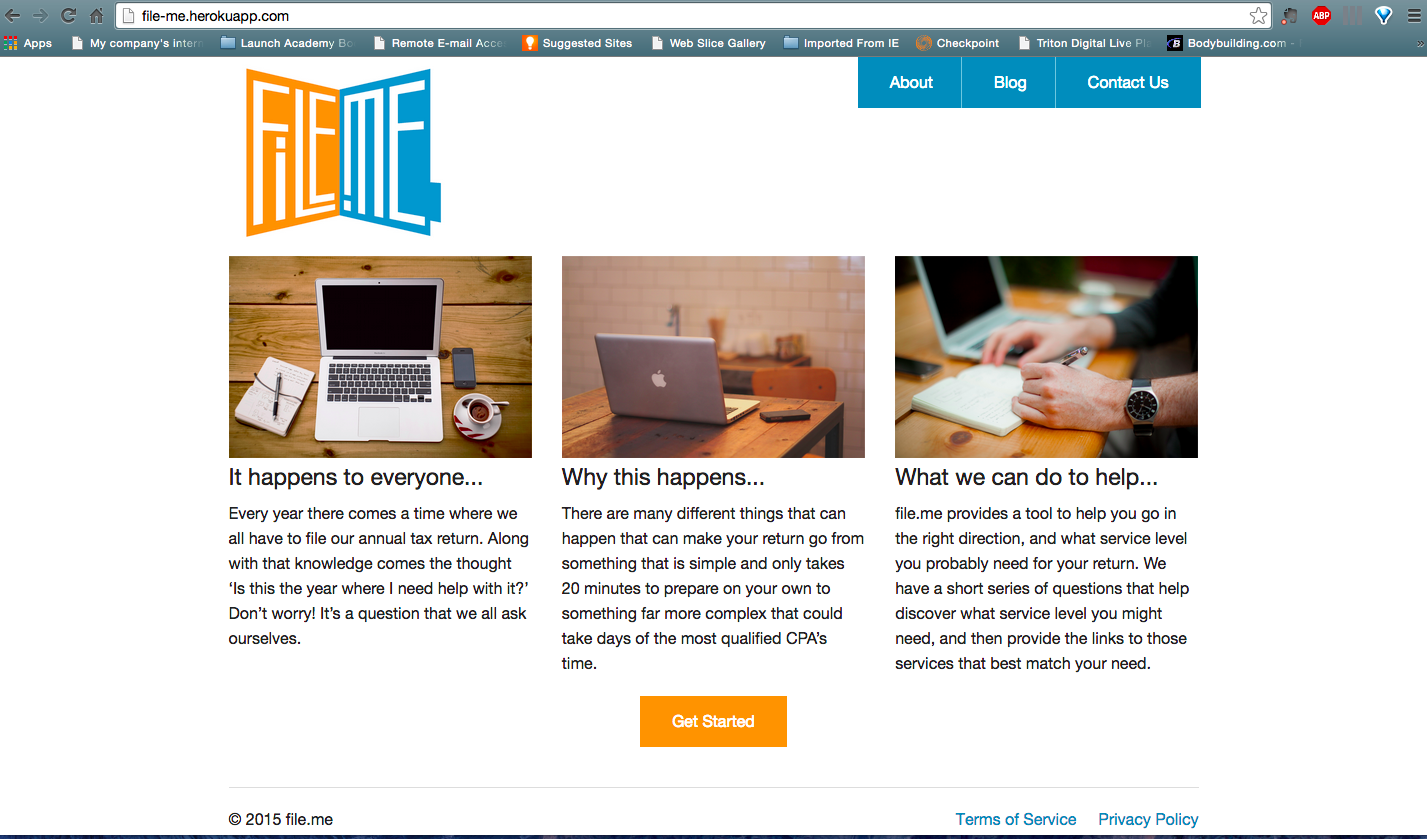

tax_determiner is an app that will help users determine the level of tax service that they might want to consider.

