| title | output | ||||||

|---|---|---|---|---|---|---|---|

Homework 4 and 5 |

|

HOMEWORK 4 EXERCISE 2

a)

library(metRology)##

## Attaching package: 'metRology'

## The following objects are masked from 'package:base':

##

## cbind, rbind

library(e1071)

tGARCH= function(n,omega,alpha,beta,nu){

z=rt.scaled(n, nu, mean = 0, sd = 1)

y=rep(0,n)

sigma=rep(0,n)

sigma[1]=omega

y[1]=sqrt(omega)*z[1]

for(t in 2:n){

sigma[t]= omega+alpha*(y[t-1])^2+beta*sigma[t-1]

y[t]=sqrt(sigma[t])*z[t]

}

result=cbind(y,sigma)

}

d<-tGARCH(1000,0.05,0.1,0.85,4)b)

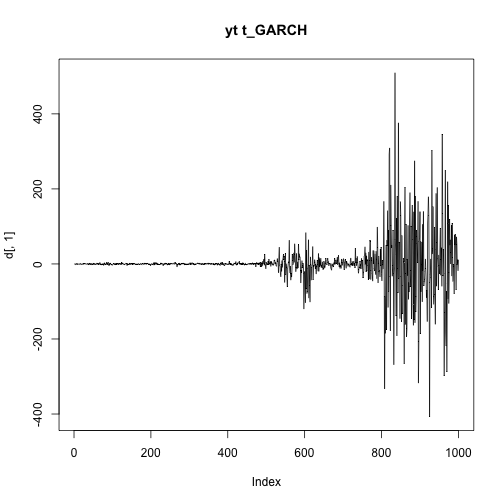

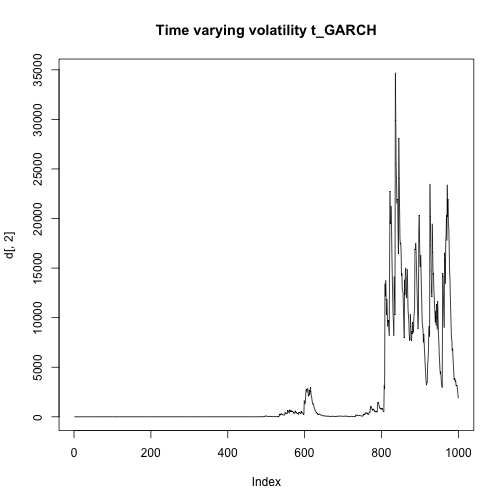

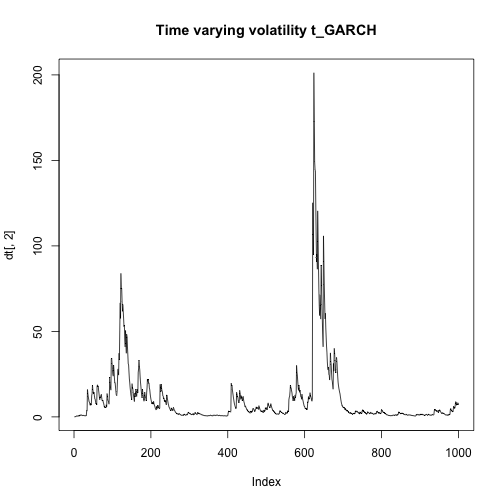

plot(d[,1],type="l",main="yt t_GARCH")plot(d[,2],type="l",main="Time varying volatility t_GARCH")c)

y<-d[,1]

mean(y)## [1] 0.1367977

var(y)## [1] 3666.289

skewness(y)## [1] 0.5439049

kurtosis(y)## [1] 16.06455

d)

