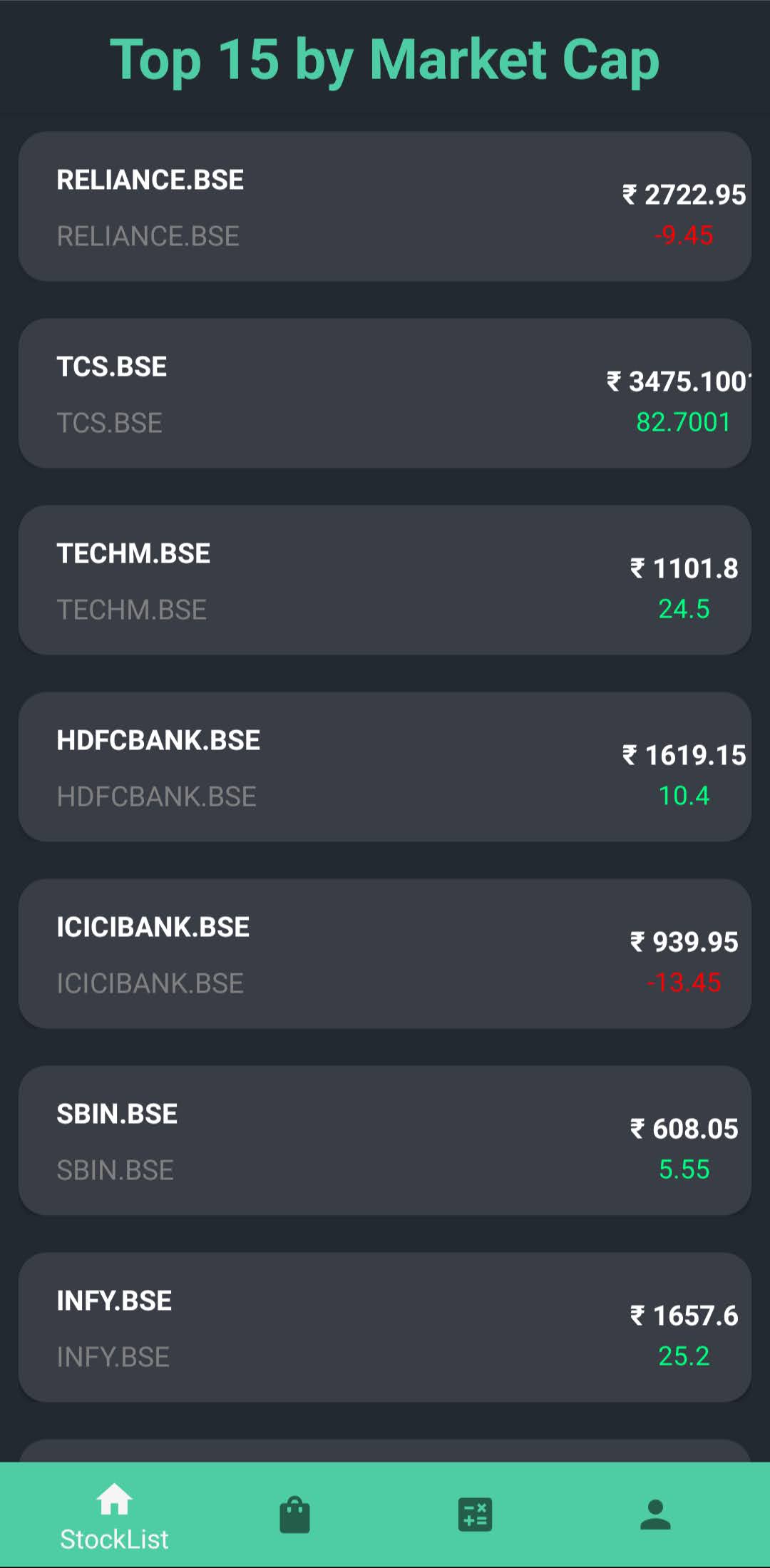

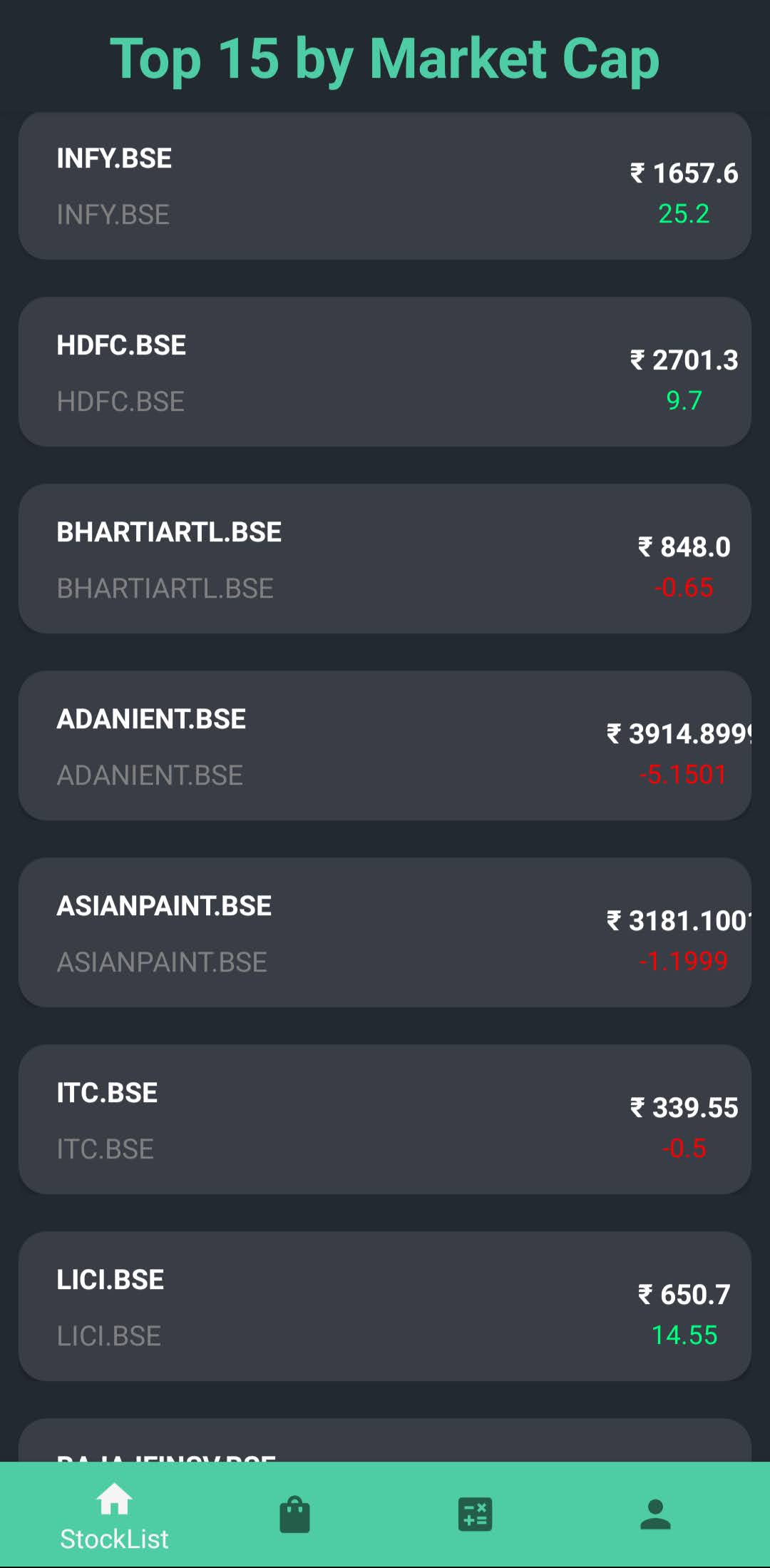

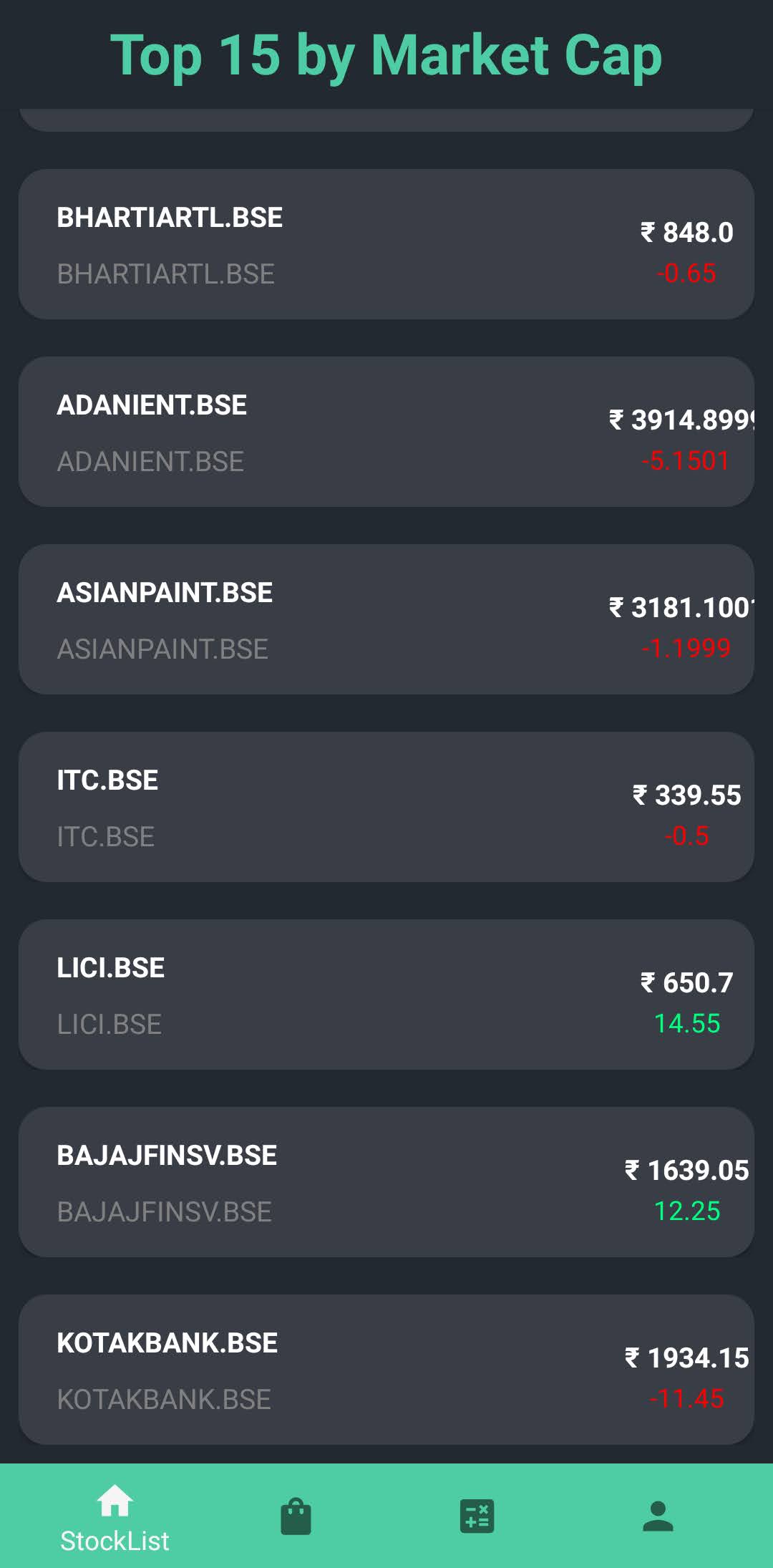

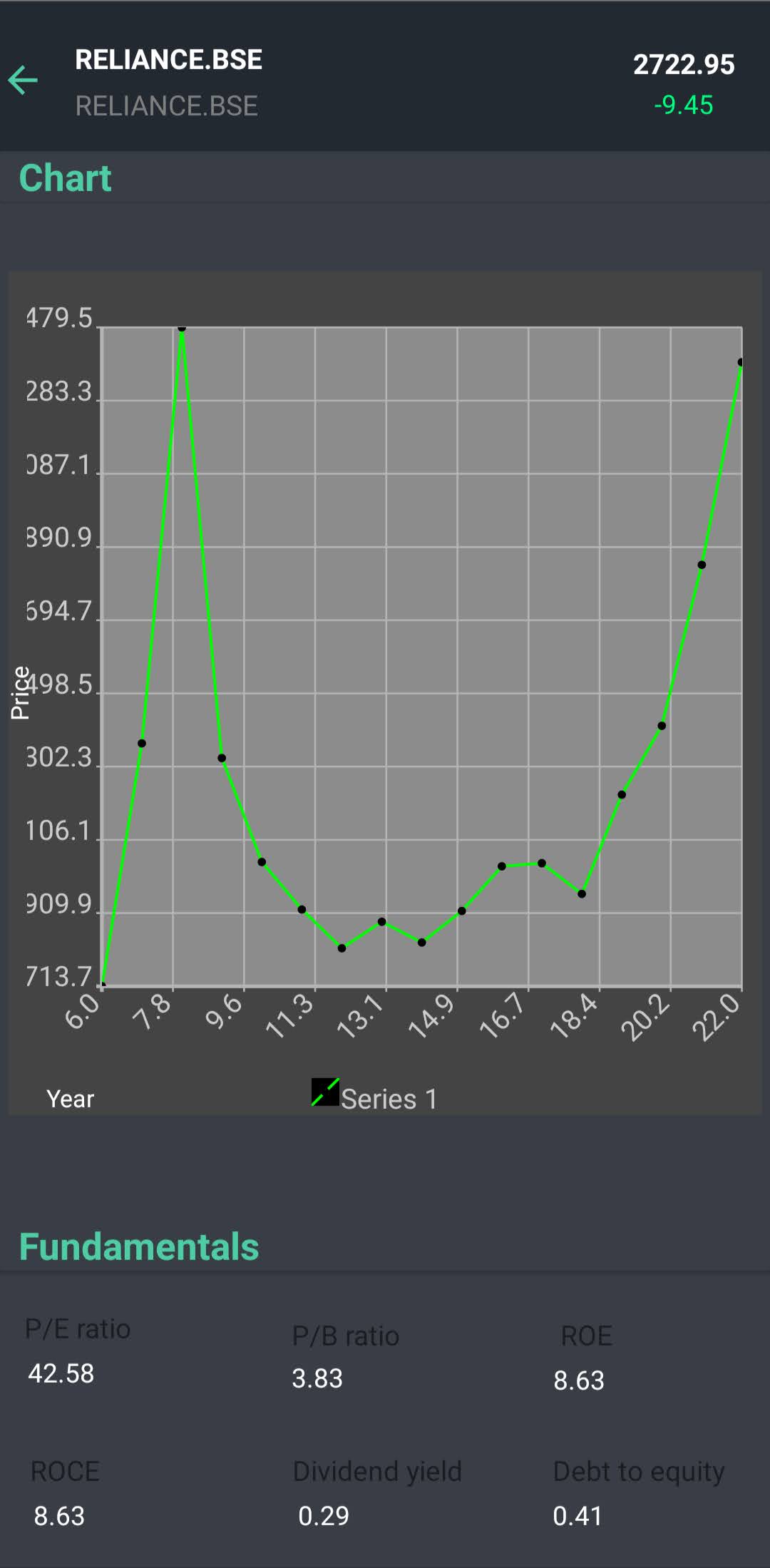