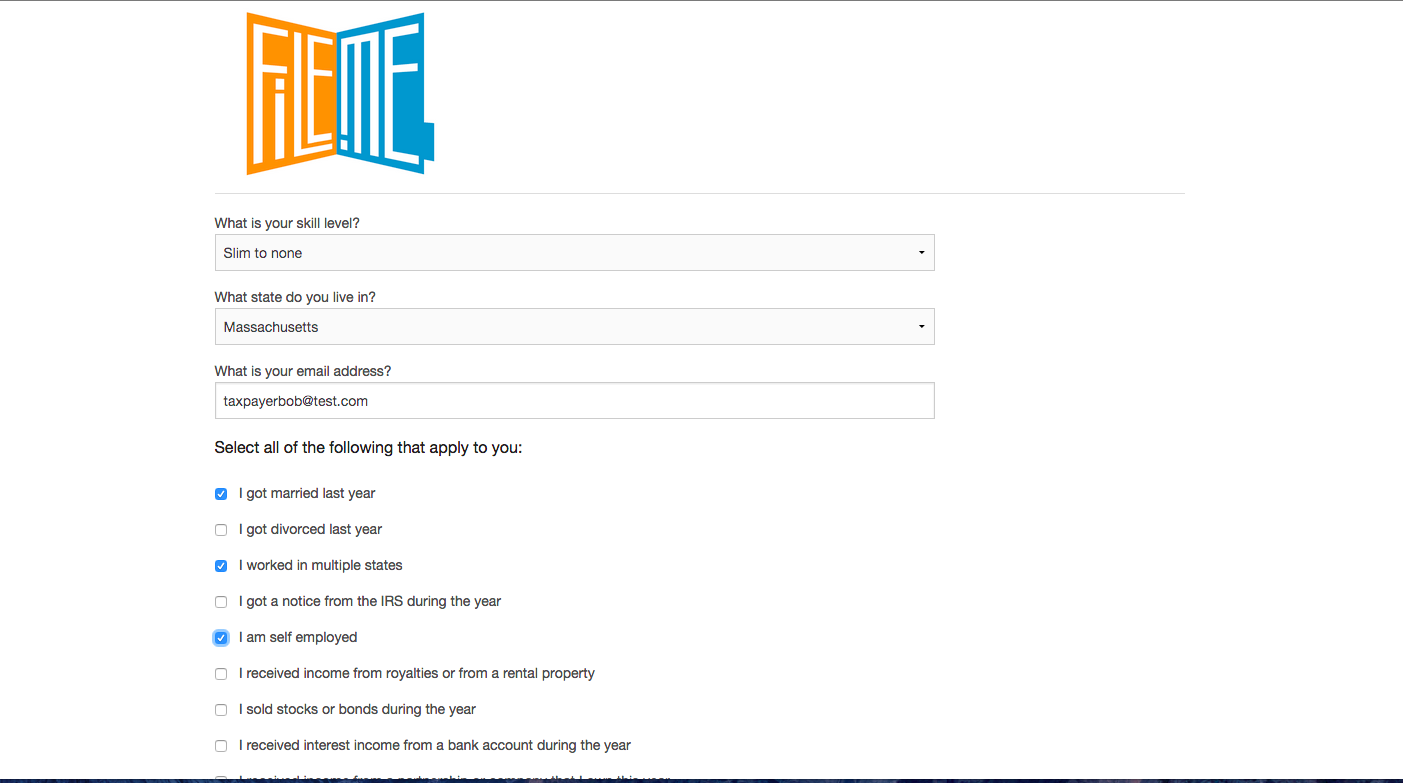

It takes into consideration the user's experience level and events that have taken place during the year to make the determination.

I developed the scores and the the effect of the user's experience from my own experience as a licensed CPA, and from other CPAs I know in the profession.

-

Usage of Active Model to mimic Active Record for use in the contact page. Being able to create an object and get all of the benefits of Active Record (validations, etc) was pretty interesting. I decided to use Active Model instead of Active Record to try to keep my database as simple as possible, and avoid unnecessary database hits.

