The time zone tax refers to the human cost associated with working across time zones. Like financial taxes, time zone tax comes in many forms.

Working across time zones always incurs a tax. Like all taxes they need to be paid. If you think you are not paying it, someone else is. If no one is paying it, you are accumulating time zone debt, and as with all debts, it gains interest.

The time zone tax is not simply doing a late meeting with a different time zone, or working in a different time zone’s hours. These are the obvious and very visible taxes that most people are aware of. “It must be late where you are” statements on calls are an acknowledgement of the tax. But the full cost of the time zone tax relates to the underlying burden that is paid, the cumulative result of the visible taxes, and invisible taxes.

While we have many tools to help us understand the time around the world, the tooling is still not good enough. We still miss meetings because day light savings just changed, and we still book meetings on someone else’s public holiday. And we often book meetings unaware of what time zone someone is in.

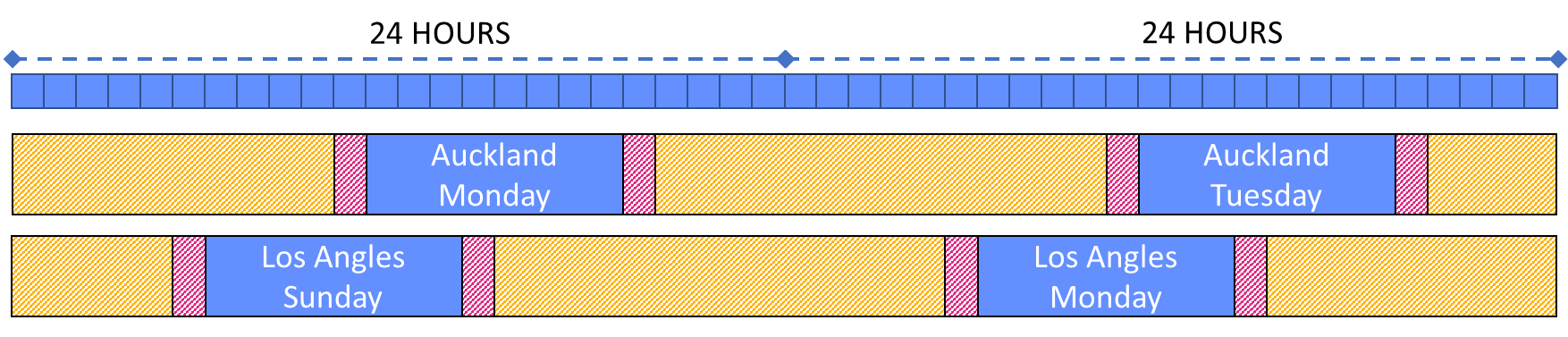

The observations outlined here are assuming a global team across the widest possible time zone split. Think more along the lines of Auckland to Los Angeles, where the time difference heads close to 24 hours. Not all the following will apply to 4–5-hour time zone shifts, but many of it still will apply. Your mileage may vary.

There are only two types of time zones. Trailing, and leading. Leading time zones are those often referred to as “ahead” in time. Trailing time zones are those often referred to as “behind”. For example:

Sydney, Australia is a leading time zone when compared to London, United Kingdom.

Sydney to los Angeles

London to los Angeles

Logistical taxes are incurred when there is high awareness of time zone differences. This tax is unavoidable, but the impact can be mitigated.

A quick example of a logistical tax is two people living in separate time zones that are 12 hours apart. The time zones are not controlled by the individuals.

Inclusion taxes are incurred when there is low awareness of time zone differences, or little or no effort taken to mitigate the impacts. In many cases an inclusion tax is mitigated through awareness. In many cases inclusion taxes can be mitigated completely with deliberate steps to be more inclusive.

The aim is to reduce the tax, but in most cases it cannot be removed completely. So who ultimately pays the tax? If the aim is for people to no longer pay a personal tax, how is it being paid?

The answer is simple: The business pays. Deadlines may get pushed back; approvals may take longer. These are highly visible impacts, and while not desirable, by doing so the business can be more predictable understanding where the cost lies in the business and course correct.

| Impact of Personal Tax | Impact of Business Tax |

|---|---|

| Deadlines get missed, and rescheduled | Deadlines get pushed back ahead of time |

| Approvals are rushed, mistakes are made | Approvals take longer |

| People burn out, project output is reduced, project is rescheduled | Deadlines get pushed back ahead of time |

| People quit, creates resource contention | Deadlines get pushed back ahead of time |

| The people and business outcomes are unpredictable | The people and business outcomes are predictable |

| The tax is not observable and therefore can not be measured or addressed | The tax is observable and can be measured and addressed |

Table 1 - Impact of Personal Tax vs Business Tax

Forcing the tax onto team members results in productivity reduction, burnout, churn, and mistakes. These have a significant business impact, are often invisible, and as a result make the impact of teams unpredictable. The tax has to be paid, the business is still impacted – productivity reduces, teams miss deadlines, quality reduces, and general team health all have huge business impacts. And there are additional compounding impacts. By design this creates a business environment for people to be irritable, unreliable, and to resign. It models that non-inclusive behaviour is desirable and acceptable to the business.