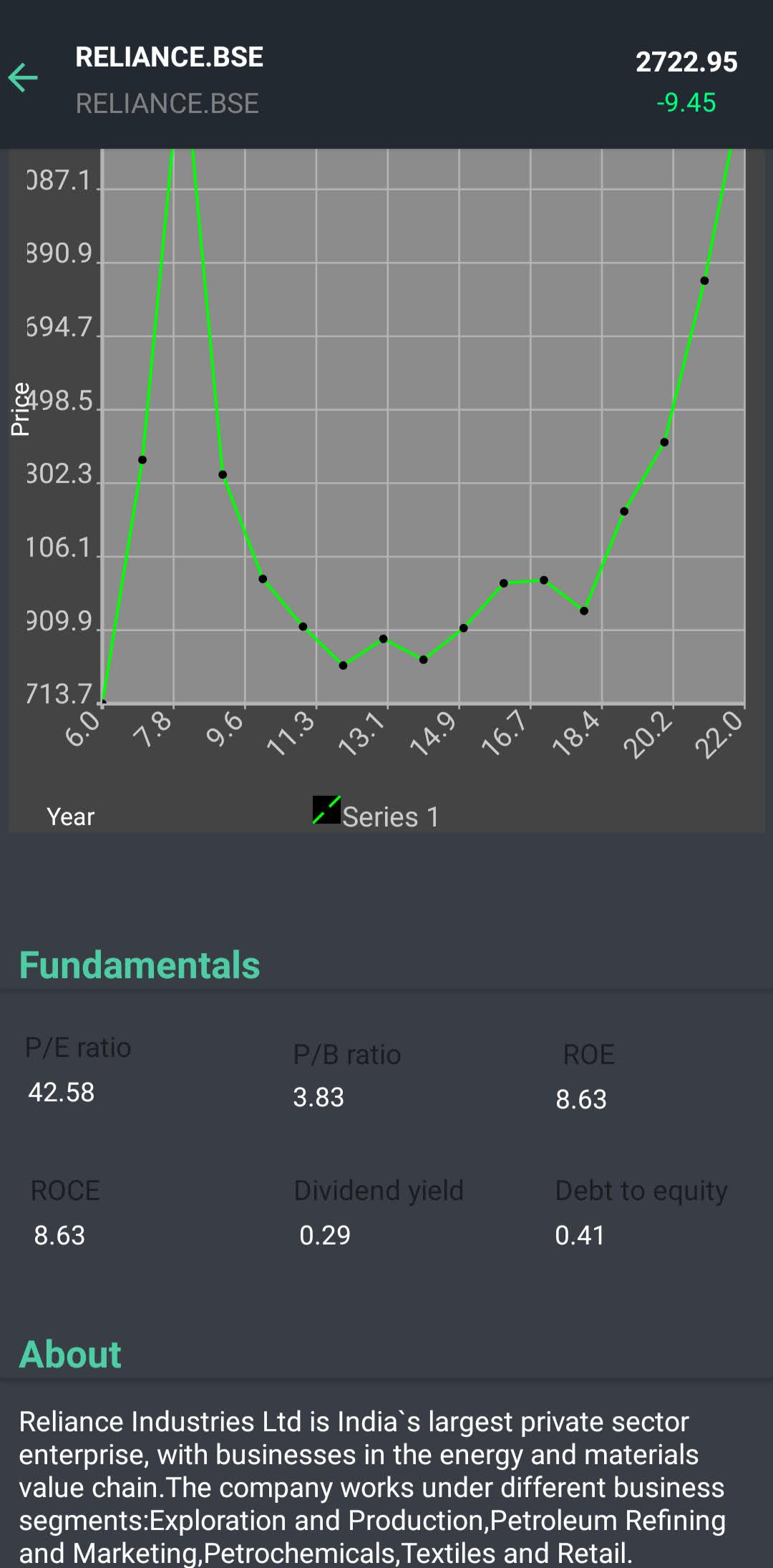

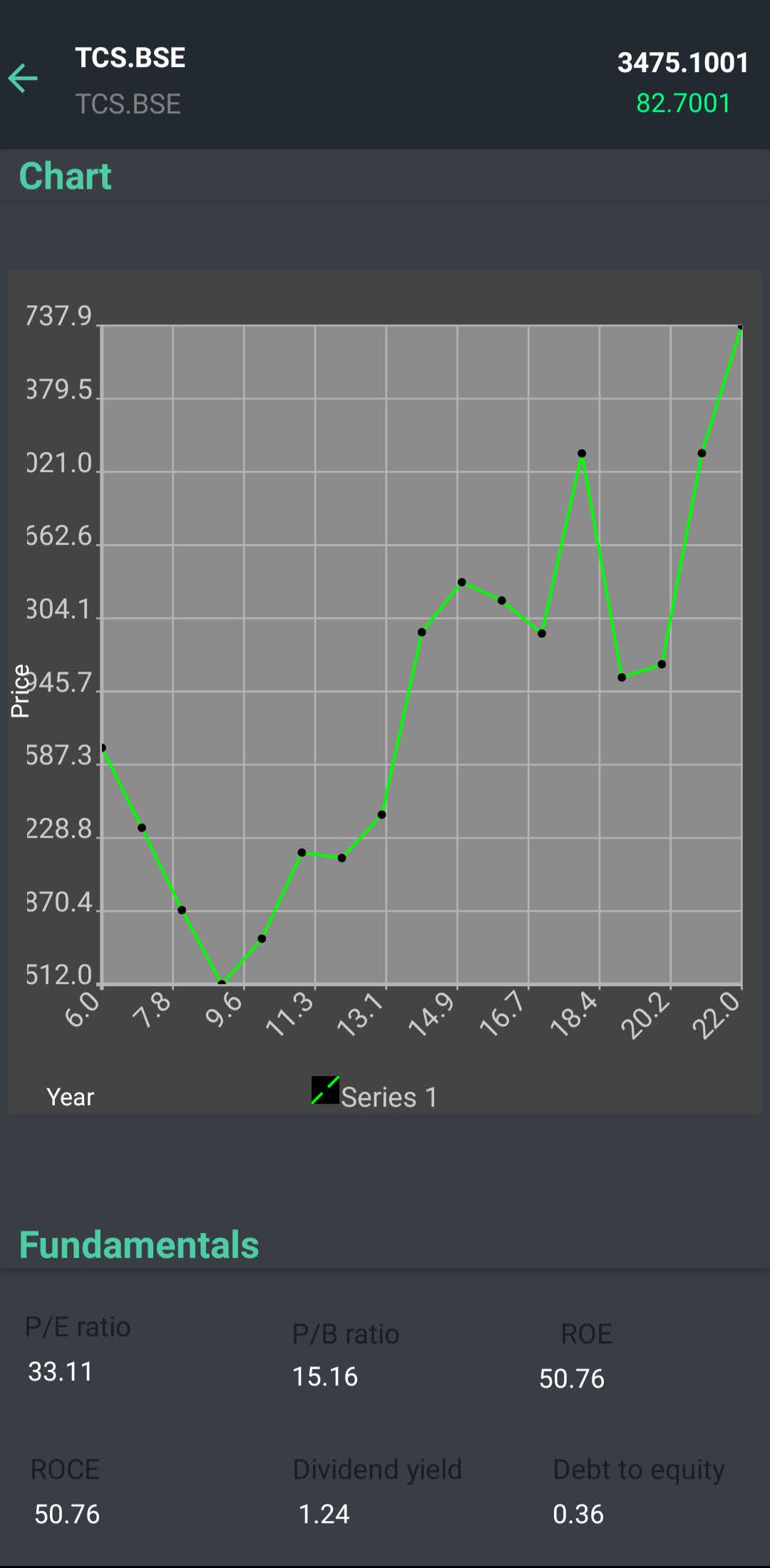

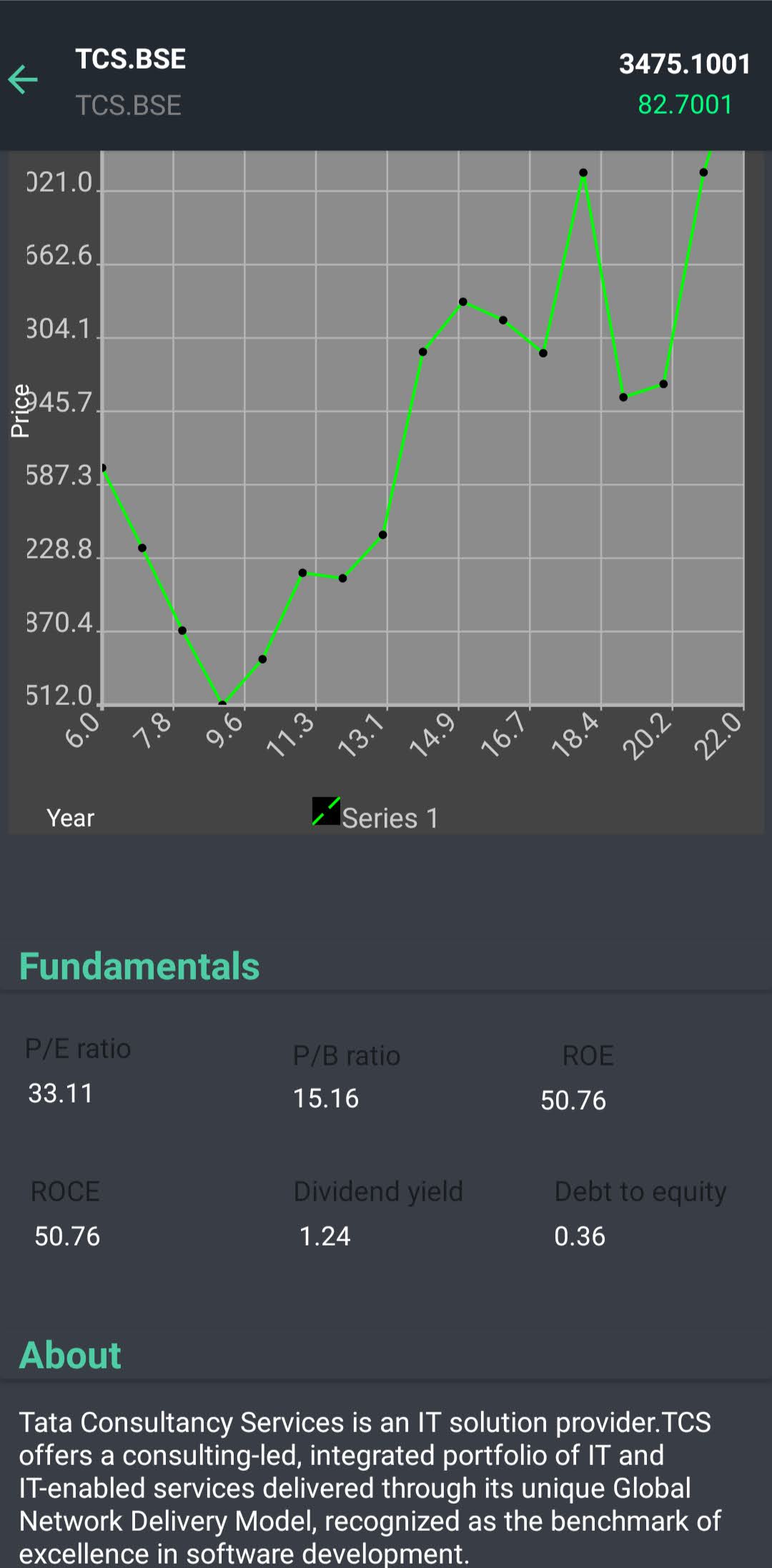

