Command Line-based ATM application designed to facilitate digital financial transactions, without the need for any direct interactions with banking staff. A demo of our application is available here.

- Peter Febrianto Afandy

- Pang Zi Jian Adrian

- Muhammad Nur Dinie Bin Aziz

- Tng Jian Rong

- Ryan Lai Wei Shao

- System Design

- Features

- UML Design

- Project Components

- Getting Started

- Program Usage

- Database Design

- Financial Data

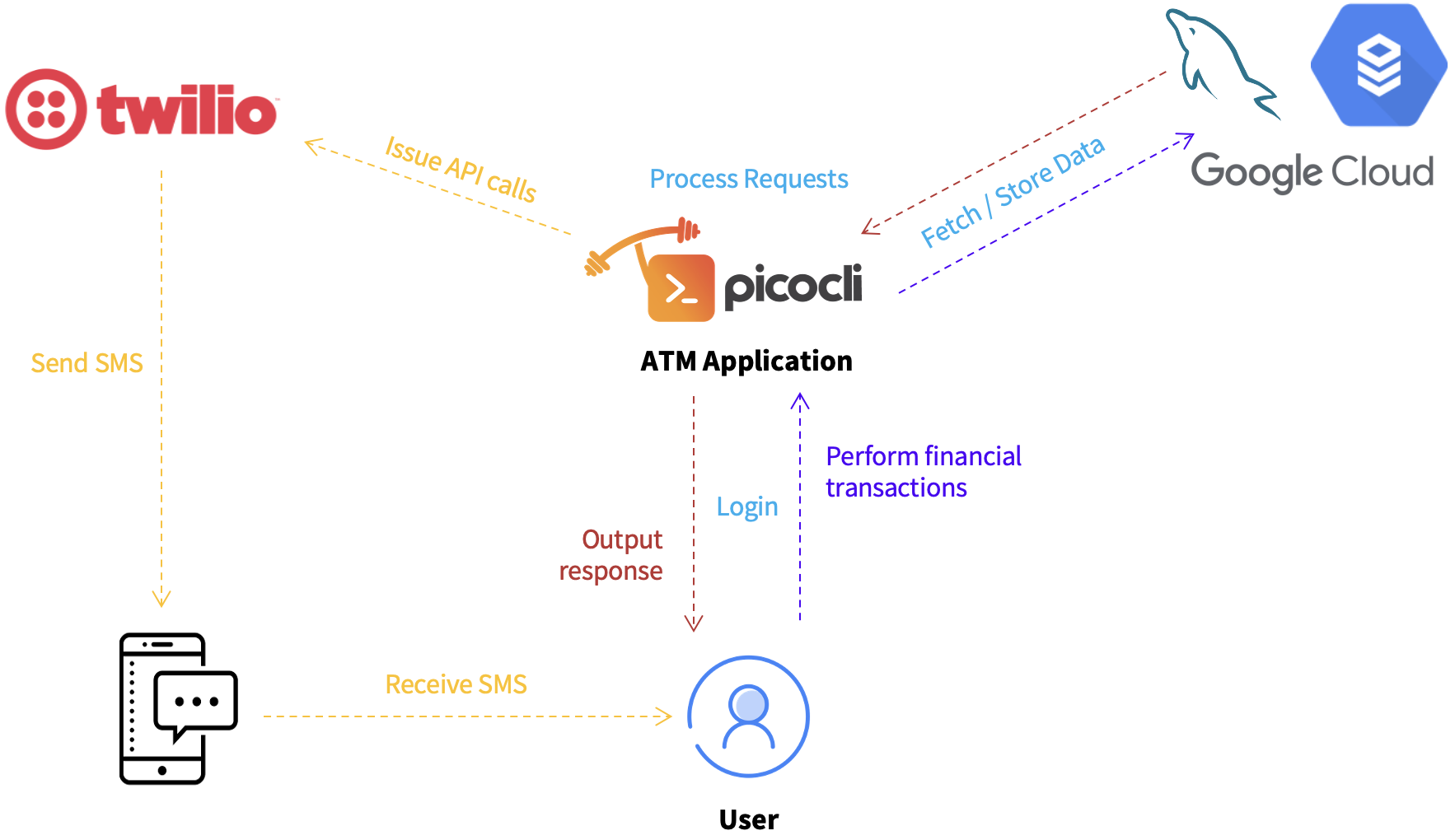

This application consists of two main components:

- Database (GCP Cloud server)

- ATM Application

Database

A MySQL database hosted on the cloud through the Google Cloud Platform is used to store all user and financial transaction data for this application. Should the cloud server be unavailable, the application also supports the use of a local MySQL database, which requires additional configurations. For more information on the database design and how the financial data has been integrated, click here.

