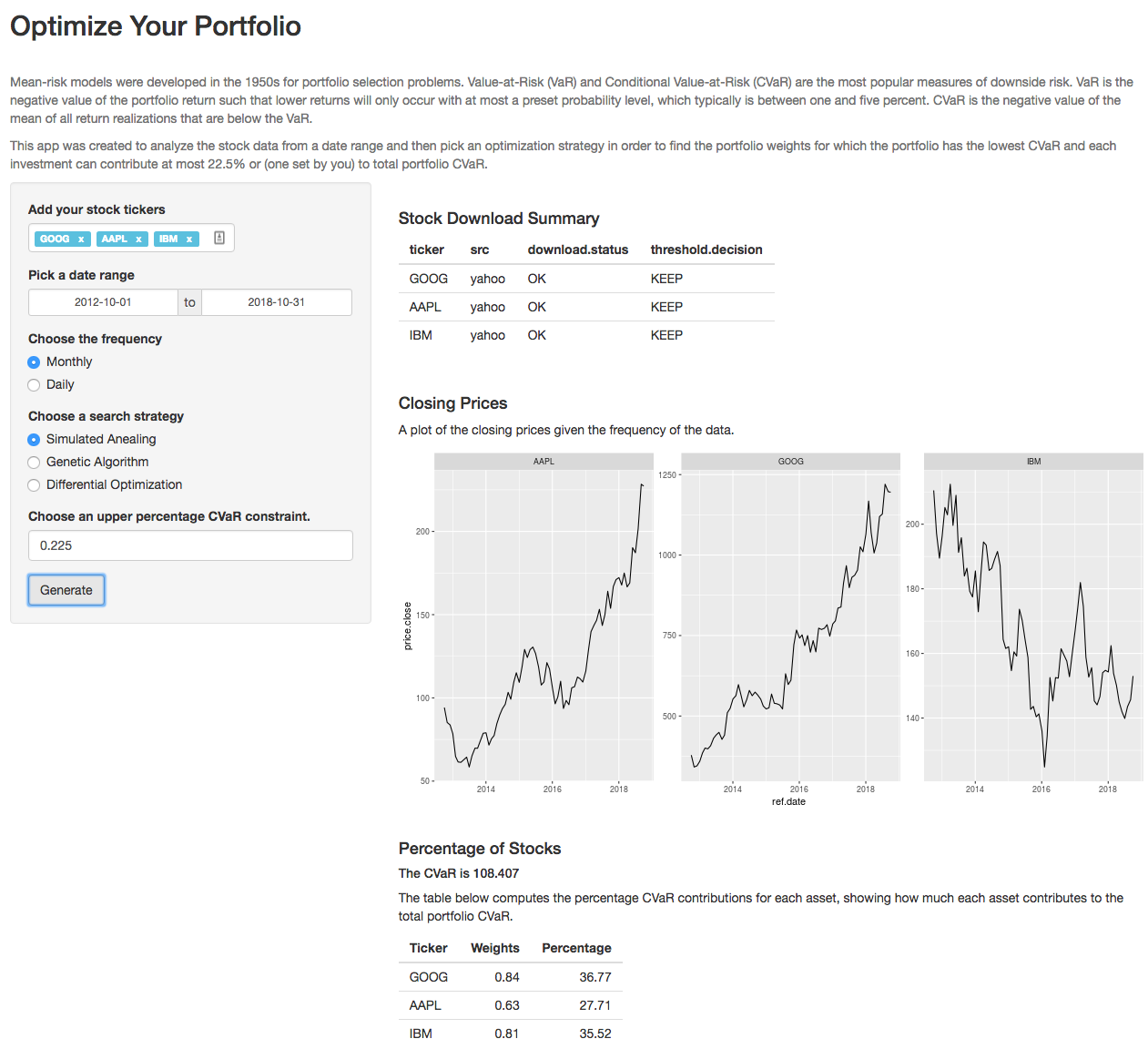

Mean-risk models were developed in the 1950s for portfolio selection problems. Value-at-Risk (VaR) and Conditional Value-at-Risk (CVaR) are the most popular measures of downside risk. VaR is the negative value of the portfolio return such that lower returns will only occur with at most a preset probability level, which typically is between one and five percent. CVaR is the negative value of the mean of all return realizations that are below the VaR.

This shiny app was created you to analyze the stock data from a date range and then pick an optimization strategy in order to find the portfolio weights for which the portfolio has the lowest CVaR and each investment can contribute at most 22.5% or (one set by you) to total portfolio CVaR.

The app can be accessed here