

One of the first protocols allowing this mechanism was Uniswap, which called it Flash Swaps:

The purpose of of the Flash Swaps was to perform price arbitrage and equalize the Uniswap price against other on-chain exchanges. To achieve this, the sequence of swapping asset A for asset B was:

- Optimistically receive the asset B (in counter-value of the asset A).

- Having received asset B, while still in possession of asset A, call out another protocol (intentional callback). This would typically be a swap of asset B to A at another decentralized exchange (DEX) at better price.

- Having received more A because of the other DEX's better price, pay the required counter-value of asset A, and have some left-over of A to pay the fee and receive profit.

Note that the above Flash Swap can be executed by caller that has no funds (other than for gas), and make profit, while importantly performing price arbitrage to equalize the appropriate Uniswap market (pool) with the other DEX. Note that the borrowed funds have to previously exist in the appropriate Uniswap pool before calling the Flash Swap.

There is also an additional issue with Flash Loans: they are not available when they are needed the most. Namely, in times of low liquidity, the sources of flash lending are insufficient due to market conditions.

Our calling pattern is different, as it originates at our protocol and ends with our protocol, thus allowing for more universality.

In addition, it allows for borrowing funds that do not exist. This technique has been proven in a typical calling pattern with single protocol and demonstrated in liquidation of a delinquent leveraged position, otherwise not possible with usual flash loan, at CFD DEX and Flash Trillions presented at ETHGlobal Scaling Ethereum 2023.

However, while such flash loan of non-existent funds was demonstrated to work in a single protocol for liquidations, we go one step further, allowing such Unlimited Flash Loans that borrow non-existent funds, to be used across multiple protocols.

Read on...

