NOTE : Please check these Published API Docs to get examples and information of all test cases of the API endpoints.

- Django

- Django REST framework

- PostgreSQL

- Docker

- Docker Compose

- backend : The API endpoints folder with all settings and configuration.

- Dockerfile : Dockerfile to build the image for the backend APIs.

- requirements.txt : Requirements file with all the necessary dependencies required to run the project.

- docker-compose.yml : YAML file configure the back end, and the database service.

- user : App for user authentication and user roles and permissions.

- loan : App for the loan management of the users.

- User test cases present at tests

- Loan test cases present at tests

Pre-requites:

- python3.7 or greater

- docker version 20.10.x

- docker-compose version 1.29.x

Steps:

- Navigate to the directory with Dockerfile and use the following command:

docker build --force-rm -t backend:latest .

- Check your local docker image repository to see if the image has been built. Use command:

docker images

- Navigate to the folder with docker-compose.yml.

- To run migrations and set up the database, use commands:

docker-compose run --rm apis python manage.py makemigrations user

docker-compose run --rm apis python manage.py makemigrations loan

docker-compose run --rm apis python manage.py migrate

- To start the development server, use command:

docker-compose up --remove-orphans

- To shut the development serve, use command:

docker-compose down --remove-orphans

7. IMPORTANT: To test the backend with test cases, use command:

docker-compose run --rm apis python manage.py test

- Create the first admin user of the system using command:

docker-compose run --rm apis python manage.py createsuperuser

- There are 3 roles in the system - Customer, Agent, Admin.

- Admins are the highest role available in the system and they can access the admin panel at http://127.0.0.1:8000/admin/ to view all data.

- PBKDF2 algorithm with a SHA256 hash is used for hashing the password before storing it in the database.

- permissions.py is used to set permissions of the user.

- JWT is used to perform token authentication and the token is only valid for 2 hours after it's creation. This is to increase security of the system.

- After 2 hours, a new token needs to be requested from the server.

- Every API call is protected by permissions and authentication to ensure maximum safety.