By moving the tax onto the business, it creates a forcing function for processes and procedures to change, tools change, and people change, all to be more inclusive, and stay sustainably and reliably productive.

The time zone tax that most people are aware of is the working hours tax. People in different time zones, work at different times. But the working hours tax can be caused by more than time zones.

Working hours may vary for many reasons, including variation across time zones, and adjusted local working hours.

Nominal working hours in different time zones result in people working at different times.

Example: Jennifer starts work at 9am in Sydney. Her teammate Robert Is in London and starts work at 9am in London, which is in 10 hours. Their working day does not overlap.

Figure 1 Working Hours Shift Due To Time Zones

Some employees have adjusted local working hours, often due to regular external commitments, including but not limited to medical and family commitments.

Example: David works an agreed 5am – 3pm schedule every day due to family commitments.

Figure 2 Individual Working Hours Shift To Local Hours

TBD

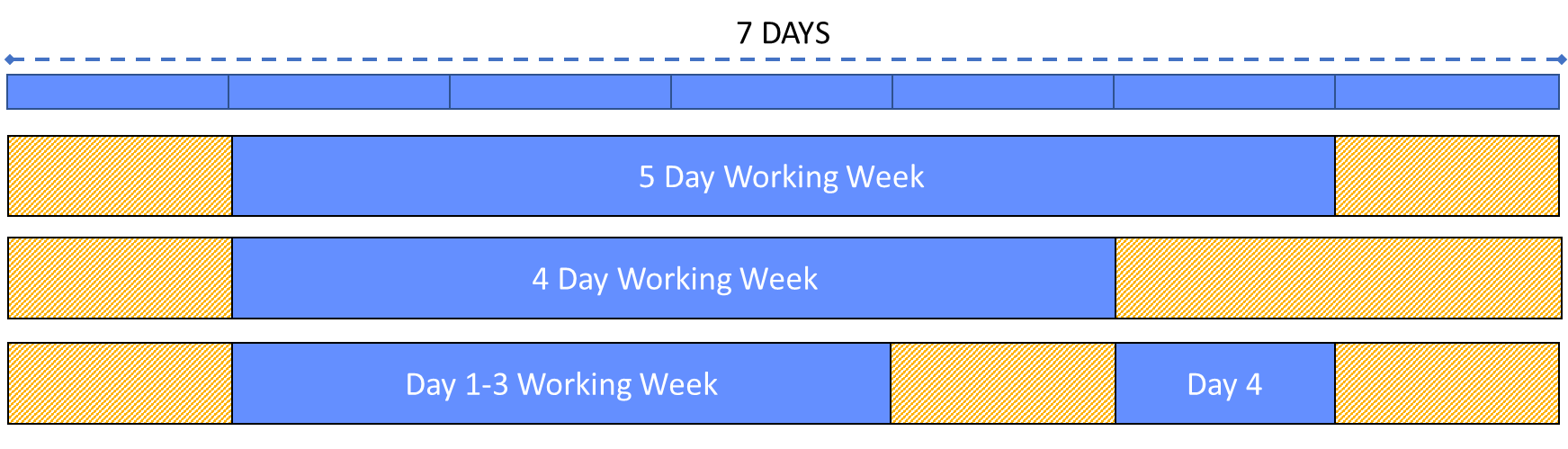

The working week tax relates to the fact that not all teams have the same working week. There are many reasons for this.

We live in a diverse planet with cultures that observe different working weeks, regardless of time zone. Israel for example, has a Sunday to Thursday working week.

Example: Rachel lives in Israel, where her working week is Sunday to Thursday. Laurent, who lives in Paris, has a working week from Monday to Friday. Their working week overlaps for 4 days.

Figure 3 Working Week Shifted in Same Time Zone

Similarly, people may work part time (long-term or short-term) and take leave for certain days of the week. This usually is either a Monday or Friday which causes a similar impact to the above, however the day of absence may also be mid-week. Impacts occur due to assumptions that the individual is working the full week.