-

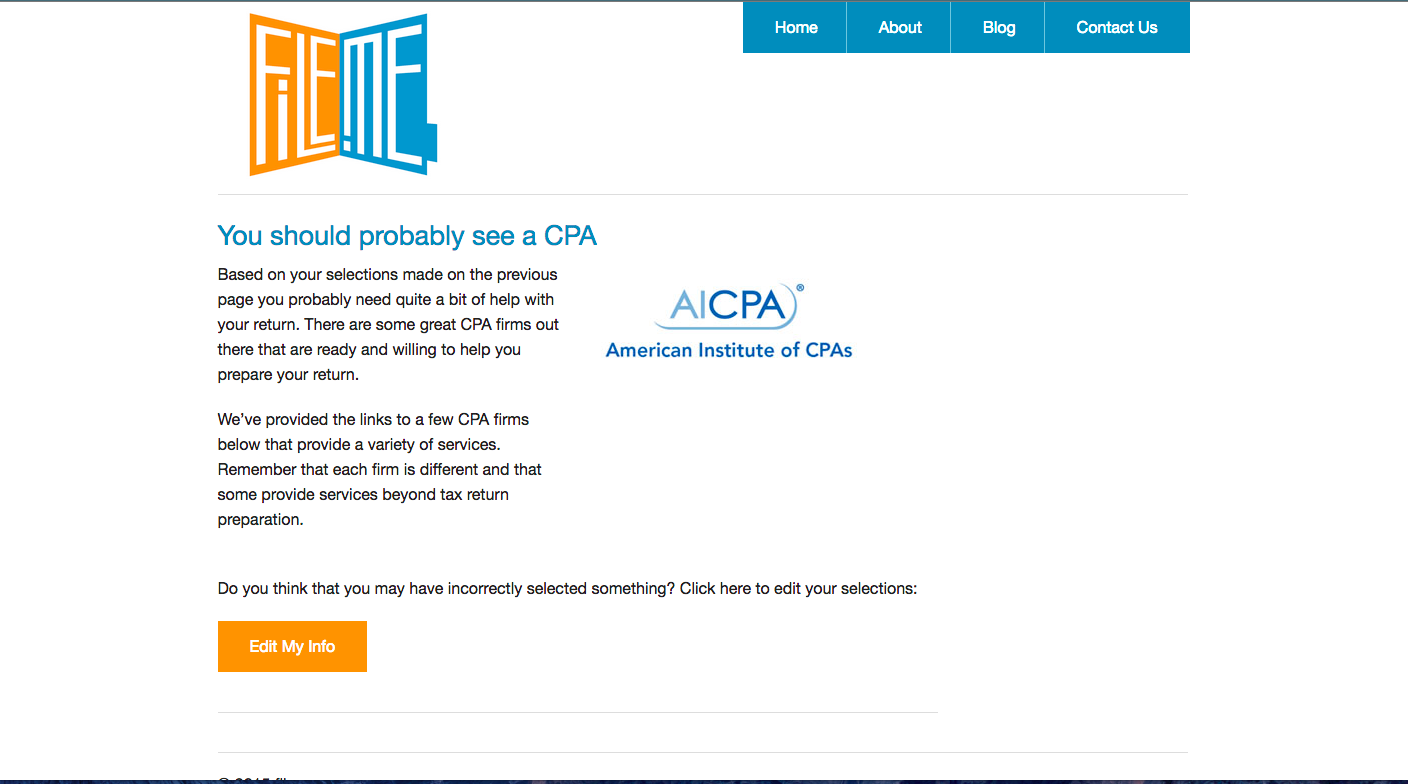

Realizing that because of how browsers cache previous pages that a user visited, just using 'Back' would not result in what I had intended. My intention was that the user would utilize the app and when they had gotten to the show page, showing the level of service that they would be able to go back and edit their selection. If the user had hit the back button instead of the 'Edit' button the browser would use the cached version of the previous page and not render a new one. This would allow boxes that were unchecked to not be updated properly. I discovered that validations may not save you in this instance and set the app to force a page refresh when back was used. To solve this I added a method to the ApplicationController.rb file called 'set_cache_buster' which essentially forces the app to refresh by resetting the setting allowing the browser to cache. Additionally I added to the return model a method that would reset all the associated return_questions when edit is called.

-

Implementing the fat model/skinny controller convention to the project. Initially I had too much logic in the return controller, and as a result, the return controller had become difficult to read. Refactoring the logic in a way that it still worked as intended as a separate methods took some thinking, but in the end I learned that I should have planned to do this from the beginning of the app.

