Repository maintained and data gathered by Weston Evans, student studying Information Systems at St. Cloud State University, Herberger Business School

Market performance measures such as broad indexes (Ex, Dow Jones Industrial Average Index: DJIA) are often used as economic and business indicators representing the current market standing or its expected future performance. There are numerous studies examining this relationship and various theories about the strength and nature of this relationship between indexes and the general market and economy. What is rarely studied is the relationship between broad market indexes and outcomes of wars.

In his 2008 book (Wealth, War, & Wisdom), Barton Biggs, renowned Wall Street investor hypothesized that markets in their representation of the wisdom of the crowds can be good predictors of outcomes of wars and armed conflict. Biggs tested his theory be examining the performance of indexes such as the DJI and the British Financial Times 30 Industrials during World War II. He found that market indexes turned bullish and moved upward during the most desperate episodes facing the allies during World War II. During these dark moments for the allies, no politician or military strategist was expressing any optimism because the war was not going well at all for the allies. Surprisingly, it was during these times that markets started to move upward defying the desperate mood and negative outlook of the war. Biggs argued that markets, since they embody the wisdom of the crowds, could see the positive end of the war in favor of the allies even though this was not evident to anyone else at the time.

This study attempts to test Biggs’s theory by examining the performance of the DJI and the Financial Times Stock Exchange 100 indexes during three of the more recent conflicts. This study only intends to see if we can find the same patterns of movement of stock market indexes

during these modern conflicts. If Bigg’s findings hold true, we expect to see market indexes moving upward during these modern wars when their outcomes were still not clear at all. We also expect to see these markets moving upward during the most oblique phases of these modern conflicts. This study, due to its limited scope will not confirm any predictive relationship between markets and wars, it will only supply further insight into a very intriguing and rarely examined topic that was first explored by Barton Biggs over 50 years ago.

For this study we looked at the DJIA, S&P500, FTSE100, and FT30 indexes pending available data.

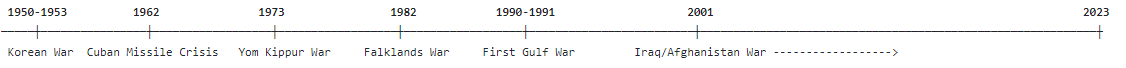

In order from least recent to most, we looked at the Korean War(1950-1953), the Cuban Missile Crisis(1962), the Yom Kippur/Ramadan/Arab-Israeli War(1973), the Falklands War(1982), the First Gulf War(1990-1991), and finally the Iraq/Afghanistan War(2001-2023).