Each of the functions comes with default parameters and can be run without arguments for ease of illustration or they can be specified individually. Sensitivities can be calculated both analytically and numerically.

Install from PyPI:

$ pip install optionvisualizer

Install in a new environment using Python venv:

Create base environment of Python 3.11

$ py -3.11 -m venv .venv

Activate new environment

$ .venv\scripts\activate

Ensure pip is up to date

$ (.venv) python -m pip install --upgrade pip

Install Spyder

$ (.venv) python -m pip install spyder

Install package

$ (.venv) python -m pip install optionvisualizer

Or to install in new environment using anaconda:

$ conda create --name optvis

Activate new environment

$ activate optvis

Install Python

(optvis) $ conda install python==3.9

Install Spyder

(optvis) $ conda install spyder

Install package

(optvis) $ pip install optionvisualizer

Import visualizer and initialise an Option object

from optionvisualizer.visualizer import Visualizer

opt = Visualizer()

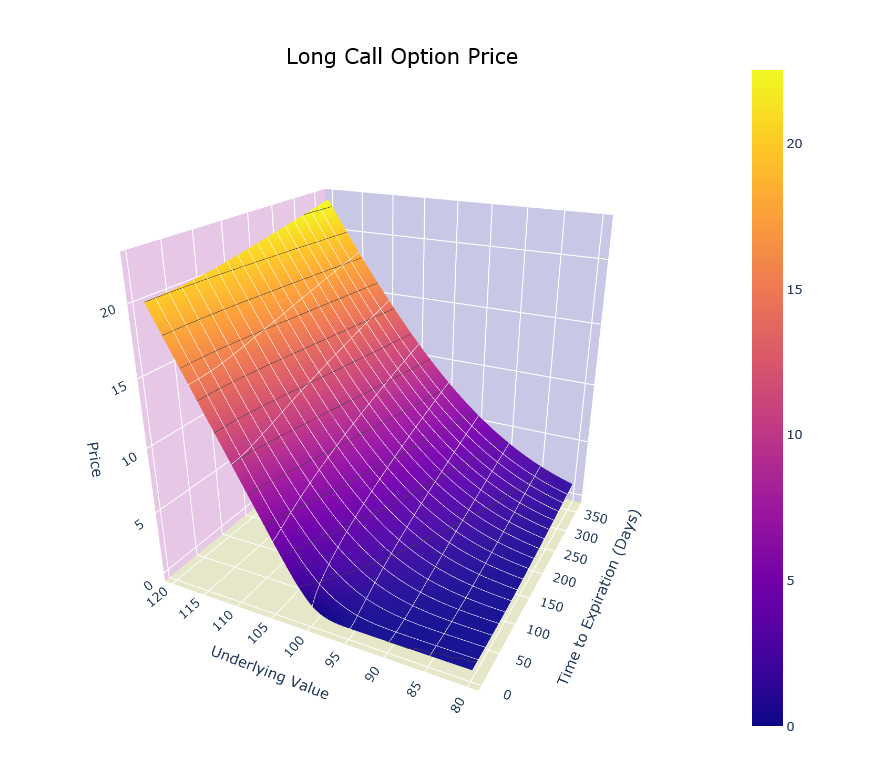

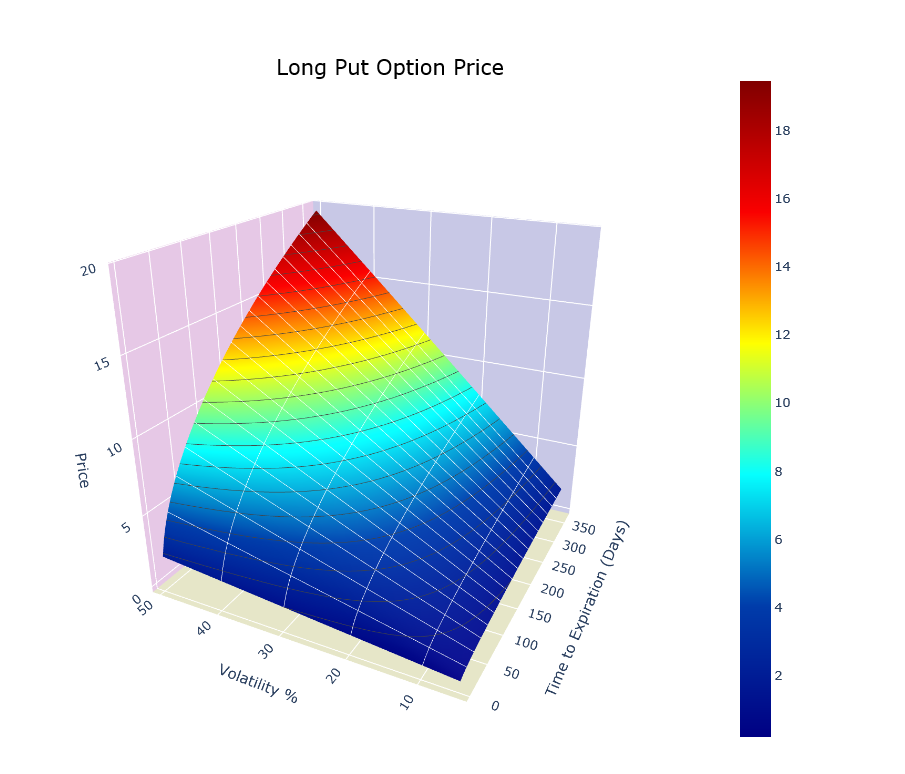

- Price: option price

- Delta: sensitivity of option price to changes in asset price

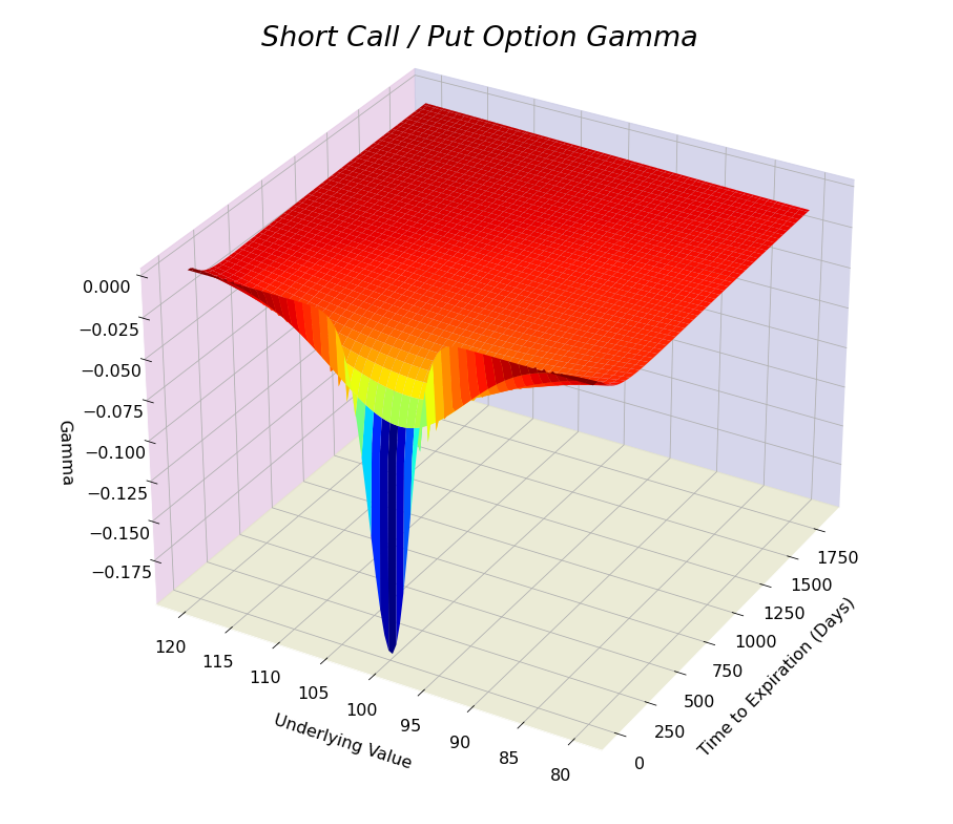

- Gamma: sensitivity of delta to changes in asset price

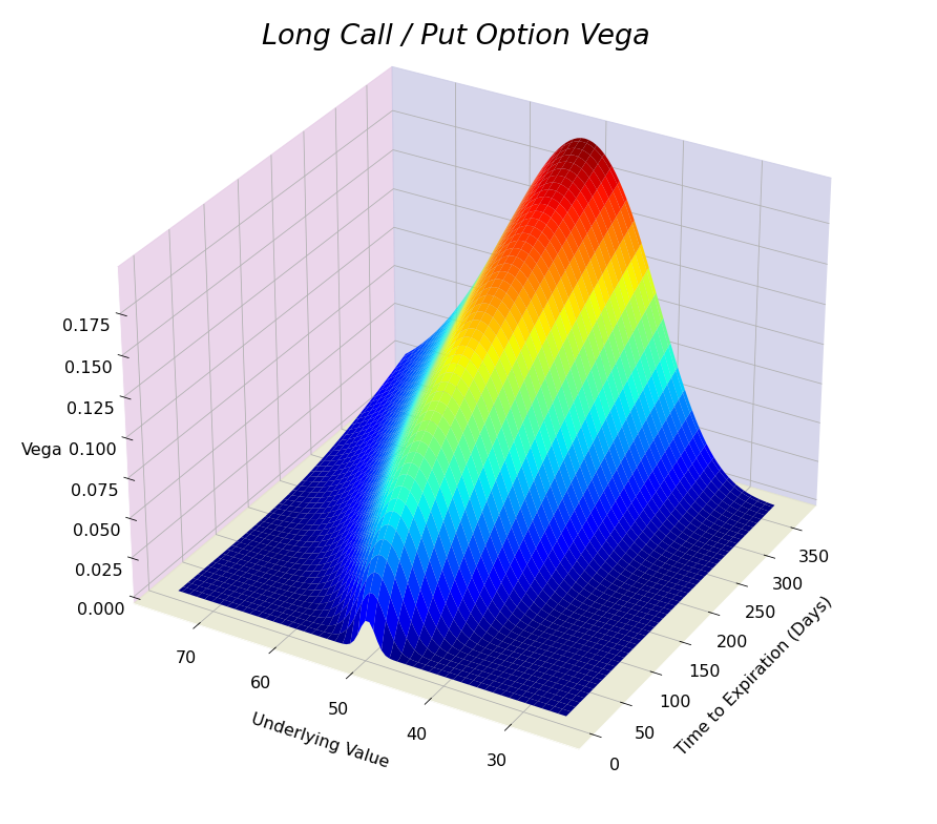

- Vega: sensitivity of option price to changes in volatility

- Theta: sensitivity of option price to changes in time to maturity