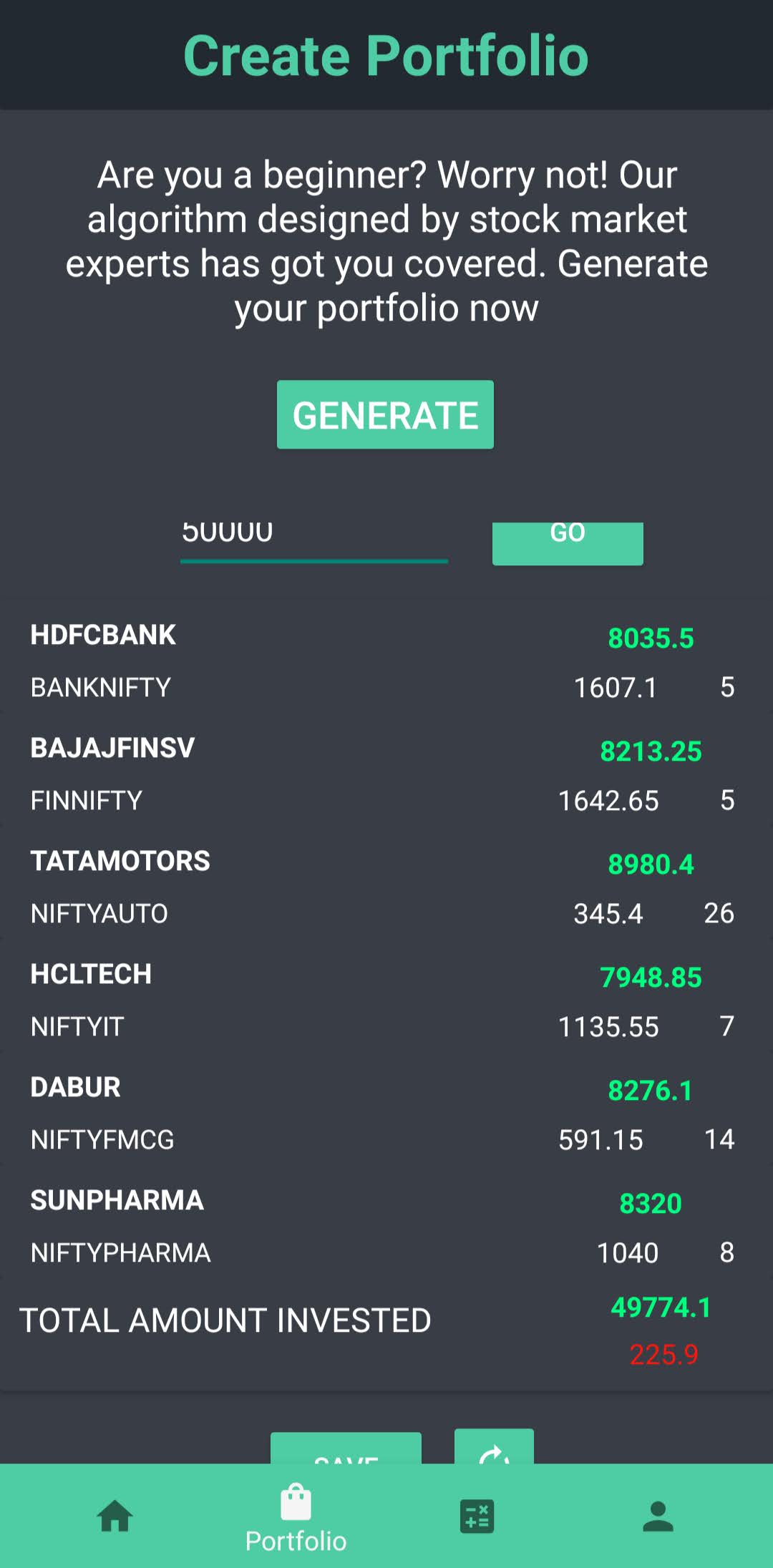

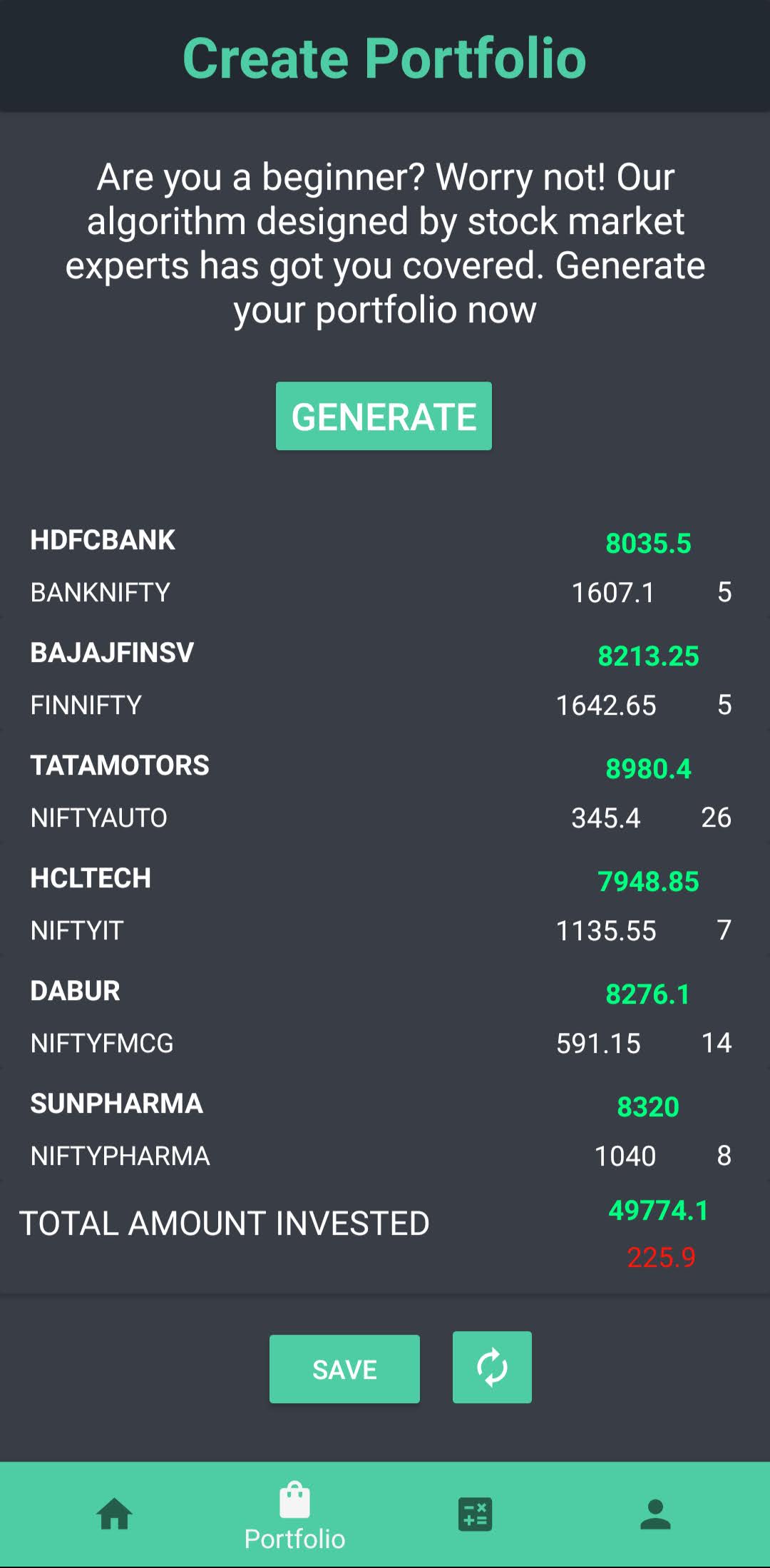

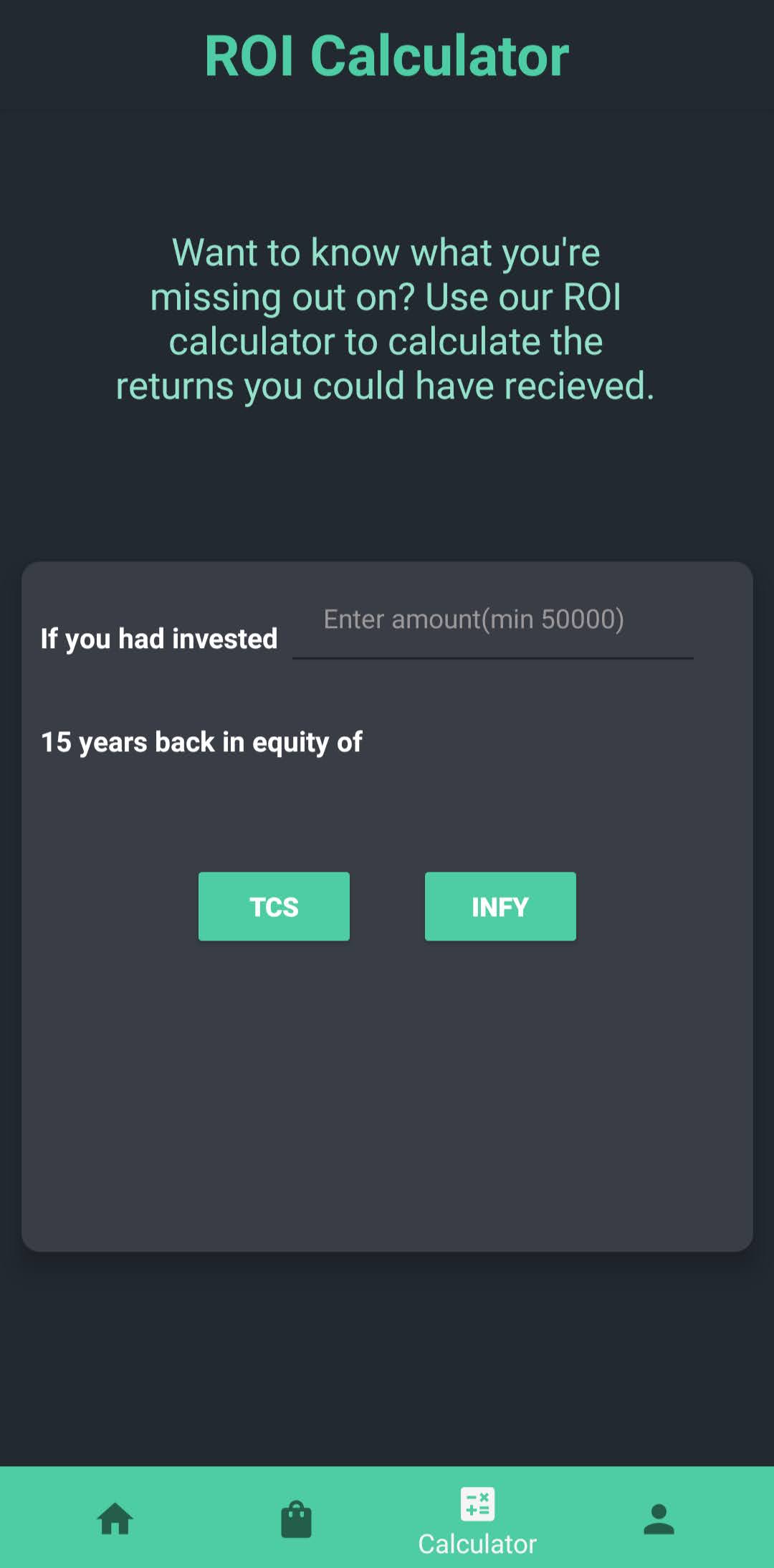

An Android application that will display top 15 stocks (Selected by a stock market expert) and their analyzed data (P/B Ratio , P/E Ratio , Return on Equity , Dividend Yield , Debt to Equity and Net Profit Margin and Stock Prices from year 2006 to 2022). This application is mainly for beginners. The application also provides the user to automatically generate a portfolio and also provides a Return of Investment Calculator (ROI) for 2 stocks (as of 08/12/2022) namely TCS and Infosys