ATM Application

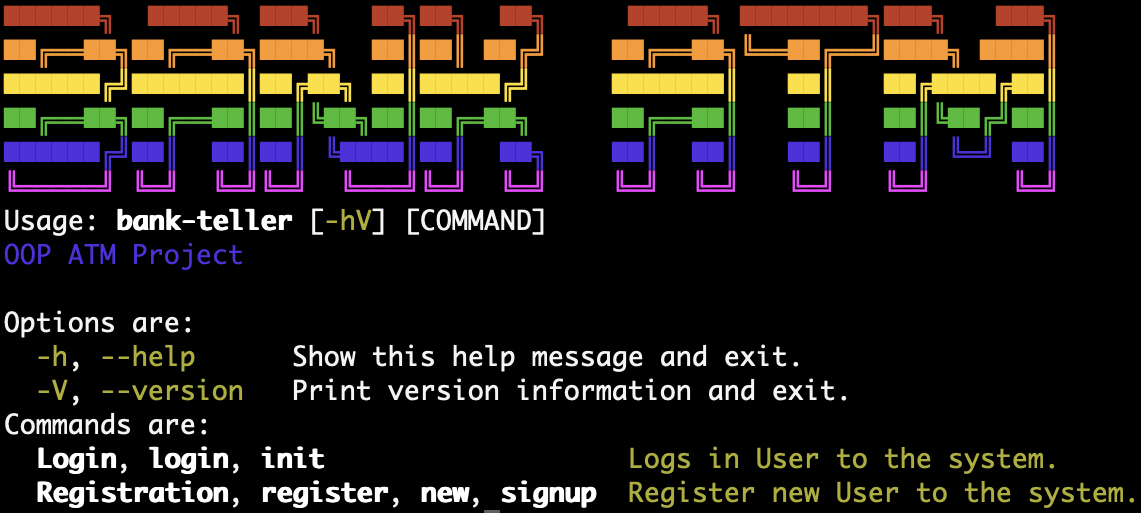

The main ATM application is packaged into a single Java ARchive (JAR) file, which compiles all project dependencies and components, for ease of execution. Various libraries are used in the application, such as picocli for the main command line interface, and Twilio, which enables 2-Factor Authentication through SMS messages.

Various fundamental features have been implemented in this application to support its base operations. These include Create, Read, Update, Delete (CRUD) operations on the bank user, and their associated accounts. For deletion related operations, deletion will not effect in the actual deletion of data from the system. Like real-world banking applications, the data that is selected for deletion will be kept for record-keeping purposes. Deletion in this application would essentially only update the respective associated status (ie account status set to disabled).

User Operations

- User login

- User authentication

- New user registration

- User deactivation

- Reset of password

- Updating of user details

Account Operations

- Account creation

- Account deactivation

- Account information inquiry (account details, current balance)

- Cash withdrawal

- Cash deposit

- Fund transfer

- Inter-account Transfer

- Third-party Transfer

- Setting account transfer limit

- Setting account withdrawal limit

- View transactions

- View cheques received

Database

A MySQL database was designed to store the user, financial transaction and other ATM information. An in-depth explanation of the database design is provided in this section.

Twilio API

The Java API provided by Twilio was used in this application in the implementation of user 2-Factor Authentication, through SMS text messages.

Beautified Colored Command Line Interface

To improve the user experience and make the application visually appealing for use, picocli was implemented to provide a colorful user interface, delivered on the command line.

Password Hashing and Encryption

To improve the cybersecurity aspects of this application, the SHA256 hashing algorithm was used to hash user passwords, together with a randomised given salt value. Additionally, AES256 encryption was utilised on top of the hashed password to further improve its confidentiality.

This application utilises the following UML architecture:

Upon completion of development, the overall UML architecture is:

Upon completion of development, the overall UML architecture is:

README.md (this file)

credentials.md (file containing a list of user credentials)

CSC1109-ATM.jar (executable application)

ATM/ (contains application's source code)

database/ (contains database and dataset programs)

docs/ (contains documentation images)

presentation/ (contains presentation slides)

There are three main components/folders for this project:

- JAR file

- An executable platform-independent Java ARchive file is provided to ease the deployment and execution of this application.

- ATM

- Contains all the relevant program source code, and dependencies required.

- Database

- Contains programs used to process the given dataset, as well SQL files to set up the database.

- Download all required files and folders for this project.

- Ensure that you have

java(minimally Java 17) installed on your machine. Click here for installation instructions if they are not already installed.

This project utilises a Cloud MySQL database that have already been pre-configured for use. You can skip this section if you don't plan on setting up a local database again from scratch.

Follow the instructions below to setup a local database for the application:

- Ensure that you have installed MySQL on your machine. For installation instructions, click here.

- On a terminal, run the following command to import the pre-configured database:

mysql -u<username> -p < database/sql/DatabaseFullMockData_Setup30March2023.sql - Modify the

settings.configconfiguration file inATM/to connect to the local database instead of the cloud database. The following changes are required:DB_HOST=localhost DB_PORT=3306 DB_NAME=OOP_ATM (Generally unchanged, unless your schema has a different name) DB_USER=username DB_PASSWORD=password

- Run the ATM application using the following command on a terminal:

*Ensure that you are in the same working directory as the program files (same directory asATM/)java -jar --enable-preview CSC1109-ATM.jar <option> Available options: Show all available options: -h, --help Login to ATM: Login, login, init Register as a new user: register, new, signup, Registration - Start banking with us! You can use any user account provided in the

credentials.mdfile to test the ATM application.

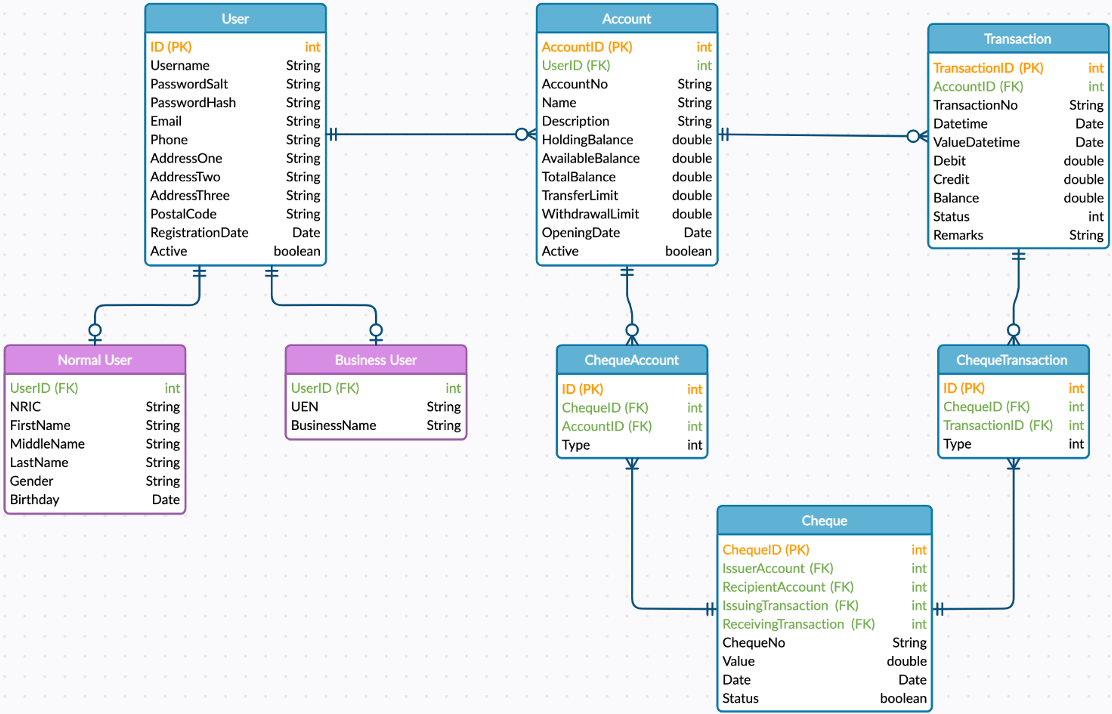

Due to the connected nature of financial data in the provided bank.xlsx dataset, a normalised relational database was designed to facilitate the storage and use of such data. The database is designed to be scalable, and to maintain minimal data replication. Each data table has an extra column which is used as its primary key within the database. The rationale for using an extra column for identifying each row of data is due to the use of custom formats for data such as Account Number, Cheque Number and Transaction Number.

The database is designed to support different status for financial transactions to emulate real-life applications. For example, the Transaction table has a Status column that is used to indicate whether a transaction has been successfully executed, pending or failed/rejected. This status column is used in particular to mitigate fraudulent transactions, which is present in the dataset provided (more details are covered here).

Additionally, the database also supports real-world usecases, such as pending transactions through the inclusion of various balances for a bank user's account. In this case, three separate balances are maintained for each account, HoldingBalance, which is used to indicate earmarked funds or pending incoming funds, AvailableBalance, which is used to indicate the actual balance available for use after deduction of the holding balance, and TotalBalance. These balances coupled with the status of financial transactions will enable the application to function and meet the needs of real-world usecases.

Similarly, tables associated with cheques have varying statuses to indicate whether a cheque has been cleared, and to indicate the type of account and transaction involved (ie issuing account or receiving account, and issuing transaction or receiving transaction).

However, for this application, these extra columns and data are not used directly, as there are ambiguities in terms of their usage, especially since this project is just in the form of a Proof-of-Concept. There are no easy way of verifying whether a cheque has been cleared, whether a transaction is fraudulent or not and whether a transaction has been released and deemed successful. In the real-world, there are separate systems built for these purposes alone, and varying factors are involved (ie company only charge pending transactions on a certain date). Hence, whilst the database have been specifically designed to support real-life applications, these design choices may not be directly used and implemented in this application.

The database consists of nine tables, each consisting of the following data columns:

- User

UserID(database identifier)- Username

- PasswordSalt

- PasswordHash

- Phone

- AddressOne

- AddressTwo

- AddressThree

- Postal code

- RegistrationDate

- UserType

1: Normal User2: Business User

- Active

1: Active0: Deactivated / Disabled

- NormalUser

- UserID

- NRIC

- FirstName

- MiddleName

- LastName

- Gender

- Birthday

- BusinessUser

- UserID

- UEN

- BusinessName

- Account

AccountID(database identifier)- AccountNo

- Name

- Description

- HoldingBalance

- AvailableBalance

- TotalBalance

- TransferLimit

- WithdrawalLimit

- OpeningDate

- Active

1: Active0: Deactivated / Disabled

- Transaction

TransactionID(database identifier)- AccountID

- ID of account that the transaction is associated with

- TransactionNo

- Datetime

- Transaction date (date at which a transaction is initiated/requested)

- ValueDatetime

- Value date refers to the effective date of a transaction (ie for cheques, it is the date that funds are released from the payer (to the bank) to the payee)

- Debit

- Credit

- Balance

- Account’s available balance after the transaction

- Status

-1: Failed / Blocked0: Pending1: Successful

- Remarks

- Cheque

ChequeID(database identifier)- ChequeNo

- IssuerAccount

- Account that issued the cheque

- RecipientAccount

- Account that will receive the funds released from the cheque

- IssuingTransaction

- Associated transaction for the outflow of money from issuer account

- ReceivingTransaction

- Associated transaction for the Inflow of money to recipient account

- Value

- Date

- Status

- Whether cheque has been successfully cleared (outflow from issuer, inflow to recipient accounts)

-1: Failed / Blocked0: Pending1: Successful

- ChequeTransaction

- Mapping of Transactions with Cheques

- ID

- ChequeID

- TransactionID

- Type

- 0: Issuing Transaction

- 1: Receiving Transaction

- ChequeAccount

- Mapping of Accounts with Cheques

- ChequeID

- AccountID

- Type

- 0: Issuing Account

- 1: Receiving Account

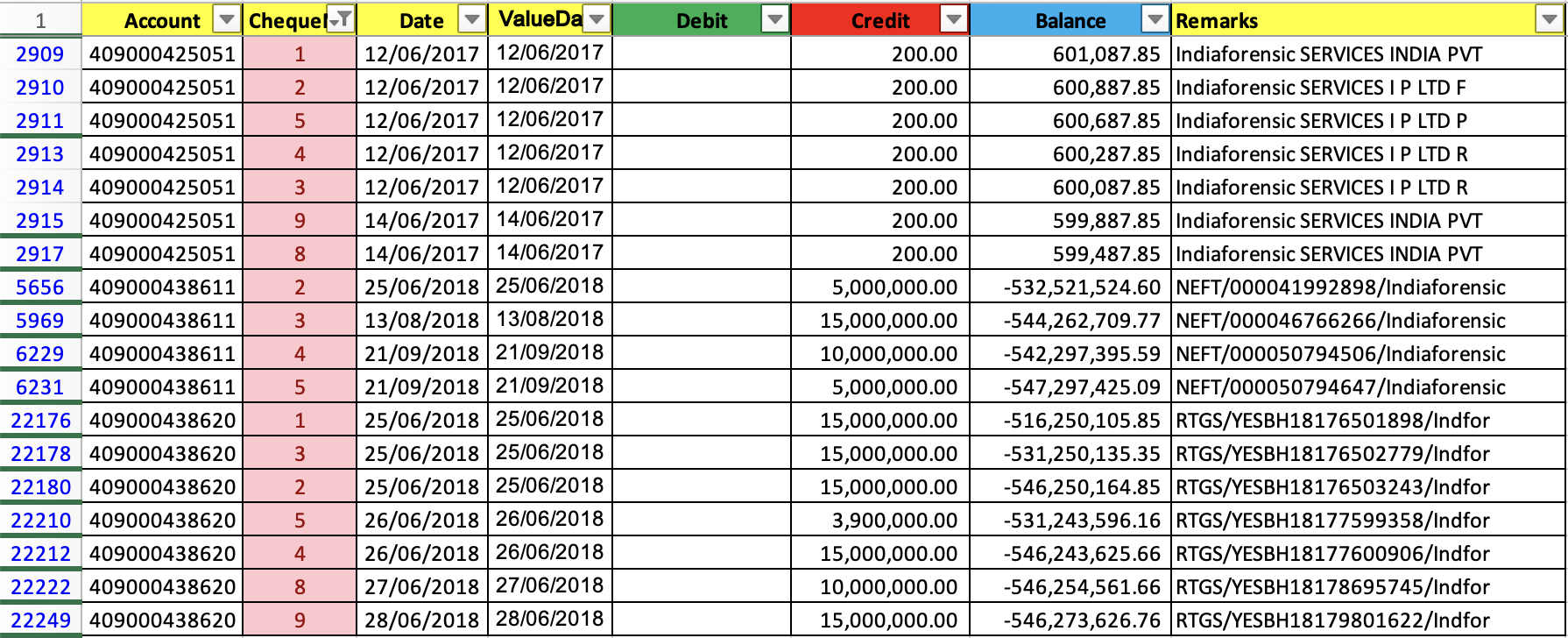

To facilitate and emulate its operations, the bank.xlsx dataset included in the project's specifications has been integrated into the application's database. Due to the raw and unclear formatting of the dataset, a series of data pre-processing and transformations was applied to clean the data in order to integrate it into the database designed. Before cleaning and integrating the data, preliminary data analysis was performed to understand the data.

Additionally, to ease the use of the dataset, the following assumptions were taken:

- Transactions provided in the dataset are assumed to be correct and effected successfully (no concerns over negative balances)

- To avoid ambiguity in edge cases (ie when an account has negative balance but is still able to withdraw money (could be a loan provided by the bank))

- Transactions are assumed to be executed in sequential order if they have the same date due to the absence of transaction time (ie transactions from the same date but further down are assumed to have been processed after earlier transactions from the same date higher up the file)

- Workaround due to absence of

timein Date column

- Workaround due to absence of

- All accounts are assumed to be from the same bank branch (account number formatting)

- Added branch code

409to the front of the following account numbers (with zero-padding):1196711→4090011967111196428→409001196428

- Added branch code

The following set of data cleaning was performed on each column of the bank.xlsx dataset provided:

- TransactionNo (New Column)

-

New column based on row index

-

Standardised format:

<8 digit no>-<transaction month>-<transaction year>- 8 Digit Number

- Incremental

- Zero-padded

- Transaction Month

MM

- Transaction Year

YYYY

- Transaction month and year are based on the

dateof transaction, which was previously namedvalueDate - Length: 16

- Example:

12345678-02-2023

- Example:

- 8 Digit Number

-

- Account No (

Account)-

Renamed to

Account -

Remove trailing

' -

Standardised format

<branch code><accountNo>- Branch Code

- First 3 digits of account number

- Account No

- Next 9 digits

- Zero-padded

- Length: 12

- Example:

409001196711

- Example:

- Added branch code

409to the front of the following account numbers (with zero-padding):1196711→4090011967111196428→409001196428

- Branch Code

-

- CHQ.NO. (

ChequeNo)- Renamed to

ChequeNo - Standardised format:

<6 digit no>:month & year:<accountNo>- 6 digit no

- Incremental

- Zero-padded

- Month & Year

MMYYYY- Based on

Date(date cheque was effected)

- Based on

- Account No

- Length: 26

- Example:

873790:022023:409001196711

- Example:

- By utilising the specified format, duplicate cheque numbers within the dataset are separated into unique values

- 6 digit no

- Renamed to

- VALUE DATE (

Date)- Renamed to

Date- Transaction date (date at which a transaction is initiated/requested)

- Format date

- Renamed to

- DATE (

ValueDate)- Renamed to

ValueDate- Value date refers to the effective date of a transaction (ie for cheques, it is the date that funds are released from the payer (to the bank) to the payee)

- Also known as Settlement Date

- Format date

- Renamed to

- DEPOSIT AMT (

Debit)- Renamed to

Debit- Debit refers to inflow of money into an account

- Renamed to

- WITHDRAWAL AMT (

Credit)- Renamed to

Credit- Credit refers to outflow of money from an account

- There are withdrawals for cents (eg. $0.01, $20.98), not possible for ATM

- Might be bank transfers or some deductions, not through ATM (assumed to be correct)

- Renamed to

- Status (New)

- New column to check whether the transaction is successful or not

- Values

-1: Failed / Blocked0: Pending1: Successful

- BALANCE AMT (

Balance)- Renamed to

Balance - Recalculate balances

- Assumptions

- Transactions are processed sequentially from the top-down. It is assumed that transactions with a lower index are effected earlier.

- It is assumed that all transactions are approved by the bank and successful

- To avoid ambiguity in edge cases such as when an account has negative balance but is still being able to withdraw money (could be a loan provided by the bank)

- Assumptions

- Renamed to

- TRANSACTION DETAILS (

Remarks)- Renamed to

Remarks - Convert values into general values (ie 6.13e+11)

- Renamed to

- . (

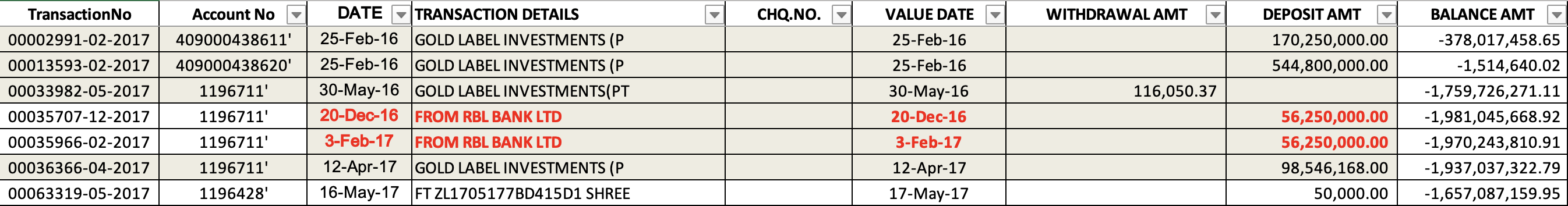

Removed) Apart from these data processing on the dataset's columns, duplicate row entries were removed. Anomaly data were also dealt with separately, together with the following flagged transactions which were eventually deemed to be fraudulent transactions (status set to-1, rejected):

- Record

63342(TransactionNo:00063319-05-2017)- Value date is earlier than requested date

- Date: 17/05/2017

- Value Date: 16/05/2017

- Resolved by swapping both values

- Date: 16/05/2017

- Value Date: 17/05/2017

- Value date is earlier than requested date

- Transaction that have been flagged out (highlighted cells and cells with red text)

-

Transactions are assumed to be flagged out as potentially fraudulent transactions

- Deposits from RBL Bank Ltd

- Deposits from and withdrawals to Gold Label Investments

-

Resolution: Transaction are not processed, status set to

0

-

- Record