Welcome to the Kard Postman Collection! Use this collection for a quick and easy way to get started working in the Kard sandbox environment.

- How it Works

- Recommended Integration Patterns

- Recommended User Experiences

- User Acceptance Test Cases

: click button to fork the collection

- Import postman_environment.json: provided by the Sales team, contains sensitive

clientHashandissuer_webhook_keyvariables.

Code Recipe:

GET Session Tokenrequest in collection root directory- baseURL:

https://test-rewards-api.auth.us-east-1.amazoncognito.com {clientHash}: base64 encoded copy ofclient_id:client_secret, provided in the postman_environment.json.

const axios = require('axios');

const config = {

method: 'post',

url: 'https://test-rewards-api.auth.us-east-1.amazoncognito.com/oauth2/token?grant_type=client_credentials',

headers: {

'Content-Type': 'application/x-www-form-urlencoded',

'Authorization': 'Basic {clientHash}'

}

};

axios(config)

.then(function (response) {

console.log(JSON.stringify(response.data));

})

.catch(function (error) {

console.log(error);

});

example response:

{

"access_token": "jwt-info",

"expires_in": 3600,

"token_type": "Bearer"

}

Code Recipe:

B. Merchant Offersfolder in collection- baseURL:

https://test-rewards-api.getkard.com {access_token}: provided in response body of authentication call

const axios = require('axios');

const config = {

method: 'get',

url: 'https://test-rewards-api.getkard.com/rewards/merchant/offers',

headers: {

'Content-Type': 'application/json',

'Authorization': '{access_token}'

}

};

axios(config)

.then(function (response) {

console.log(JSON.stringify(response.data));

})

.catch(function (error) {

console.log(error);

});

Your application allows cardholders to link cards from other programs. As a result, transactions may originate from a variety of different card networks, so the UI must capture cardBIN and cardLastFour when the user is being created.

Code Recipe:

Creating a User with cardInfo object:

- required: userName OR email, referringPartnerUserId, zipCode, cardInfo

- cardInfo["issuer"]: Program Name as known to Kard, rather than the underlying Card Issuer

{

"email": "testuser@test-TEST.com",

"userName": "testUser",

"referringPartnerUserId": "438103",

"zipCode": "30047",

"cardInfo": {

"last4": "4321",

"bin": "123456",

"issuer": "TEST",

"network": "VISA"

}

}

Note: If a cardholder tries to enroll a card of a direct partner the following error message will be returned from the API:

"Invalid request: This card is already registered. Provide another card for user enrollment."

Your application supports only cards issued by your program manager. As a result, transactions will originate from known cardBINs and networks so a user can be created with or without card-level information. If creating without the cardInfo object, the user can later be updated.

Code Recipe:

Creating a User:

- required: userName OR email, referringPartnerUserId, zipCode

{

"email": "testuser@test-TEST.com",

"userName": "testUser",

"referringPartnerUserId": "438103",

"zipCode": "30047",

}

Add cardInfo to User:

- cardInfo["issuer"]: Program Name as known to Kard, rather than the underlying Card Issuer

- required: referringPartnerUserId, cardInfo

{

"referringPartnerUserId": "438103",

"cardInfo": {

"last4": "4321",

"bin": "123456",

"issuer": "TEST",

"network": "VISA"

}

}

Your application supports cards issued by your program manager as well as cards your members want to link to your program. You will be provided 1 Issuer environment (for issued cards) and 1 Aggregator environment (for linked cards), and manage the integration of these environments to your application environment.

Personalized National CLOs, based on an individual cardholder's transaction history.

Each sandbox environment is configured with the following cardholder personas:

sandbox-{issuerName}-new-customer: this cardholder has no record of prior transactions at the merchant.sandbox-{issuerName}-lapsed-customer: this cardholder has prior transaction history at the merchant, but none within the last 6 months.

These personas demonstrate targeting functionality in terms of offer discovery (the cardholder is viewing a personalized offer) and transaction matching (the cardholder transaction matches to the personalized offer). The {issuerName} variable is provided in the sandbox environment.json.

The three primary patterns used to send transactions to Kard for matching processing are:

In order to accurately match incoming transactions, specific fields must be provided which can be found here:https://developer.getkard.com/#operation/incomingTransactionEndpoint.