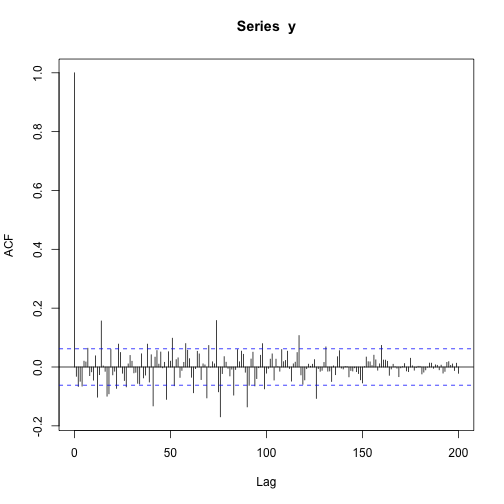

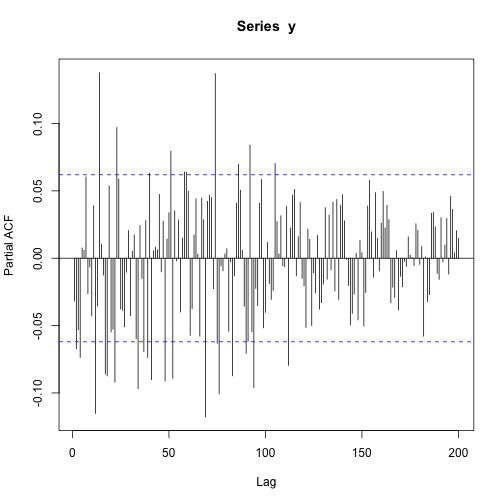

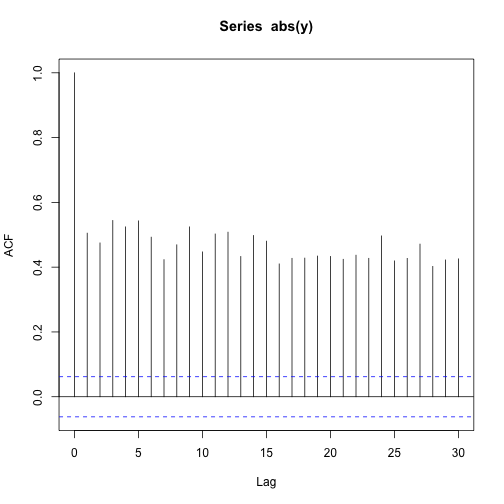

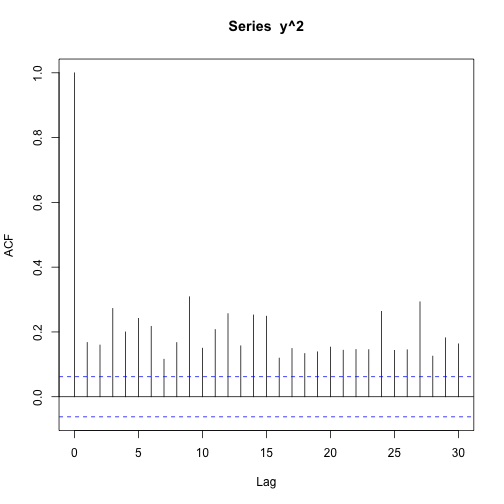

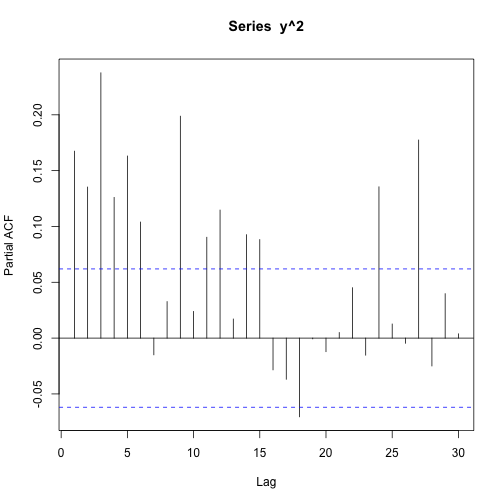

acf(y,200)pacf(y,200)acf(abs(y))acf(y^2)pacf(y^2)e)

gGARCH= function(n,omega,alpha,beta){

z=rnorm(n,mean=0,sd=1)

y=rep(0,n)

sigma=rep(0,n)

sigma[1]=omega

y[1]=sqrt(omega)*z[1]

for(t in 2:n){

sigma[t]= omega+alpha*(y[t-1])^2+beta*sigma[t-1]

y[t]=sqrt(sigma[t])*z[t]

