- Introduction

- Protocol architecture overview

- Order-Book

- AMM

- Tokenomics

In traditional, centralized finance, the act of exchange is facilitated by a trusted third-party, such as a market maker, bookie, or other intermediary. This was accomplished using order-books, where buy and sell orders were matched. These paper order-books eventually turned into centralized exchanges (CEXes), like those used in stock markets.

The act of exchange without trusted parties is one of the most basic features necessary for decentralized finance (DeFi) on top of blockchains. Instead of trusted intermediaries, a decentralized exchange (DEX) works using trusted smart contracts. Many features of centralized, order-book exchanges - such as partial filling of orders, buyback guarantees and so on - have been successfully implemented within smart contracts. In smart contracts, these features are usually composable. Composable elements in smart contracts are good for traders for a number of reasons, such as they make them easier to understand and use.

In DeFi, there are two types of decentralized exchanges (DEXes): order-book, similar to traditional, financial exchanges and Automated Market Maker (AMM). Swap order contracts allows for order-book based DEXes, and these follow traditional financial models. They are well established, and they work best in markets with high liquidity. AMM DEXes are also becoming possible on blockchains with advanced smart contracts. AMM uses mathematical models to set the price and match buyers and sellers rather than merely matching buy and sell orders, as in traditional order-books. AMM is best in markets with low liquidity. One of the features of AMM is that liquidity providers add assets to the exchange for a fee, and the market benefits from an increase in liquidity, smaller latency, limited price slippage, and less market volatility when using this additional liquidity.

Interestingly, one of the unique features of Ergo and Cardano is that, thanks to the eUTXO ledger model they use, liquidity pool contracts for AMM DEXes can be combined with the order contracts used in order-book DEXes. This capability enables shared liquidity among different types of exchanges on the Ergo and Cardano blockchains, which was not possible to do before.

This document provides a description of the Automated Decentralized Exchange protocol on top of Ergo and Cardano.

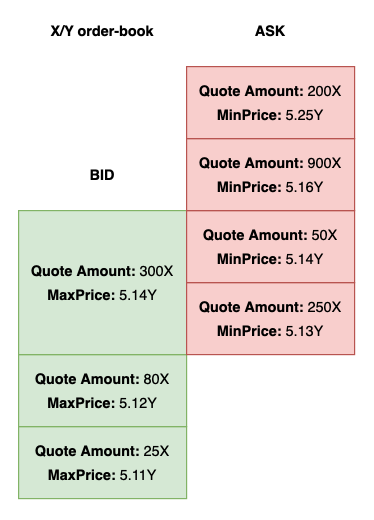

Orders are waiting for other orders to be matched, or for a cancellation. There are the following three types of orders — "buy" (i.e. buy tokens for native asset), "sell" (i.e. sell tokens for native asset), and "swap" (buy tokens for other tokens) orders. Order-book DEX has the advantage of working best for those pairs with high liquidity.

Atomic orders can only be executed completely and are otherwise refunded. Such orders can either be aggregated by the ErgoDEX client so that users can choose from them or matched in an order-book with partial orders which will be defined next.

Partial orders are something more familiar to those who've ever used classical centralized exchanges (CEXes). These orders can be partially executed so the best way to work with them is an order-book, where they can be aggregated, matched and executed by ErgoDEX bots.

Unlike order-book based DEX which relies on an order-book to represent liquidity and determine prices AMM DEX uses an automated market maker mechanism to provide instant feedback on rates and slippage. AMM DEX suits best for pairs with low liquidity.

Each AMM liquidity pool is a trading venue for a pair of assets. In order to facilitate trades a liquidity pool accepts deposits of underlying assets proportional to their price rates. Whenever deposit happens a proportional amount of unique tokens known as liquidity tokens is minted. Minted liquidity tokens are distributed among liquidity providers proportional to their deposits. Liquidity providers can later exchange their liquidity tokens share for a proportional amount of underlying reserves.

Classical AMM pools are based on Constant Product formula which is x*y=c, where x and y are deposits on tokens X and Y respectively and c is their product which has to remain constant after swap operations. CFMMs provide liquidity across the entire price range.

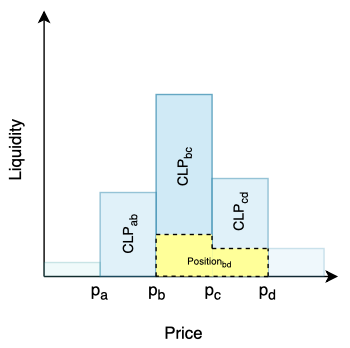

While in CFMMs liquidity is uniformly distributed along the reserve curve, which is slightly inefficient as much of the reserves held in a pool are never used, Concentrated AMMs allow LPs to provide liquidity to smaller price ranges. Each pair is composed of smaller pools each corresponding to some price range. We call such pool a concentrated liquidity pool (CLP). A CLP only needs to maintain enough reserves to support trading within its range, and therefore can act like a constant product pool with larger reserves (we call these the virtual reserves) within that range. At the same time LPs are not bound to some particular CLP and price range and can provide liquidity to multiple adjacent CLPs therefore forming something what we call a position. While price of an asset is within a position's price range the position is earning protocol fees. When the price escapes the position's price range it's liquidity no longer earns fees as it's not active anymore.

In the ErgoDEX each actor is incentivized to fulfill his role as well as possible.

There are four types of economic agents in the ErgoDEX ecosystem:

- Miners - need to be incentivized in order to process transactions

- DEXes (Parties which run DEX bots and UI) - need to be incentivized in order to provide best services.

- Liquidity providers (LPs) - need to be incentivized in order to provide liquidity.

- Traders

Each type of agents benefits from using DEX in his own way:

- Miners are earning miner fees paid in ERGs

- DEXes are earning fees paid in ERGs from both OrderBook and AMM services

- In AMM: fees are charged for every operation on a liquidity pool

- An amount of native tokens defined by a user for deposit|redeem operations

- An amount of native tokens defined by a user for each unit of quote asset exchanged

- In OrderBook: fees are charged in native tokens for each unit of quote asset exchanged

- In AMM: fees are charged for every operation on a liquidity pool

- LPs benefit from protocol fees paid in tokens and accumulated in liquidity pools

- Traders benefit from DEX services they use