As a private investor, the sheer amount of information that can be found on the internet is rather daunting. Trying to understand what type of companies or ETFs are available is incredibly challenging with there being millions of companies amd derivatives available on the market. Sure, the most traded companies and ETFs can quickly be found simply because they are known to the public (for example, Microsoft, Tesla, S&P500 ETF or an All-World ETF). However, what else is out there is often unknown.

This database tries to solve that. It features 180.000+ symbols containing Equities, ETFs, Funds, Indices, Futures, Options, Currencies, Cryptocurrencies and Money Markets. It therefore allows you to obtain a broad overview of sectors, industries, types of investments and much more.

The aim of this database is explicitly not to provide up-to-date fundamentals or stock data as those can be obtained with ease (with the help of this database) by using FundamentalAnalysis or yfinance. Instead, it gives insights into the products that exist in each country, industry and sector and gives the most essential information about each product. With this information, you can analyse specific areas of the financial world and/or find that product that is hard to find. See for examples on how you can combine this database and the earlier mentioned packages the section Examples.

Some key statistics of the database:

| Product | Quantity | Sectors | Industries | Countries | Exchanges |

|---|---|---|---|---|---|

| Equities | 84.091 | 16 | 262 | 109 | 79 |

| ETFs | 15.892 | 268* | 88* | 100** | 44 |

| Funds | 34.947 | 857* | 416* | 100** | 25 |

| Product | Quantity | Exchanges |

|---|---|---|

| Indices | 24.548 | 62 |

| Currencies | 2.529 | 2 |

| Cryptocurrencies | 3.624 | 1 |

| Options | 13.819 | 1 |

| Futures | 1.173 | 7 |

| Money Markets | 1.384 | 2 |

* These numbers refer to families (iShares, Vanguard) and categories (World Stock, Real Estate) respectively.

** This is an estimation. Obtaining the country distribution can only be done by collecting data on the underlying

or by manual search.

To access the database you can download the entire repository but I strongly recommend making use of the package closely attached to the database. It allows you to select specific json files as well as search through collected data with a specific query.

You can install the package with the following steps:

pip install FinanceDatabase- Alternatively, download the 'Searcher' directory.

- (within Python)

import FinanceDatabase as fd

The package has the following functions:

show_options(product)- gives all available options from the below functions per product (i.e. Equities, Funds) which then can be used to collect the data.select_cryptocurrencies(cryptocurrency=None)- with no input gives all cryptocurrencies, with input gives the cryptocurrency of choice.select_currencies(currency=None)- with no input gives all currencies, with input gives the currency of choice.select_etfs(category=None)- with no input gives all etfs, with input gives all etfs of a specific category.select_equities(country=None, sector=None, industry=None)- with no input gives all equities, with input gives all equities of a country, sector, industry or a combination of the three.select_funds(category=None)- with no input gives all funds, with input gives all funds of a specific category.def select_indices(market=None)- with no input gives all indices, with input gives all funds of a specific market which usually refers to indices in a specific country (like de_market gives DAX).select_other(product)- gives either all Futures, all Moneymarkets or all Options.search_products(database, query, new_database=None)- with input from the above functions, this function searching for specific values in the summary of the product (i.e. the query 'sustainable')

This section gives a few examples of the possibilities with this package. These are merely a few of the things you can do with the package and it only uses yfinance. As you can obtain a wide range of symbols, pretty much any package that requires symbols should work.

If I wish to obtain all companies within the United States listed under 'Airlines' I can write the following code:

import FinanceDatabase as fd

airlines_us = fd.select_equities(country='United States', industry='Airlines')

Then, I can use packages like yfinance to quickly collect data from Yahoo Finance for each symbol in the industry like this:

from yfinance.utils import get_json

from yfinance import download

airlines_us_fundamentals = {}

for symbol in airlines_us:

airlines_us_fundamentals[symbol] = get_json("https://finance.yahoo.com/quote/" + symbol)

airlines_us_stock_data = download(list(airlines_us))

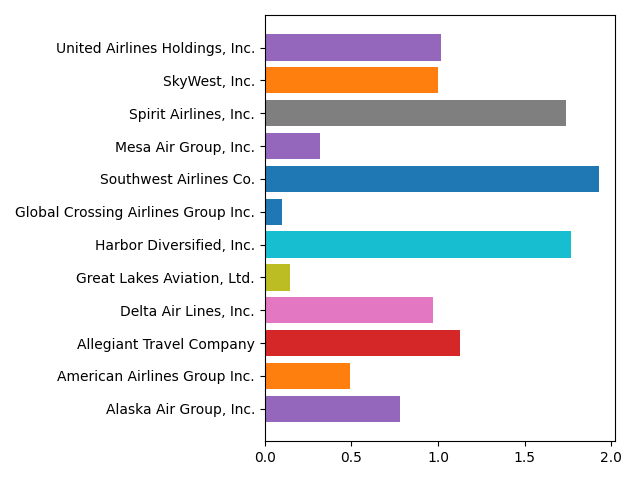

With a few lines of code, I have collected all data from a specific industry within the United States. From here on you can compare pretty much any key statistic, fundamental data and stock data. For example, let's plot a simple bar chart that gives insights in the Quick Ratios (indicator of the overall financial strength or weakness of a company):

import matplotlib.pyplot as plt

for symbol in airlines_us_fundamentals:

quick_ratio = airlines_us_fundamentals[symbol]['financialData']['quickRatio']

long_name = airlines_us_fundamentals[symbol]['quoteType']['longName']

if quick_ratio is None:

continue

plt.barh(long_name, quick_ratio)

plt.tight_layout()

plt.show()

Which results in the graph displayed below (as of the 3rd of February 2021). From this graph you could identify companies that currently lack enough assets to cover their liabilities (quick ratio < 1) and those that do have enough assets (quick ratio > 1). Both too low and too high could make you wonder whether the company adequately manages its assets.

If I wish to obtain all ETFs that have something to do with 'semiconductors' I can use the search function which works as follows:

import FinanceDatabase as fd

all_etfs = fd.select_etfs()

semiconductor_etfs = fd.search_products(all_etfs, 'semiconductor')

The variable semiconductor_etfs returns all etfs that have the word 'semiconductor' in their summary which usually also corresponds to the fact they are targeted around semiconductors. Next, I collect data:

semiconductor_etfs_fundamentals = {}

for symbol in semiconductor_etfs:

semiconductor_etfs_fundamentals[symbol] = get_json("https://finance.yahoo.com/quote/" + symbol)

And lastly, I have a look at the YTD returns (as of the 3rd of February 2021) of each ETF to understand which ones might be worthwile to invest in:

for symbol in semiconductor_etfs_fundamentals:

ytd_return = semiconductor_etfs_fundamentals[symbol]['fundPerformance']['trailingReturns']['ytd']

long_name = semiconductor_etfs_fundamentals[symbol]['quoteType']['longName']

if ytd_return is None:

continue

plt.barh(long_name, ytd_return)

plt.tight_layout()

plt.xticks([-1, -0.5, 0, 0.5, 1], ['-100%', '-50%', '0%', '50%', '100%'])

plt.show()

This results in the following graph which gives some insights in the available semiconductor ETFs. Then with the large amount of fundamentals data you can figure out how each ETF differs and what might be worthwile to invest in.

Projects are bound to have (small) errors and can always be improved. Therefore, I highly encourage you to submit issues and create pull requests to improve the package.

The last update to the database is the 3rd of February 2021. I do always accept Pull Requests every few months to keep the database up to date. Extending the amount of tickers and data is also much appreciated.