by Joe Hahn

jmh.datasciences@gmail.com

21 January 2018

git branch=master

This demo trains an LSTM neural network to predict daily changes in the Ethereum cryptocurrency. Source code is a Jupyter notebook that uses Keras on Tensorflow to build a simple LSTM neural network to predict daily changes in Ethereum. This model is trained on a very narrow dataset, namely the daily values and volumes of Bitcoin and Ethereum. The following implicitly assumes that Bitcoin movements are driving the Ethereum valuations, which is at best partly true and certainly not sufficient for building an adequate predictive model for Ethereum. But the principal goal here is to build and test an LSTM model using a simple dataset, and that at least is achieved.

1 i use the following to download conda to install Anaconda python plus the additional libraries needed to execute this demo on my Mac laptop:

wget https://repo.continuum.io/miniconda/Miniconda2-latest-MacOSX-x86_64.sh

chmod +x ./Miniconda2-latest-MacOSX-x86_64.sh

./Miniconda2-latest-MacOSX-x86_64.sh -b -p ~/miniconda2

~/miniconda2/bin/conda install -y seaborn

~/miniconda2/bin/conda install -y scikit-learn

~/miniconda2/bin/conda install -y jupyter

~/miniconda2/bin/conda install -y lxml

~/miniconda2/bin/conda install -y BeautifulSoup4

~/miniconda2/bin/conda install -y keras

2 Start Jupyter via

~/miniconda2/bin/jupyter notebook

and then execute the predict_crypto_price.ipynb notebook

3 Note that the LSTM model used here was cribbed from David Sheehan's blog post https://dashee87.github.io/deep%20learning/python/predicting-cryptocurrency-prices-with-deep-learning, which is worth a read.

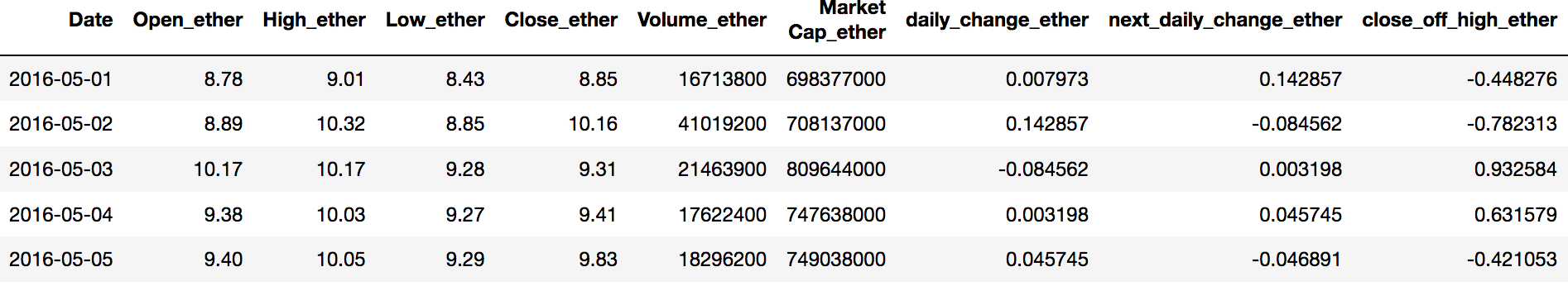

The notebook downloads two years of bitcoin and ethereum prices:

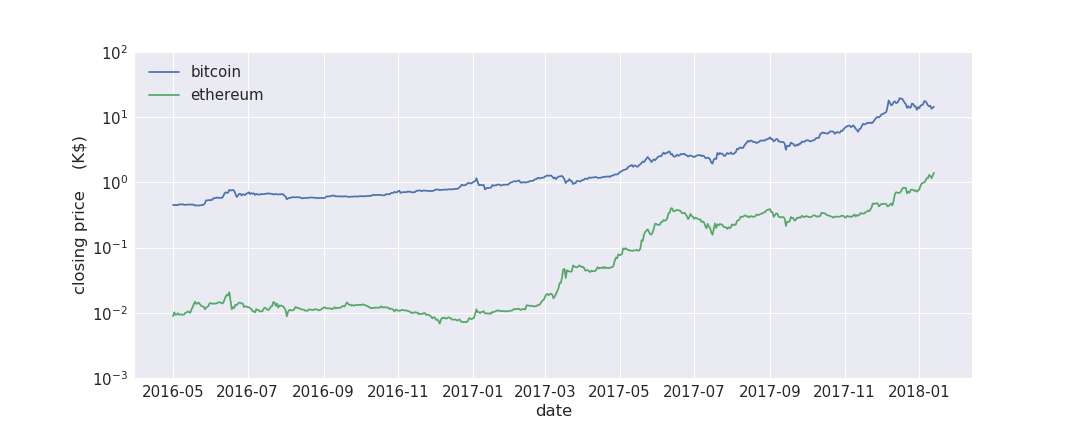

and plots currency prices

and plots currency prices

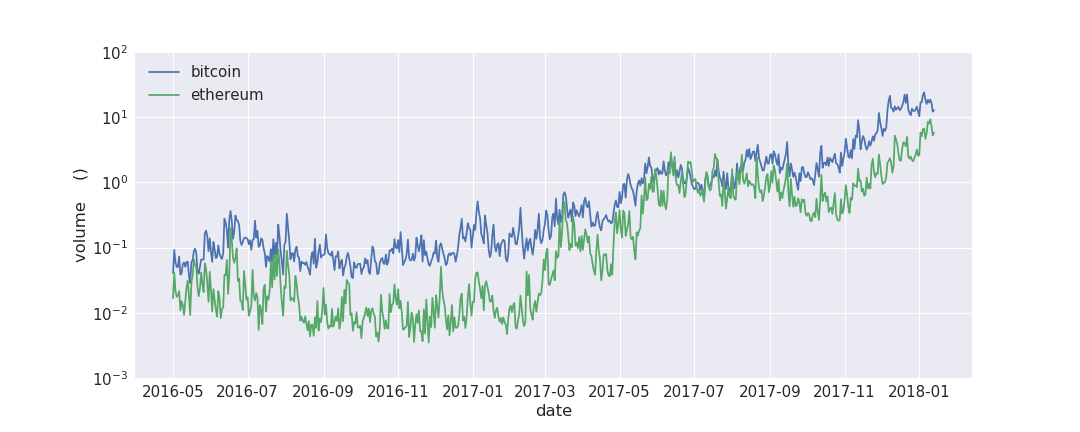

and volumes versus time:

and volumes versus time:

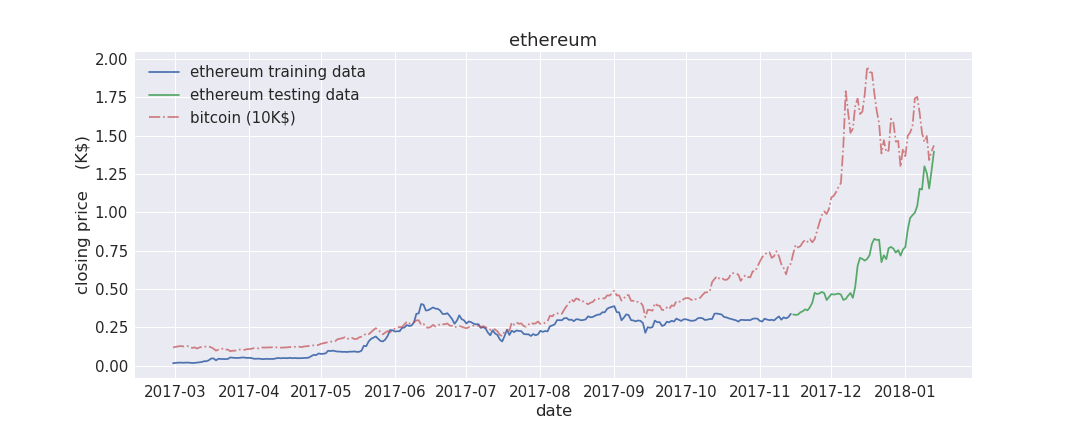

An LSTM (Long Short Term Memory) model will be trained on data

accrued prior to 2017-11-15 (blue curve, below)

and that model will then be used to predict the next-day change in ethereum's price

during subsequent days (green curve)

An LSTM (Long Short Term Memory) model will be trained on data

accrued prior to 2017-11-15 (blue curve, below)

and that model will then be used to predict the next-day change in ethereum's price

during subsequent days (green curve)