Example: Petro works a 5-day week. Kristofer works a 4-day week permanently Monday-Thursday. Naomi usually works a 5-day week, but currently works a 4-day week as a short-term arrangement, and as such does not work Thursdays.

Due to the international dateline, Monday in Auckland, is Sunday in Los Angeles. Their working days overlap 3-5 hours depending on the time of year. While their working day is similar, the day of week between each location is different. This means that there is 4 days of overlap of their working week.

Clear Mondays and Fridays for global rhythm of business interaction activities. A good rule is to work on a Tuesday to Thursday basis for heavy global interaction. How do you select the working week? For what time zone do you select Tuesday to Thursday? Los Angeles? Auckland? Paris? The magic here is that it does not matter. This habit ensures you will never book something on someone’s Sunday by mistake.

When working with teams around the world, assume there is zero overlap where the day of the week is the same. A team in Japan shares no working day with a team in Los Angeles. As such, if someone is saying “hold for Monday” in one location, that will not be Monday in the other location. For global teams, placeholders in calendars for days i.e. “HOLD FOR CUSTOMER MEETING TO BE SCHEDULED” are guaranteed to be wrong, and will result in the opposite of the intended affect. Full day event placeholders are useful for marking your own availability, or a national holiday, but should be avoided when applied to others outside your time zone.

Example: Alyssa lives in Auckland and was asked to “hold Monday for a meeting” by Charles who is based in Los Angeles. However, Monday for Charles overlaps with Tuesday for Alyssa. Alyssa moved Monday activities to Tuesday to clear her schedule and is now less likely to have time on Tuesday for the meeting.

Figure 6 Day of Week Alignment

Block the hours in the calendar instead, 8 hours, 12 hours, 24 hours… this will then adjust for the day automatically due to adjusting to time zone.

Similarly, there is no point declaring “Friday a no meeting day” for all unless trailing time zones observe this on a Thursday.

A broadly known but rarely remembered fact: Time zones change throughout the year. In fact, for more than 1/6 of the year, time zones are changing.

PLACEHOLDER

Figure 3 Show time of year that time zones are changing

Day light savings is observed across many countries and can vary by state, resulting in a meeting at 8am, to now be at 6am without anything being rescheduled. This does not impact the scheduler directly, as the meeting will still be at their original time. It does however impact the scheduler indirectly since attendees may miss meetings or decline.

PLACEHOLDER

Example: State by state might not be needed

Figure 3 Working Week Shifted in Same Time Zone

Daylight rolls out across various countries over approximately a one-month period. Throughout the month when time zone changes happen (twice per year), like shifting sands, the meetings start to move through calendars. The only way to handle this is to put forethought into how this impacts everyone on the meeting, communicate, and adjust accordingly. Since times for meetings may need to be rescheduled significantly, these can be good months to reduce meetings while they are rescheduled.

PLACEHOLDER

Example: Over the month how calendars will look week by week

Figure 3 Working Week Shifted in Same Time Zone

Creating deadlines based on days with short notice can result in a considerable difference across time zones. If today is Tuesday in a trailing time zone, a Friday deadline is 3 days away, in a leading time zone it is 2 days away. This is a 50% difference in terms of time provided to people to deliver.

PLACEHOLDER

Example: Over the month how calendars will look week by week

Figure 3 Working Week Shifted in Same Time Zone

Reminding people of deadlines from a trailing time zone when it is already too late for those in leading time zones. Similar to the short deadline tax, a Friday morning reminder for a Friday COB deadline in a trailing time zone, is likely past the deadline in a leading time zone.

PLACEHOLDER

Example: Over the month how calendars will look week by week

Figure 3 Working Week Shifted in Same Time Zone

This happens when there is limited allocation for an opportunity, for example “register quick, spots are limited!!”. The time zone of the announcement benefits more than others as they can respond immediately.

While this can occur in any time zone, leading or trailing. There are two common ways to increase the impact of this. One way is to “open doors” on a Monday morning in the leading time zone (~24-hour impact to trailing time zone). The highest impact scenario is to “open doors” on Friday in a trailing time zone (~48-hour impact to the leading time zone).

PLACEHOLDER

Example: Over the month how calendars will look week by week

Figure 3 Working Week Shifted in Same Time Zone

Reserve spots for each region. Release them if not registered.

Assuming consensus after a long discussion, when others outside the time zone are yet able to contribute. Decisions are therefore made without any time zone considerations, and not all perspectives were sought.

In addition, often these discussions happen in forums that will no longer be at the top of the inbox/collaboration tool for the other time zones when they come online.