- Motivation

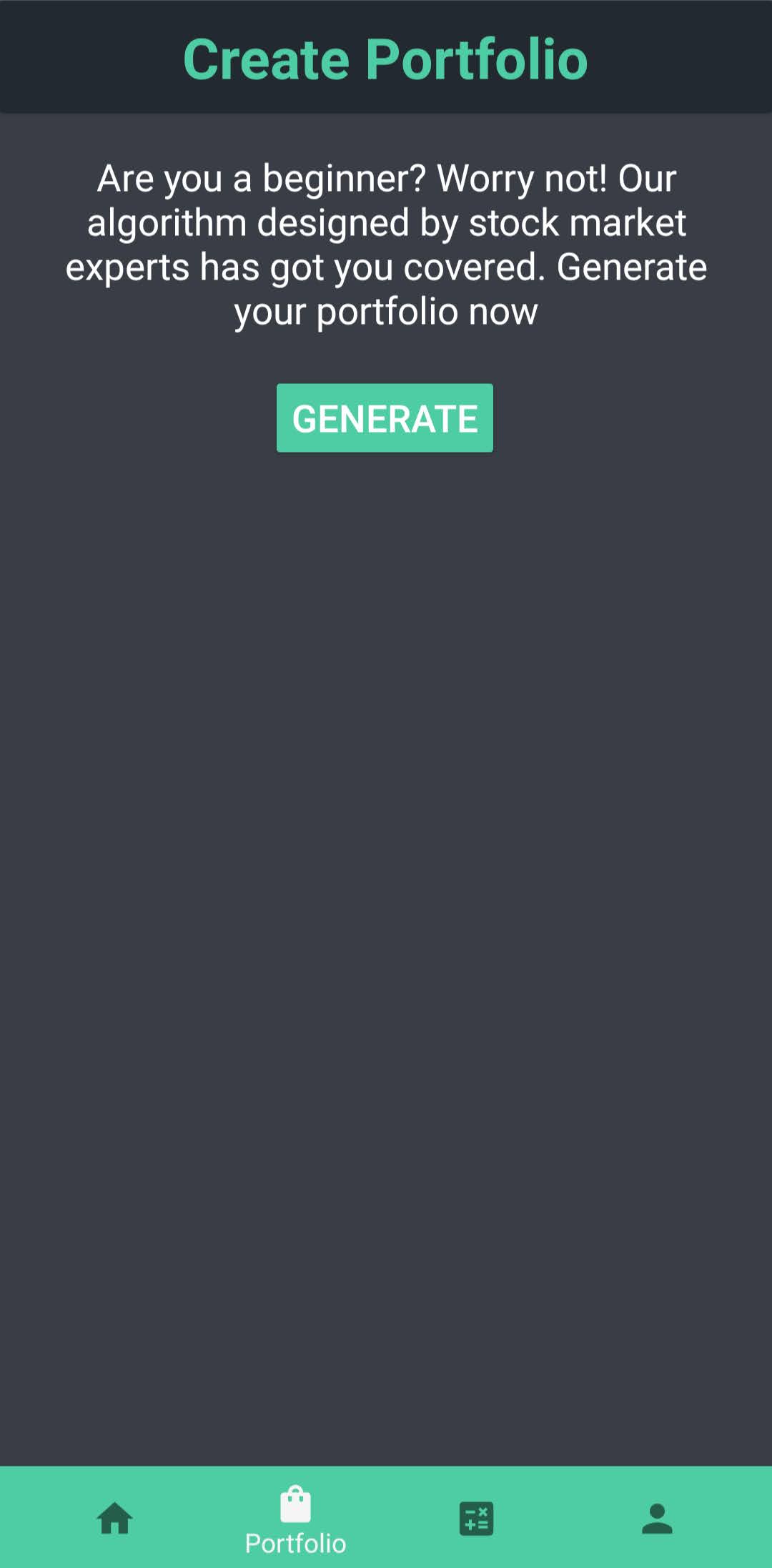

- Screenshots

- Technology/Framework Used

- Algorithms

- Features

- Code Examples

- Installation

- How To Use ?

- API Reference

- Credits

- License

- @Pratham-cymk: Backend & Logic of App

- @ram7203: Frontend

- @puneetmpatil: Backend & Logic of App

In recent times, investing is as important as earning. Financial literacy can allow a person to reach different level of heights. Investing is considered to be a risky task (particularly in stocks) because of which many people avoid it. Hence to make investing easy we are proposing this idea.

IDES

Given :

- Bonus year array

- Bonus year ratio factor array

- Dividend factor

- Price of stock with year varying from current year to base year

Input :

- Investment

Output :

- Total dividend received over no of years (current year - base year)

- Current evaluation

Algorithm:

- Input amount to be invested from user

- Let base year for calculation be 2006

- Define an array which will store the bonus year of each stock and another array for bonus year ratio factor. For example: TCS has offered 1:1 ratio of stocks in the years 2006, 2009 and 2018. It means that the quantity of stocks doubled in those years.

- Define an array price which will contain prices from 2006 (base year) to 2022 (current year) in decreasing order of year

- Define dividend factor of the stock

- If the base year = 2006 and the current year = 2022, no of years = 17. Therefore number of financial years = 16

- Find initial quantity of stocks

- Initialize total dividend to zero

-

for i := (no of years - 2) to 0 and year := (2006)

- If year is a bonus year then multiply quantity of stocks by bonus_year_factor_ratio for that year

- total_dividendent = total_dividendent + quantity*((price[i]*dividendFactor)/100)

- Increment value of year

- Decrement value of i

- Output current evaluation and total dividend received

current_valuation = (current_stock_price * quantity_of_stocks)

quantity = investment_amount/price(2006)

Portfolio Generation Algorithm

Input : Budget / Investment amount

Output :

- Total allocated amount

- Sector-wise allocated amount

- Quantity of stock sector-wise

- Total remaining amount

Algorithm:

- Input budget or amount to be invested from user (Minimum investment = 50000)

- We assume the no. of sectors from which stocks will be allocated belong to be 6 and we select the top 3 best stocks from many stocks based on research by a team of experts.

- Find the sector-wise amount to be allotted

sectoralAmount = budget / noOfSectors

- We have the top 3 companies per sector wise along with their current prices with us

- for i = 1 to noOfSectors

- Select a stock from each sector and find the quantity

-

quantity = sectoralAmount/(price_of_stock_randomly_selected)

-

remainingAmountPerSector = sectoralAmount%(price_of_stock_randomly_selected)

-

totalAllocated = totalAllocated + (quantity * (price_of_stock_randomly_selected))

-

totalRemaining = budget - totalAllocated

- From each sector we find the stock with minimum price and that minimum price should be less than remaining amount

- If no stock can be found which has price less than remaining amount then your portfolio has been generated

- Else u find the additional quantity of stocks which can be bought using the remaining amount

- Find total allocated amount and total remaining amount

- Output the total allocated amount, sector-wise allocated amount, quantity of stock sector-wise and total remaining amount

- AI powered portfolio

- Return of Investment Calculator (ROI)