}

result=cbind(y,sigma)

}

dt<-tGARCH(1000,0.05,0.1,0.85,4)

dg<-gGARCH(1000,0.05,0.1,0.85)

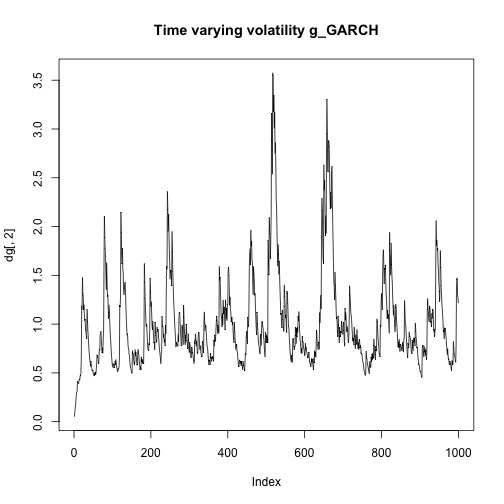

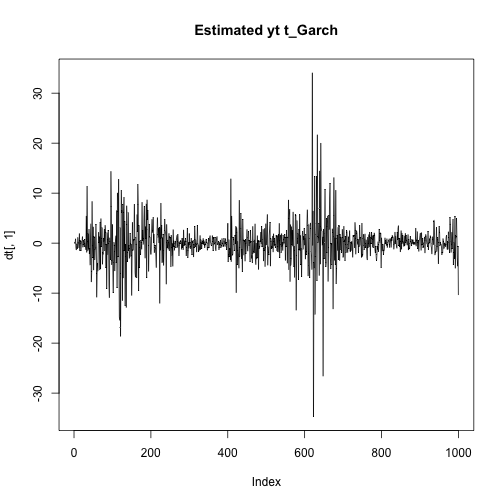

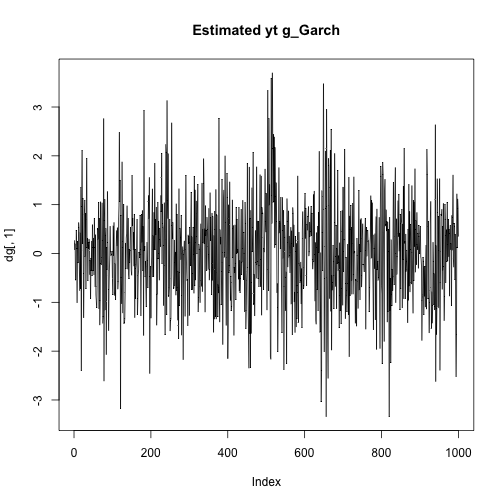

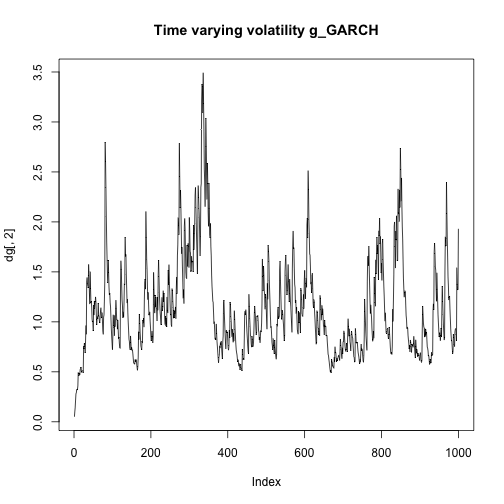

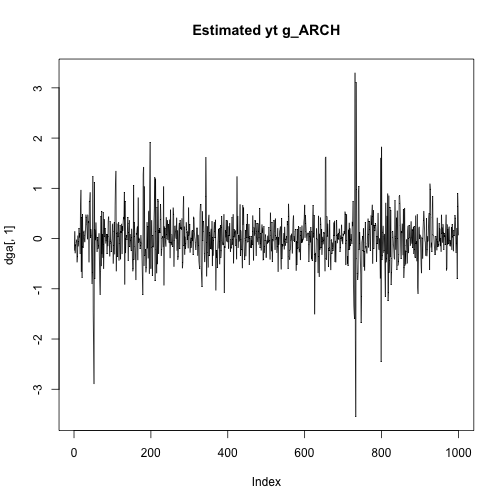

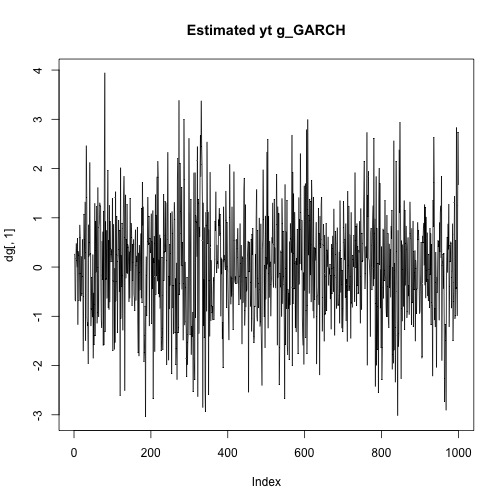

plot(dt[,2],type="l",main="Time varying volatility t_GARCH")plot(dg[,2],type="l",main="Time varying volatility g_GARCH")plot(dt[,1],type="l",main = "Estimated yt t_Garch")plot(dg[,1],type="l",main = "Estimated yt g_Garch")As we can see the estimated time varying volatility explodes in the case of the t_GARCH because it's very sensitive to outliers, overpredicting the real values. The same happens for the estimated values of yt