The prime meridian is an imaginary line that splits the world vertically to create two equal vertical hemispheres, often referred to as the East and West. For globally spread teams, this is commonly used to create two “inclusive” zones for global meetings and rhythms. This assumes a work cycle of 12 hours. The team members at the edges of the zones will routinely be pay a much higher tax by design.

PLACEHOLDER

Example: Over the month how calendars will look week by week

Figure 3 Working Week Shifted in Same Time Zone

Have 3 x 8-hour time zones for regular global rhythms, with minimal overlap, and make sure they cover the planet.

Having commitments to do a meeting late, while having commitments to do an early meeting the following day. This results in lack of sleep, and inability to focus in the second meeting.

We do not get the best out of people when we burn the candle at both ends, and when we do this by design, we are intentionally burning our people out and willingly creating an environment for poor performance.

PLACEHOLDER

Example: Over the month how calendars will look week by week

Figure 3 Working Week Shifted in Same Time Zone

Having commitments to do an early meeting, while having commitment to do a late meeting on the same day, creating an extra-long day. This results in mental exhaustion, and inability to focus in the second meeting.

Stretching team members thin does not allow them to do their best work, and exhausted workers make mistakes.

PLACEHOLDER

Example: Over the month how calendars will look week by week

Figure 3 Working Week Shifted in Same Time Zone

Someone schedules a meeting in someone else’s calendar. Unable to accept the request, the recipient context switches from their current activity, to explain that the meeting was scheduled at 3am their time and suggests an appropriate time.

This sounds minor, but context switching has a high cost. It impacts productivity by 20-40%, and with deep thinking the impact is even high to get back into a flow state. That tax is not paid by the sender, and is paid by the recipients outside the sender’s time zone.

PLACEHOLDER

Example: Over the month how calendars will look week by week

Figure 3 Working Week Shifted in Same Time Zone

For truly global activities, start them on the same day and roll them around the world. Have recordings that people can re-watch in their own time, and schedule group viewing meetings.

PLACEHOLDER

Example: Over the month how calendars will look week by week

Figure 3 Working Week Shifted in Same Time Zone

Avoid scheduling a 5-day live event for everyone, as a maximum 4 days can be inclusive of most people.

Someone gets up early to join a meeting, only find it was cancelled while they were sleeping.

PLACEHOLDER

Example: Over the month how calendars will look week by week

Figure 3 Working Week Shifted in Same Time Zone

Real-time communication across time zones may create a false sense of urgency for someone to respond outside their working hours.

PLACEHOLDER

Example: Anna in Germany sends an instant messages asking Hiroto (her direct report in Japan) for something that's not time sensitive. While Anna sends the message during her working hours, Hiroto receives it during his non-working hours. Receiving requests particularly from a manager during non-working hours can create a false sense of urgency.

If your messaging app supports it, use "delay send" features to queue non-urgent messages, so that they are sent during the recipients working hours. Make sure that non-urgent messages are clearly identified as such with prefixes like "not urgent", "don't respond until tomorrow", etc.

Making someone obliged to do a meeting out of time zone simply because others have done this. Often a mitigation strategy, sharing can stop people from burning out or breaking, but this simply distributes the tax across an entire team. The aim should be to reduce the time zone tax, not force it on others.

PLACEHOLDER

Example: Over the month how calendars will look week by week

Figure 3 Working Week Shifted in Same Time Zone

Rather than shifting the time zone tax, consider shifting the meeting times and not having participants obligated to attend. Enforce this where possible, and do not invite them. They can provide input ahead of time, listen to recordings, read minutes, and take action in their own time zone. These are all activities that would have happened regardless, and are now in the right time zone.

This is more in relation to how time and date is defined between countries, but as a side effect it often impacts scheduling across time zones. It occurs when there is confusion between the date formats MM DD YYYY and DD MM YYYY when interpreting or proposing dates in writing. This is compounded more when MM/DD is written as a shorthand, i.e. 5/6.

| Who | Written Communication | Impact |

|---|---|---|

| Sender | I will schedule the meeting in Seattle on 5/6 | None. Book meeting rooms mid may for meeting to take place on 5th of June. |

| Recipient | I will schedule the meeting in Seattle on 5/6 | Book flights to fly to Seattle and turn up on the 6th of May, meeting is not for a month. |

Use calendar proposal tools for proposing dates for meetings, events, etc. This also ensures the data and time are defined explicitly.

When writing/creating written dates avoid using numerical months.

| Numerical | Literal |

|---|---|

| 01.10.2020 | 10 Jan 2020 |

| 10.01.2020 | Jan 10 2020 |

When reading/interpreting written date formats, ask for clarification before assuming if they are in numerical format. This is a far cheaper tax to pay than getting the dates wrong.