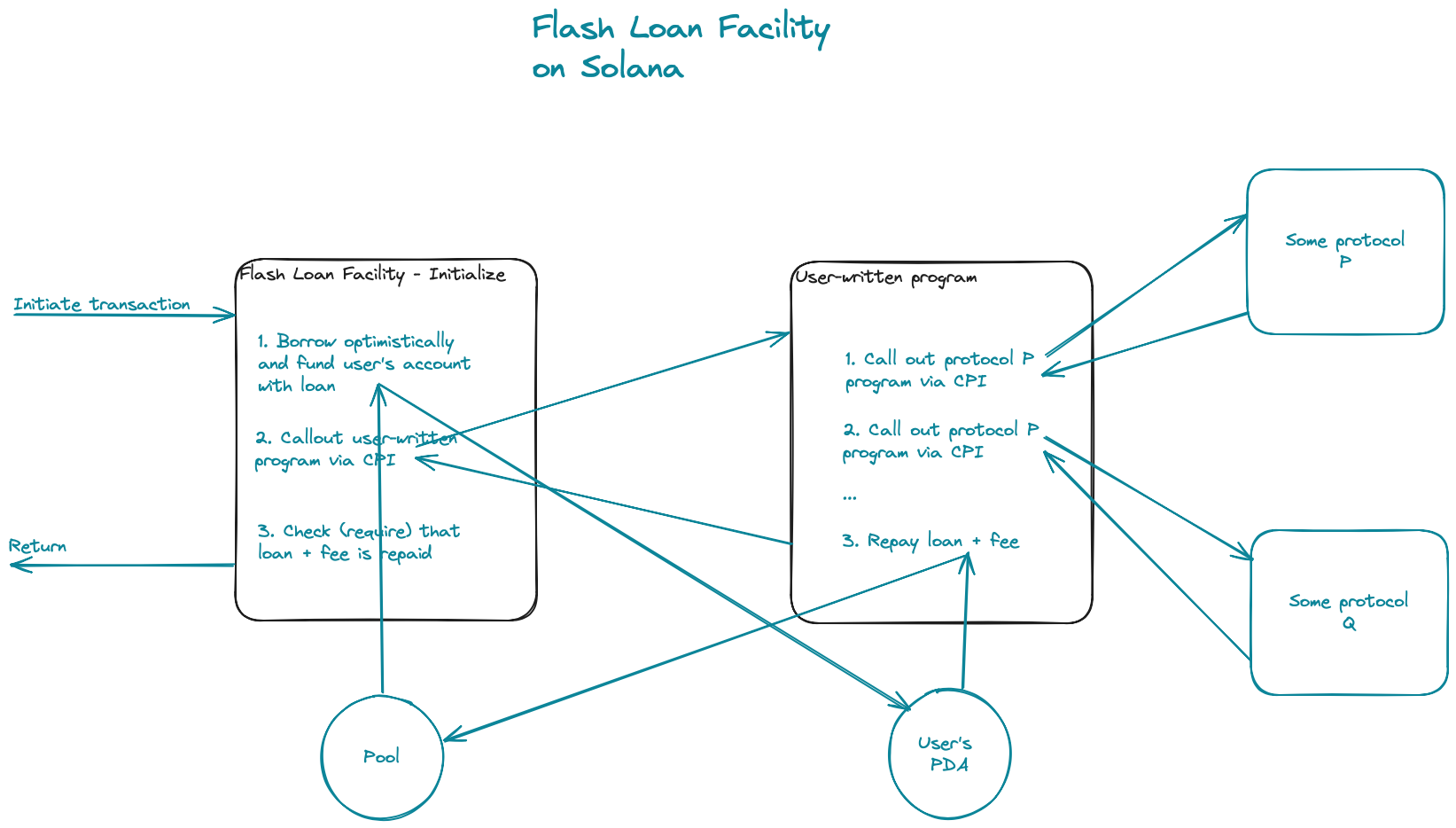

In order to allow for universal Flash Loan Facility usable by sequence of protocols all unaware of the flash loans, we use a different calling pattern / sequence:

- The Flash Loan Facility borrows funds from its pool (PDA - Solana Program Derived Account) and transfers the borrowed funds to the user's program PDA.

- The Flash Loan Facility calls (via CPI - Solana Cross Program Invocation) the user-written program intended for execution of the Flash Loan transaction.

- Having funds available, the user-written program permissionlessly calls a sequence of protocols it wants to utilize.

- Once the call to the user-written program returns, the Flash Loan Facility checks whether the loan is repaid along with the fee and otherwise it reverts the entire transaction.

But what does the "U" stand for in the FLUF Protocol? Read on...

FLUF stands for Flash Loan Unlimited Facility. The FLUF Protocol can offer Flash Loans of any requested amount, regardless whether the funds exist or not. How does this work? Here is the explanation:

Protocols are usually agnostic to the assets used and anyone can create new pools. For example, in an AMM (Automated Market Maker) anyone can create a Liquidity Pool for trading any desired pair of tokens A and B. As appropriate amounts of A and B are deposited in the Liquidity Pool, then anyone can trade against the Liquidity Pool.

Let's say we wrap both tokens A and B with another pair of tokens wA and wB, in one-to-one proportion (each token wA contains/wraps one token A and each token wB contains/wraps one token B).

We can then create a Liquidity Pool for trading wA and wB and deposit wA and wB in it. This is equivalent in value to the original Liquidity Pool of A and B as long as the amounts of wA and wB in the new pool are the same as the amounts of A and B in the original pool. To trade A for B in the new pool, we can wrap A into wA, trade wA for wB and then unwrap B from the returned wB, thus achieving the same as trading A for B in the original pool.

To recap:

- To wrap amount x of A into wA means to lock amount x of A, then to mint amount x of wA and to return it to the caller.

- To unwrap amount x of wA means to burn amount x of wA, then to unlock amount x of A and return it to the caller.

The FLUF Protocol (Flash Loan Unlimited Facility Protocol) operates Pools of capital (tokens) and it is in charge of minting and burning but it enforces the following rules:

- Any investor depositing a token T into the FLUF Pool, receives an equivalent value of amount of token fT. Note that the amount of fT received is not necessary the same amount of T deposited, as fT is an appreciating asset, as we will see that in the "Economics" section below. In addition, as the fT tokens contain actual collateralized value, they can be used in other DeFi protocols, for additional yield, but that's irrelevant to our explanation.