To properly ingest a matched transaction earned reward webhook, check out the section on HMAC Signature Verification.

The following are descriptions and code recipes for each pattern.

The most common pattern used to transmit transactions is the Dual Message system, also known as a Signature transactions. Using this system, a transaction is submitted in 2 events. The first, originating event is a temporary transaction state followed by a second event that is a final, clearing transaction state.

- Temporary Transaction Event: APPROVED

- Final Transaction Event: SETTLED, REVERSED, DECLINED, RETURNED*

*special case where the originating, temporary transaction ID is not readily identifiable

Temporary transaction event:

- status: APPROVED

- authorizationDate timestamp

{

"transactionId": "sandbox-web-313",

"referringPartnerUserId": "438103",

"cardBIN": "123456",

"cardLastFour": "4321",

"mcc": "1234",

"merchantId": "123456789101213",

"amount": 10000,

"currency": "USD",

"description": "Hilltop BBQ",

"merchantId": "542814140150267",

"merchantName": "Hilltop BBQ",

"merchantAddrCity": "Atlanta",

"merchantAddrState": "GA",

"merchantAddrStreet": "123 Peachtree St",

"status": "APPROVED",

"authorizationDate": "2022-10-29T17:48:06.135Z"

}

Final transaction event:

- status: SETTLED

- authorizationDate timestamp

- settledDate timestamp

- identical transactionId as the originating APPROVED event

{

"transactionId": "sandbox-web-313",

"referringPartnerUserId": "438103",

"cardBIN": "123456",

"cardLastFour": "4321",

"mcc": "1234",

"merchantId": "123456789101213",

"amount": 10000,

"currency": "USD",

"description": "Hilltop BBQ",

"merchantId": "542814140150267",

"merchantName": "Hilltop BBQ",

"merchantAddrCity": "Atlanta",

"merchantAddrState": "GA",

"merchantAddrStreet": "123 Peachtree St",

"status": "SETTLED",

"authorizationDate": "2022-10-29T17:48:06.135Z"

"settledDate": "2022-10-30T17:48:06.135Z"

}

Code Recipe: Reversed, Signature Transaction

Sending Reversal infomration enables the platform's Transaction Monitoring, where Kard conducts internal fraud detection to identify suspicious behavior through abnormal transaction amounts and high volume transactions or returns per cardholder on a daily basis. We then notify Issuers of any potential fraud to be investigated if it is found.

Temporary transaction event:

- status: APPROVED

- authorizationDate timestamp

{

"transactionId": "sandbox-web-313",

"referringPartnerUserId": "438103",

"cardBIN": "123456",

"cardLastFour": "4321",

"amount": 10000,

"mcc": "1234",

"merchantId": "123456789101213",

"currency": "USD",

"description": "Hilltop BBQ",

"merchantId": "542814140150267",

"merchantName": "Hilltop BBQ",

"merchantAddrCity": "Atlanta",

"merchantAddrState": "GA",

"merchantAddrStreet": "123 Peachtree St",

"status": "APPROVED",

"authorizationDate": "2022-10-29T17:48:06.135Z"

}

Final transaction event:

- status: REVERSED

- transactionDate timestamp

- identical transactionId as the originating APPROVED event

{

"transactionId": "sandbox-web-313",

"referringPartnerUserId": "438103",

"cardBIN": "123456",

"cardLastFour": "4321",

"amount": 10000,

"mcc": "1234",

"merchantId": "123456789101213",

"currency": "USD",

"description": "Hilltop BBQ",

"merchantId": "542814140150267",

"merchantName": "Hilltop BBQ",

"merchantAddrCity": "Atlanta",

"merchantAddrState": "GA",

"merchantAddrStreet": "123 Peachtree St",

"status": "REVERSED",

"transactionDate": "2022-10-30T17:48:06.135Z"

}

Another common pattern used to transmit transactions is the Single Message system, also known as a PIN debit transaction. In these transactions, the cardholder is required to enter a PIN. The PIN is validated in real-time by the bank, so a transaction submitted as a single message will be a final transaction event and the authorization and settlement dates are effectively the same.

