The purpose of this project was to implement a Dynamic Delta Hedging strategy for European Options in C++. Delta Hedging is a great strategy for trying to create a neutral portfolio to minimize risk exposure.

To run this program, you need to have a C++11 compiler installed as well as the boost and quantlib libraries.

Folder Structure:

- /bin: compiled executable files

- /data: input data files for Part II

- /doc: documentation files

- /include: .h header files

- /results: output csv files

- /src: .cpp files

- makefile: makefile to compile and run the programs

Before compiling and running the program, you should make sure that the paths in "makefile" reflect the ones in your machine. If you are using a Mac, these are the commands to compile and run the program:

make (compile main file)

make run (run main file)

make compile_test (compile unit test)

make run_test (run compiled unit test)

For this project, I implemented 3 main classes:

- option: this is a generic option class

- black_scholes: this class inherits the option class and adds functionality specific to the black scholes model

- stock: this class was implemented to generate stock prices using the following formula:

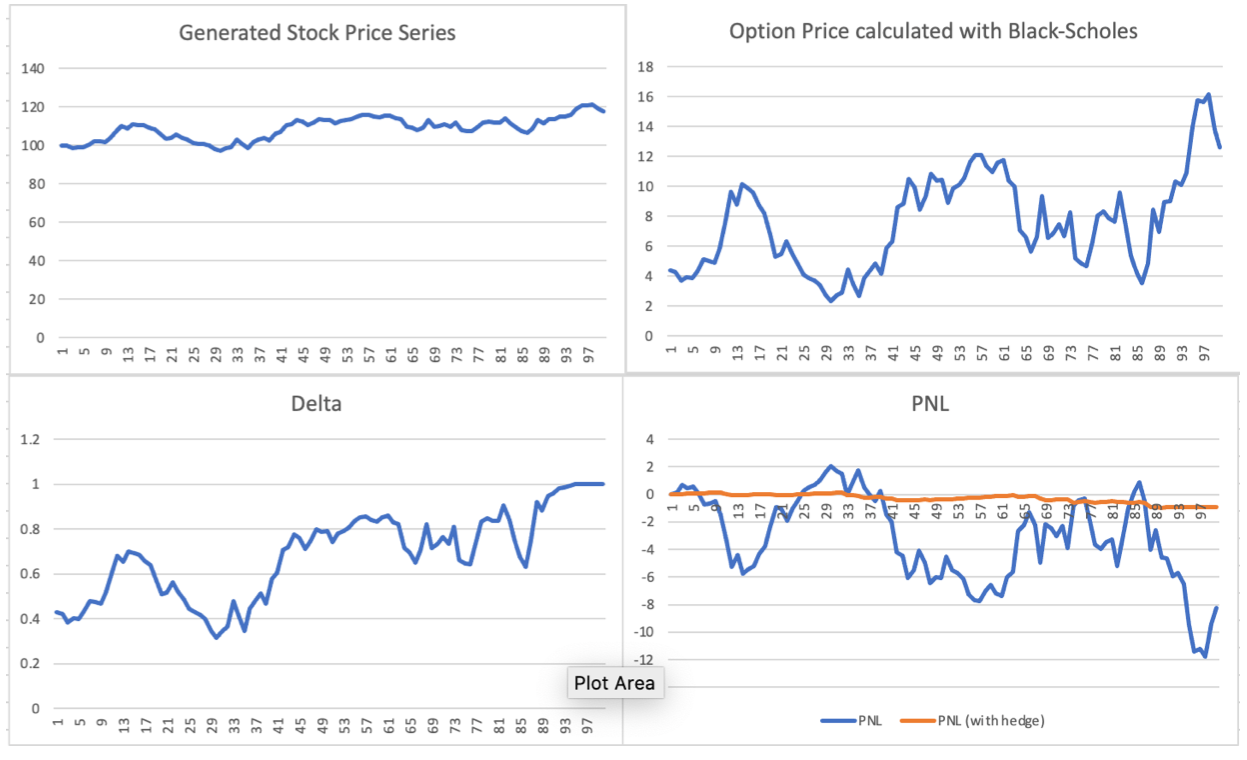

- For Part I of the project, I implemented the hedging strategy 1000 different times. The outputs can be found in the results folder. Here are the plots for one of those strategies:

- The output for Part II is also in the results folder.