f)

gARCH= function(n,omega,alpha){

z=rnorm(n,mean=0,sd=1)

y=rep(0,n)

sigma=rep(0,n)

sigma[1]=omega

y[1]=sqrt(omega)*z[1]

for(t in 2:n){

sigma[t]= omega+alpha*(y[t-1])^2

y[t]=sqrt(sigma[t])*z[t]

}

result=cbind(y,sigma)

}

dg<-gGARCH(1000,0.05,0.1,0.85)

dga<-gARCH(1000,0.05,0.85)

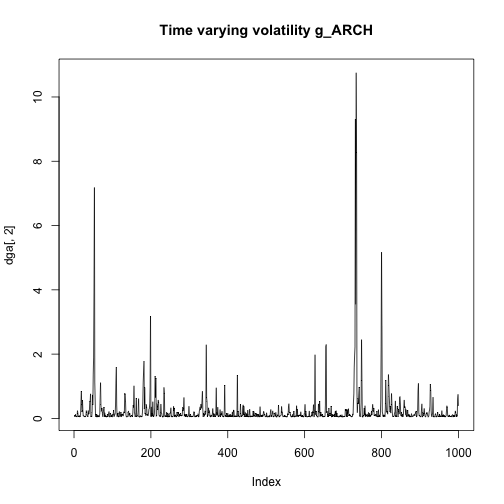

plot(dga[,2],type="l",main="Time varying volatility g_ARCH")plot(dg[,2],type="l",main="Time varying volatility g_GARCH")plot(dga[,1],type="l",main="Estimated yt g_ARCH")plot(dg[,1],type="l",main="Estimated yt g_GARCH")In this case we get more similar results, the estimated time varying volatility and yt don't seem to explode

