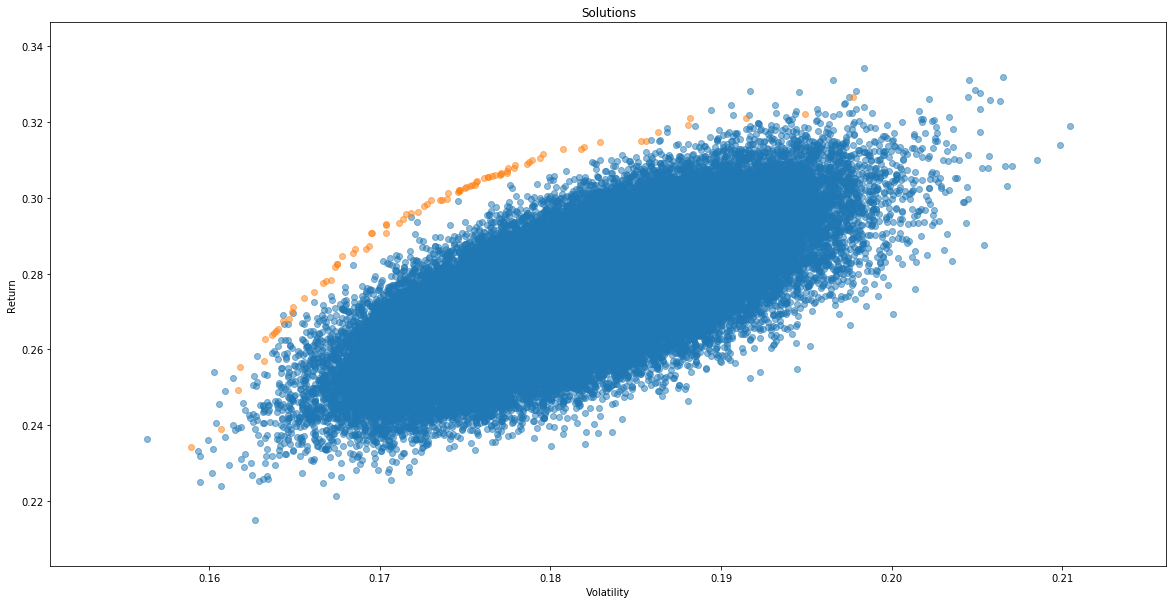

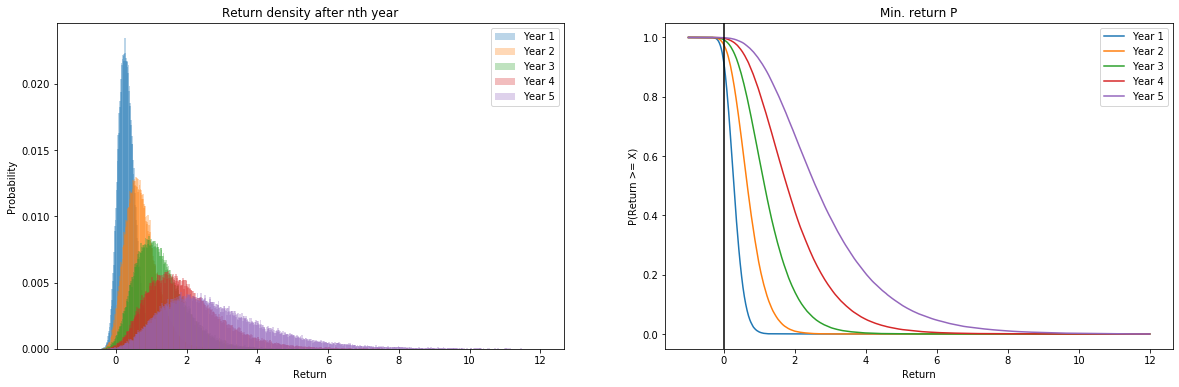

This package provides an investment portfolio optimization tool that uses NSGA-II evolutionary algorithm to approximate a Pareto optimal set of portfolio asset allocations. Returns of a particular portfolio asset distribution can be projected into the future using Monte Carlo or Markov Chain Monte Carlo methods.

