SLARM performs gap-filling for two kinds of transactions. First, SLARM performs gap-filling for real-time transactions, which can help the current consensus node to collect more SLA stringent transactions before proposing the next block. Second, SLARM performs gap-filling for smart contract transactions. Smart contracts are stateful programs; different execution orders of transactions can lead to different results. For instance, an IoT blockchain system [1] updates the temperature/humidity variables of smart contracts using the temperature/humidity data (i.e., transaction) received from sensors connected to the blockchain. If the transactions are executed out of order, the variables on smart contracts cannot reflect the real temperature/humidity, which may cause severe security issues. Therefore, transactions invoking smart contracts must be executed in order. If the consensus nodes receive smart contract transactions with gaps, all smart contract transactions cannot be proposed. To prevent transaction delay caused by gaps, SLARM performs a two-phase gossip-correction transaction dissemination protocol to fill-gaps in the received smart contract transactions as well as real-time transactions that require fast commit.

1 Why most SLA transactions can meet their SLA deadline in SLARM if we set the SLA transactions' deadlines as 2*T (An extra explanation of Section 4.3)?

In Section 4.3, we have already proved that the end-to-end commit latency of transactions disseminated by Gossip follows Poisson distribution, so setting transactions' SLA deadline as 2*T can ensure a high SLA satisfaction rate (e.g. 96%).

Here we provide extra prove that the end-to-end commit latency of transactions disseminated by SLARM also follows the Poisson distribution. The end-to-end latency of a transaction is consist of the dissemination latency and the consensus latency. Because the consensus latency is a constant (Section 7.1), we prove that the dissemination latency of SLA transactions in SLARM follows the Poisson distribution.

In SLARM, the SLA transactions are disseminated with a two-phase Gossip-correction (fill gap) protocol. SLARM adopts a light-weight gap-filling protocol to fix the missed transactions at each hop during Gossip. Because each node only requests for lost transactions from one-hop peers, this gap-filling latency at each hop is stable. Moreover, the total number of hops for an SLA transaction to be disseminated to all P2P nodes is concentrated around its mean value log(N). Therefore, the latency caused by gap-filling can be regarded as a constant. The entire dissemination latency of an SLA transaction is the sum of the Gossip latency and the gap-filling latency. As we have already proved that the latency of Gossip transaction dissemination follows the Poisson distribution, the total dissemination latency of SLARM's SLA transactions also follows the Poisson distribution. Therefore, if we set the SLA transactions' deadlines as 2*T, most SLA transactions can meet their SLA deadline in SLARM.

2 Extra explanation of Figure 1 in the paper.

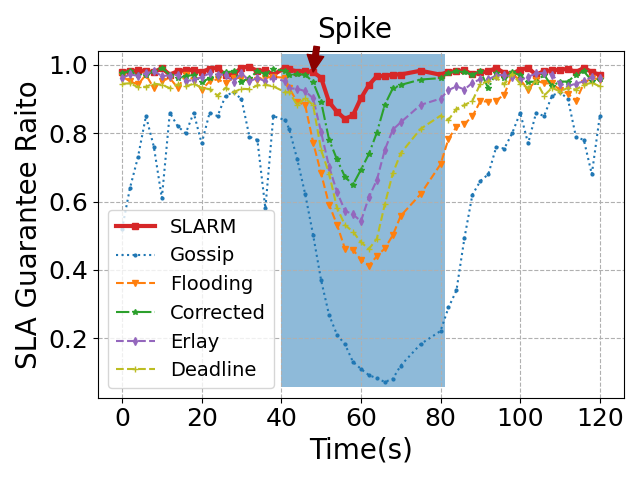

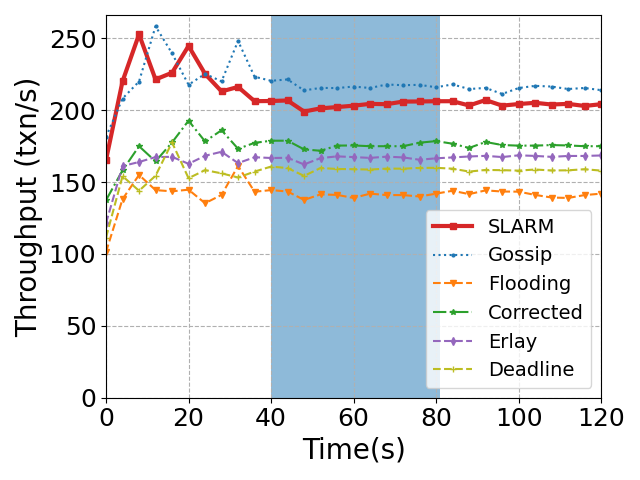

Extended Figure 1: SLA guarantee for SLA transactions and throughputs for all transactions (30Mbps bandwidth, 5000 nodes).

Extended Figure 1: An extended figure to show the SLA guarantees for SLA transactions and throughputs for all transactions of the online trading application. Our paper (Figure 1, Page 2, left column) only shows a part of the entire experiment (the blue region).

Setting (same with paper): 30Mbps bandwidth, 5000 nodes.

Experiment (same with paper): We compared the SLA satisfaction rates and throughputs of SLARM with three reliable multicast protocols (i.e., Deadline Gossip [30], Corrected Gossip [35], Erlay [51]), the traditional Gossip, and the flooding. At 0s, SLA (70%, all invoke smart contracts) and non-SLA (30%) transactions are submitted to the network until peak throughput; at 48s, a spike of 200 txn/s SLA transactions lasts for 5s.