HOMEWORK 5 EXERCISE 2

a)

tDCS=function(d,chi,k,nu,lamda,n){

mu=rep(0,n)

u=rep(0,n)

y=rt(n,nu)

v=rep(0,n)

mu[1]=d

for(t in 1:n){

v[t]=y[t]-mu[t]

u[t]=(v[t]/(1+(v[t]^2)/(nu*exp(2*lamda))))

mu[t+1]=d+ chi*mu[t]+ k*u[t]

}

result=list("y"=y,"u"=u,"mean"=mu,"v"=v)

return(result)

}

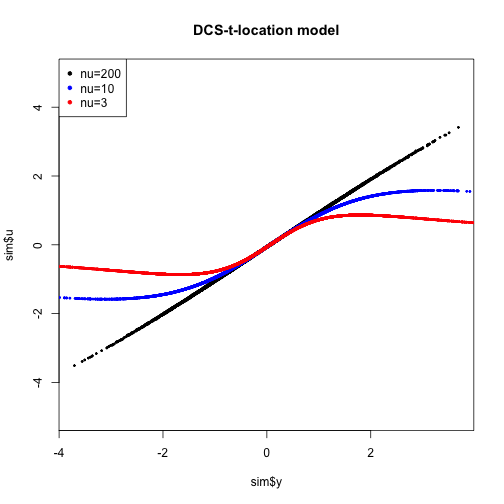

sim<-tDCS(0.05,0.2,0.01,200,0,10000)

plot(sim$y,sim$u,pch=20,ylim=c(-5,5),cex=0.5,col="black",main="DCS-t-location model")

sim<-tDCS(0.05,0.2,0.01,10,0,10000)

points(sim$y,sim$u,col="blue",pch=20,cex=0.5)

sim<-tDCS(0.05,0.2,0.01,3,0,10000)

points(sim$y,sim$u,col="red",pch=20,cex=0.5)

legend("topleft", pch=20,legend = c("nu=200","nu=10","nu=3"),col=c("black","blue","red"))As we can see for nu that goes to infinity ut=vt so it becomes linearly related to yt. When nu takes small values the outlier values of yt are in some sense downweighted in order to obtain robust estimates.

b)

beta_tGARCH=function(d,chi,k,nu,n){

z=rt.scaled(n, nu, mean = 0, sd = 1)

sigma=rep(0,n)

y=rep(0,n)

u=rep(0,n)

sigma[1]=d

for(t in 1:n){

sigma[t+1]=d+chi*sigma[t]+k*sigma[t]*u[t]

y[t]=sqrt(sigma[t])*z[t]

u[t]=(((nu+1)*y[t]^2)/((nu-2)*sigma[t]+y[t]^2))-1

}

result= list("y"=y,"u"=u)

return(result)

}

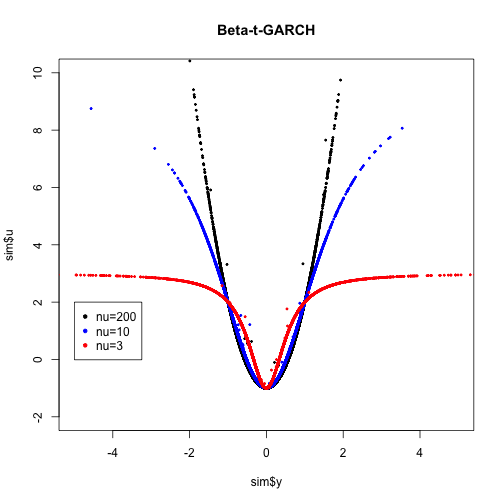

sim<-beta_tGARCH(0.05,0.85,0.01,200,10000)

plot(sim$y,sim$u,pch=20,cex=0.5,col="black",main="Beta-t-GARCH",ylim=c(-2,10),xlim=c(-5,5))