- Rho: sensitivity of option price to changes in the risk free rate

- Vomma: sensitivity of vega to changes in volatility; Volga

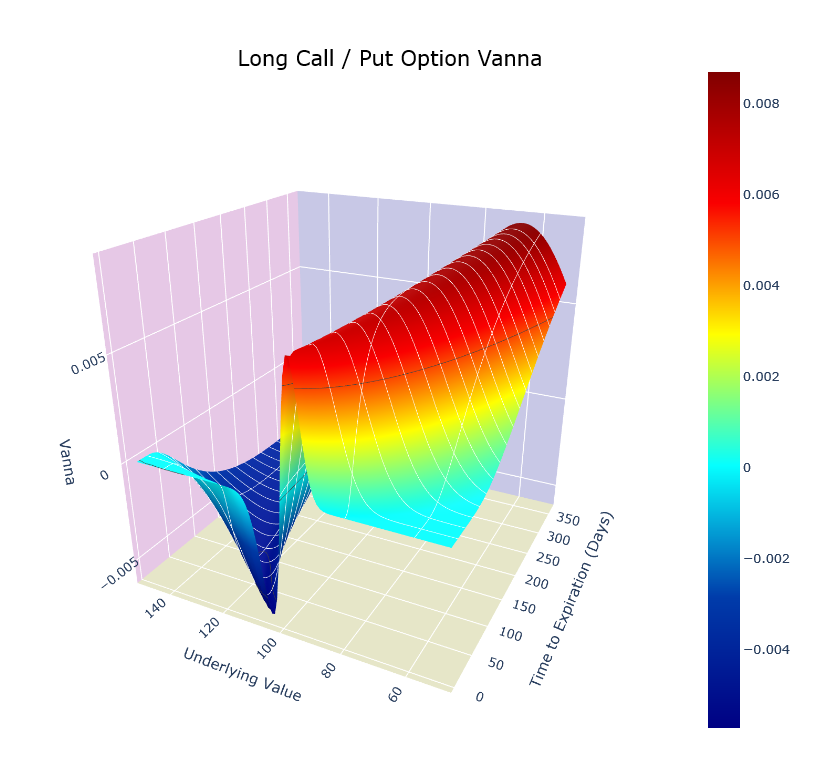

- Vanna: sensitivity of delta to changes in volatility / of vega to changes in asset price

- Charm: sensitivity of delta to changes in time to maturity aka Delta Bleed

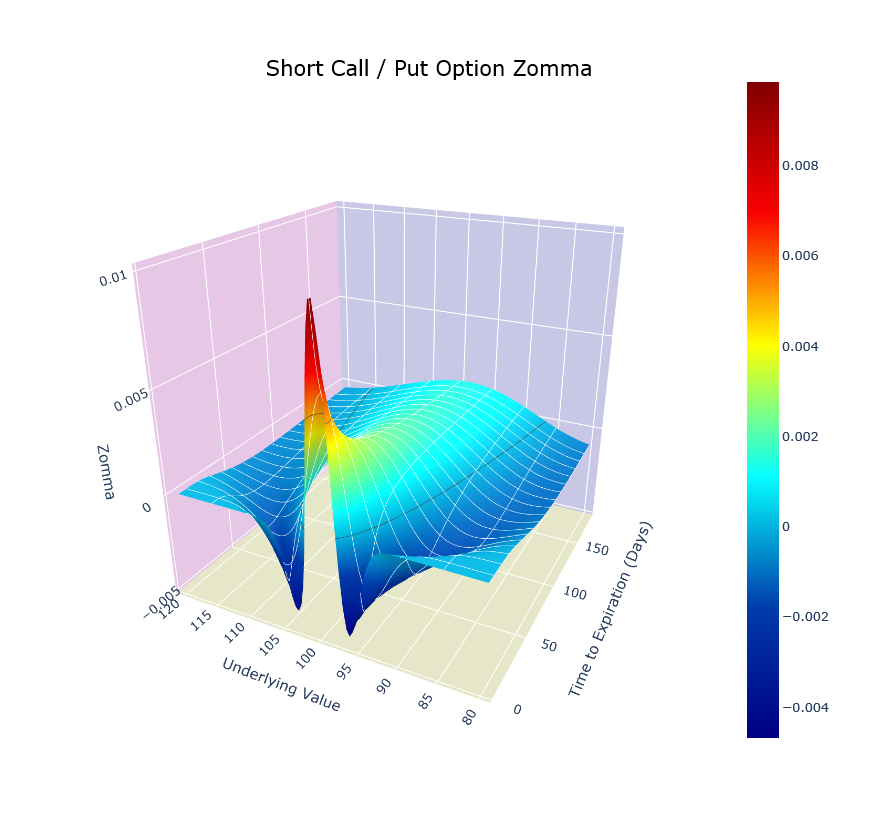

- Zomma: sensitivity of gamma to changes in volatility

- Speed: sensitivity of gamma to changes in asset price; 3rd derivative of option price wrt spot