from optfolio.optimize import Optimizer

optimizer = Optimizer()

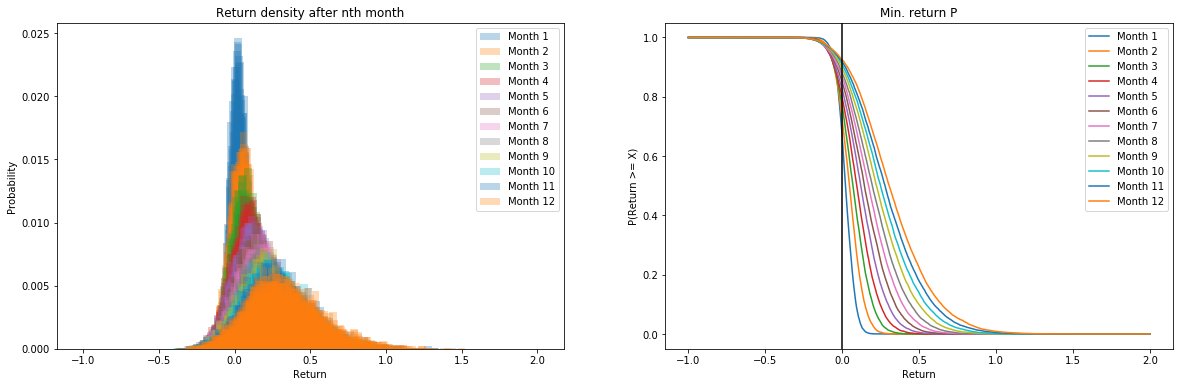

solutions, stats = optimizer.run(returns)from optfolio.returns_projection import sample_returns

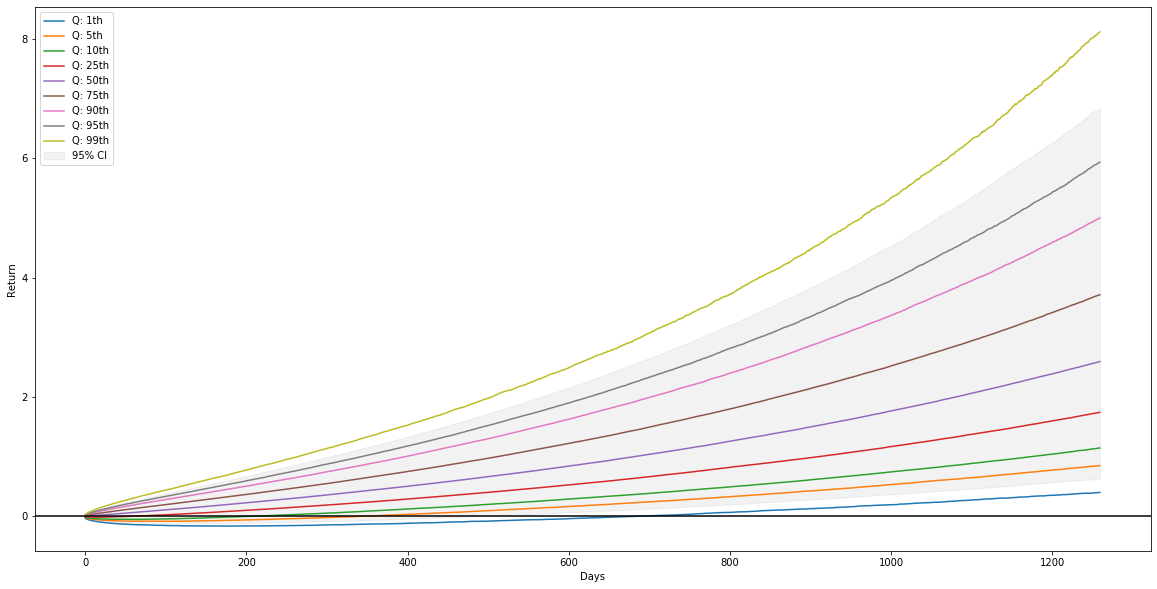

traces = sample_returns(ret, 5 * 252, n_traces = 100000)