sim<-beta_tGARCH(0.05,0.85,0.01,10,10000)

points(sim$y,sim$u,col="blue",pch=20,cex=0.5)

sim<-beta_tGARCH(0.05,0.85,0.01,3,10000)

points(sim$y,sim$u,col="red",pch=20,cex=0.5)

legend(-5,2, pch=20,legend = c("nu=200","nu=10","nu=3"),col=c("black","blue","red"))As we can see also in this case the extreme values of yt are downweighted when the value of nu is small

beta_tEGARCH=function(d,chi,k,nu,n){

z=rt.scaled(n, nu, mean = 0, sd = 1)

lamda=rep(0,n)

y=rep(0,n)

u=rep(0,n)

lamda[1]=d

for(t in 1:n){

lamda[t+1]=d+chi*lamda[t]+k*u[t]

y[t]=exp(lamda[t])*z[t]

u[t]=(((nu+1)*y[t]^2)/(nu*exp(2*lamda[t])+y[t]^2))-1

}

result= list("y"=y,"u"=u)

return(result)

}

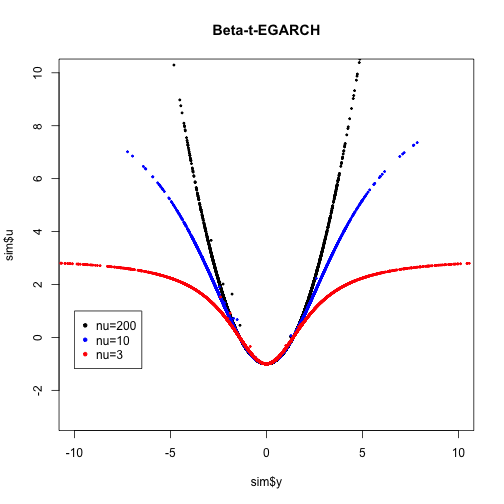

sim<-beta_tEGARCH(0.05,0.85,0.01,200,10000)

plot(sim$y,sim$u,pch=20,cex=0.5,col="black",main="Beta-t-EGARCH",ylim=c(-3,10),xlim=c(-10,10))

sim<-beta_tEGARCH(0.05,0.85,0.01,10,10000)

points(sim$y,sim$u,col="blue",pch=20,cex=0.5)

sim<-beta_tEGARCH(0.05,0.85,0.01,3,10000)

points(sim$y,sim$u,col="red",pch=20,cex=0.5)

legend(-10,1, pch=20,legend = c("nu=200","nu=10","nu=3"),col=c("black","blue","red"))We get very similar results in comparison with Beta-t-GARCH, but in this case the curves seem to be tighter

EXERCISE 3

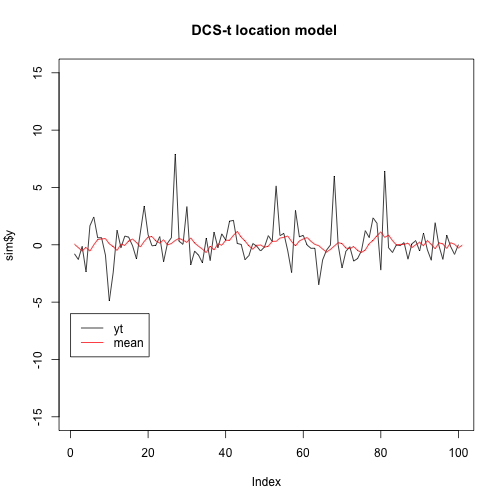

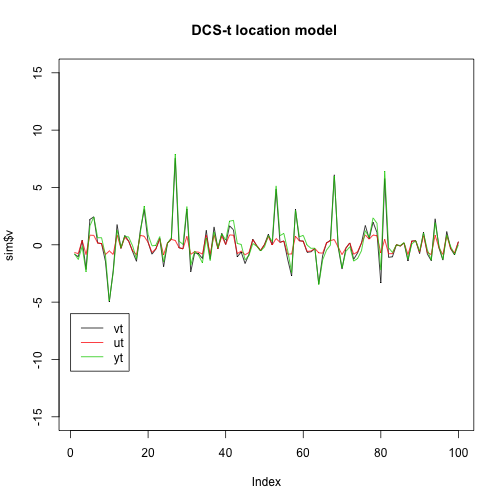

set.seed(123)

