Team: Zaid Al dulaimi, Ronald Lam, Haoyue (Jimmy) Lin, Marco Teh

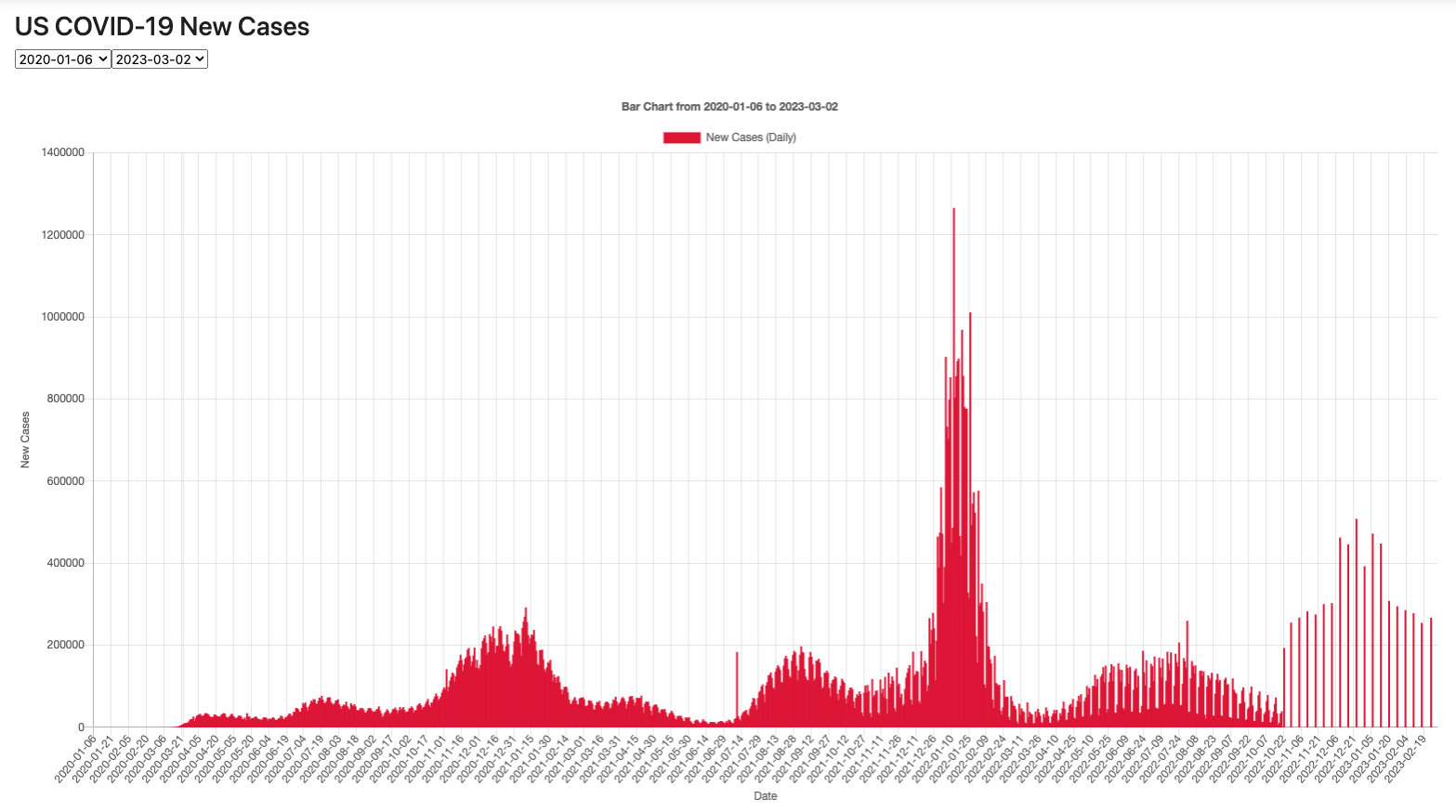

COVID-19 had struck the world in March of 2020. Its initial blow was felt through all facets of human life, forever changing ongoing aspects of societal structures. May it be economically, environmentally, or personally, the world has changed forever.

Objective: To gather a macrocosmic, financial understanding of the initial and continued impact of the COVID-19 pandemic, we are looking at how this international virus outbreak has affected the Healthcare, Banking, Information, Real Estate, and Energy Sectors.

