A set of tools to perform fixed income securities related calculation in Python. The Python module is accompanied by a Flask app with the same functionality.

Products covered:

- Z-spread calculation from zero coupon bond

- Z-spread calculation from par coupon bond

- Bond price, yield and other related calculations

- Repo start payment, end payment, and break even yield

- Bond future's net basis and implied repo rate

- CDS spread

In the command line:

make install

or

pip install .

To run the app, in the command line:

make run

or

python app/main.py

Then type

http://127.0.0.1:5000/

in the browser will bring you to the app.

First import packages

import numpy as np

import matplotlib.pyplot as plt

from datetime import date

from fincomepy import Bond, Repo, BondFuture, ZspreadPar, ZspreadZero, CDS

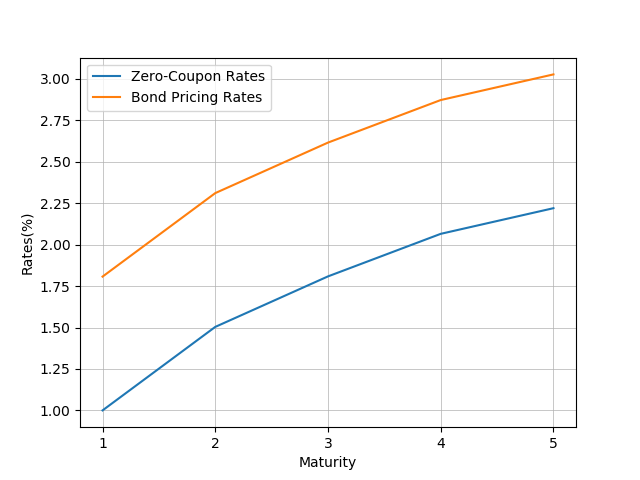

Assuing we have a 5-year bond with 3% annual coupon. Suppose the 1-5 year zero-coupon rates are 1%, 1.5038%, 1.8085%, 2.0652% and 2.2199% respectively. i.e.

| Maturity | Zero Coupon Rate | Coupon Cash Flow |

|---|---|---|

| 1 | 1.0% | 3.0% |

| 2 | 1.5038% | 3.0% |

| 3 | 1.8085% | 3.0% |

| 4 | 2.0652% | 3.0% |

| 5 | 2.2199% | 103.0% |

To calculate z-spread, first construct a ZspreadZero object:

zero_discrete = np.array([1.0, 1.5038, 1.8085, 2.0652, 2.2199])

coupon_cf = np.array([3.0, 3.0, 3.0, 3.0, 103.0])

zspr_test1 = ZspreadZero(zero_discrete, coupon_cf)

Obtain z-spread (the value returned is in percentage):

zspr_test1.get_zspread()

Visualize the z-spread:

zspr_test1.plot_zspread()

plt.show()

Assuing we have a 5-year bond with 3% annual coupon. Suppose the 1-5 year par-coupon rates are 1%, 1.5%, 1.8%, 2.05%, and 2.2% respectively. i.e.

| Maturity | Par Coupon Rate | Coupon Cash Flow |

|---|---|---|

| 1 | 1.0% | 3.0% |

| 2 | 1.5% | 3.0% |

| 3 | 1.8% | 3.0% |

| 4 | 2.05% | 3.0% |

| 5 | 2.2% | 103.0% |

Obtain z-spread (the value returned is in percentage):

par_rates = np.array([1.00, 1.50, 1.80, 2.05, 2.20])

zspr_test2 = ZspreadPar(par_rates, coupon_cf)

zspr_test2.get_zspread()

Suppose we have a bond with following information.

| Bond Info | |

|---|---|

| Settlement | 2020-7-15 |

| Maturity | 2030-5-15 |

| Coupon | 0.625% |

| Market Price | 100.015625% |

| Coupon Frequency | 2 |

| Basis | 1 |

- Previous coupon payment date (EXCEL equivalent of COUPPCD):

pcd = Bond.couppcd(settlement=date(2020,7,15), maturity=date(2030,5,15), frequency=2, basis=1)

print(pcd)

The "basis" argument specifies the day count convention

| Basis | Day Count |

|---|---|

| 0 | 30/360 |

| 1 | actual/actual |

| 2 | actual/360 |

| 3 | actual/365 |

| 4 | 30E/360 |

- Next coupon payment date (EXCEL equivalent of COUPNCD):

ncd = Bond.coupncd(settlement=date(2020,7,15), maturity=date(2030,5,15), frequency=2, basis=1)

print(ncd)

- Accrued interest (EXCEL equivalent of ACCRINT)

accrued_int = Bond.accrint(issue=pcd, first_interest=ncd,

settlement=date(2020,7,15), rate=0.625, par=1, frequency=2, basis=1)

print(accrued_int)

- Bond dirty price (EXCEL equivalent of PRICE)

# Given bond yield, calculate bond dirty price. Assuming yield is 0.6233%

dirty_price = Bond.dirty_price(settlement=date(2020,7,15), maturity=date(2030,5,15),

rate=0.625, yld=0.6233, redemption=100, frequency=2, basis=1)

print(dirty_price)

- Bond yield (EXCEL equivalent of YIELD)

yld = Bond.yld(settlement=date(2020,7,15), maturity=date(2030,5,15), rate=0.625,

pr=100.015625, redemption=100, frequency=2, basis=1)

print(yld)

- Bond Macaulay duration, modified duration, DV01 and convexity

# first construct a Bond object

bond_test = Bond(settlement=date(2020,7,15), maturity=date(2030,5,15),

coupon_perc=0.625, price_perc=100.015625, frequency=2, basis=1)

# Macaulay duration

bond_test.mac_duration()

# modified duration

bond_test.mod_duration()

# DV01

bond_test.DV01()

# convexity

bond_test.convexity()

- Estimate bond price change with respect to yield change

# For 0.1% change in yield, the bond price will change by:

bond_test.price_change(yld_change_perc=0.1)

Suppose we have a bond and repo with following information.

| Repo and Bond Info | |

|---|---|

| Settlement | 2020-7-15 |

| Maturity | 2030-5-15 |

| Coupon | 0.625% |

| Market Price | 99.9375% |

| Coupon Frequency | 2 |

| Basis | 1 |

| Face Value | $100,000,000 |

| Repo Period | 1 |

| Repo Rate | 0.145% |

- Repo purchase price

# first construct a repo object

repo_test = Repo(settlement=date(2020,7,15), maturity=date(2030,5,15),

coupon_perc=0.625, price_perc=(99+30/32), frequency=2, basis=1,

bond_face_value=100000000, repo_period=1, repo_rate_perc=0.145)

# another way to construct a repo object is to use repo end date

repo_test2 = Repo.from_end_date(settlement=date(2020,7,15), maturity=date(2030,5,15),

coupon_perc=0.625, price_perc=(99+30/32), frequency=2, basis=1,

bond_face_value=100000000, repo_end_date=date(2020,7,16), repo_rate_perc=0.145)

# purchase price without margin or haircut

repo_test.start_payment()

# purchase price with margin

repo_test.purchase_pr_with_margin(margin_perc=102)

# purchase price with haircut

repo_test.purchase_pr_with_haircut(haircut_perc=2)

- Repo end payment

repo_test.end_payment()

The Repo purchase and end payment can also be obtained by providing only partial bond information.

# purchase payment

start_payment = Repo.get_start_payment(bond_face_value=100000000, dirty_price_perc=100.06)

print(start_payment)

# end payment

end_payment = Repo.get_end_payment(bond_face_value=100000000, dirty_price_perc=100.06,

repo_period=32, repo_rate_perc=0.145, type='US')

print(end_payment)

- Break even yield

repo_test.break_even_yld()

Suppose we have the following bond future information.

| Bond Future Info | |

|---|---|

| Settlement | 2020-7-17 |

| Maturity | 2027-5-15 |

| Coupon | 2.375% |

| Market Price | 113.015625% |

| Coupon Frequency | 2 |

| Basis | 1 |

| Repo Period | 75 |

| Repo Rate | 0.14% |

| Future Price | 139.4375% |

| Conversion Factor | 0.8072 |

# first construct a bond future object

bf_test = BondFuture(settlement=date(2020,7,15), maturity=date(2030,5,15), coupon_perc=0.625,

price_perc=99.9375, frequency=2, basis=1, repo_period=30, repo_rate_perc=0.145,

futures_pr_perc=140, conversion_factor=0.8)

# similar to repo, another way to construct a bond future object is to use repo end date

# BondFuture.from_end_date()

- Forward price

bf_test.forward_price()

- Future value

bf_test.full_future_val()

- Net basis

bf_test.net_basis()

- Implied repo rate

bf_test.implied_repo_rate()

Assuing we have 1-10 years risk free bond rate of 3.12% and 1-10 years risky bond rate of 3.72%. i.e.

| Maturity | Risk Free Rate | Risky Rate |

|---|---|---|

| 1 | 3.12% | 3.72% |

| 2 | 3.12% | 3.72% |

| 3 | 3.12% | 3.72% |

| 4 | 3.12% | 3.72% |

| 5 | 3.12% | 3.72% |

| 6 | 3.12% | 3.72% |

| 7 | 3.12% | 3.72% |

| 8 | 3.12% | 3.72% |

| 9 | 3.12% | 3.72% |

| 10 | 3.12% | 3.72% |

To calculate CDS, first construct a CDS object:

# suppose the recovery rate is 40%

cds_test = CDS(risk_free_perc=np.array([3.12]*10), risky_perc=np.array([3.72]*10),

face_value_perc=100, rr_perc=40)

Obtain CDS spread:

cds_test.cds_spread()

An alternative way of constructing CDS object is to risk free rate and bond spread

cds_test2 = CDS.from_bond_spread(risk_free_perc=np.array([3.12]*10),

spread_perc=np.array([0.6]*10), face_value_perc=100, rr_perc=40)

cds_test2.cds_spread()