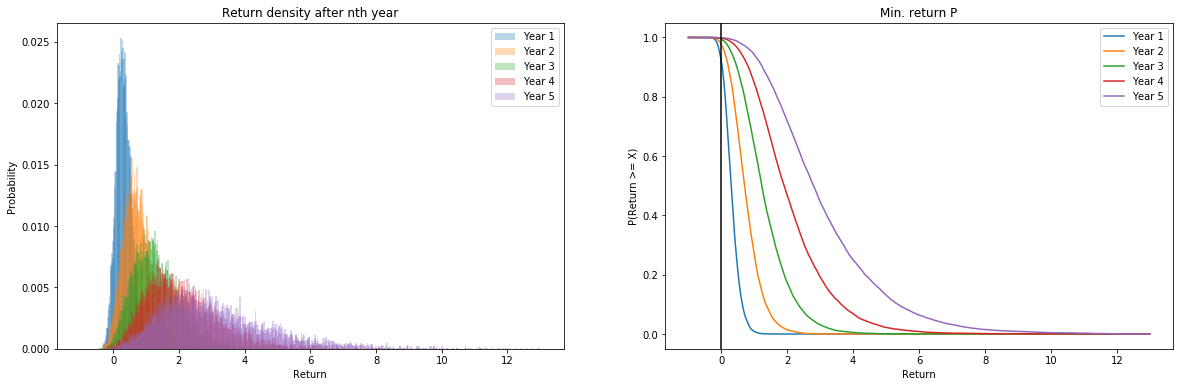

plot_traces(traces)from optfolio.returns_projection import mcmc_sample_returns

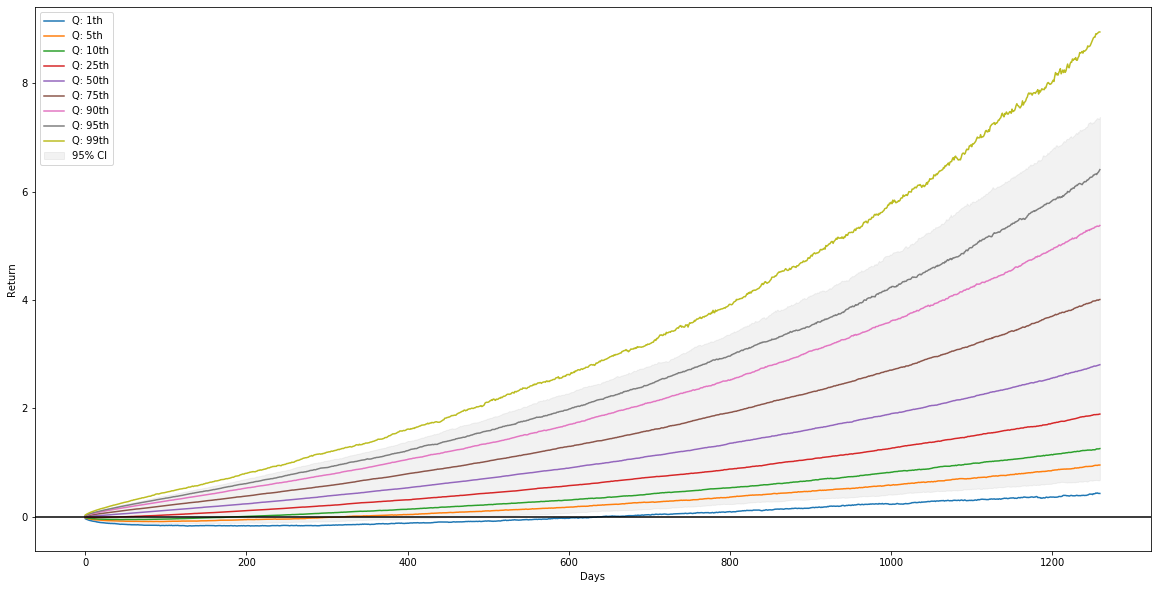

traces = mcmc_sample_returns(ret, 5 * 252, n_traces=100000, mc_states = 15, n_jobs=10)

plot_traces(traces)