For each sector:

- What are the effects of the pandemic on the sector as a whole?

- How did companies performed through each COVID-19 wave and beyond?

- Why did this sector perform the way it did through each wave and beyond?

- Fetching Data through API

- Clean, transform and merge data

- Create CSV file

- Create Entity Relational Diagram

- Load data into Postgres

- Exploration

- Identifying 3-4 key insights answering our initial questions

- Formulating conclusions and determine potential correlational relationships

- Create Javascript and HTML files

- Create presentation

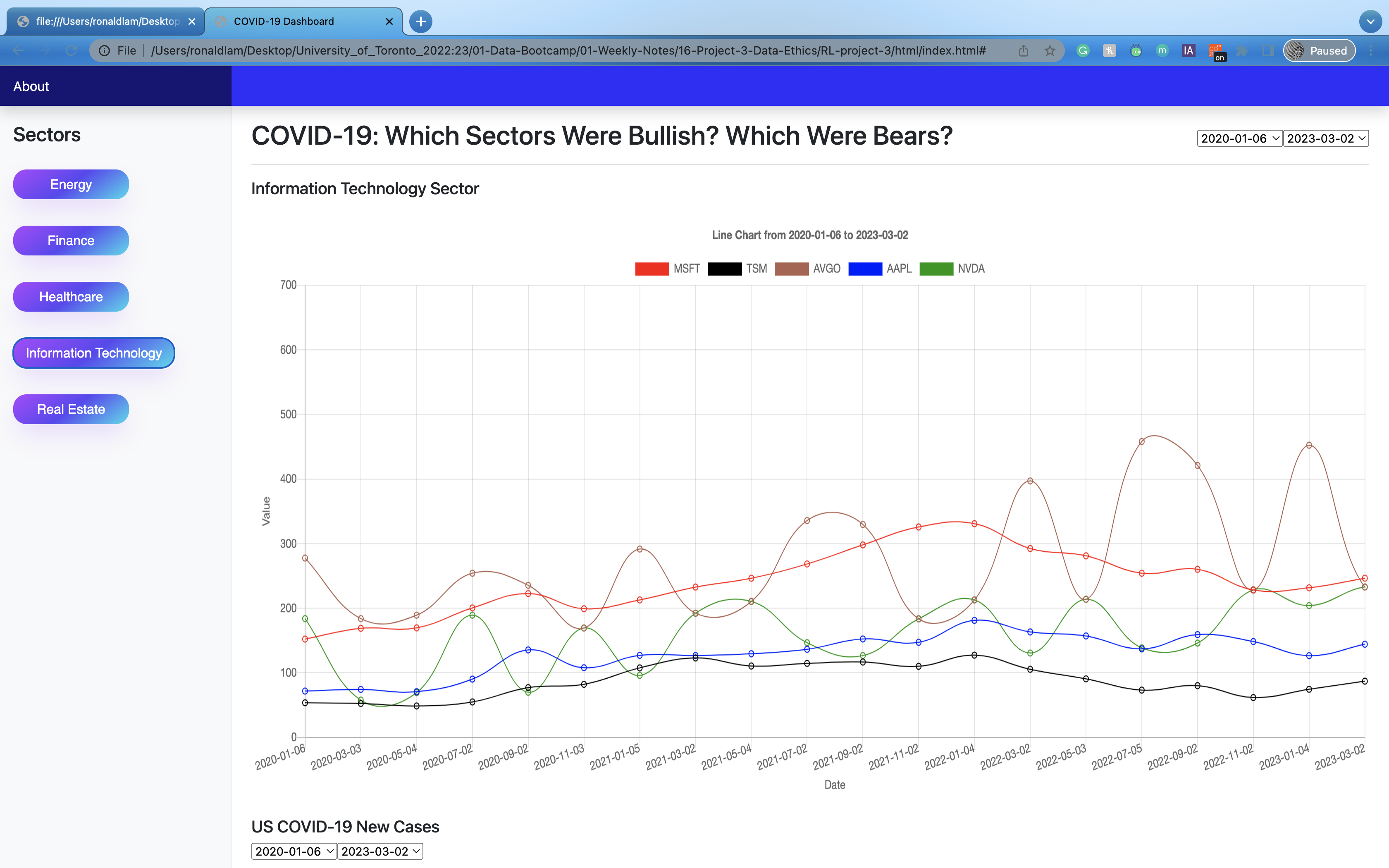

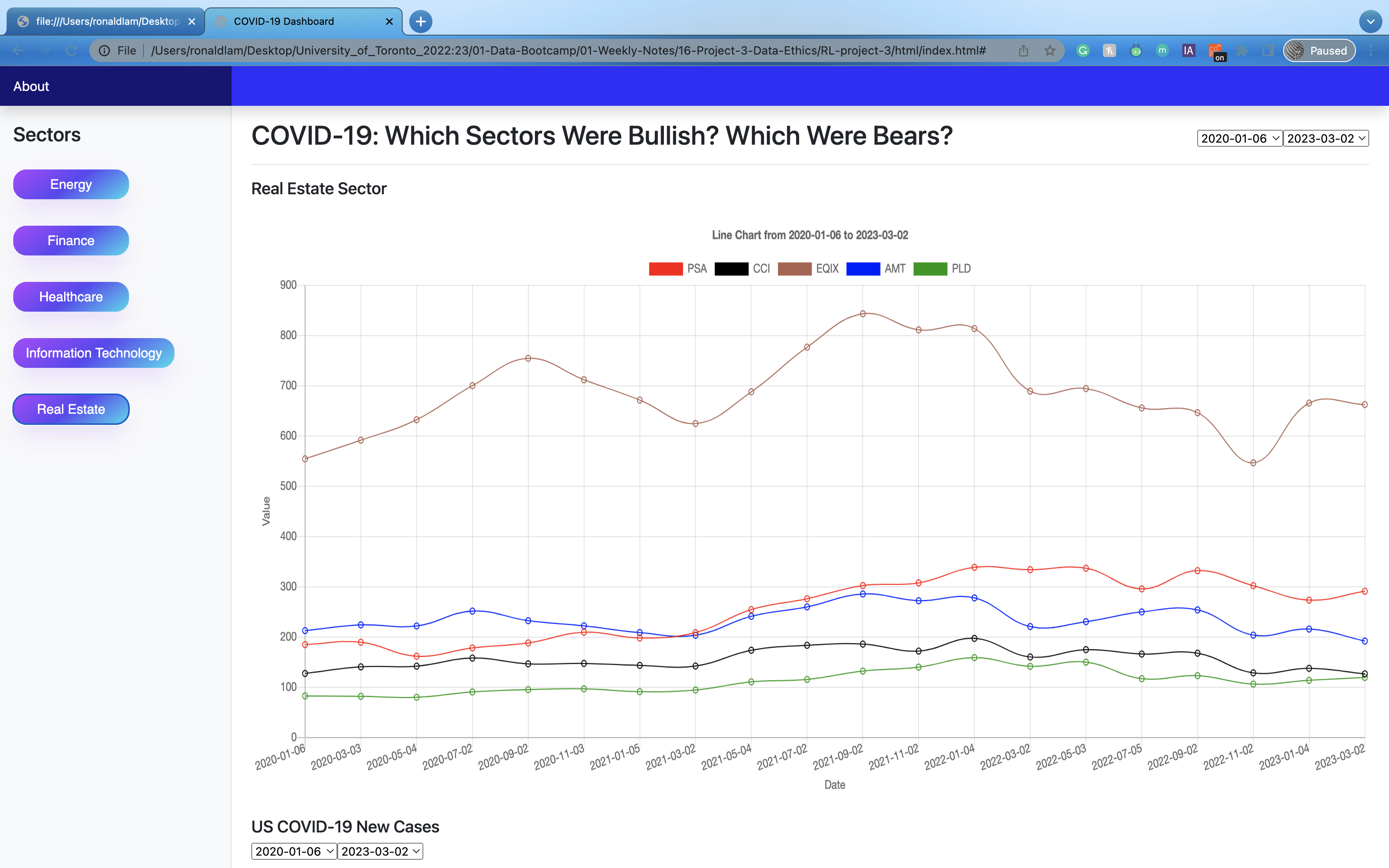

Microsoft (MSFT): In February and March 2020, MSFT's stock price fell by around 20% as the pandemic led to widespread economic uncertainty. However, as demand for remote work and online services grew, MSFT's stock price recovered and hit all-time highs in September 2020.