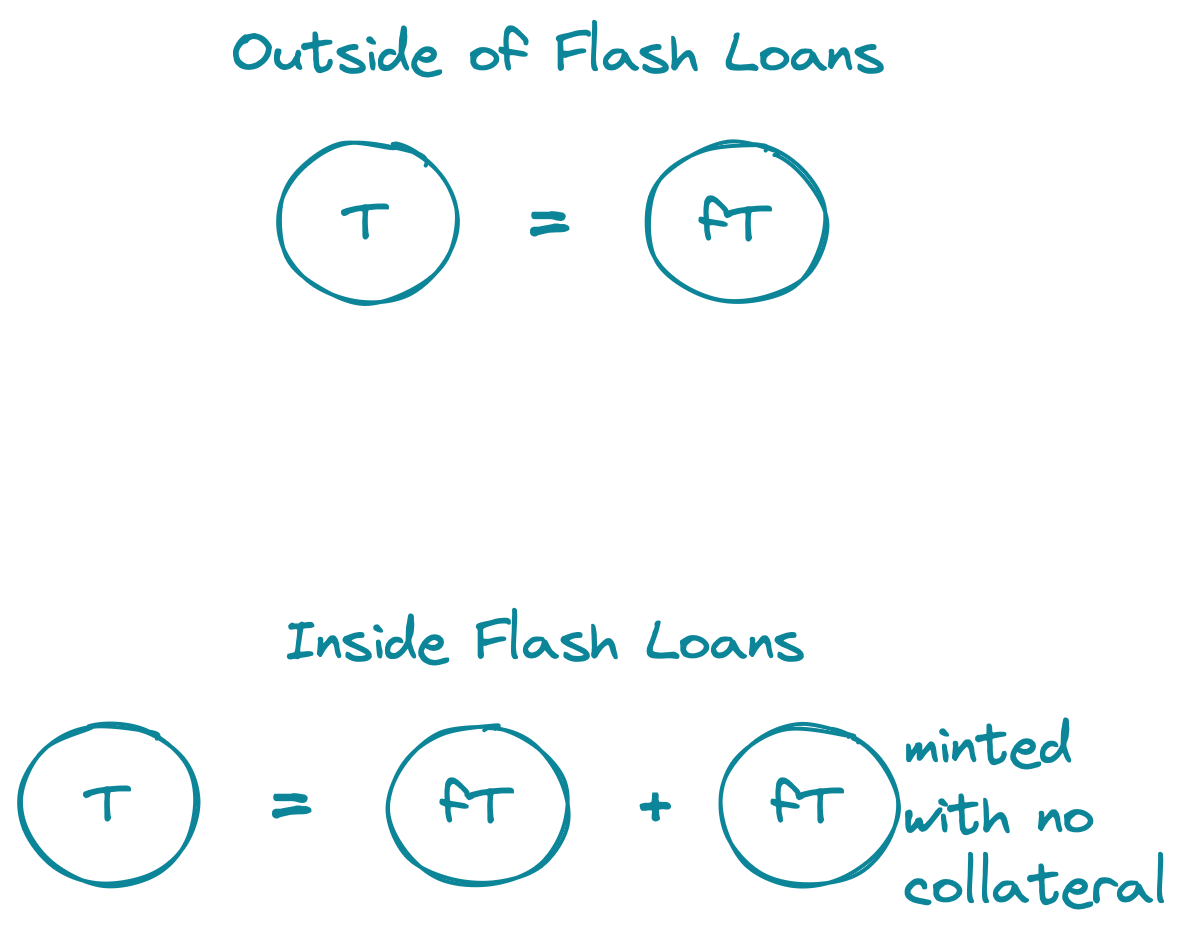

- The FLUF Protocol does not lend the deposited tokens T, but instead it lends ft. Outside of Flash Loans each fT is collateralized by T.

- Outside of Flash Loans, only T can be exchanged for fT (Pool Deposit) and vice versa (Pool Withdrawal).

- Inside Flash Loan (entrypoint

lendAndCall), the FLUF Protocol mints any requested amount of fT without collateral (regardless of the amount of T in the pool). However, this amount has to be repaid by the end of the transaction along with the fee, but then the FLUF Protocol burns only the amount that was lent. The reason why the FLUF Protocol can mint any amount without limit is because it does so without collateral, yet with appropriate repayment accounting.

The participants in the FLUF Protocol are the folloiwng:

- Investor: deposits tokens T into the appropriate FLUF Protocol Pool. Each token has its own pool, which is created permissionlessly by anyone, upon its first usage. In exchange for the deposited T the investors gets an equivalent counter-value fT tokens (FLUF-T). fT is an appreciating asset against T, so the investor depositing T to get a certain amount of fT, can withdraw the his investment and receive more T than initially deposited.

- Protocol: can use fT as any other token. This could be collateral for CFD or Perp Decentralized Exchanges (DEX), liquidity pools for lending and/or borrowing fT, spot DEXes for trading fT etc. This can be done in a permissioned manner by the protocol, or permissionlessly by the users of protocols that allow it. All such protocols, even previously unaware of flash loans, can utilize fT Flash Lending to stabilize their locked capital by price arbitrage, liquidation of delinquent accounts etc.

- Flash Loan User: can borrow any amount of fT to perform above mentioned arbitrage, liquidations etc. If the Flash Loan User needs T instead of fT, even for the duration of the Flash Loan (within an atomic transaction), he can convert fT to T up to the existent amount of T in the pool, and utilize it in protocols that operate on any token T. More importantly, fT can be borrowed in arbitrary amounts, making the liquidity pools, lending pools, fT-collateralized protocols, etc. even more stable, by being able to perform the desired actions even in liquidity crunches.

