Credit risk is an inherently unbalanced classification problem, as good loans easily outnumber risky loans. Therefore, I employed different techniques to train and evaluate models with unbalanced classes. I used imbalanced-learn and scikit-learn libraries to build and evaluate models using resampling to predict credit risk.

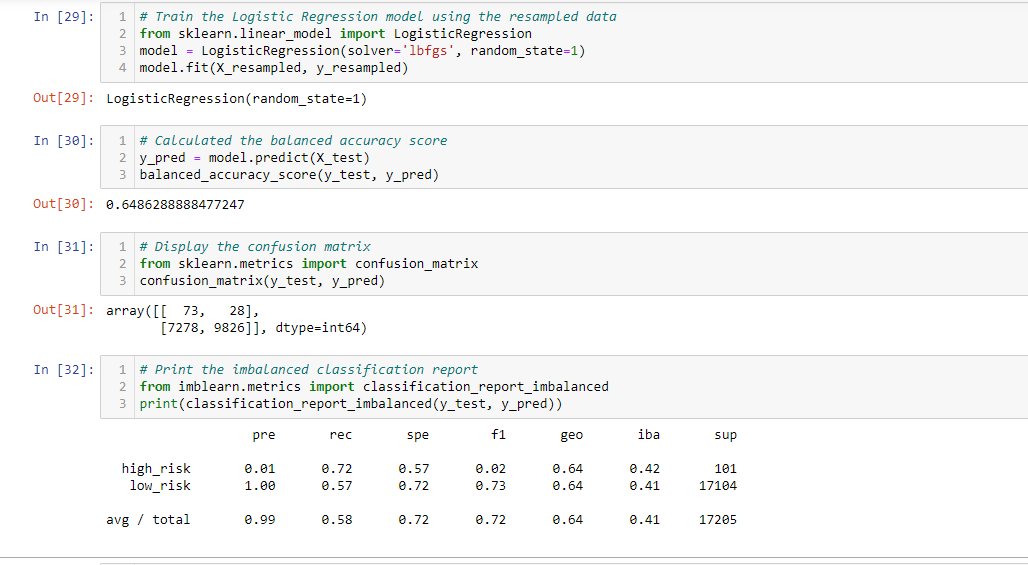

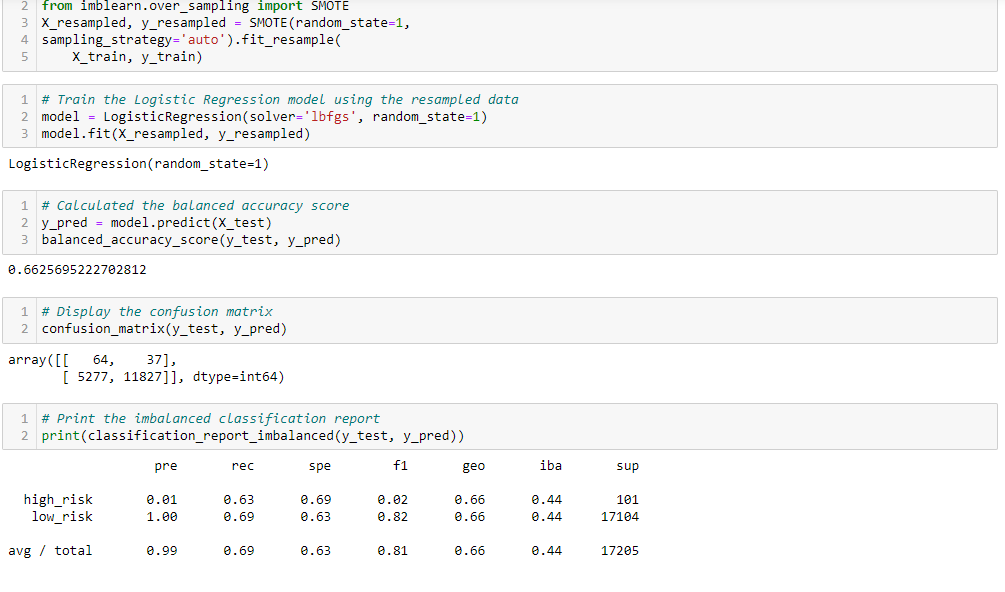

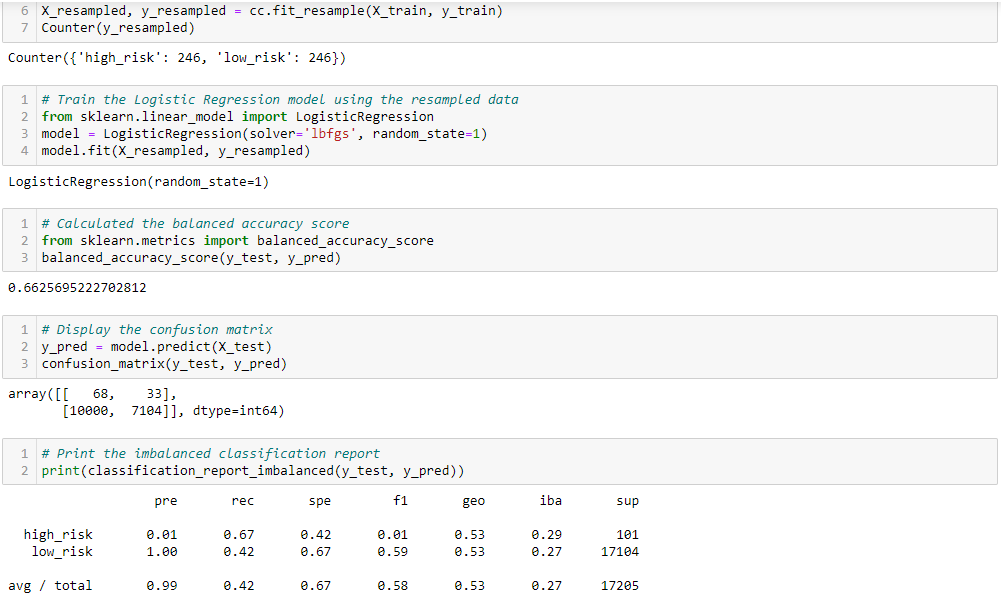

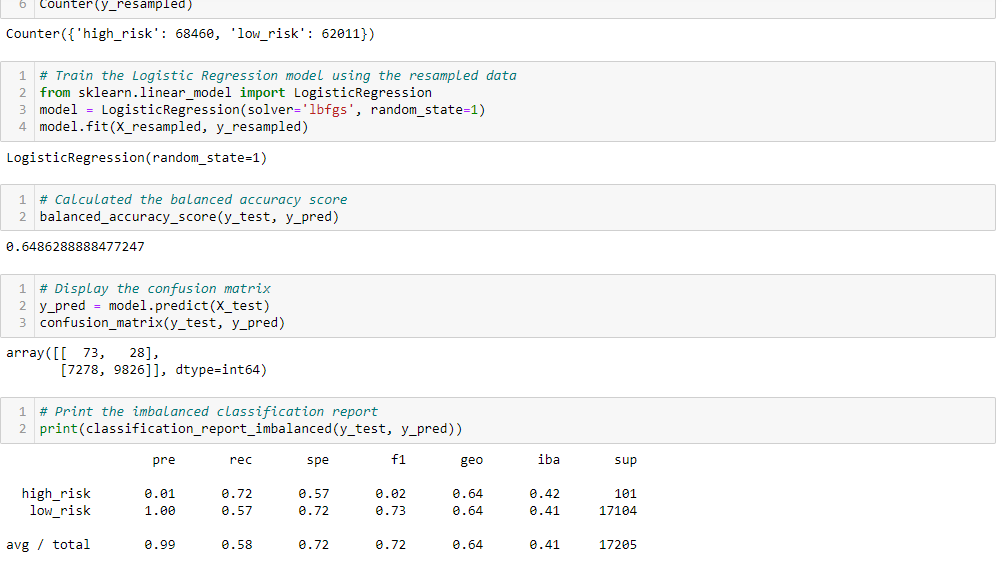

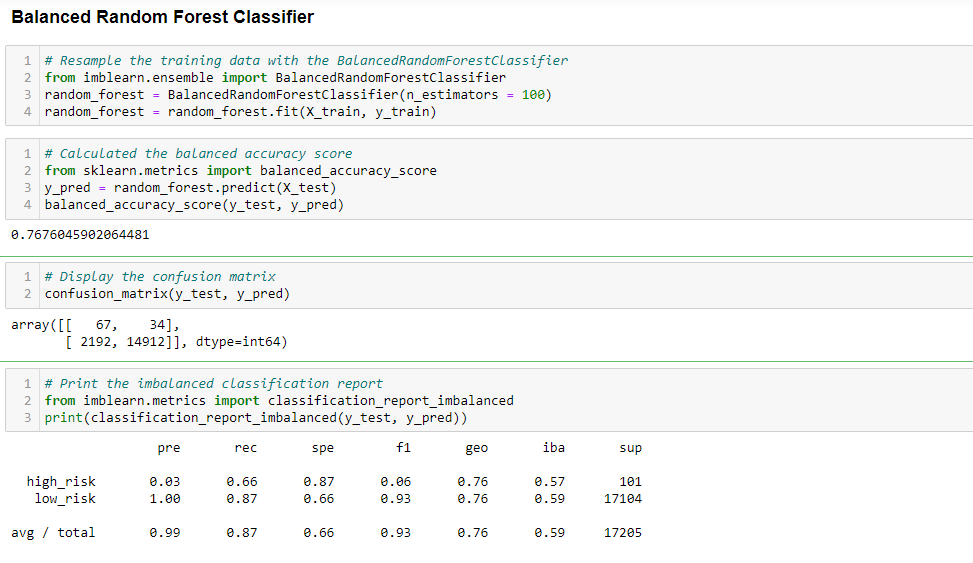

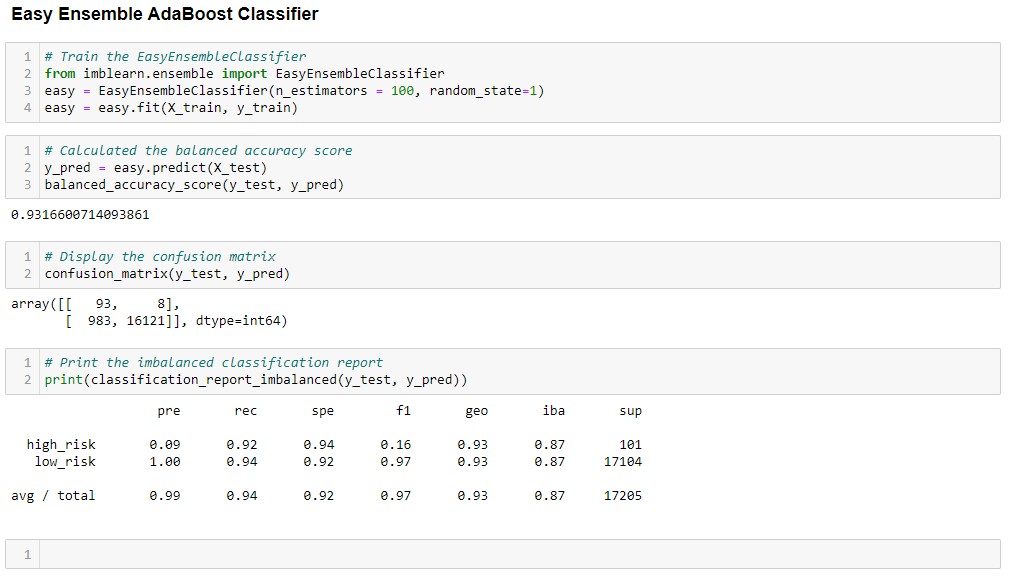

Using a CSV credit card credit dataset from LendingClub, a peer-to-peer lending services company, I oversampled the credit card data using the RandomOverSampler and SMOTE algorithms, and undersampled the data using the ClusterCentroids algorithm. Then, I used a combinatorial approach of over- and undersampling using the SMOTEENN