Written by: Javier Ng

With 79 explanatory variables describing (almost) every aspect of residential homes in Ames, Iowa, this Kaggle competition challenges you to predict the final price of each home. This is an excellent opportunity to test out your feature engineering, RFs and gradient boosting techniques.

You can download the dataset from the Data folder, train.csv and test.csv. Below are the file descriptions.

- train.csv - the training set

- test.csv - the test set

- data_description.txt - full description of each column, originally prepared by Dean De Cock but lightly edited to match the column names used here

- sample_submission.csv - a benchmark submission from a linear regression on year and month of sale, lot square footage, and number of bedrooms

Here's a brief version of what you'll find in the data description file.

- SalePrice - the property's sale price in dollars. This is the target variable that you're trying to predict.

- MSSubClass: The building class

- MSZoning: The general zoning classification

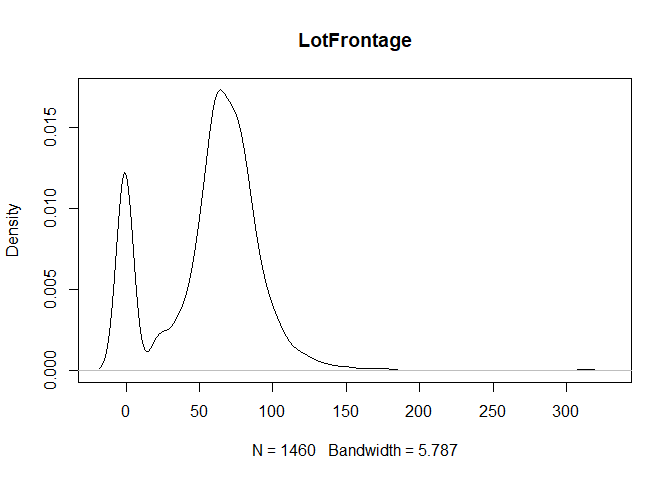

- LotFrontage: Linear feet of street connected to property

- LotArea: Lot size in square feet

- Street: Type of road access

- Alley: Type of alley access

- LotShape: General shape of property

- LandContour: Flatness of the property

- Utilities: Type of utilities available

- LotConfig: Lot configuration

- LandSlope: Slope of property

- Neighborhood: Physical locations within Ames city limits

- Condition1: Proximity to main road or railroad

- Condition2: Proximity to main road or railroad (if a second is present)

- BldgType: Type of dwelling

- HouseStyle: Style of dwelling

- OverallQual: Overall material and finish quality

- OverallCond: Overall condition rating

- YearBuilt: Original construction date

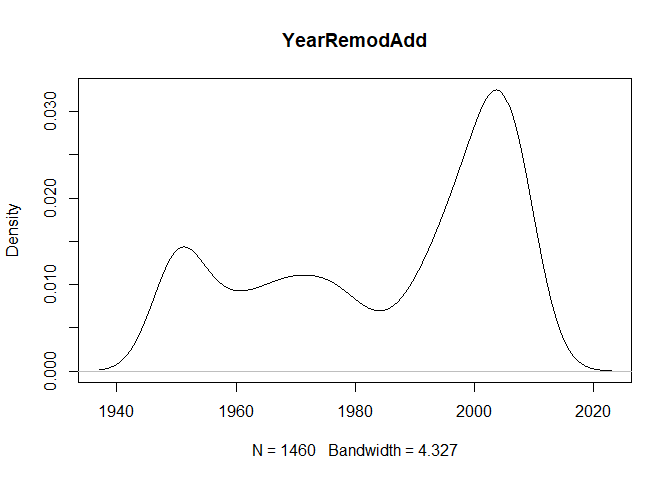

- YearRemodAdd: Remodel date

- RoofStyle: Type of roof

- RoofMatl: Roof material

- Exterior1st: Exterior covering on house

- Exterior2nd: Exterior covering on house (if more than one material)

