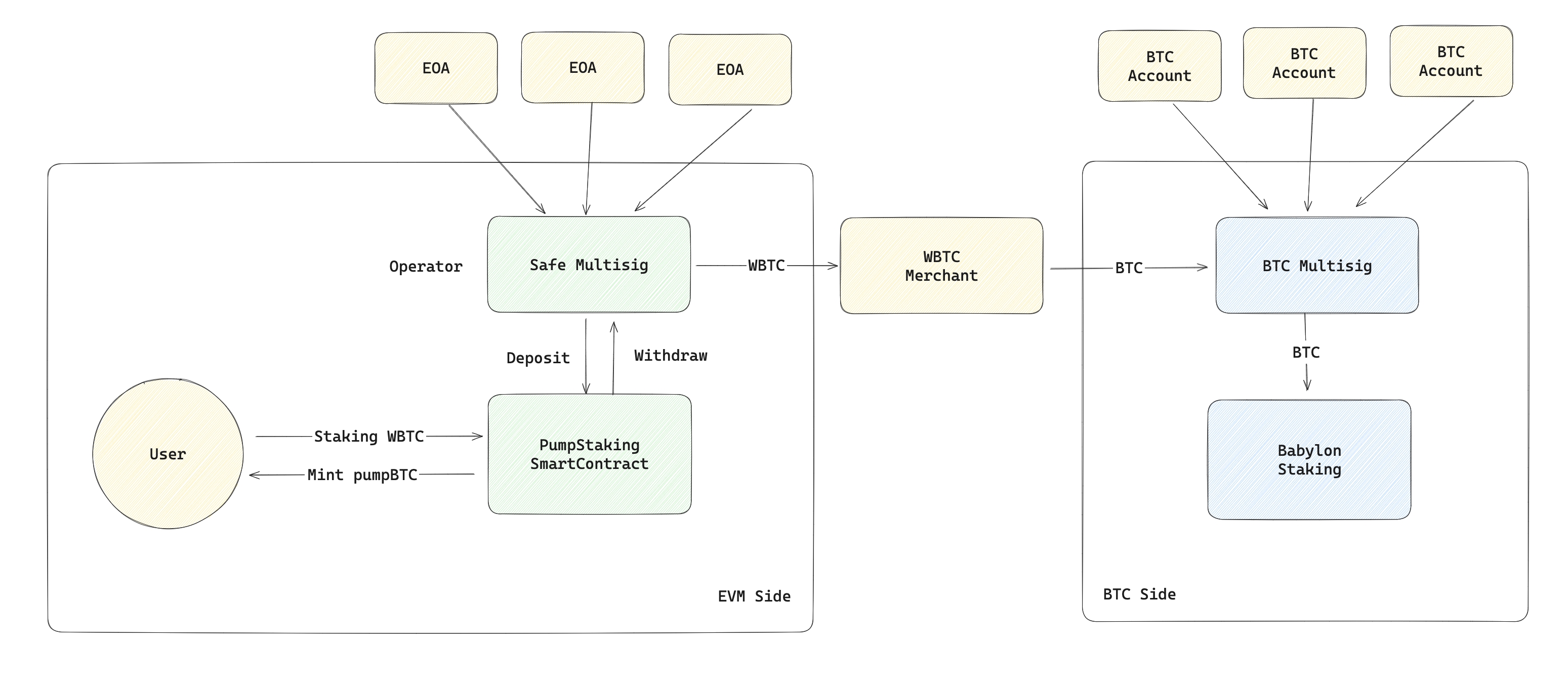

PumpBTC is a contract that allows users to stake Wrapped Bitcoin (e.g. WBTC, sBTC, BTCB) into an EVM contract and earn rewards in BTC, which are staked in Babylon. The process is shown in the figure below:

The project facilitates both standard and instant unstake options with associated fees. This README provides detailed instructions on deployment, configuration, and the usage of contract functions.

Copy the .env.example file to .env and fill in the required values.

PRIVATE_KEY_ADMIN="<your private key>"

ADDRESS_ADMIN="<your wallet address>"

API_ETHERSCAN="<etherscan api (can be empty)>"

RPC_SEPOLIA="<sepolia network rpc>"-

Install dependencies by running:

yarn

-

Compile the contracts and run the test:

npx hardhat test -

Deploy the contracts:

npx hardhat run ./scripts/deploy.ts --network sepolia

Remember to finish the manual steps in the deployment script. See

./scripts/deploy.tsfor details. -

Upgrade the contracts(optional):