As each Flash Loan has to be repaid (back to the Pool) in token fT along with the fee of 0.25% (1/400) of the original amount borrowed. 1/5 of that fee goes to the FLUF Protocol and the remaining 5/6 is burned, thus distributing the fees to the depositors (Investors) via deflation, as their unchanged deposit in fT results in more T. To be able to pay the fee in fT, the Flash Loan Borrowers have to deposit more T to receive the needed fT.

With the above we can see that the pool grows in value, which is the reason why 1 fT is not equal to 1 T. Each pool has a factor

- When an investor deposits into the pool, the factor

$f_d = f$ is recorded with the deposit. If there was a previous deposit of$d$ tokens T and depositing new$n$ tokens T, instead of rebasing the total deposit to:$d * f / f_d + n$ , the factor$f_d$ is adjusted to achieve equivalence at the same amount of deposit$d + n$ :$f_d = f_d * (d+n) / (d * f / f_d + n)$ . - When a Flash Loan is repaid, it's factor f is adjusted as follows:

$f = f * T_a / T_b$ , where$T_b$ is the amount of T in the pool before the flash loan and$T_a$ is the amount of T in the pool after the flash loan. - When the investor withdraws from the Pool by returning

$x$ fT tokens, he receives$x * f_w / f_d$ where$f_d$ is the Pool's factor$f$ recorded at the time with the investor's deposit, and$f_w$ is the curren Pool's factor$f$ (at the time of withdrawal).

The above calculations stimulate initial investors, but not unfairly. As there is more need for fT tokens in circulation, there is more need for minting fT, but also more usage of fT for all investors to enjoy.

To effectively implement the above calculations,

- The withdrawals are always

in-full, paying out

$f * x$ of T for the surrendered$x$ amount of fT. - Upon deposit of

$x$ of T, the depositor receives$x/f$ of fT.

Solana's low network fees allow for change of the deposited amount by simply withdrawing the entire holdings and then depositing the desired amount. This approach allows for cleaner code and less mistakes. In the future this may be optimized.

So far only the yield obtained from the FLUF Protocol is explained. But there is more: As investors deposit tokens T into the FLUF Protocol they receive tokens fT, which have actual collateralized value. As such they can be used in other DeFi protocols for additional yield, for example to borrow other assets against fT, or even to borrow more T against fT and re-engage the borrowed T in another round of investment into the FLUF Protocol. Moreover, borrowing T against fT should not require much overcollateralization, as fT is an appreciating asset relative to T and there is no Delta Risk.

Here are some important questions and answers, which clarify the economics of the Pool's operation:

- Q: Why do we need tokens fT outside of Flash Loans?

- A: Because they have actual collateralized value, for other protocols to trade and the FLUF Protocol to receive fees.

--

- Q: Why can then fT be minted in any amount inside Flash Loans? Isn't that frivolous?

- A: It is not frivolous because whatever is minted has to be burned at the end in the same amount. No one profits and no one loses. This can be viewed as stimulus in order to perform arbitrage, liquidate delinquent derivative positions, liquidate delinquent loans etc.

The flash loans are not initiated via graphical user interface. Instead, the opportunities are sniped in an automated manner to determine when and to execute the flash loan and the associated actions. To facilitate this, I have prepared a set of command line programs:

The options for all commands are as follows:

- -u <url>: the connection used. It defaults to https://api.devnet.solana.com

- -p <file>: the file where the payer private key is stored. It defaults to the location where Solana stores this in the user's environment.

Create: creates the pool for a given token mint T. This creates the associated (loosely, wrapped) token mint fT (for FLUF-T), which is controlled by the FLUF Protocol (as authority). The FLUF tokens cannot be frozen.

./cli/flufcli.ts create -u <url> -p <file> <token mint>

It prints out the fT token mint address as it is created. The parameters are:

- <token mint>: the base59 address of the token mint that to be deposited in the pool.

Deposit: deposits the token T and receives an equivalent counter-value of fT.

./cli/flufcli.ts deposit -u <url> -p <file> <token mint> <amount> <T-account> <fT-account>

The parameters are:

- <token mint>: the base59 address of the token mint that to be deposited in the pool.

- <amount>: the amount of T to deposit.

- <T-account>: the account from which to draw T

- <fT-account>: the account to receive fT counter-value

Withdraw: withdraws the entire deposited amount the token T and takes the equivalent counter-value of fT.

./cli/flufcli.ts withdraw -u <url> -p <file> <token mint> <T-account> <fT-account>

The parameters are:

- <token mint>: the base59 address of the token mint that to be deposited in the pool.