- Download the app from our website

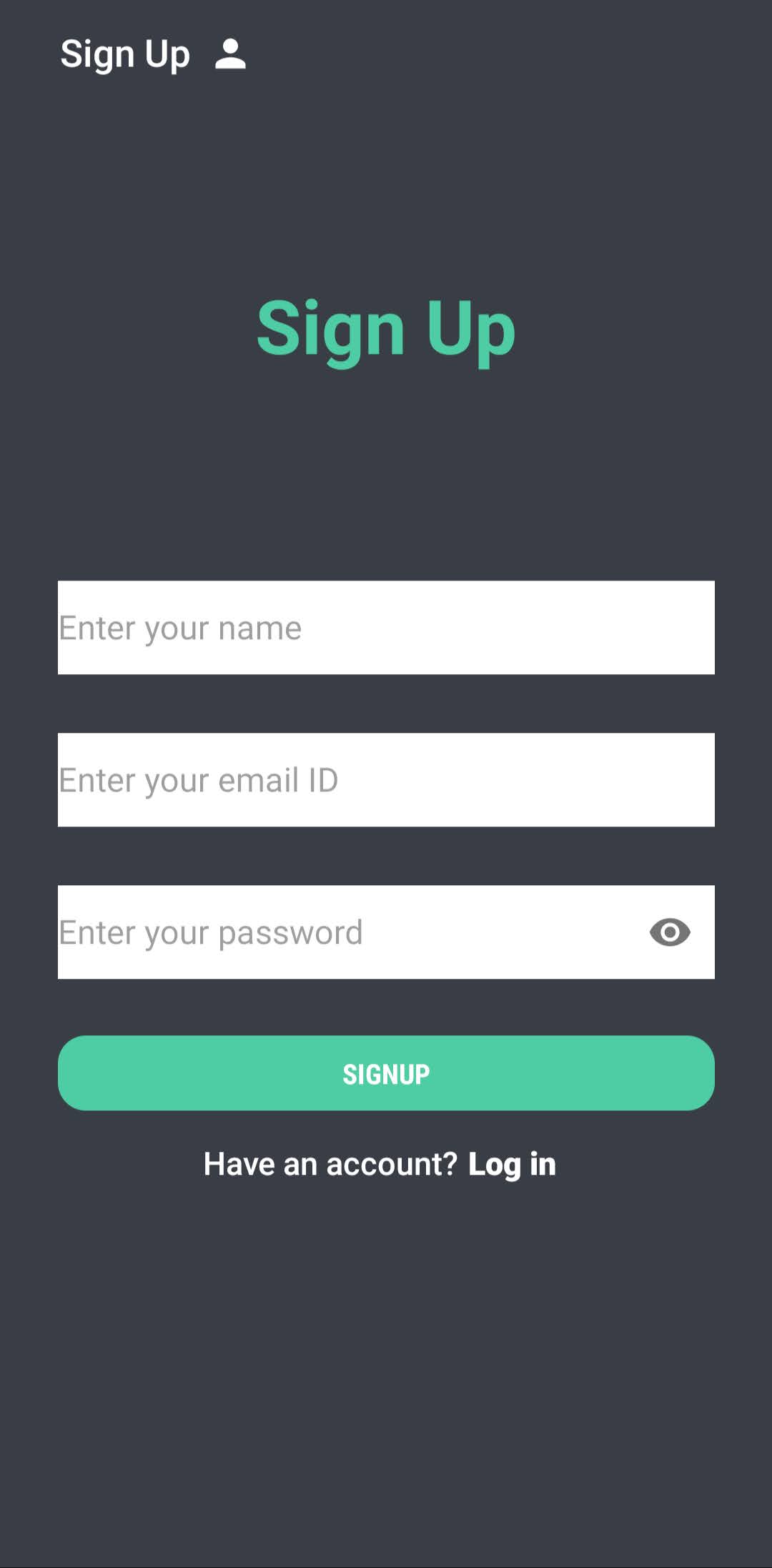

- Sign up using your email id

- Verify your email address via a confirmation mail which you might have received on your email (Mostly in spam folder)

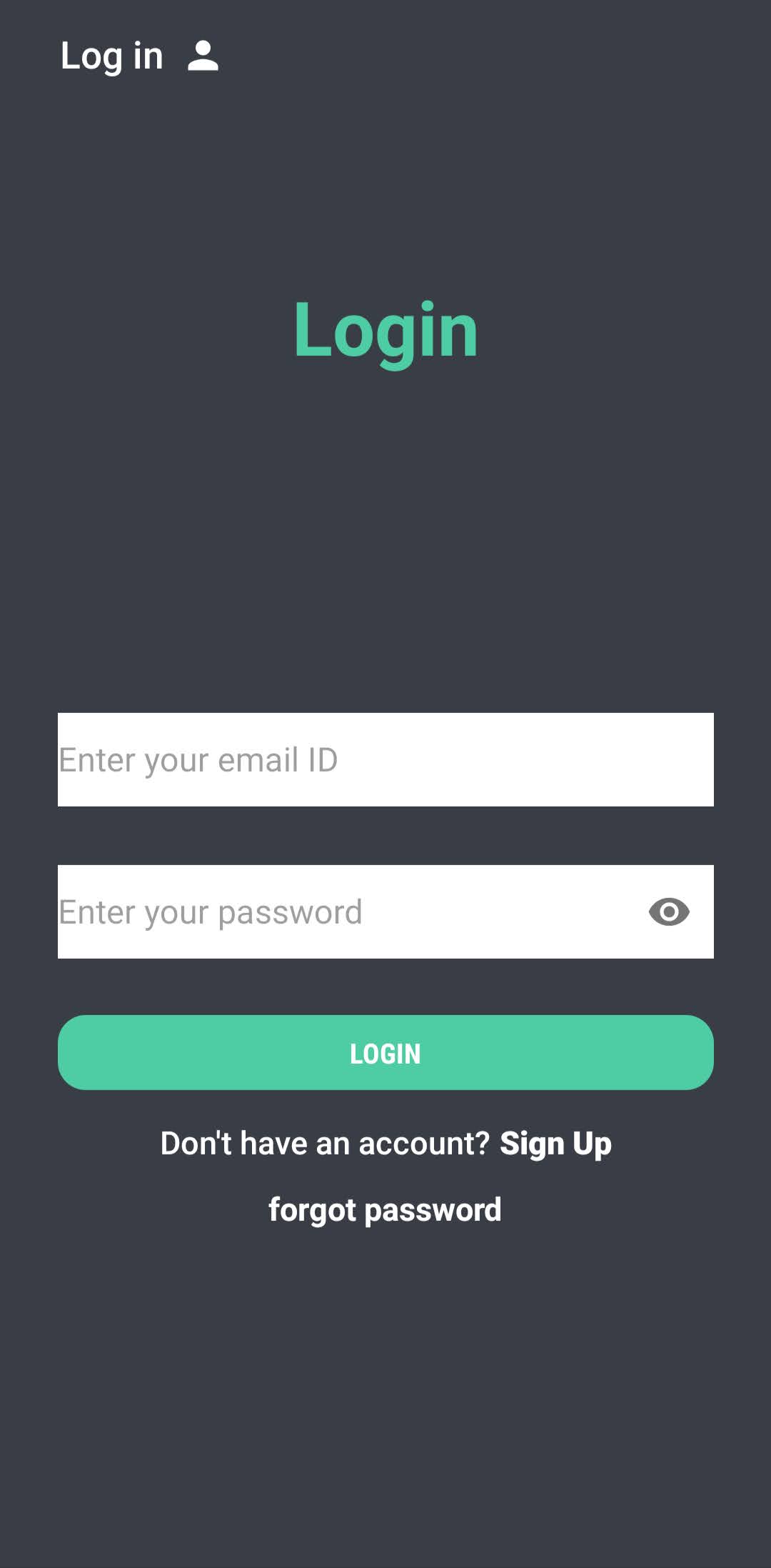

- Login into our app using the verified email address

- You are ready to get started!