Taiwan Semiconductor Manufacturing Company (TSM): TSM's stock price experienced a dip in February and March 2020, but then quickly recovered and hit all-time highs in May 2020 as the company benefited from increased demand for semiconductors due to the shift to remote work and online activities.

Broadcom Inc. (AVGO): AVGO's stock price fell by around 30% in March 2020, as the pandemic led to supply chain disruptions and economic uncertainty. However, the stock price rebounded and hit all-time highs in June 2021, as demand for semiconductors and wireless communication technologies increased.

Apple Inc. (AAPL): AAPL's stock price fell by around 25% in February and March 2020, but then rebounded and hit all-time highs in August 2020, as the company benefited from increased demand for online services and work-from-home devices such as laptops and tablets.

NVIDIA Corporation (NVDA): NVDA's stock price fell by around 30% in March 2020, as the pandemic led to supply chain disruptions and economic uncertainty. However, the stock price quickly rebounded and hit all-time highs in November 2020, as demand for gaming and data center products increased due to the shift to remote work and online activities.

In general, most technology stocks experienced a dip in stock prices in March 2020 due to the economic uncertainty caused by the pandemic. However, as the world shifted towards remote work and online activities, demand for technology products and services increased, leading to a rebound in most tech stock prices in the following months.

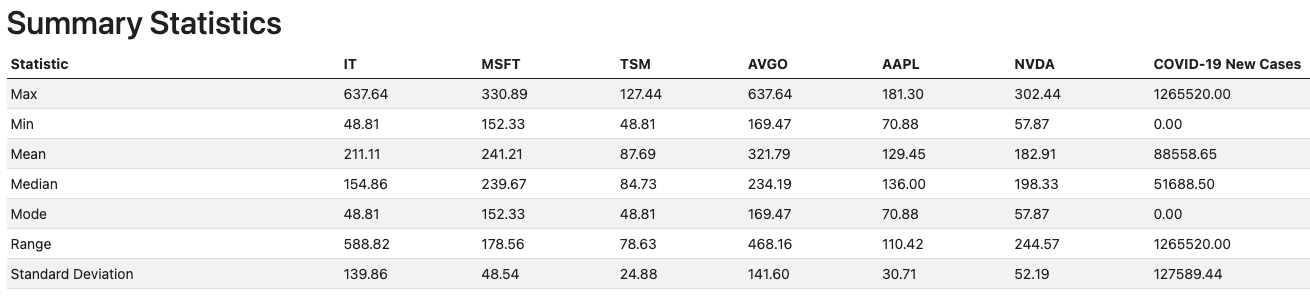

Prologis (PLD): Between February and March 2020, PLD saw its stock price drop from around $95 to $70, a decline of over 25%, as the pandemic spread across the US and caused widespread uncertainty in the market.

American Tower (AMT): In late February and early March 2020, AMT's stock price fell from around $250 to $190, a drop of about 25%, due to concerns about the pandemic's impact on the economy and the company's business.

Equinix (EQIX): EQIX's stock price saw a sharp decline in mid-March 2020, falling from around $725 to $450 in just a few weeks, a drop of over 35%, as the pandemic led to widespread lockdowns and business closures.

Crown Castle International (CCI): In February and March 2020, CCI's stock price fell from around $160 to $110, a drop of about 30%, as the pandemic took hold in the US and caused widespread economic disruption.

Public Storage (PSA): PSA's stock price initially saw a sharp decline in March 2020, falling from around $250 to $160, a drop of over 35%, due to concerns about the pandemic's impact on the economy and consumer spending. However, the stock price quickly recovered and reached new all-time highs in the following months as demand for self-storage remained strong during the pandemic.

Conclusion: The COVID-19 pandemic had a significant impact on the stock prices of Prologis, American Tower, Equinix, Crown Castle International, and Public Storage, with most of these companies experiencing significant declines in early 2020. However, the pandemic's impact on these companies varied, with some recovering more quickly than others, and some ultimately benefiting from increased demand for their services.