algorithm. Next, I compared two new machine learning models that reduce bias, BalancedRandomForestClassifier and EasyEnsembleClassifier, to predict credit risk.

The purpose of this analysis is to determine if any of the six models provide a reliable credit risk predicitve tool using the provided dataset from LendingClub. I will also provide a recommendation concerning one or more of the model's performance. That is, what percentage does it accuractely predict? Each of the models reported an accuracy score and confusion matrix array with four quadrants. The columns of each array represent the predicted high and predicted low risks. The rows of each array represent the actual high and actual low risks.

In the first four models I undersampled, oversampled and did a combination of both to determine which model is best at predicting which loans are the highest risk. The next two models resampled the data using ensemble classifiers to try and predict which which loans are high or low risk. In the first four models the accuracy score is not as high as the ensemble classifiers and the recall in the oversampling/undersampling/mixed models is low as well. It appears that the Easy Ensemble had the best balance of all the models because of it's higher accuracy score and balance of precision and recall scores.

All models show poor results, except the Easy Ensemble AdaBoost Classifier which shows promise. Of the six models the Easy Ensemble provided the best predictive analysis of the dataset with metrics at 93% or above. However, the metrics are not indicative of a reliable statistical tool returning at least 99.5% predictive reliability. For that reason, I would strongly recommend improving the LogisticRegression model by finding an additional solver not used in this analysis to reliably predict credit risk.