sim<-tDCS(0.05,0.85,0.5,3,0,100)

plot(sim$y,type="l",ylim=c(-15,15),main = "DCS-t location model ")

lines(sim$mean,col="red")

legend(0,-6,legend=c("yt","mean"),col=c("black","red",3),lty=1)The value of the the time varying mean at time t depends on information at time t-1, for this reason on the graph it appears to be shifted ahead by 1 lag

plot(sim$v,type = "l",ylim=c(-15,15), main="DCS-t location model ")

lines(sim$u,type = "l",col="red")

lines(sim$y,type="l",col=3)

legend(0,-6,legend=c("vt","ut","yt"),col=c("black","red",3),lty=1) As we can see ut seems to be more robust against the shocks of yt compared to vt

As we can see ut seems to be more robust against the shocks of yt compared to vt

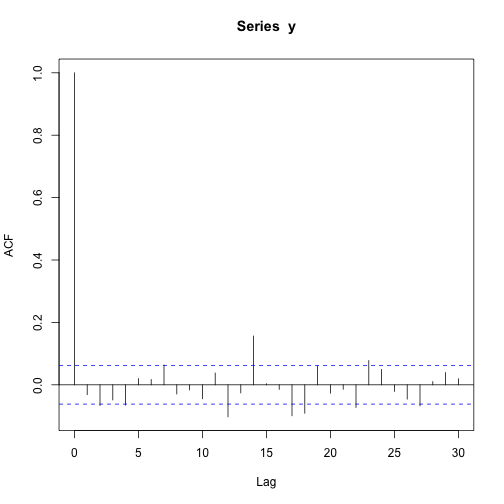

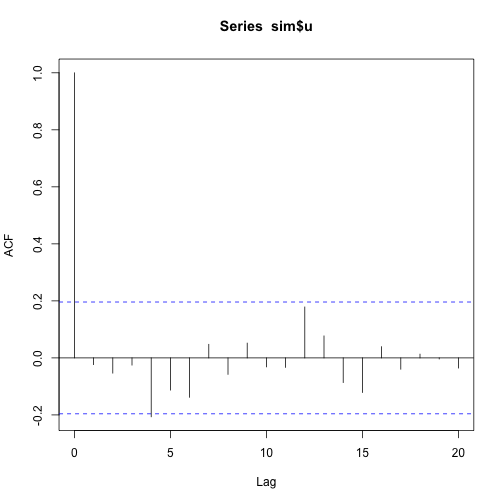

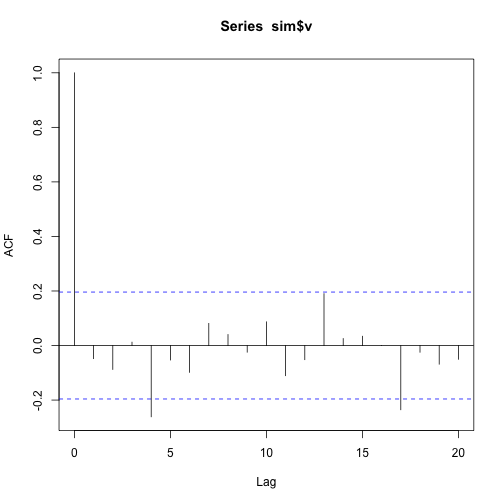

acf(y)acf(sim$u)acf(sim$v)As we can see the autocorrelation function never seems to be significative