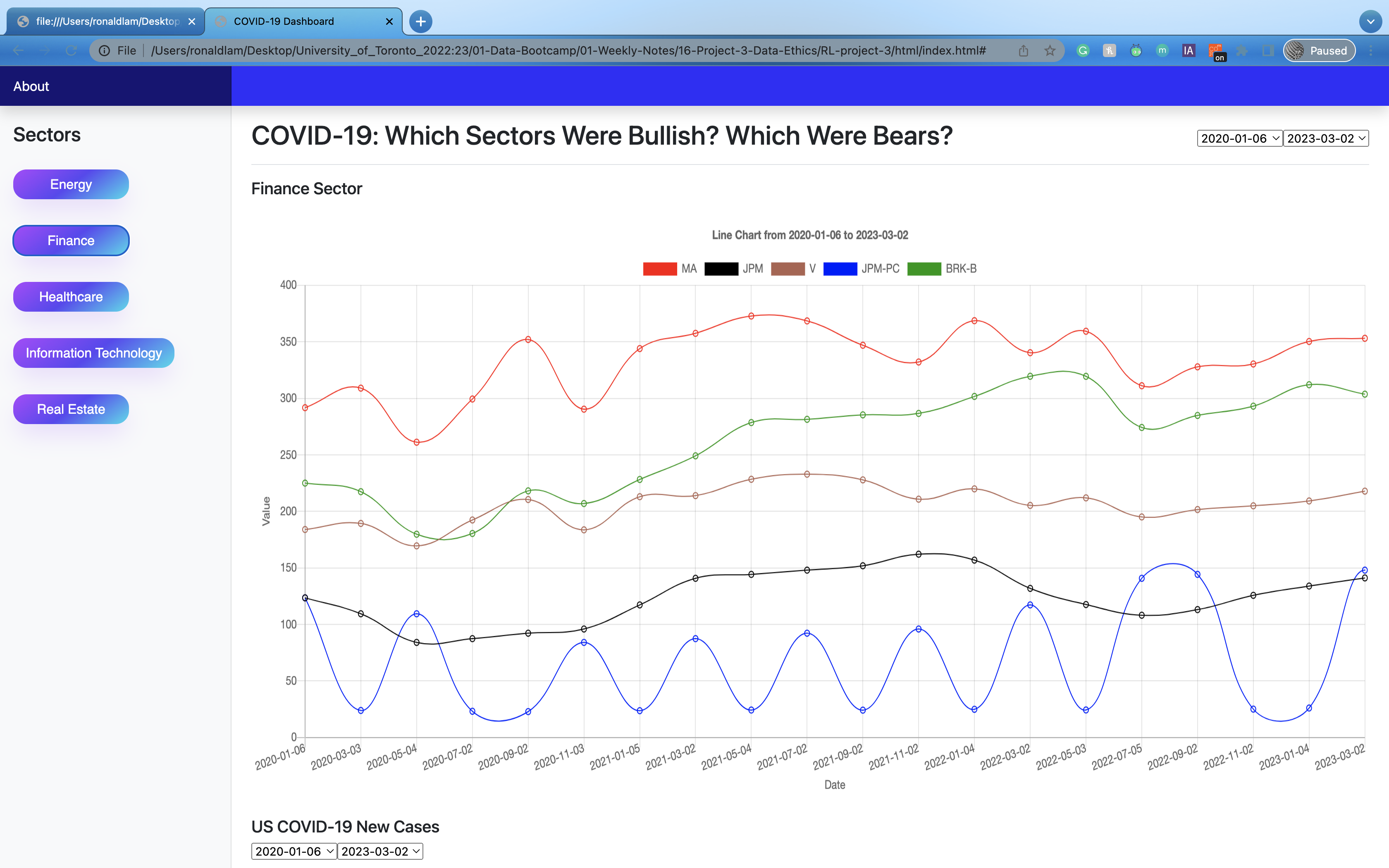

BRK-B (Berkshire Hathaway Inc. Class B): The stock fell sharply in February and March 2020, along with the broader market, as investors panicked over the potential impact of the pandemic. However, the stock has since rebounded and reached new all-time highs in early 2021.

JPM-PC (JPMorgan Chase & Co. Preferred Stock Class P): The preferred stock, which pays a fixed dividend, experienced some volatility in early 2020 but has since recovered and has been trading steadily.

V (Visa Inc.): The stock initially fell sharply in February and March 2020 but quickly recovered and has been trading near all-time highs in 2021. The shift towards digital payments during the pandemic has boosted the company's prospects.

JPM (JPMorgan Chase & Co.): The stock fell sharply in February and March 2020, but has since rebounded and has been trading near all-time highs in 2021. The company's strong financial position and diversified business model have helped it weather the pandemic.

MA (Mastercard Inc.): Like Visa, Mastercard's stock initially fell sharply in February and March 2020 but quickly rebounded and has been trading near all-time highs in 2021. The company has benefited from the shift towards digital payments during the pandemic.

Conclusion: The pandemic had a significant impact on the stock prices of these companies in early 2020, with most experiencing sharp drops before recovering later in the year. However, the overall trend for these financial services companies has been positive, with many of them trading near all-time highs in 2021. The shift towards digital payments during the pandemic has boosted the prospects of Visa and Mastercard, while JPMorgan Chase's diversified business model and strong financial position have helped it weather the storm.

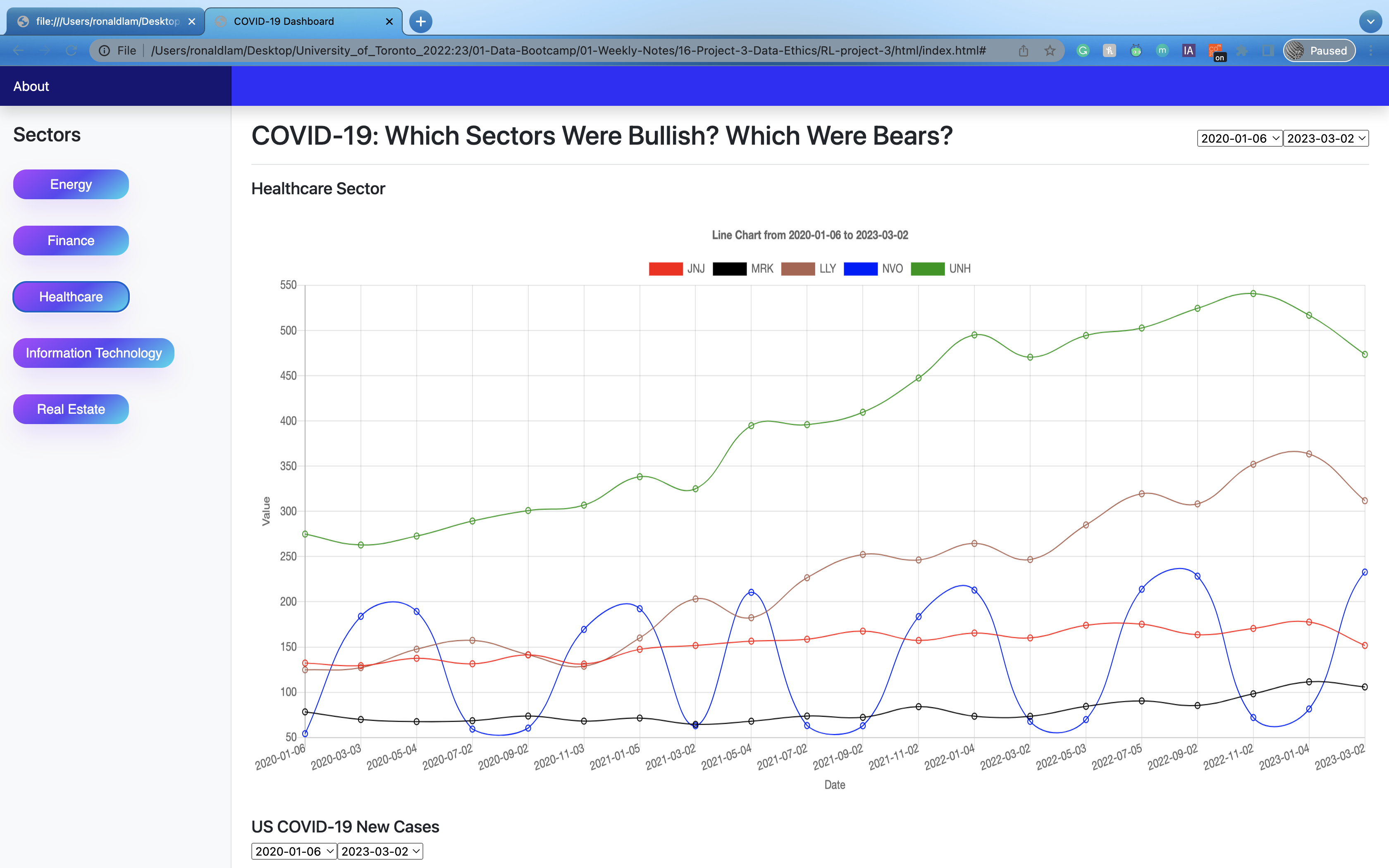

COVID provided growth and expansion in healthcare industries due to the increase in demand of certain medical products and services.

Many pharmaceutical companies have been developing COVID 19 vaccines. Vaccines were bought by many different countries which drives the revenue and profit of the pharmaceutical companies. There is an increase in demand for medical devices and medical related products such as Ventilators, COVID TEST Kit and Personal Protective Equipment (Mask, gloves, gowns), Pharmaceutical companies and medical device manufacturers made revenue and profit on those as well.

During the pandemic many patients consult with doctors remotely. Many healthcare companies developed their own Telemedicine services. Growth in Telemedicine has made revenue and profit for the healthcare companies as well.

Overall the healthcare related stock remains bullish from Jan 2020 to now.

For example, UnitedHealth Group is a health insurance and healthcare services company. They played a big role in the distribution and administration of the COVID 19 vaccine, and they also provide healthcare services and technology solutions.

We can see that from Jan 2021 to 2021 March, their stock dropped by 10%, this is because of the release of their earnings reports for 2020, which showed a decline in revenue compared to the previous year. This is caused by delay of distribution during the starting of COVID in March 2020 and also lockdowns in 2020. Which caused the revenue to decrease and go down. But after that, as demand for distribution of COVID vaccine increases, the stock is in an upwards trend all the way to Nov 2022. Due to interest rates and other reasons, the stock price dropped from the end of 2022 to now.