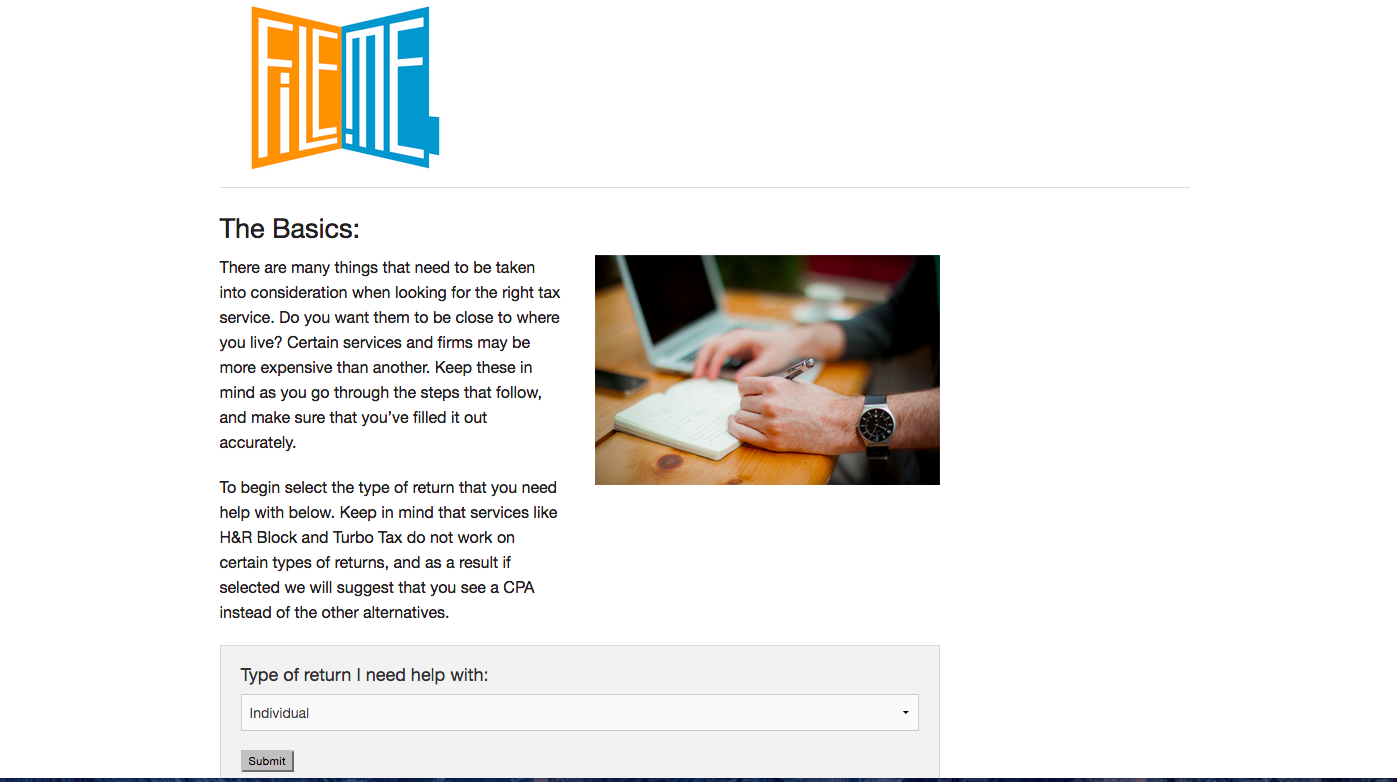

After clicking 'Get Started' the app will ask you what type of return that you need help with

Once you have selected the type of return you need help with the app will ask for basic information and questions related to your return. Note that at this time only the individual return type has a question list.

The app will then calculate the difficulty of your potential return and generate what type of service you might require.

- Clone from github.

- The Gemfile requires Ruby 2.0.0 so ensure that you are running on that version of Ruby.

- Bundle the gems, just in case you don't have something.

- Run

rake db:create,rake db:migrateandrake db:seedto create, migrate and seed the database. - Add in your account info for your mailer (Sendgrid/Mandrill/etc) to your .env file.

- Run rake to ensure that tests are passing.

You should be all set for localhost running at this point.

-

Lead generation additions for Turbo Tax, H&R Block, and CPA firms.

-

My intention is to build this app out for the other types of returns. As they can be much more complicated and can cause wildly different pricing for a return CPA firms will find this additional info helpful.

-

I'd like to add a Q&A page for users to post questions that would be answered by a professional.