- MasVnrType: Masonry veneer type

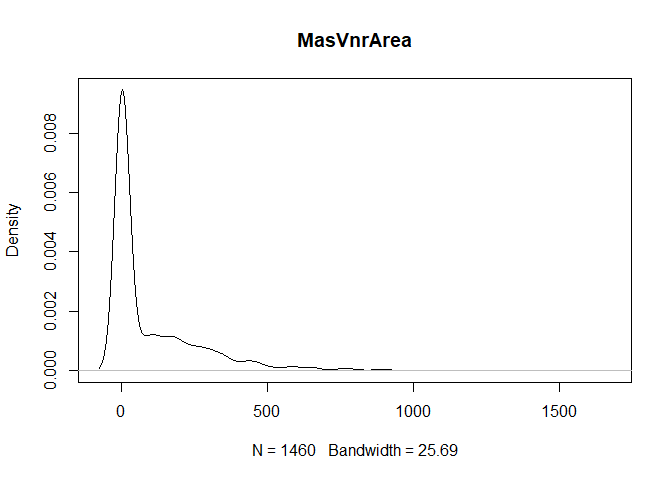

- MasVnrArea: Masonry veneer area in square feet

- ExterQual: Exterior material quality

- ExterCond: Present condition of the material on the exterior

- Foundation: Type of foundation

- BsmtQual: Height of the basement

- BsmtCond: General condition of the basement

- BsmtExposure: Walkout or garden level basement walls

- BsmtFinType1: Quality of basement finished area

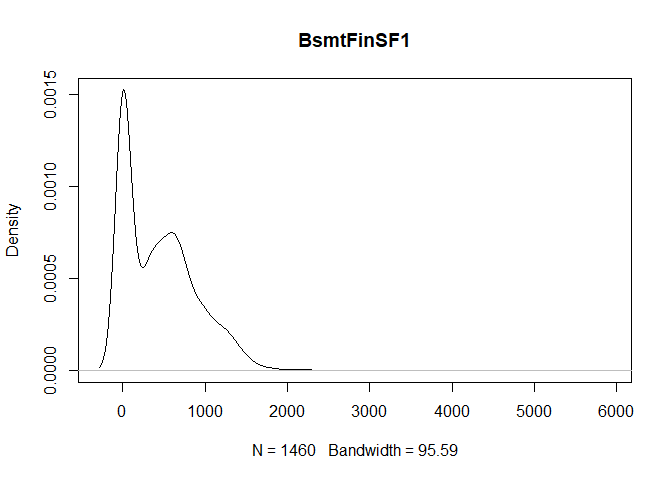

- BsmtFinSF1: Type 1 finished square feet

- BsmtFinType2: Quality of second finished area (if present)

