Stock-Prediction-Models, Gathers machine learning and deep learning models for Stock forecasting, included trading bots and simulations.

- LSTM

- LSTM Bidirectional

- LSTM 2-Path

- GRU

- GRU Bidirectional

- GRU 2-Path

- Vanilla

- Vanilla Bidirectional

- Vanilla 2-Path

- LSTM Seq2seq

- LSTM Bidirectional Seq2seq

- LSTM Seq2seq VAE

- GRU Seq2seq

- GRU Bidirectional Seq2seq

- GRU Seq2seq VAE

- Attention-is-all-you-Need

- CNN-Seq2seq

- Dilated-CNN-Seq2seq

Bonus

- How to use one of the model to forecast

t + N, how-to-forecast.ipynb - Consensus, how to use sentiment data to forecast

t + N, sentiment-consensus.ipynb

- Deep Feed-forward Auto-Encoder Neural Network to reduce dimension + Deep Recurrent Neural Network + ARIMA + Extreme Boosting Gradient Regressor

- Adaboost + Bagging + Extra Trees + Gradient Boosting + Random Forest + XGB

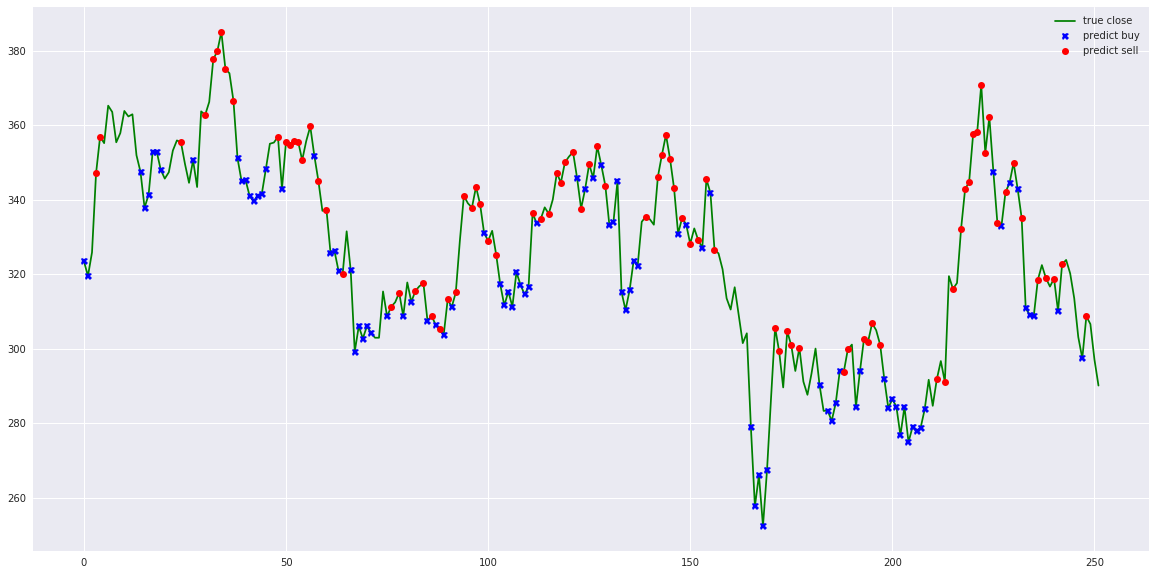

- Turtle-trading agent

- Moving-average agent

- Signal rolling agent

- Policy-gradient agent

- Q-learning agent

- Evolution-strategy agent

- Double Q-learning agent

- Recurrent Q-learning agent

- Double Recurrent Q-learning agent

- Duel Q-learning agent

- Double Duel Q-learning agent

- Duel Recurrent Q-learning agent

- Double Duel Recurrent Q-learning agent

- Actor-critic agent

- Actor-critic Duel agent

- Actor-critic Recurrent agent

- Actor-critic Duel Recurrent agent

- Curiosity Q-learning agent

- Recurrent Curiosity Q-learning agent

- Duel Curiosity Q-learning agent

- Neuro-evolution agent

- Neuro-evolution with Novelty search agent

- ABCD strategy agent

- stock market study on TESLA stock, tesla-study.ipynb

- Outliers study using K-means, SVM, and Gaussian on TESLA stock, outliers.ipynb

- Overbought-Oversold study on TESLA stock, overbought-oversold.ipynb

- Which stock you need to buy? which-stock.ipynb

- Simple Monte Carlo, monte-carlo-drift.ipynb

- Dynamic volatility Monte Carlo, monte-carlo-dynamic-volatility.ipynb

- Drift Monte Carlo, monte-carlo-drift.ipynb

- Multivariate Drift Monte Carlo BTC/USDT with Bitcurate sentiment, multivariate-drift-monte-carlo.ipynb

- Portfolio optimization, portfolio-optimization.ipynb, inspired from https://pythonforfinance.net/2017/01/21/investment-portfolio-optimisation-with-python/

I code LSTM Recurrent Neural Network and Simple signal rolling agent inside Tensorflow JS, you can try it here, huseinhouse.com/stock-forecasting-js, you can download any historical CSV and upload dynamically.

- fashion trending prediction with cross-validation, fashion-forecasting.ipynb

- Bitcoin analysis with LSTM prediction, bitcoin-analysis-lstm.ipynb

- Kijang Emas Bank Negara, kijang-emas-bank-negara.ipynb

This agent only able to buy or sell 1 unit per transaction.

- Turtle-trading agent, turtle-agent.ipynb

- Moving-average agent, moving-average-agent.ipynb

- Signal rolling agent, signal-rolling-agent.ipynb

- Policy-gradient agent, policy-gradient-agent.ipynb

- Q-learning agent, q-learning-agent.ipynb

- Evolution-strategy agent, evolution-strategy-agent.ipynb

- Double Q-learning agent, double-q-learning-agent.ipynb

- Recurrent Q-learning agent, recurrent-q-learning-agent.ipynb

- Double Recurrent Q-learning agent, double-recurrent-q-learning-agent.ipynb

- Duel Q-learning agent, duel-q-learning-agent.ipynb

- Double Duel Q-learning agent, double-duel-q-learning-agent.ipynb

- Duel Recurrent Q-learning agent, duel-recurrent-q-learning-agent.ipynb

- Double Duel Recurrent Q-learning agent, double-duel-recurrent-q-learning-agent.ipynb

- Actor-critic agent, actor-critic-agent.ipynb

- Actor-critic Duel agent, actor-critic-duel-agent.ipynb

- Actor-critic Recurrent agent, actor-critic-recurrent-agent.ipynb

- Actor-critic Duel Recurrent agent, actor-critic-duel-recurrent-agent.ipynb

- Curiosity Q-learning agent, curiosity-q-learning-agent.ipynb

- Recurrent Curiosity Q-learning agent, recurrent-curiosity-q-learning.ipynb

- Duel Curiosity Q-learning agent, duel-curiosity-q-learning-agent.ipynb

- Neuro-evolution agent, neuro-evolution.ipynb

- Neuro-evolution with Novelty search agent, neuro-evolution-novelty-search.ipynb

- ABCD strategy agent, abcd-strategy.ipynb

I will cut the dataset to train and test datasets,

- Train dataset derived from starting timestamp until last 30 days

- Test dataset derived from last 30 days until end of the dataset

So we will let the model do forecasting based on last 30 days, and we will going to repeat the experiment for 10 times. You can increase it locally if you want, and tuning parameters will help you by a lot.

- LSTM, accuracy 95.693%, time taken for 1 epoch 01:09

- LSTM Bidirectional, accuracy 93.8%, time taken for 1 epoch 01:40

- LSTM 2-Path, accuracy 94.63%, time taken for 1 epoch 01:39

- GRU, accuracy 94.63%, time taken for 1 epoch 02:10

- GRU Bidirectional, accuracy 92.5673%, time taken for 1 epoch 01:40

- GRU 2-Path, accuracy 93.2117%, time taken for 1 epoch 01:39

- Vanilla, accuracy 91.4686%, time taken for 1 epoch 00:52

- Vanilla Bidirectional, accuracy 88.9927%, time taken for 1 epoch 01:06

- Vanilla 2-Path, accuracy 91.5406%, time taken for 1 epoch 01:08

- LSTM Seq2seq, accuracy 94.9817%, time taken for 1 epoch 01:36

- LSTM Bidirectional Seq2seq, accuracy 94.517%, time taken for 1 epoch 02:30

- LSTM Seq2seq VAE, accuracy 95.4190%, time taken for 1 epoch 01:48

- GRU Seq2seq, accuracy 90.8854%, time taken for 1 epoch 01:34

- GRU Bidirectional Seq2seq, accuracy 67.9915%, time taken for 1 epoch 02:30

- GRU Seq2seq VAE, accuracy 89.1321%, time taken for 1 epoch 01:48

- Attention-is-all-you-Need, accuracy 94.2482%, time taken for 1 epoch 01:41

- CNN-Seq2seq, accuracy 90.74%, time taken for 1 epoch 00:43

- Dilated-CNN-Seq2seq, accuracy 95.86%, time taken for 1 epoch 00:14

Bonus

- How to forecast,

- Sentiment consensus,

- Outliers study using K-means, SVM, and Gaussian on TESLA stock

- Overbought-Oversold study on TESLA stock

- Which stock you need to buy?

- Simple Monte Carlo

- Dynamic volatity Monte Carlo

- Drift Monte Carlo

- Multivariate Drift Monte Carlo BTC/USDT with Bitcurate sentiment

- Portfolio optimization