Gaussian process local volatility model.

Code accompanies this paper by Martin Tegner and Stephen Roberts.

Clone and enter the repo.

git clone https://github.com/martnj/GP-LV

cd GP-LVdata/data_gp_lv.Rdata contains a synthetic dataset with price and implied volatility surfaces from a single date.

Similarly, data/data_sequence_gp_lv.Rdata contains a sequence of synthetic surfaces from ten dates.

Functions in functions_gp_lv.R include MCMC samplers, GP covariance functions and prediction equations, Black-Scholes and local volatility pricing functions.

> Ts = c(0.1, 0.25, 0.5, 1, 2, 3)

> Ks = c(90, 95, 100, 105, 110, 115, 120)

> LV = matrix(0.25, nrow=length(Tgrid), ncol=length(Kgrid))

> localVolCalls(S0=100, rf=0.015, q=0.02, LV=LV, Kgrid=Ks, Tgrid=Ts, KflatExt=100*seq(0.1, 4, by=0.2), impVol=TRUE)will produce a 6x7 matrix with implied volatilities (impVol=FALSE for prices) over Tgrid x Kgrid:

[,1] [,2] [,3] [,4] [,5] [,6] [,7]

[1,] 0.2098161 0.2214284 0.2642055 0.2252830 0.2334082 0.2474540 0.2583035

[2,] 0.2123303 0.2414574 0.2370104 0.2504015 0.2439533 0.2406356 0.2383015

[3,] 0.2265204 0.2329941 0.2438070 0.2409527 0.2449153 0.2443306 0.2413687

[4,] 0.2386151 0.2419249 0.2400347 0.2442403 0.2427800 0.2427263 0.2423808

[5,] 0.2464329 0.2453425 0.2472783 0.2447980 0.2456464 0.2450801 0.2442844

[6,] 0.2474535 0.2480237 0.2462238 0.2476969 0.2465076 0.2463319 0.2461990main_gp_lv.R contains a demo:

- Model setup: Definitions of link function, likelihood, GP-prior (wrappers for cov. functions) and hyperprior.

- Data: Load synthetic dataset from single date.

- MCMC algorithm: Posterior sampling of local volatility and hyperparameters from price surface of a single date.

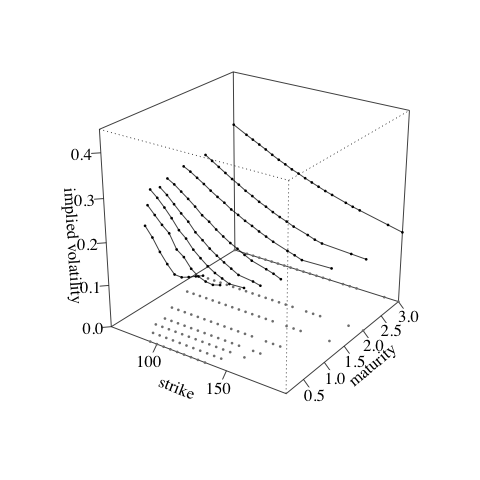

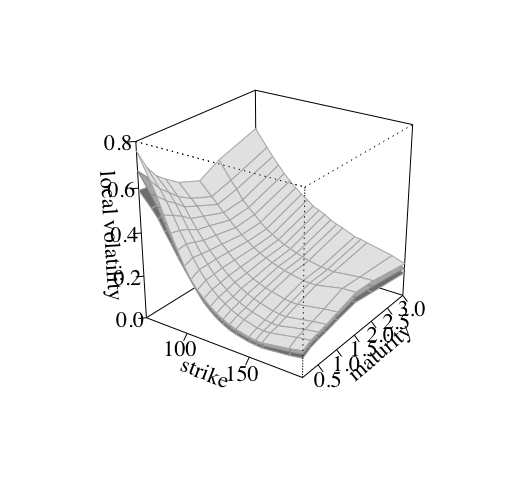

- Results: Extract variables from MCMC sample; confidence envelope over local vol (in 3D) and implied vol (2D cross-sections).