- Color: sensitivity of gamma to changes in time to maturity; GammaTheta

- Ultima: sensitivity of vomma to changes in volatility; 3rd derivative of option price wrt volatility

- Vega Bleed: sensitivity of vega to changes in time to maturity

opt.option_data(option_value='price', S=3477, K=3400, T=0.5, r=0.005, q=0, sigma=0.3, option='put')

opt.sensitivities(greek='delta', S=3477, K=3400, T=0.5, r=0.005, q=0, sigma=0.3, option='put')

- option value

- delta

- gamma

- vega

- theta

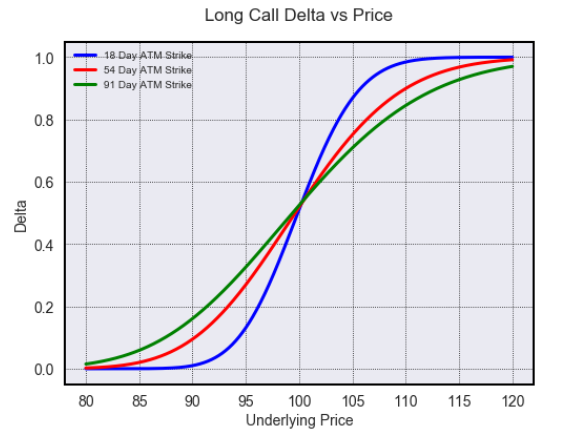

opt.visualize(risk=True, x_plot='price', y_plot='delta', G1=100, G2=100, G3=100, T1=0.05, T2=0.15, T3=0.25)

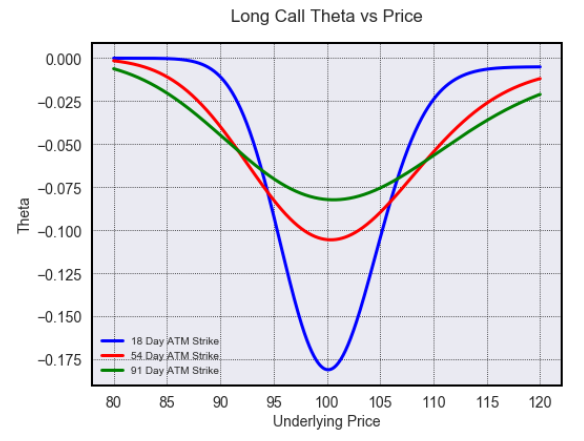

opt.visualize(risk=True, x_plot='price', y_plot='theta', G1=100, G2=100, G3=100, T1=0.05, T2=0.15, T3=0.25)

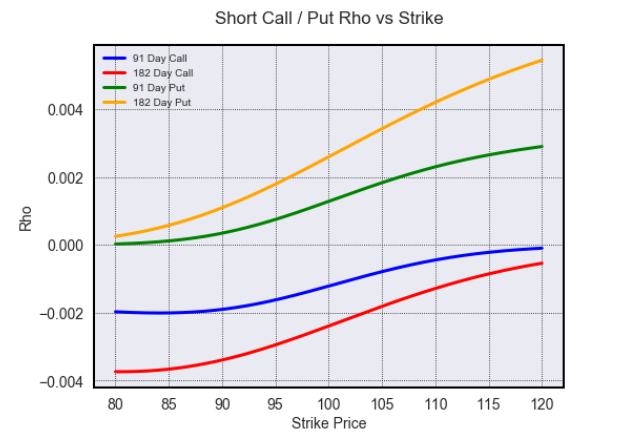

opt.visualize(risk=True, x_plot='strike', y_plot='rho', direction='short')

opt.animated_gif(graphtype='2D', x_plot='price', y_plot='vega', direction='long', T=1, gif_folder='images/greeks_2d', gif_filename='price_vega_l')

opt.visualize(risk=True, graphtype='3D', greek='vega', S=50)

opt.visualize(risk=True, graphtype='3D', greek='gamma', direction='short')

opt.visualize(risk=True, graphtype='3D', greek='price', colorscheme='Plasma', interactive=True)