- status: SETTLED

- authorizationDate timestamp

- settledDate timestamp

{

"transactionId": "sandbox-web-313",

"referringPartnerUserId": "438103",

"cardBIN": "123456",

"cardLastFour": "4321",

"amount": 10000,

"mcc": "1234",

"merchantId": "123456789101213",

"currency": "USD",

"description": "Hilltop BBQ",

"merchantId": "542814140150267",

"merchantName": "Hilltop BBQ",

"merchantAddrCity": "Atlanta",

"merchantAddrState": "GA",

"merchantAddrStreet": "123 Peachtree St",

"status": "SETTLED",

"authorizationDate": "2022-10-29T17:48:06.135Z"

"settledDate": "2022-10-30T17:48:06.135Z"

}

The last pattern is one where a single authorization is followed by multiple settlement events. This pattern is generally seen when a single transaction represents multiple objects.

For example, imagine using an e-commerce site and checking out a cart with multiple items. If these items are shipped individually, there may be multiple, subsequent settlement events.

Code Recipe: Single Auth, Multiple Settlements Transaction

- identical referringPartnerUserId for all events

- identical transactionId for all events

- different settledDate timestamps for each SETTLED event

Temporary transaction event: (1 of 1)

- status: APPROVED

- authorizationDate timestamp

- $100 transaction amount

{

"transactionId": "sandbox-web-323",

"referringPartnerUserId": "438103",

"cardBIN": "123456",

"cardLastFour": "4321",

"amount": 10000,

"mcc": "1234",

"merchantId": "123456789101213",

"currency": "USD",

"description": "Hilltop BBQ",

"merchantId": "542814140150267",

"merchantName": "Hilltop BBQ",

"merchantAddrCity": "Atlanta",

"merchantAddrState": "GA",

"merchantAddrStreet": "123 Peachtree St",

"status": "APPROVED",

"authorizationDate": "2022-10-29T17:48:06.135Z"

}

Final transaction event: (1 of 2)

- status: SETTLED

- authorization timestamp ("2022-10-30T17:48:06.135Z")

- settledDate timestamp ("2022-10-30T18:48:06.135Z")

- $75 transaction amount

{

"transactionId": "sandbox-web-323",

"referringPartnerUserId": "438103",

"cardBIN": "123456",

"cardLastFour": "4321",

"amount": 7500,

"mcc": "1234",

"merchantId": "123456789101213",

"currency": "USD",

"description": "Hilltop BBQ",

"merchantId": "542814140150267",

"merchantName": "Hilltop BBQ",

"merchantAddrCity": "Atlanta",

"merchantAddrState": "GA",

"merchantAddrStreet": "123 Peachtree St",

"status": "SETTLED",

"authorizationDate": "2022-10-30T17:48:06.135Z"

"settledDate": "2022-10-30T18:48:06.135Z"

}

Final transaction event: (2 of 2)

- status: SETTLED

- authorizationDate timestamp ("2022-10-30T17:48:06.135Z")

- settledDate timestamp ("2022-10-31T18:48:06.135Z")

- $25 transaction amount

{

"transactionId": "sandbox-web-323",

"referringPartnerUserId": "438103",

"cardBIN": "123456",

"cardLastFour": "4321",

"amount": 2500,

"mcc": "1234",

"merchantId": "123456789101213",

"currency": "USD",

"description": "Hilltop BBQ",

"merchantId": "542814140150267",

"merchantName": "Hilltop BBQ",

"merchantAddrCity": "Atlanta",

"merchantAddrState": "GA",

"merchantAddrStreet": "123 Peachtree St",

"status": "SETTLED",

"authorizationDate": "2022-10-30T17:48:06.135Z"

"settledDate": "2022-10-31T18:48:06.135Z"

}

An issuer will be provided a webhook key for both the sandbox and production environments.

The webhook key is used to generate an HMAC of the webhook body. We calculate the HMAC and send it in the notify-signature header.

To validate the message, you should generate the HMAC with the body, key, and SHA-256 hashing algorithm, then compare it to the HMAC in the header.

The following is a Node.js code recipe that shows one approach to:

- Stand up a service to ingest an earned reward webhook

- Implement HMAC signature verification

Code Recipe: Authenticating, then Ingesting an Earned Reward Webhook

auth.js: signature verification middlewareindex.js: POST endpoint

# auth.js

const { createHmac } = require("crypto");

const secretKey = issuer_webhook_key; //provided in postman_environment.json

const verifyToken = (req, res, next) => {

// grab HMAC signature from Notify-signature header of request

const token = req.get("notify-signature");

if (!token) {

return res.status(403).send("A token is required for authentication");

}

try {

// cast webhook as string

const stringRequest = JSON.stringify(req.body);

// hash using sha256, webhook key, and webhook body as string

const hash = createHmac('sha256', secretKey)

.update(stringRequest)

.digest('base64')

// verified request

if (token === hash){

return next();

}

// unverified request

return res.status(401).send("Invalid token");

} catch (err) {

return res.status(400).send("Bad Request");

}

};

module.exports = verifyToken;

# index.js

const express = require('express');

const app = express();

const port = 3000;

const auth = require('./auth');

app.use(express.json());

app.post('/earned-rewards-webhook', auth, (req, res) => {

try {

// insert code that processes the webhook

console.log('earned reward webhook: ', req.body);

}

catch (err) {

res.send(err);

}

res.status(200).send('thanks Kard!');

});

app.listen(port, () => {

console.log(`Example app listening on port ${port}`);

});

There are two standard reports that Kard issues: Daily reconciliation files and end-of-month reconciliation files. Both of these files are shared via an S3 Bucket.

-

S3 Access: For information on how to access the S3 Bucket

-

Daily Reconciliation File

At the end of each day, a daily reconciliation file of transactions is automatically generated and shared to the S3 bucket under

/uploadby the Kard team. All previous files are automatically moved to/backupfor your team to reference. This file will be ideal for your team to compare against received webhooks and will act as a ledger until the EOM file is generated.- The file is generated at 4:30 am EST. Note that this is generated at midnight UTC. That means it'll shift by an hour when we enter daylight savings.

- Previous files move to

/backupwhen the new files are generated. This makes sure the/uploaddirectory only has one of each file. - file naming convention:

cardlinked-reconciliation-YYMMDD - file format:

.json

-

End of Month (EOM) Reconciliation File

On the 15th (or following business day in case the 15th should fall on a weekend or a holiday) each month, a monthly reconciliation file will be posted to the S3 bucket. Similar to the daily reconciliation file, the new monthly file will be uploaded to

/uploadby the Kard team and the previous files will be available in/backup. The EOM reconciliation report contains onlySETTLEDtransactions that occurred in the previous month bothPAID_IN_FULLandPENDING, as well as allPENDINGtransactions from all previous months that still have yet to be paid, andPAID_IN_FULLtransactions from previous months that are being paid out that month.- Previous files move to

/backupwhen the new files are generated. This makes sure the/uploaddirectory only has one of each file. - file naming convention:

cardlinked-reconciliation-YYMM - file format:

.csv

- Previous files move to

-

Payouts:

- Merchants: Merchant terms are generally Net 30 across our merchant partners, but payment can be up to Net 90.

- Issuers: the product supports the 2 following options for payouts to end users.

- Immediate

- Issuers may opt to disburse payments to their end-users immediately, or shortly after a transaction occurs. By selecting this option, the Issuer agrees to front the payment amounts to the end-users. Kard will reimburse the Issuer for these payments once Kard receives the corresponding commissions from the Merchants.

- Withheld

- Alternatively, Issuers may choose to withhold payments to their end-users until such time as they have received the corresponding commission payments from Kard. This option allows the Issuer to avoid fronting the payment amounts.

- Immediate

Transaction Status Mapping

Kard currently receives the following transaction event types from Marqeta:

| Marqeta | Kard |

|---|---|

| authorization | Approved |

| authorization.clearing | Settled |

| pindebit | Settled |

Note: The data mapping for the transaction events below also apply to Kard’s Earned Rewards Webhook.

| Marqeta Field | Kard Field |

|---|---|

| token | transactionId |

| user_token | referringPartnerUserId |

| user_transaction_time | transactionDate, authorizationDate |

| Note: Depending on status of transaction | |

| settlement_date | settledDate |

| amount | amount |

| state | status |

| preceding_related_transaction_token | transactionId |

| Note: valid for transactions after the first transaction event | |

| card_acceptor.mcc | mcc |

| card_acceptor.name | merchantName |

| card_acceptor.street_address | merchantAddrStreet |

| card_acceptor.city | merchantAddrCity |

| card_acceptor.state | merchantAddrState |

| card_acceptor.zip | merchantAddrZipcode |

| card.last_four | cardLastFour |

| card.pan | cardBIN |

| Note: Kard receives a masked PAN, only showing BIN and Last 4 | |

| currency_code | currency |

| card_acceptor.mid | merchantId |

| card_acceptor.name | description |

| network_reference_id | transactionId |

| Note: This is relevant for specific integrations. Consult your Kard Account Manager with questions |

FIPS State Abbreviation mappings FIPS codes are numbers which uniquely identify geographic areas

| FIPS State Code | State |

|---|---|

| 01 | ALABAMA |

| 02 | ALASKA |

| 04 | ARIZONA |

| 05 | ARKANSAS |

| 06 | CALIFORNIA |

| 08 | COLORADO |

| 09 | CONNECTICUT |

| 10 | DELAWARE |

| 11 | DISTRICT OF COLUMBIA |

| 12 | FLORIDA |

| 13 | GEORGIA |

| 15 | HAWAII |

| 16 | IDAHO |

| 17 | ILLINOIS |

| 18 | INDIANA |

| 19 | IOWA |

| 20 | KANSAS |

| 21 | KENTUCKY |

| 22 | LOUISIANA |

| 23 | MAINE |

| 24 | MARYLAND |

| 25 | MASSACHUSETTS |

| 26 | MICHIGAN |

| 27 | MINNESOTA |

| 28 | MISSISSIPPI |

| 29 | MISSOURI |

| 30 | MONTANA |

| 31 | NEBRASKA |

| 32 | NEVADA |

| 33 | NEW HAMPSHIRE |

| 34 | NEW JERSEY |

| 35 | NEW MEXICO |

| 36 | NEW YORK |

| 37 | NORTH CAROLINA |

| 38 | NORTH DAKOTA |

| 39 | OHIO |

| 40 | OKLAHOMA |

| 41 | OREGON |

| 42 | PENNSYLVANIA |

| 44 | RHODE ISLAND |

| 45 | SOUTH CAROLINA |

| 46 | SOUTH DAKOTA |

| 47 | TENNESSEE |

| 48 | TEXAS |

| 49 | UTAH |

| 50 | VERMONT |

| 51 | VIRGINIA |

| 53 | WASHINGTON |

| 54 | WEST VIRGINIA |

| 55 | WISCONSIN |

| 56 | WYOMING |

Code Recipe:

GETEligible Rewards Offers EndpointreferringPartnerUserIdpath param:sandbox-{issuerName}-new-customer

var axios = require('axios');

var config = {

method: 'get',

url: 'https://test-rewards-api.getkard.com/rewards/merchant/offers/user/sandbox-{issuerName}-new-customer',

headers: {

'Content-Type': 'application/json',

'Authorization': 'redaced_token

}

};

axios(config)

.then(function (response) {

console.log(JSON.stringify(response.data));

})

.catch(function (error) {

console.log(error);

});

Code Recipe:

GETEligible Rewards Offers EndpointreferringPartnerUserIdpath param:sandbox-{issuerName}-lapsed-customer

var axios = require('axios');

var config = {

method: 'get',

url: 'https://test-rewards-api.getkard.com/rewards/merchant/offers/user/sandbox-{issuerName}-lapsed-customer',

headers: {

'Content-Type': 'application/json',

'Authorization': 'redaced_token

}

};

axios(config)

.then(function (response) {

console.log(JSON.stringify(response.data));

})

.catch(function (error) {

console.log(error);

});

Code Recipe:

GETEligible Locations EndpointreferringPartnerUserIdpath param:sandbox-{issuerName}-new-customer- query params:

includeLocallongitude=-73.9930148latitutde=40.74201480000001

var axios = require('axios');

var config = {

method: 'get',

url: 'https://test-rewards-api.getkard.com/rewards/merchant/locations/user/sandbox-{issuerName}-new-customer?longitude=-73.9930148&latitude=40.74201480000001&includeLocal',

headers: {

'Content-Type': 'application/json',

'Authorization': 'redacted_token'

}

};

axios(config)

.then(function (response) {

console.log(JSON.stringify(response.data));

})

.catch(function (error) {

console.log(error);

});

The following steps provide a demo experience from the perspective of the sandbox-{issuerName}-new-customer cardholder.

Code Recipe:

{

"_id": "6409fa6d8a2a4300083d4143",

"isLocationSpecific": false,

"terms": "This offer is only valid for first-time customers.",

"redeemableOnce": false,

"name": "BaaS Pro Shops - New Customers",

...

"merchant": {

"_id": "6409f118705b8a000834f23d",

"description": "Trusted source for all products debit, credit, crypto, and more.

In business since 2011, shop online or swing by our store!",

...

"name": "BaaS Pro Shops",

"bannerImgUrl": "https://assets.getkard.com/public/banners/kard.jpg"

},

"source": "NATIONAL",

"totalCommission": 12

},

POSTIncoming Transactions Endpoint- Map Rewards offer

merchant.nameto Incoming Transactiondescription

{

"transactionId": "sandbox-web-313",

"referringPartnerUserId": "sandbox-{issuerName}-new-customer",

"cardBIN": "123456",

"cardLastFour": "4321",

"amount": 10000,

"mcc": "1234",

"merchantId": "123456789101213",

"currency": "USD",

"description": "BaaS Pro Shops",

"status": "APPROVED",

"authorizationDate": "2023-03-29T17:48:06.135Z"

}

- Ingest Earned Reward Webhook.

POSTIssuer Earned Reward Webhook Endpoint- Authenticate webhook using HMAC Signature Verification

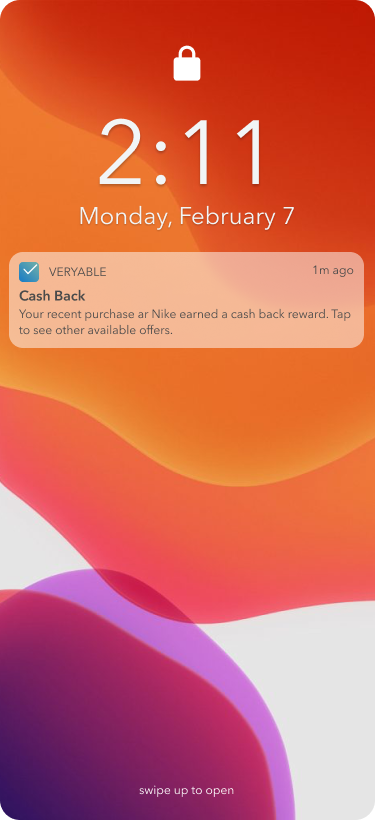

- Delight your cardholder with a notification!

- Note: Cashback/Reward does not have to be given to cardholder when notification is triggered

As a cardholder, I should be able to successfully:

- Enroll in the rewards program.

- Unenroll from the rewards program.

- Add a card to my profile.

- View a list of eligible ONLINE rewards.

- View a list of eligible INSTORE rewards.

- View a list of eligible rewards near me.

- View Offer Details.

- Submit a Clearing, Dual Message Transaction.

- Submit an APPROVED(aka AUTH) event to the Incoming Transactions Endpoint

- Submit a SETTLED (aka CLEARED) event to the Incoming Transactions Endpoint

- Submit a Declined, Dual Message Transaction.

- Submit an APPROVED(aka AUTH) event to the Incoming Transactions Endpoint

- Submit a DECLINED event to the Incoming Transactions Endpoint

- Submit a Reversed, Dual Message Transaction.

- Submit an APPROVED(aka AUTH) event to the Incoming Transactions Endpoint

- Submit a REVERSED (aka CLEARED) event to the Incoming Transactions Endpoint

- Submit a Single Message, PIN-debit Transaction.

- Submit a SETTLED (aka CLEARED) event to the Incoming Transactions Endpoint

- Submit a Refund Transaction.

- Submit a RETURNED event to the Incoming Transactions Endpoint

- Receive an Earned Reward Webhook push notification

As a rewards program manager, I should be able to successfully:

- Consume recon files.

- Daily

- Monthly

- Create an Audit Request.

- Get an Audit Request Status.