Sequential sampling with serial data:

- Data series: Load synthetic datasets.

- Sequential MCMC algorithm: Sequential sampling of local volatility and hyperparameters from series of price-surfaces.

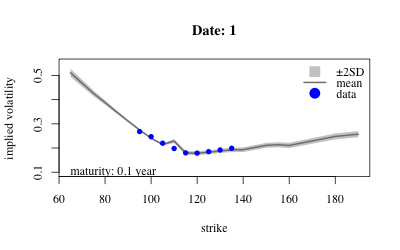

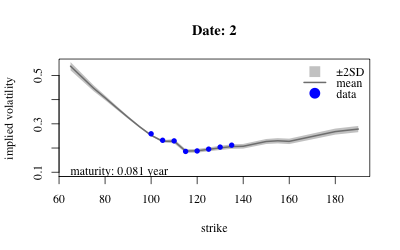

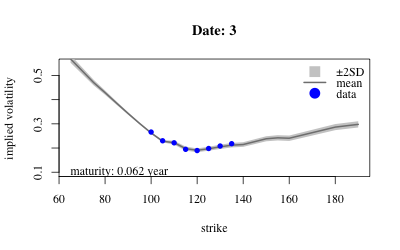

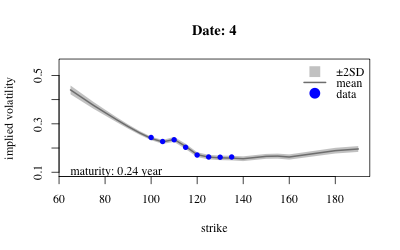

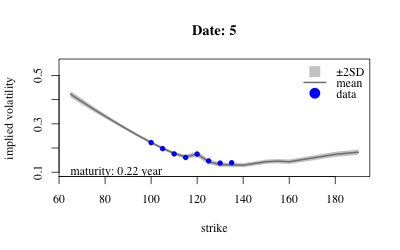

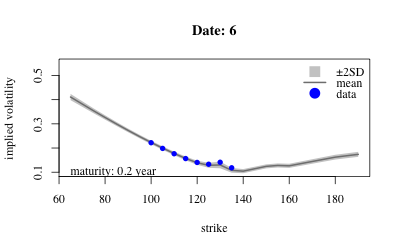

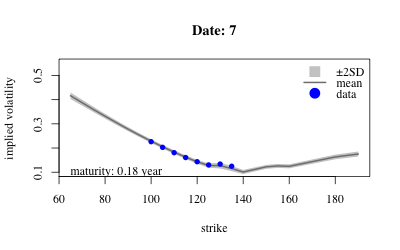

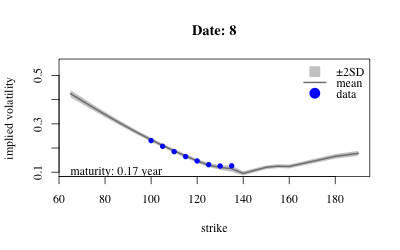

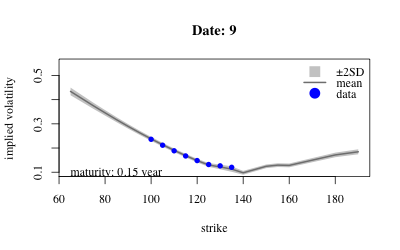

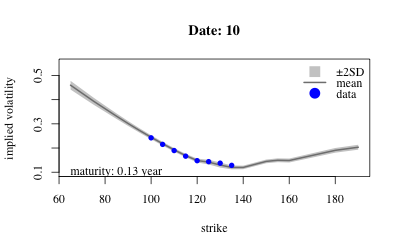

- Results: Extract variables from sample and look at posterior over implied volatility at earliest maturity of each date.