Predict the stock price trend of Google for the next one month. The data was downloaded from Yahoo Finance. It contains stock prices of google for the last 5 years. Stacked LSTM architecture is used for predictive modelling.

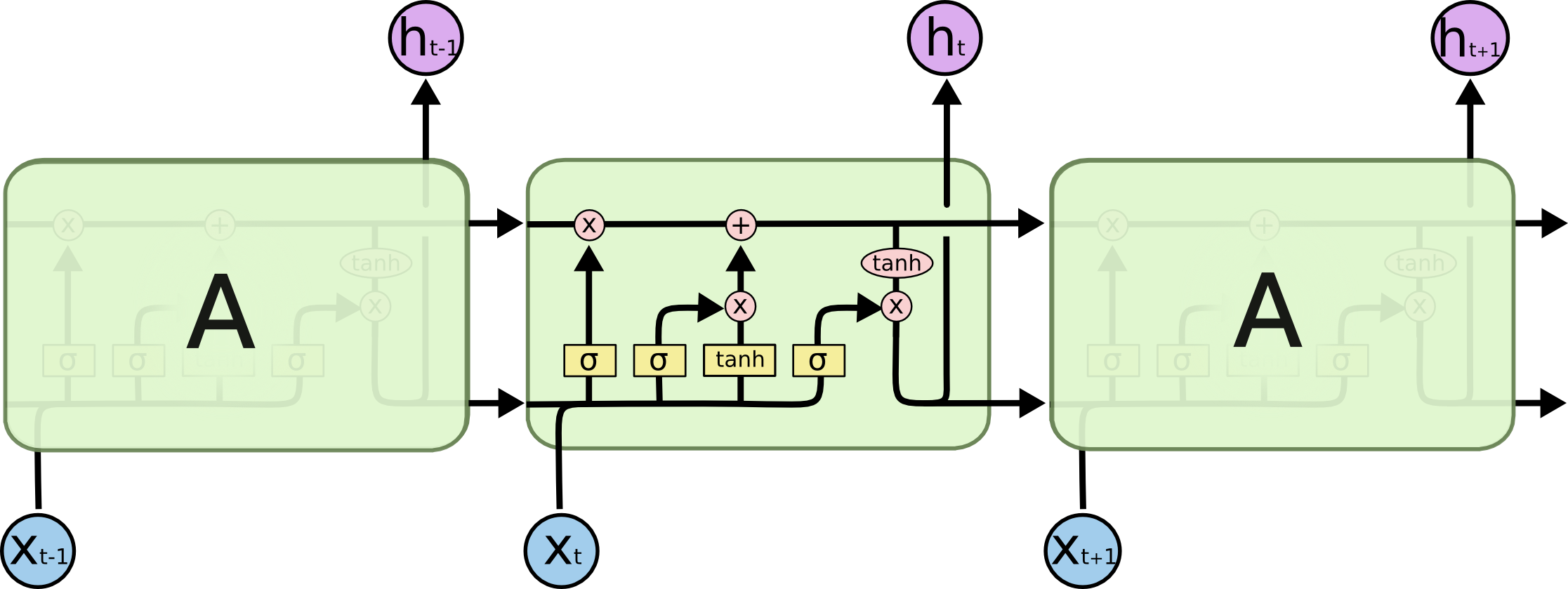

Long Short Term Memory networks aka LSTMs are a special kind of RNN, capable of learning long term dependencies. They are designed to avoid vanishing and exploding gradient problem that RNN faces for long term dependencies. LSTMs provide a highway for the gradient to propagate backwards.

- c(t) - Cell state vector

- x(t) - Input vector

- Forget Gate Layer - Looks at h(t-1) and x(t) to output what amount of information to throw away

- Input Gate Layer - Decides which value to update

- Cell State Vector - Creates a vector of candidate values

- Output Gate Layer - Decides which parts of the cell state to output

- Output Vector(h(t)) - Some part of cell state in the range of -1 to +1 is the output

- The forget gate ouputs values that determine what amount of previous cell state values to keep

- Input gate outputs values that is multiplied by the cell state vector to create an update

- Multiply previous cell state with the output of forget gate

- Then we add the result of 2 and 3. This is the new candidate values(C(t)), scaled by how much we decided to update each state value.

- C(t) is then squashed by tanh layer, multiplied by the output of output gate layer to give h(t)

- Clone this repository to your computer.

- Get into the folder using cd Stock-Trend-Predictor.

- Download the data from Yahoo Finance into this directory.

- pip install keras

- pip install tensorflow

- pip install pandas

- pip install matplotlib

- Run each cell in the Model_script.ipynb file.

- Save the graph for presentation

The model is able to predict the trend of stock prices accurately as shown in the graph