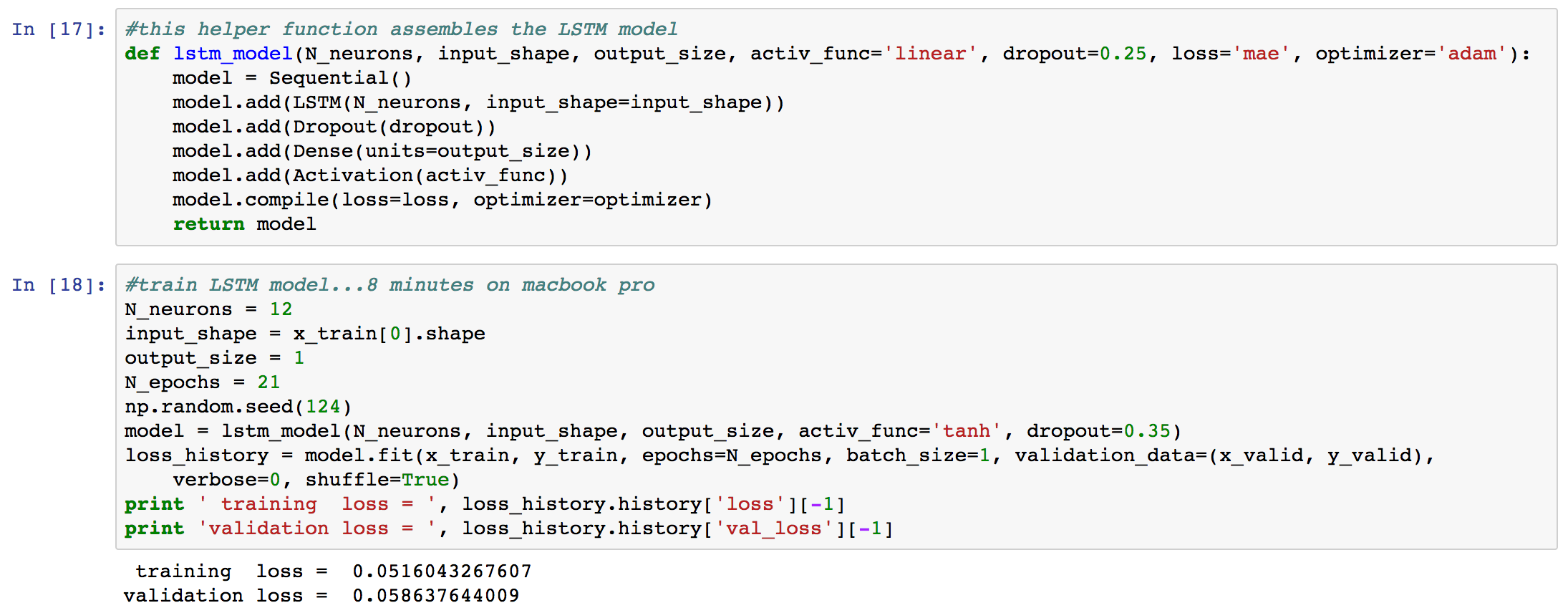

To help the model predict ethereum's next-day price change, the model is trained

on 4 days of lagged price and volume data. The notebook then builds a simple

LSTM neural network using Keras on top of Tensorflow;

this network has 2 hidden layers that are all 12 neurons wide,

and training requires about 1 minute using a Mac laptop's CPU.

To help the model predict ethereum's next-day price change, the model is trained

on 4 days of lagged price and volume data. The notebook then builds a simple

LSTM neural network using Keras on top of Tensorflow;

this network has 2 hidden layers that are all 12 neurons wide,

and training requires about 1 minute using a Mac laptop's CPU.