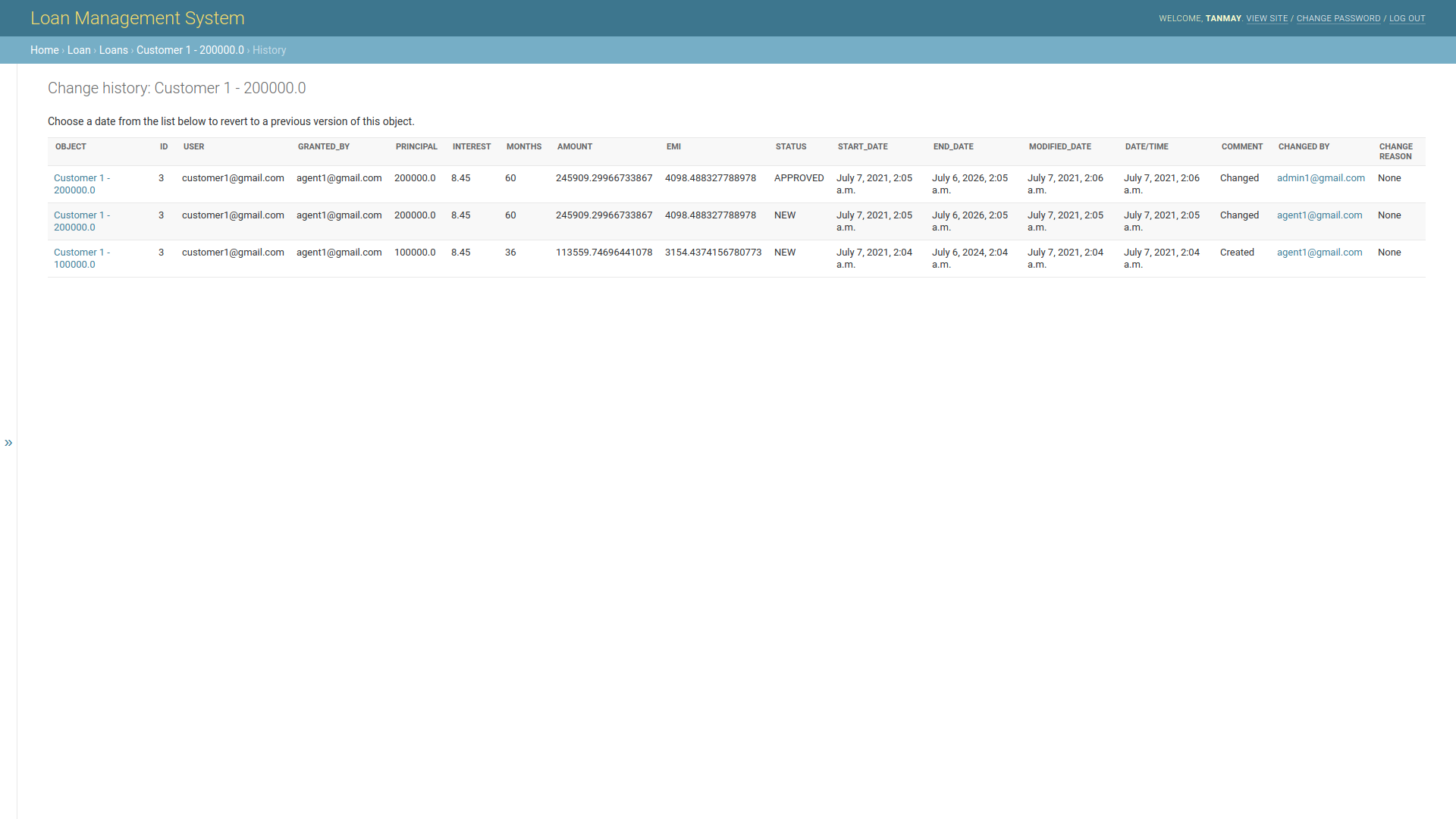

- History for "double safety" is being logged at every change made to a loan object. This can help us to rollback in extreme cases. Here is an example,

- Filter by loan type is present.

- Indian Standard Timezone is considered in the system and date handling is done accordingly.

- Base URL : http:127.0.0.1:8000/api

- User APIs:

- Signup: /user/signup/

- This endpoint can be used to sign up a user(customer or agent).

- Cannot signup if user already exists.

- Tokens have a validity of 2 hours only after which re-login is required.

- A user token is generated on successful registration.

- POST request has to be sent to this endpoint.

- Create Admin: /user/create-admin/

- This endpoint can be used by ADMINS ONLY to make more admin users.

- Authorization of admin level required to access this endpoint.

- POST request has to be sent to this endpoint.

- Login : /user/login/

- This endpoint can be used to log in by admin, agent or customer.

- Cannot log in agent if it is not approved by the admin.

- Admin and Customer can login using correct credentials directly.

- A user token is generated on successful login.

- Tokens have a validity of 2 hours only after which re-login is required.

- POST request has to be sent to this endpoint.

- Profile : /user/profile/

- This endpoint can display the user information depending on the authorization token present in the header.

- Authorization is required to access this endpoint.

- GET request has to be sent to this endpoint.

- List Users(Agent) : /user/list-agent/

- This endpoint can be used by AGENTS OR ADMINS to list the customers present in the system.

- Customer role cannot access this endpoint.

- Authorization required to access this endpoint.

- GET request has to be sent to this endpoint.

- List Users(Admin) : /user/list-approvals/

- This endpoint can be used by ADMINS only to list the customers and agents present in the system.

- Customer and Agent role cannot access this endpoint.

- Authorization required to access this endpoint.

- GET request has to be sent to this endpoint.

- Approve or Delete and Agent : /user/approve-delete/int:pk/

- This endpoint can be used by ADMINS only to list approve an agent to the system or delete one.

- Customer and Agent role cannot access this endpoint.

- Authorization required to access this endpoint.

- PUT request with int:pk i.e. agent ID as a URL parameter with is_approved status can be used to approve or reject an agent.

- DELETE request with int:pk i.e. agent ID as a URL parameter can be used to delete an agent.

- Signup: /user/signup/

- Loan APIs:

- Request Loan by Agent for Customer : /loan/customer-loan/

- This endpoint is for the agent to request a loan to the admin on behalf of a customer.

- Only Agent role can access this endpoint.

- Authorization required to access this endpoint.

- POST request has to be sent to this endpoint.

- Approve or Reject a loan by admin : /loan/approve-reject-loan/int:pk/

- This endpoint is for the ADMIN users only to accept or reject a loan request.

- Customer and Agent role cannot access this endpoint.

- Authorization required to access this endpoint.

- PUT request with int:pk i.e. loan ID as a URL parameter and status in the body can be used to approve or reject a loan.

- Edit Loan by agent : /loan/edit-loan/int:pk/

- This endpoint is for the AGENT role only to edit loan details for a user.

- Authorization required to access this endpoint.

- PUT request with int:pk i.e. loan ID as a URL parameter and new loan details in the body can be used to edit a loan.

- If loan is already approved, then edit is not allowed.

- List Loans of all customers to Admins and Agents : /loan/list-loans-admin-agent/

- This endpoint can be used by agents and admin users to list all loans in the system.

- Customer role cannot access this endpoint.

- Authorization required to access this endpoint.

- GET request has to be sent to this endpoint.

- Filters available:

- status?=NEW

- status?=APPROVED

- status?=REJECTED

- For example:

- For only one of the filters use: http://localhost:8000/api/loan/list-loans-admin-agent?status=APPROVED

- List Loans of a particular Customer : /loan/list-loans-customer/

- This endpoint can be used by customers to list their loans in the system.

- Authorization required to access this endpoint.

- GET request has to be sent to this endpoint.

- Filters available:

- status?=NEW

- status?=APPROVED

- status?=REJECTED

- For example:

- For only one of the filters use: http://localhost:8000/api/loan/list-loans-admin-agent?status=APPROVED

- Request Loan by Agent for Customer : /loan/customer-loan/