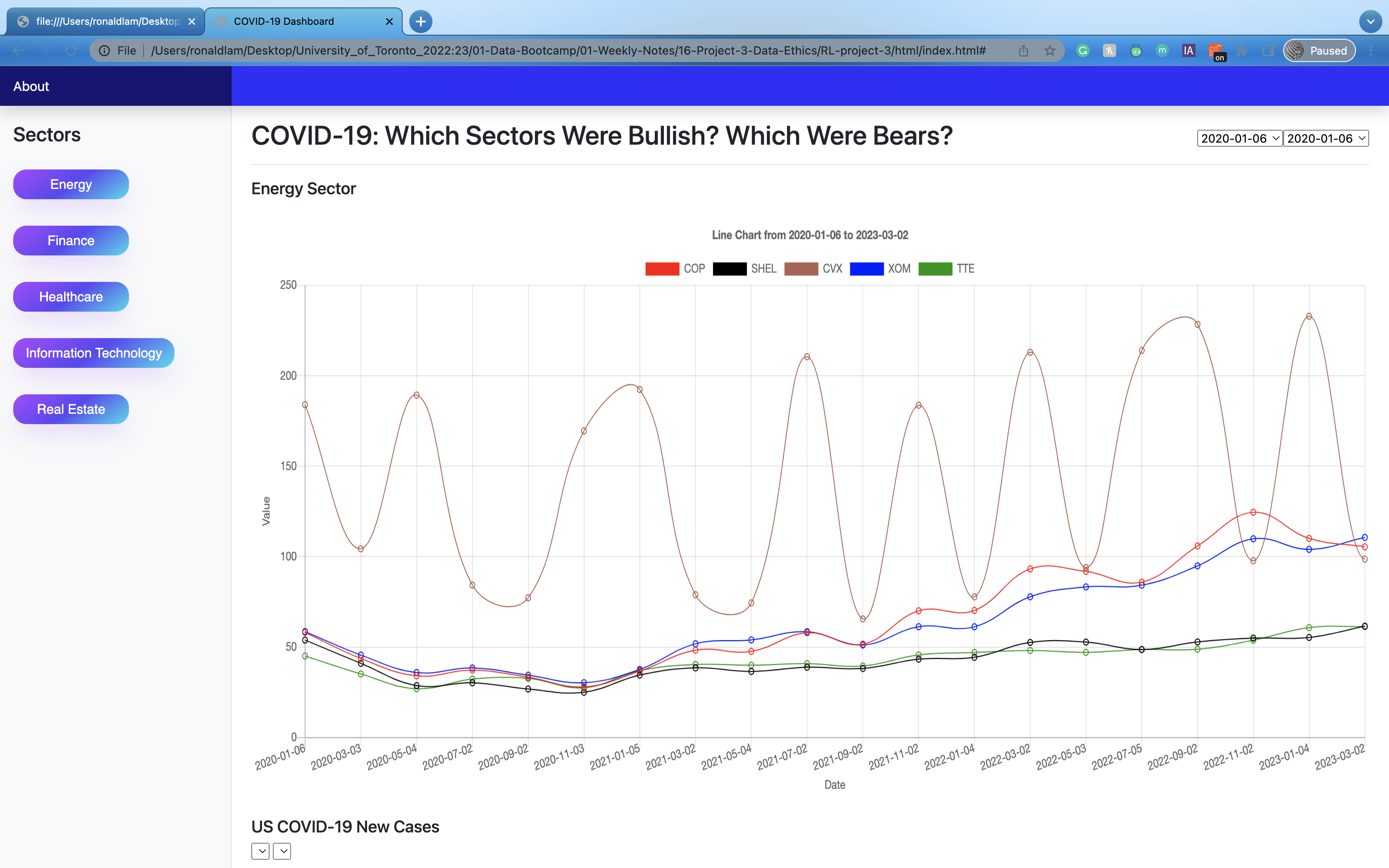

So how did energy stocks perform through each COVID-19 wave?

Stocks were chosen from the top performers in the energy sector of the market as follows:

ExxonMobil (XOM) - On February 20, 2020, XOM was trading at $61.99 per share. By March 23, 2020, the stock had fallen to $31.45 per share, a decline of nearly 50%. As the pandemic disrupted travel and caused a drop in demand for oil, XOM's revenues and profits declined sharply.

Chevron (CVX) - On February 20, 2020, CVX was trading at $111.72 per share. By March 23, 2020, the stock had fallen to $54.22 per share, a decline of over 50%. Similar to XOM, the pandemic caused a sharp drop in demand for oil and gas, leading to a significant decline in revenues and profits for CVX.

Royal Dutch Shell (RDS-A) - On February 20, 2020, RDS-A was trading at $62.46 per share. By March 23, 2020, the stock had fallen to $26.12 per share, a decline of nearly 60%. As the pandemic caused lockdowns and travel restrictions, demand for oil and gas dropped sharply, leading to a decline in revenues and profits for RDS-A.

TotalEnergies (TTE) - On February 20, 2020, TTE was trading at $49.70 per share. By March 23, 2020, the stock had fallen to $19.02 per share, a decline of over 60%. The pandemic caused a drop in demand for oil and gas, leading to a significant decline in revenues and profits for TTE.

ConocoPhillips (COP) - On February 20, 2020, COP was trading at $54.80 per share. By March 23, 2020, the stock had fallen to $23.46 per share, a decline of nearly 60%. The pandemic led to a sharp drop in demand for oil and gas, leading to a decline in revenues and profits for COP.

The COVID-19 pandemic had a severe impact on the energy sector, as travel restrictions and lockdowns caused a sharp drop in demand for oil and gas. As a result, energy stocks like XOM, CVX, RDS-A, TTE, and COP all experienced significant declines in their stock prices. While some of these stocks have since recovered, the pandemic served as a reminder of the volatility and risks associated with the energy sector.

In conclusion, COVID-19 had a significant impact on global financial markets and the performance of various stock sectors.

The information technology sector saw a surge in demand for remote communication and digital services, leading to significant gains for major tech companies.

Real estate stocks faced challenges due to declining demand for office and commercial space, resulting in declines for many real estate investment trusts.

The banking sector experienced a drop in stock prices as a result of lower interest rates and increased credit risk. Healthcare stocks were relatively resilient, with some companies seeing a boost in demand for medical supplies and equipment.

Finally, the energy sector faced significant challenges as demand for oil and gas plummeted due to lockdowns and reduced economic activity. Overall, the pandemic has resulted in a highly volatile and uncertain market environment, and it remains to be seen how long-lasting these effects will be.