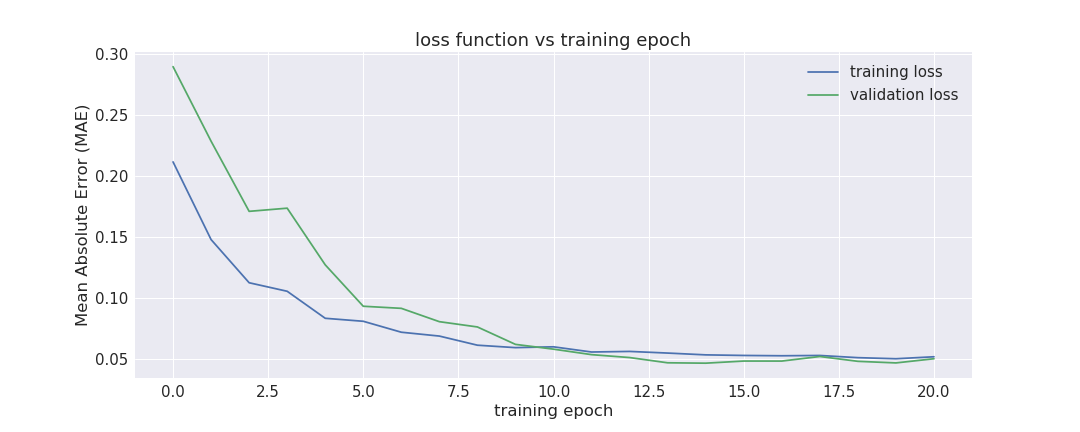

The MAE (mean absolute error) loss function is used to train the LSTM model,

and the model's MAE versus training epoch is shown below

The MAE (mean absolute error) loss function is used to train the LSTM model,

and the model's MAE versus training epoch is shown below

This model is trained to predict ethereum's fractional next-day price, so this figure

tells us that the trained LSTM model can predict

ethereum's next-day price with a 5% accuracy.

This model is trained to predict ethereum's fractional next-day price, so this figure

tells us that the trained LSTM model can predict

ethereum's next-day price with a 5% accuracy.

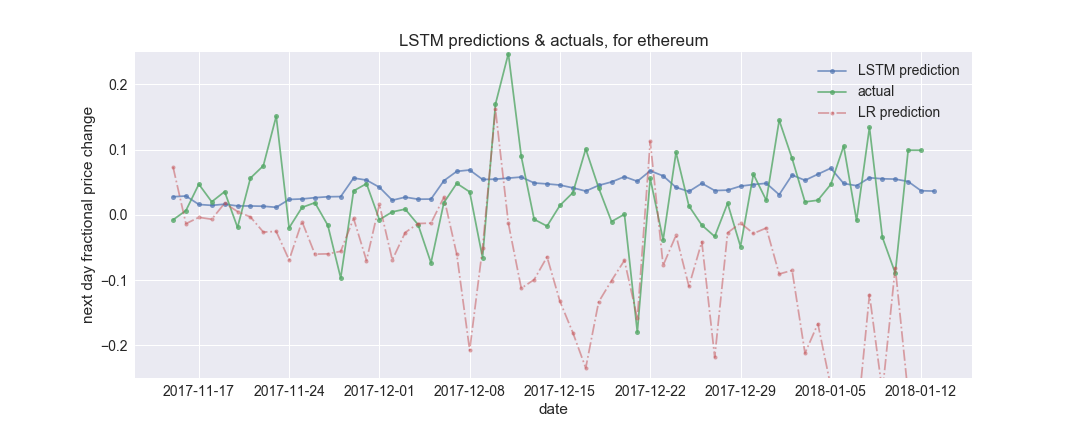

The trained LSTM model is then applied to

the test dataset, to predict ethereum's next-day fractional price

change for all dates after 2017-11-15. Green curve (below)

shows the actual next-day price variation versus date,

while the blue curve shows the predicted price change. Although the model predictions are

in the desired neighborhood, those predictions do not recover ethereum's

actual next-day price variation with enough accuracy to want to invest.

Also this model's predictions on the test dataset also have MAE = 5% (same as earlier),

so there appears to be no sign of under/over fitting.

Lastly, the red curve in the above plot shows predictions made by a simple linear regression (LR)

that was also trained on this data; that curve shows that the LR model is only somewhat useful across

the first month of testing data, with the LR model then veering away from reality at later times.

The LR model's MAE was also twice that of the LSTM model, so LSTM was two times more accurate than the

simplest of all machine-learning algorithms, and the LSTM predictions were much better behaved

further into the future.

Lastly, the red curve in the above plot shows predictions made by a simple linear regression (LR)

that was also trained on this data; that curve shows that the LR model is only somewhat useful across

the first month of testing data, with the LR model then veering away from reality at later times.

The LR model's MAE was also twice that of the LSTM model, so LSTM was two times more accurate than the

simplest of all machine-learning algorithms, and the LSTM predictions were much better behaved

further into the future.

The above illustrates how to fit a simple LSTM neural network, using Keras on top of Tensorflow plus a modest amount of cryptocurrency data, executing inside a Jupyter notebook, see https://github.com/joehahn/cryptocoin-tensorflow-demo/blob/master/predict_crypto_price.ipynb for additional details

1 migrate this demo to an AWS instance having an NVIDIA GPU

2 broaden the dataset used here to include other market data (easy) plus market & cryptocurrency news (challenging)