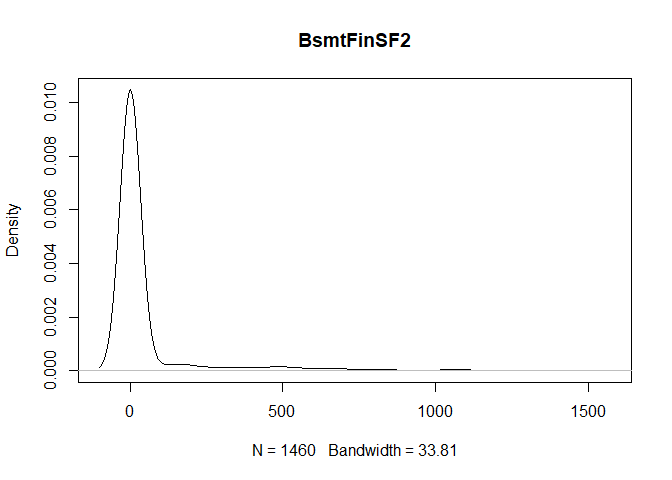

- BsmtFinSF2: Type 2 finished square feet

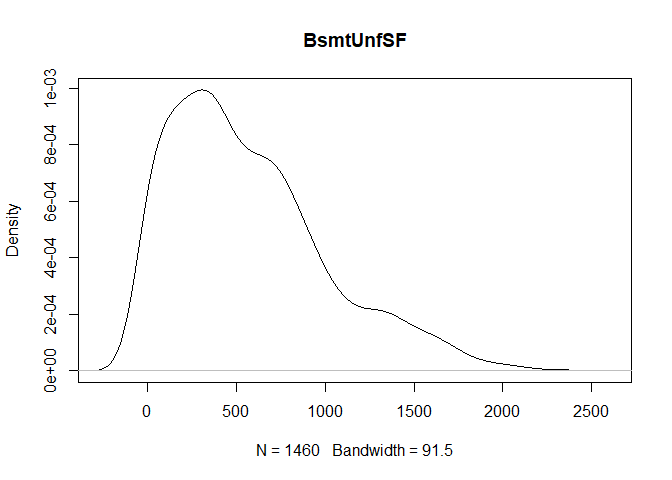

- BsmtUnfSF: Unfinished square feet of basement area

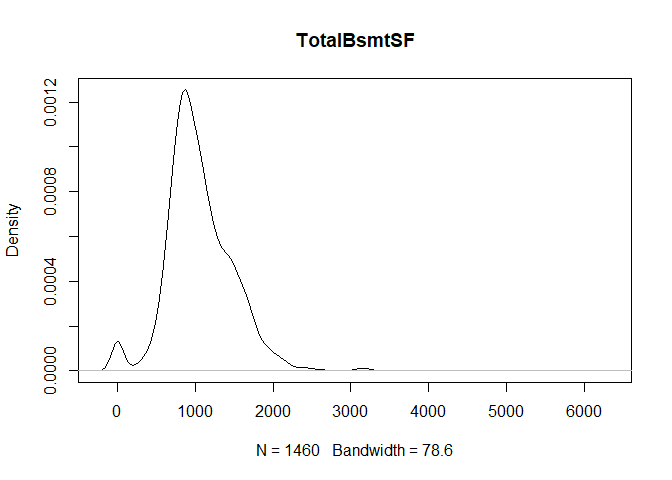

- TotalBsmtSF: Total square feet of basement area

- Heating: Type of heating

- HeatingQC: Heating quality and condition

- CentralAir: Central air conditioning

- Electrical: Electrical system

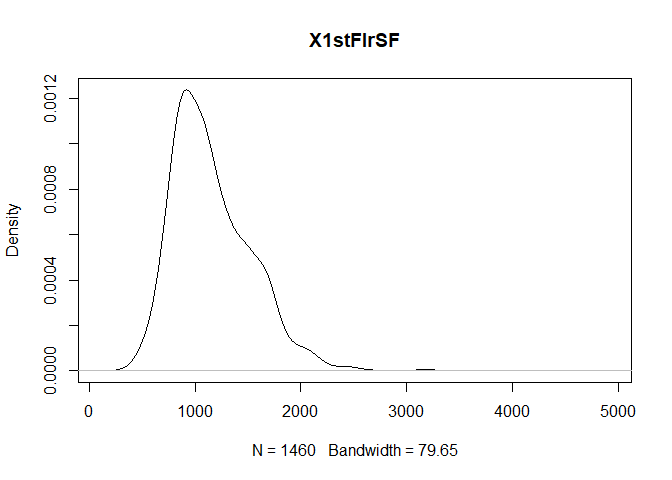