Extra explanation: Before traffic spikes (0s-48s), all protocols except for Gossip can achieve high SLA satisfaction rates (i.e., transactions are disseminated and proposed in time under low workload). However, the SLA satisfaction rate of Gossip is low and unstable even without transaction spikes (about 80%, sometimes decreases to 60%). The key reason is that Gossip only provides a probabilistic delivery guarantee: Each transaction can only reach a fraction of all P2P nodes. Many gaps exist in the SLA transactions received by each node. As SLA transactions require sequential execution, SLA transactions after the gaps are deferred to later blocks, causing deadline SLA violation. From 40s to 47s, the SLA rates of Gossip and flooding decreased due to normal fluctuations.

Under traffic spikes (48s to 53s), the number of transactions submitted by clients exceeds the system's throughput, so the SLA rates of all systems drop. SLARM achieves the highest SLA rate for two reasons. First, SLARM prioritizes the dissemination and proposing of SLA-stringent transactions. Second, SLARM incurs minimal communication overhead compared with flooding and existing reliable multicast protocols, leading to higher system throughput. As a result, more SLA transactions can be committed to the blockchain in time. After the extra transactions submitted during spikes have all been committed to the blockchain, all systems return to normal SLA satisfaction rates. Due to the higher throughput and the transaction prioritizing mechanism, SLARM has the shortest recovery time.

3 Why did we limit each blockchain node's available bandwidth?

We limited the available bandwidth of each node for two reasons. First, in a Internet-wide blockchain system, nodes are deployed across several ISPs. The ISPs' maximum available bandwidth differs by area and connection type. For example, Comcast may offer connection speeds up to 50Mbps in some areas, whereas DSL services may offer a 20Mbps connection speed in another [new 2]. To simulate commodity network links, we capped the bandwidth for each blockchain node to 20-30 Mbps, which is the same as Algorand [new 3]. Second, only increasing the nodes' bandwidth cannot significantly improve the SLA satisfaction rate. As shown in Figure 2 below, we increase the bandwidth of all nodes to 100Mbps, the Ethereum-clique blockchain with five baseline P2P multicast protocols can achieve more stable throughputs under transaction spikes. However, their SLA satisfaction rates are still low.

4 Can existing transaction multicast protocols achieve higher SLA satisfaction rates and throughputs with large network bandwidth?

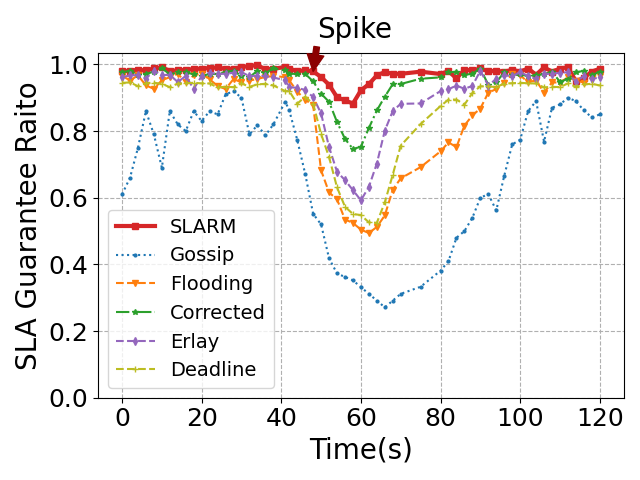

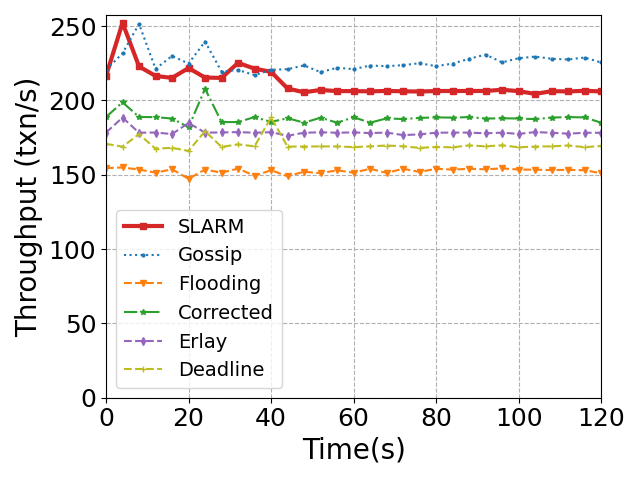

Figure 2: SLA guarantee for SLA transactions and throughput for all transactions. (100Mbps bandwidth, 5000 nodes).

Figure 2: SLA guarantees for SLA transactions and throughputs for all transactions of the online trading application.

New setting: 100Mbps bandwidth, 5000 nodes.

Experiment (same with paper): At 0s, SLA (70%, all invoke smart contracts) and non-SLA (30%) >transactions are submitted to the network until peak throughput; at 48s, a >spike of 200 txn/s SLA transactions lasts for 5s.

Explanation: With higher node bandwidth, the throughputs of all protocols are more stable under transaction spikes. However, the SLA satisfaction rates of existing P2P multicast protocols are still lower than SLARM. This is because existing protocols disseminate transactions in a FIFO manner, unaware of the priorities of transactions. Many non-SLA transactions are proposed before SLA transactions, SLA-stringent transactions are deferred by other transactions.

[new 1] A Cost Analysis of Internet of Things Sensor Data Storage on Blockchain via Smart Contracts, Electronics '20.

[new 2] https://tinyurl.com/yd8fsfb6

[new 3] Algorand: Scaling Byzantine Agreements for Cryptocurrencies, SOSP '17.

[30] Meeting the deadline: on the complexity of faulttolerant continuous gossip, PODC '10.

[35] Corrected gossip algorithms for fast reliable broadcast on unreliable systems, IPDPS '17.

[51] Erlay: Efficient transaction relay for bitcoin, CCS '19.