- <T-account>: the account from which to draw T

- <fT-account>: the account to receive fT counter-value

Run: this is the command that initiates the flash loan. It issues the loan to the borrower program's and calls it's handle_borrow entry point to perform the desired action.

./cli/flufcli.ts run -u <url> -p <file> <token mint> <amount> <borrower_deposit> <user_account> <borrower_program_account>

The parameters are:

- <token mint>: the base59 address of the token mint that to be deposited in the pool.

- <amount>: the amount of fT to be lent to the borrower program.

- <borrower_deposit>: the amount of fT that is conveniently deposited from the payer to the borrower program, needed at least for paying the fee (unless the action is profitable, as desirable).

- <user_account>: user account to fund borrower deposit of fT

- <borrower_program_account>: the account of the borrower program

which

handle_borrowfunction is called.

Feesbalance: displays the fees collected for the given pool determined by the token mint deposited.

./cli/flufcli.ts feesbalance -u <url> <token mint>

The parameters are:

- <token mint>: the base59 address of the token mint that determines the pool.

Feeswithdraw: withdraws the fees collected for the given pool determined by the token mint deposited, into the given token account.

./cli/flufcli.ts feeswithdraw -u <url> <token mint> <account>

The parameters are:

- <token mint>: the base59 address of the token mint that determines the pool.

- <account>: the token account where the associated fT tokens are sent.

Initialize: called one time upon deployment to set the account that can withdraw fees.

./cli/flufcli.ts initialize -u <url> -p <file>

The fee collector account can be set only once. It is determined by the -p option.

To integrate the FLUF Protocol one has to modify the sample program borrower_sample and look for the following inside:

// Put your business logic here

// - Use the borrowed amount to perform some business logic

// - Send the profit to the user_account

There, calls to other programs via CPI can be made.

If the program needs to borrow T, to integrate with existing deployed liquidity, the received fT as part of the Flash Loan can be converted to T by calling the withdraw entry point of the fluf program via CPI. However, this conversion can be performed for amounts up to the available T in the corresponding FLUF Pool.

Alternatively fT can be deployed in DeFi protocols. In such case, arbitrary large amount of fT can be borrowed from the FLUF Protocol and utilized further.

It is also possible to deposit fT in the FLUF Protocol and mint ffT counter-value in exchange, then fffT, ffffT etc., as long as there are interested parties in flash-borrowing those assets - otherwise they will not appreciate in value.

If the Flash Loan is needed to borrow T instead of fT, the standard pattern would be to

borrow fT, convert it to T up to a maximum amount that exists in the pool and then,

after usage, deposit back the borrowed T in addition to the appropriate amount for fees and

repay the loan and the fees. However, since an arbitrary amount of fT can be borrowed,

the caller can convert the entire pool from fT to T. Leaving nothing in it, this loses

the information about the prior ratio of fT and T. This would allow the borrower to

steal funds. To remedy this issue, the FLUF Protocol would have to keep track of minting

fT without collateral in T, which is an indication that this is happening inside of a

Flash Loan. In such case, the prior ratio

Since Solana only allows for 4 levels of CPI calls, the FLUF Protocol takes one level out

of this capability. To remedy this, the calling sequence at the lowest level should be achieved

via a sequence of Solana Instructions instead of one instruction that calls the FLUF Protocol

lendAndCall entry point. However, the sequence of Instructions should be enforced and

the repayment balances recorded (in a PDA).

The program needs a security review. u64 overflows need attention. In places noticed, the calculations are performed in u128 precision and then scaled back to avoid overflows and rounding issues. Yet, a complete review and fuzzing is needed.

Finally there is an issue with remaining_accounts in Anchor that needs to be solved, in order to pass all remaining accounts passed to the lendAndCal entry point of fluf further to the borrow_handler entry point of borrower_sample. Maybe it will get resolved in the next version, or maybe there are instructions how to work this in the current version of Anchor: v0.29.0.

There is no need for each protocol to implement their own Flash Loans. The FLUF Protocol can serve other composable protocols which are even unaware of Flash Loans.

All involved parties benefit from the Flash Loans:

- Investors make 0.2% on each Flash Loan, even when non-existent fT are lent.

- Users make profit from engaging the flash-borrowed funds in DeFi opportunities in other protocols, such as Price Arbitrage, Liquidations etc.

- The owners of the FLUF Protocol make 0.05% on each Flash Loan, even when non-existent fT are lent.

In the future the ownership of the FLUF Protocol may be tokenized and set up as a DAO in order to raise funds for faster marketing and business development.