opt.visualize(risk=True, graphtype='3D', greek='price', axis='vol', option='put', interactive=True)

opt.visualize(risk=True, graphtype='3D', greek='vanna', sigma=0.4, interactive=True)

opt.visualize(risk=True, graphtype='3D', greek='zomma', direction='short', interactive=True)

opt.animated_gif(graphtype='3D', greek='gamma', direction='short', gif_folder='images/greeks_3d',gif_filename='gamma_s', gif_min_dist=9.0, gif_max_dist=9.1, gif_min_elev=25, gif_max_elev=26, spacegrain=1000, colorscheme='seismic')

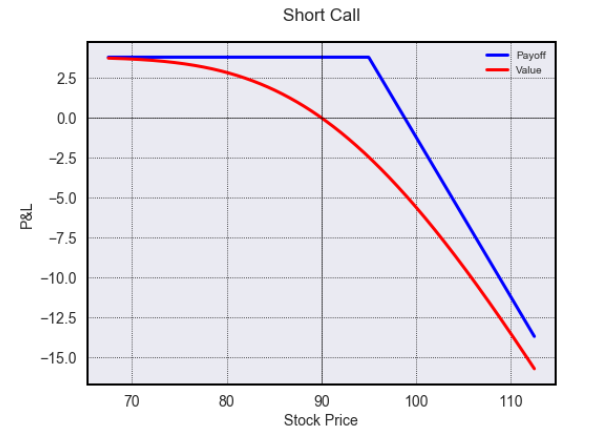

- call / put

- stock

- forward

- collar

- call / put spread

- backspread

- ratio vertical spread

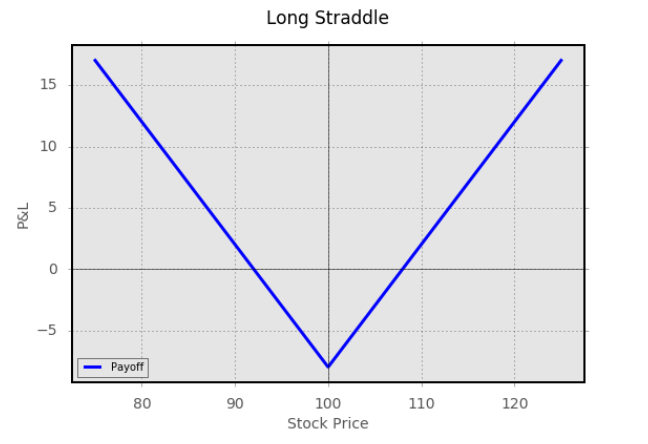

- straddle

- strangle

- butterfly

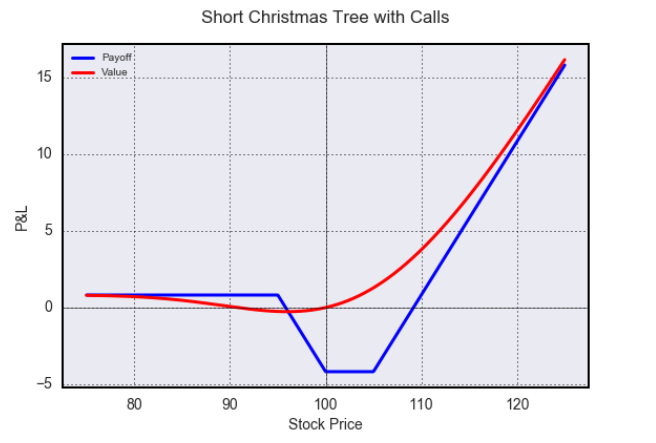

- christmas tree

- iron butterfly

- iron condor

opt.visualize(risk=False, payoff_type='call', S=90, K=95, T=0.75, r=0.05, q=0, sigma=0.3, direction='short', value=True)

opt.visualize(risk=False, payoff_type='straddle', mpl_style='ggplot')

opt.visualize(risk=False, payoff_type='christmas tree', value=True, direction='short')

The following volumes served as a reference for the formulas and charts: