Disclaimer: Nothing herein is financial advice, and NOT a recommendation to trade real money. Please use common sense and always first consult a professional before trading or investing.

Our Mission: to efficiently automate trading. We continuously develop and share codes for finance.

Our Vision: AI community has accumulated an open-source code ocean over the past decade. We believe applying these intellectual and engineering properties to finance will initiate a paradigm shift from the conventional trading routine to an automated machine learning approach, even RLOps in finance.

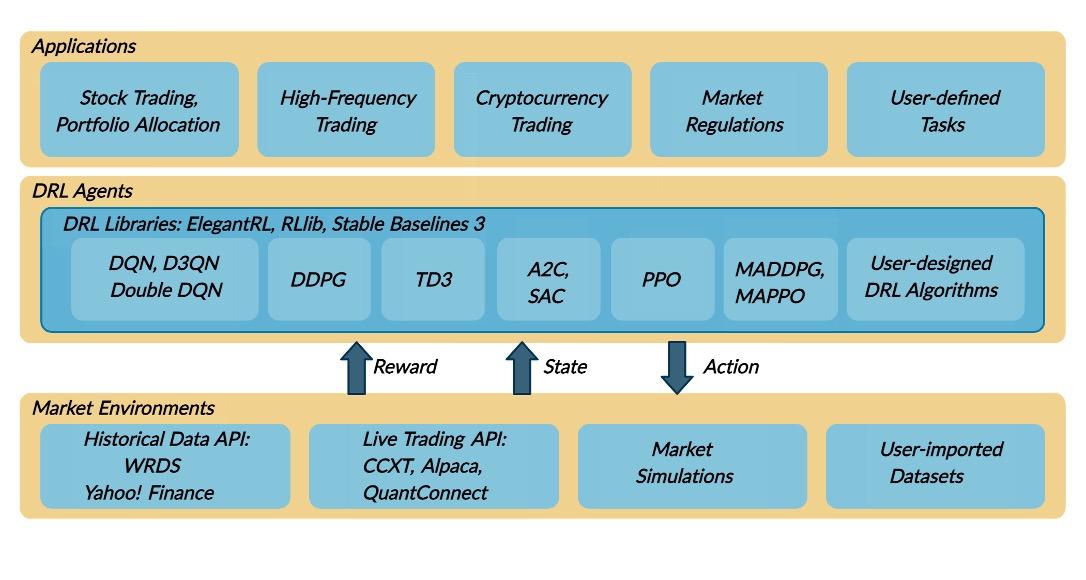

FinRL is the first open-source framework to demonstrate the great potential of applying deep reinforcement learning in quantitative finance. We help practitioners establish the development pipeline of trading strategies using deep reinforcement learning (DRL). A DRL agent learns by continuously interacting with an environment in a trial-and-error manner, making sequential decisions under uncertainty, and achieving a balance between exploration and exploitation.

News: We are maintaining codes for live trading. Let us know your needs.

Join to discuss FinRL: AI4Finance mailing list, AI4Finance Slack channel:

The FinRL ecosystem:

FinRL 3.0 (Production): advanced-level for investment banks and hedge funds. A cloud-native solution FinRL-podracer.

FinRL 2.0 (Professional): intermediate-level for full-stack developers and professionals. ElegantRL.

FinRL 1.0 (Proof of concept): entry-level for beginners, with a demonstrative and educational purpose.

FinRL 0.0 (Preparation): a universe of training/testing/trading environments in FinRL-Meta.

FinRL provides a unified framework for various markets, SOTA DRL algorithms, finance tasks (portfolio allocation, cryptocurrency trading, high-frequency trading), live trading support, etc.

- Tutorials

- Overview

- Status Update

- Installation

- Contributions

- Publications

- News

- Citing FinRL

- Welcome Contributions

- Sponsorship

- LICENSE

- [Towardsdatascience] Deep Reinforcement Learning for Automated Stock Trading

- [Towardsdatascience] FinRL for Quantitative Finance: Tutorial for Multiple Stock Trading

- [Towardsdatascience] FinRL for Quantitative Finance: Tutorial for Portfolio Allocation

- [Towardsdatascience] FinRL for Quantitative Finance: Tutorial for Single Stock Trading

- [Towardsdatascience] ElegantRL-Podracer: A Scalable and Elastic Library for Cloud-Native Deep Reinforcement Learning

- [Towardsdatascience] ElegantRL: A Lightweight and Stable Deep Reinforcement Learning Library

- [Towardsdatascience] ElegantRL: Mastering PPO Algorithms

- [MLearning.ai] Hyperparameter Optimization using Ray tune for FinRL models

- [MLearning.ai] An Empirical Approach to Explain Deep Reinforcement Learning in Portfolio Management Task

- [MLearning.ai] FinRL for Quantitative Finance: plug-and-play DRL algorithms

- [MLearning.ai] ElegantRL Demo: Stock Trading Using DDPG (Part I)

- [MLearning.ai] ElegantRL Demo: Stock Trading Using DDPG (Part II)

- [DataDrivenInvestor] FinRL-Meta: A Universe of Near Real-Market Environments for Data-Driven Financial Reinforcement Learning

- [DataDrivenInvestor] A Data Scientist’s Approach for Algorithmic Trading using Deep Reinforcement Learning: An End-to-end Tutorial for Paper Trading

- [Analytics Vidhya] Weights and Biases-ify FinRL with Stable Baselines3 models

- [Analytics Vidhya] Hyperparameter tuning using optuna for FinRL

- [Analytics Vidhya] A hitchhikers guide to FinRL: A Deep Reinforcement Learning Framework for Quantitative Finance

- [Analyticsindiamag.com] How To Automate Stock Market Using FinRL (Deep Reinforcement Learning Library)?

A video about FinRL library. The AI4Finance Youtube Channel for quantative finance.

Supported Data Sources:

| Data Source | Type | Range and Frequency | Request Limits | Raw Data | Preprocessed Data |

|---|---|---|---|---|---|

| Alpaca | US Stocks, ETFs | 2015-now, 1min | Account-specific | OHLCV | Prices&Indicators |

| Binance | Cryptocurrency | API-specific, 1s, 1min | API-specific | Tick-level daily aggegrated trades, OHLCV | Prices&Indicators |

| CCXT | Cryptocurrency | API-specific, 1min | API-specific | OHLCV | Prices&Indicators |

| IEXCloud | NMS US securities | 1970-now, 1 day | 100 per second per IP | OHLCV | Prices&Indicators |

| JoinQuant | CN Securities | 2005-now, 1min | 3 requests each time | OHLCV | Prices&Indicators |

| QuantConnect | US Securities | 1998-now, 1s | NA | OHLCV | Prices&Indicators |

| RiceQuant | CN Securities | 2005-now, 1ms | Account-specific | OHLCV | Prices&Indicators |

| tusharepro | CN Securities, A share | -now, 1 min | Account-specific | OHLCV | Prices&Indicators |

| WRDS.TAQ | US Securities | 2003-now, 1ms | 5 requests each time | Intraday Trades | Prices&Indicators |

| Yahoo! Finance | US Securities | Frequency-specific, 1min | 2,000/hour | OHLCV | Prices&Indicators |

OHLCV: open, high, low, and close prices; volume.

adj_close: adjusted close price

Technical indicators users can add: 'macd', 'boll_ub', 'boll_lb', 'rsi_30', 'dx_30', 'close_30_sma', 'close_60_sma' Users also can add their features.

ElegantRL (website) provides finance-oriented optimizations of DRL algorithms using PyTorch.

Version History [click to expand]

- 2021-08-25 0.3.1: pytorch version with a three-layer architecture, apps (financial tasks), drl_agents (drl algorithms), neo_finrl (gym env)

- 2020-12-14 Upgraded to Pytorch with stable-baselines3; Remove tensorflow 1.0 at this moment, under development to support tensorflow 2.0

- 2020-11-27 0.1: Beta version with tensorflow 1.5

- FinRL is the first open-source framework to demonstrate the great potential of applying DRL algorithms in quantitative finance. We build an ecosystem around the FinRL framework, which seeds the rapidly growing AI4Finance community.

- The application layer provides interfaces for users to customize FinRL to their own trading tasks. Automated backtesting tool and performance metrics are provided to help quantitative traders iterate trading strategies at a high turnover rate. Profitable trading strategies are reproducible and hands-on tutorials are provided in a beginner-friendly fashion. Adjusting the trained models to the rapidly changing markets is also possible.

- The agent layer provides state-of-the-art DRL algorithms that are adapted to finance with fine-tuned hyperparameters. Users can add new DRL algorithms.

- The environment layer includes not only a collection of historical data APIs, but also live trading APIs. They are reconfigured into standard OpenAI gym-style environments. Moreover, it incorporates market frictions and allows users to customize the trading time granularity.

We published FinTech papers, check Google Scholar, resulting in this project:

- FinRL-Meta: A Universe of Near-Real Market Environments for Data-Driven Deep Reinforcement Learning in Quantitative Finance. Data-Centric AI Workshop, NeurIPS 2021.

- Explainable deep reinforcement learning for portfolio management: An empirical approach. paper ACM International Conference on AI in Finance, ICAIF 2021.

- FinRL-Podracer: High performance and scalable deep reinforcement learning for quantitative finance. ACM International Conference on AI in Finance, ICAIF 2021.

- FinRL: Deep reinforcement learning framework to automate trading in quantitative finance, ACM International Conference on AI in Finance, ICAIF 2021.

- FinRL: A deep reinforcement learning library for automated stock trading in quantitative finance, Deep RL Workshop, NeurIPS 2020.

- Deep reinforcement learning for automated stock trading: An ensemble strategy, paper and codes, ACM International Conference on AI in Finance, ICAIF 2020.

- Multi-agent reinforcement learning for liquidation strategy analysis, paper and codes. Workshop on Applications and Infrastructure for Multi-Agent Learning, ICML 2019.

- Practical deep reinforcement learning approach for stock trading, paper and codes, Workshop on Challenges and Opportunities for AI in Financial Services, NeurIPS 2018.

- [央广网] 2021 IDEA大会于福田圆满落幕:群英荟萃论道AI 多项目发布亮点纷呈

- [央广网] 2021 IDEA大会开启AI**盛宴 沈向洋理事长发布六大前沿产品

- [IDEA新闻] 2021 IDEA大会发布产品FinRL-Meta——基于数据驱动的强化学习金融风险模拟系统

- [知乎] FinRL-Meta基于数据驱动的强化学习金融元宇宙

- [量化投资与机器学习] 基于深度强化学习的股票交易策略框架(代码+文档)

- [运筹OR帷幄] 领读计划NO.10 | 基于深度增强学习的量化交易机器人:从AlphaGo到FinRL的演变过程

- [深度强化实验室] 【重磅推荐】哥大开源“FinRL”: 一个用于量化金融自动交易的深度强化学习库

- [商业新知] 金融科技讲座回顾|AI4Finance: 从AlphaGo到FinRL

- [Kaggle] Jane Street Market Prediction

- [矩池云Matpool] 在矩池云上如何运行FinRL股票交易策略框架

- [财智无界] 金融学会常务理事陈学彬: 深度强化学习在金融资产管理中的应用

- [Neurohive] FinRL: глубокое обучение с подкреплением для трейдинга

- [ICHI.PRO] 양적 금융을위한 FinRL: 단일 주식 거래를위한 튜토리얼

@article{finrl2020,

author = {Liu, Xiao-Yang and Yang, Hongyang and Chen, Qian and Zhang, Runjia and Yang, Liuqing and Xiao, Bowen and Wang, Christina Dan},

title = {{FinRL}: A deep reinforcement learning library for automated stock trading in quantitative finance},

journal = {Deep RL Workshop, NeurIPS 2020},

year = {2020}

}

@article{liu2021finrl,

author = {Liu, Xiao-Yang and Yang, Hongyang and Gao, Jiechao and Wang, Christina Dan},

title = {{FinRL}: Deep reinforcement learning framework to automate trading in quantitative finance},

journal = {ACM International Conference on AI in Finance (ICAIF)},

year = {2021}

}

Welcome to the AI4Finance Foundation community!

Please check Contributing Guidances.

Thanks!

We welcome gift fundings to promote the AI4Finance (non-profit and academic) community. Check the links in the right column, or use the following vemo QR codes.

Detailed sponsorship information will be updated at Issue #425

MIT License

Disclaimer: Nothing herein is financial advice, and NOT a recommendation to trade real money. Please use common sense and always first consult a professional before trading or investing.