npx hardhat run ./scripts/upgrade.ts --network sepolia

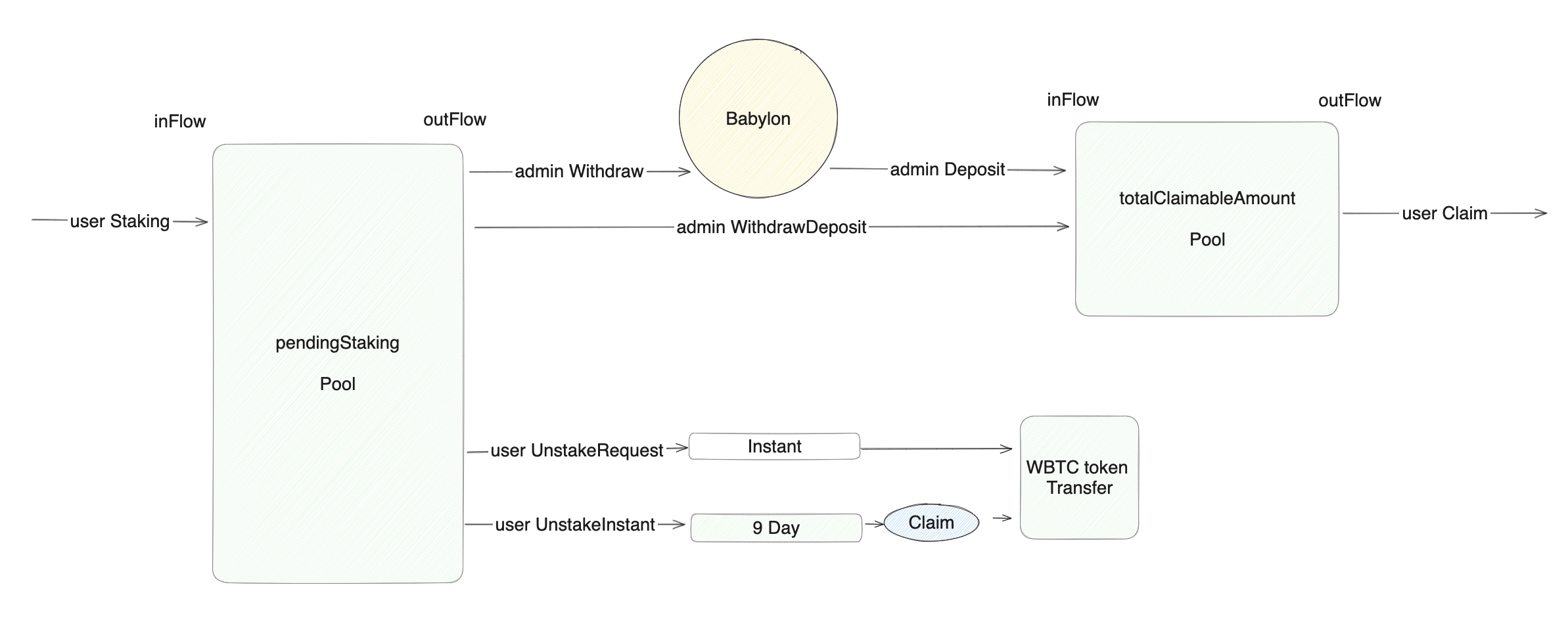

Users deposit Wrapped BTC into our EVM contract, from which the operator manually exchanges Wrapped BTC for BTC daily and deposits it into Babylon. This amount is referred to as X.

When a user requests to unstake Wrapped BTC, the operator withdraws BTC from Babylon, which takes approximately 7 days, and then exchanges it for Wrapped BTC over the next day, delivering it to the user by date T+10. This amount is referred to as Y.

Users can also request an instant unstake, receiving Wrapped BTC immediately from other users' stakes that have not yet been exchanged for BTC, subject to an extra fee. This amount is referred to as Z, and must satisfy Z < X.

The assets flow is shown in the figure below:

Upon staking Wrapped BTC, our contract mints pumpBTC for the user.

- pumpBTC: An ERC20 token with 8 decimals.

- WBTC: The mainnet address is here. A test version with 8 decimals will be deployed on testnet.

- pumpStaking: The main staking contract containing several functions and events.

Note: All quantity-related variables are in pumpBTC decimals (8 decimals).

totalStakingAmount: Total amount of BTC currently staked.totalStakingCap: Maximum cap for BTC staking.totalRequestedAmount: Total amount of BTC requested for unstake, not yet claimed.totalClaimableAmount: Total amount of BTC available for claiming.pendingStakeAmount: Amount staked today minus amount instantly unstaked today (X - Z).collectedFee: Collected fees (in WBTC, 8 decimals).operator: Address able to withdraw or deposit BTC to the contract.instantUnstakeFee: Fee rate for instant unstake, default is 300 (3%).pendingUnstakeTime: Timestamp for a user's unstake request in a specific date slot.pendingUnstakeAmount: Amount requested for unstake by a user in a specific date slot.

setStakeAssetCap: Set the staking cap.setInstantUnstakeFee: Set the fee rate for instant unstake.setOperator: Set the operator address for withdrawals and deposits.collectFee: Transfer collected fees out of the contract.withdraw: WithdrawX - ZWBTC from the contract, convert to BTC, and stake to Babylon.deposit: Deposit WBTC equivalent to the unstake request amountYafter 10 days.withdrawAndDeposit: Combine the withdraw and deposit operations.

stake: Stake a specified amount of WBTC (8 decimals).unstakeRequest: Request to unstake a specified amount of WBTC.claimSlot: Claim unstaked WBTC for a specific slot after the 10-day period.claimAll: Claim all unstaked WBTC after the 10-day period.unstakeInstant: Instantly unstake a specified amount of WBTC, subject to a fee.

Each function generally has corresponding events, detailed in the ABI. pumpBTC transfers follow standard ERC20 transfer events.

For more details on date slots and the 10-day unstake cycle, please refer to the in-depth contract documentation and comments within the ABI.