This is a challenge on Analytics Vidhya Datahack Competition

Dream Housing Finance company deals in all home loans. They have presence across all urban, semi urban and rural

areas. Customers first apply for a home loan after that company validates the customer eligibility for the loan.

Company wants to automate the loan eligibility process based on customer detail provided while filling an online

application form. These details are Gender, Marital Status, Education, Number of Dependents, Income, Loan Amount,

Credit History and others. To automate this process, they have given a problem to identify the customers segments,

those are eligible for loan amount so that they can specifically target these customers.

Banks: Automating the loan approval system

People with 2 Dependents have recieved most loans

71% Married people have recieved the loan whereas 63% Non-Married people have recieved the loan

Graduates are more likely to recieve loans as compared to Non Graduates

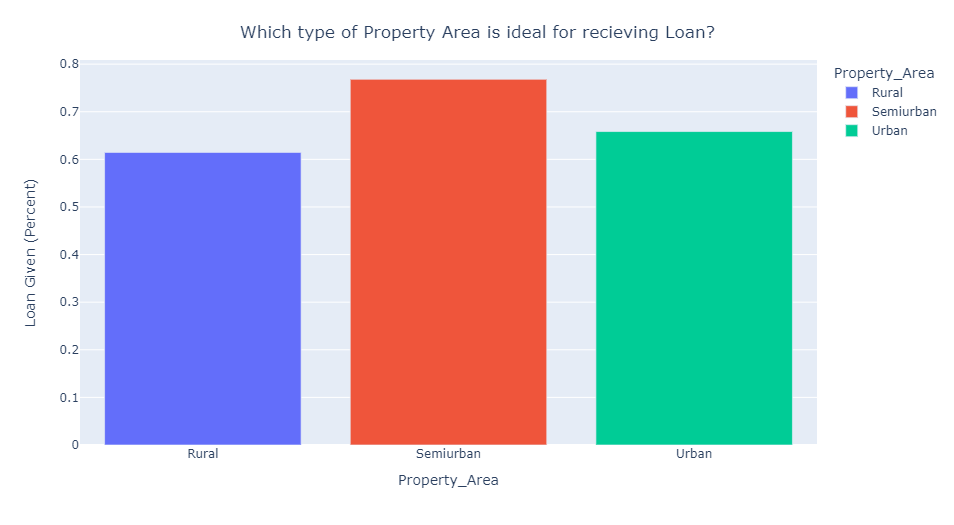

People with property area as Semi-Urban have recieved the most loans

- First, Imputed the null values using KNN imputer.

- Then, Used Smote Tomek to handle the Class Imbalance.

- Using Feature engineering Techniques, encoded categorical variables using one hot encoding also derived 2 new

features.

- Model Selection - checked the cross-val score for 5 folds for all the classification models.

- Random Forest and Cat Boost gave the best results. Then, Hypertuned the RandomForest Classifier.

- Finally, used Voting Classifier with soft voting and model used Random Forest Classifier and Cat Boost.

- Used streamlit(app.py) for providing the user interface

precision recall f1-score support

0 0.99 0.97 0.98 346

1 0.97 0.99 0.98 346

accuracy 0.98 692

macro avg 0.98 0.98 0.98 692

weighted avg 0.98 0.98 0.98 692

Checkout the notebooks for more detailed understanding.