- 1stFlrSF: First Floor square feet

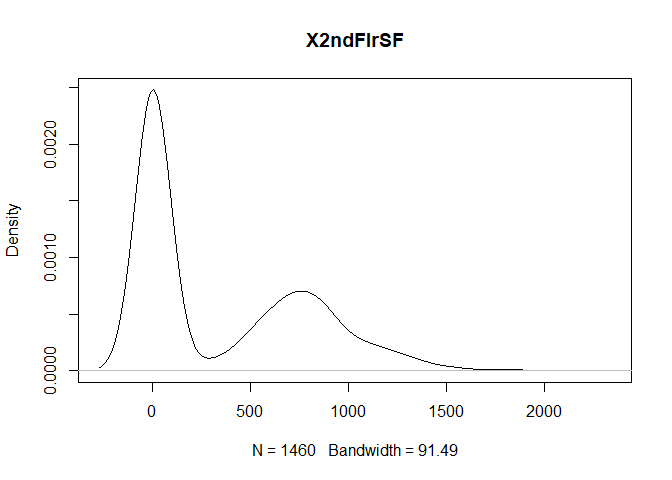

- 2ndFlrSF: Second floor square feet

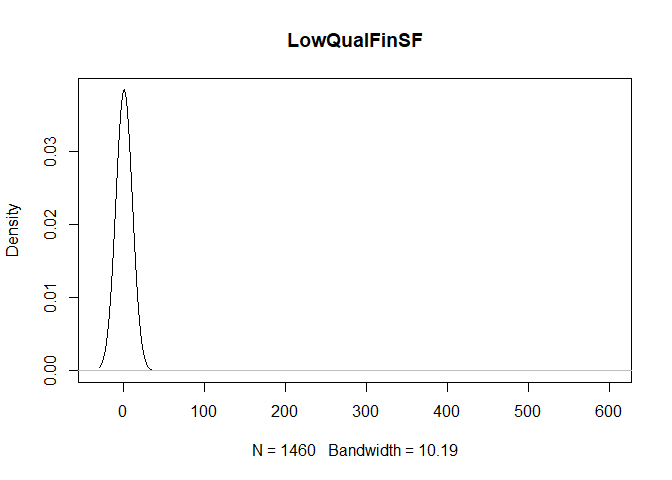

- LowQualFinSF: Low quality finished square feet (all floors)

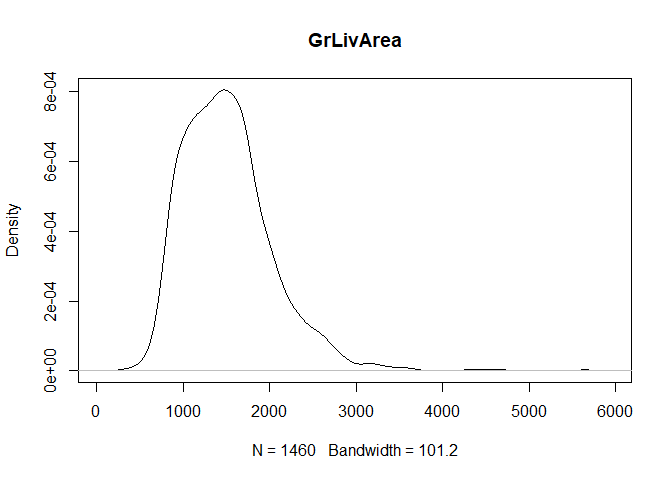

- GrLivArea: Above grade (ground) living area square feet

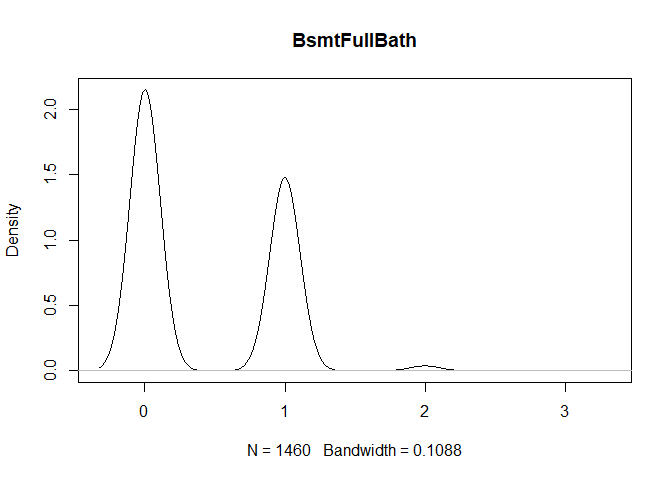

- BsmtFullBath: Basement full bathrooms

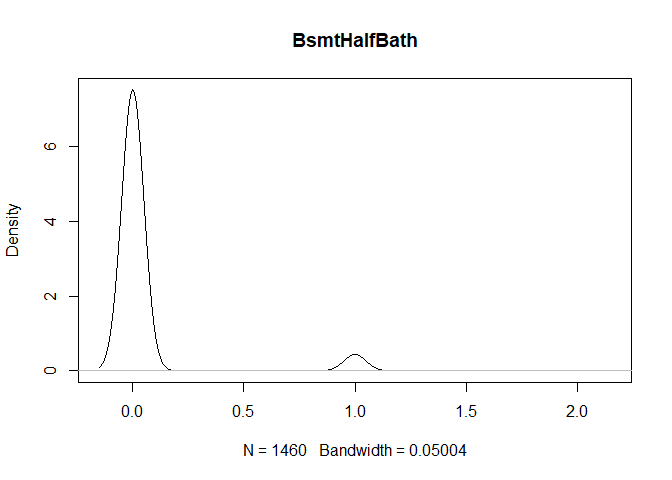

- BsmtHalfBath: Basement half bathrooms

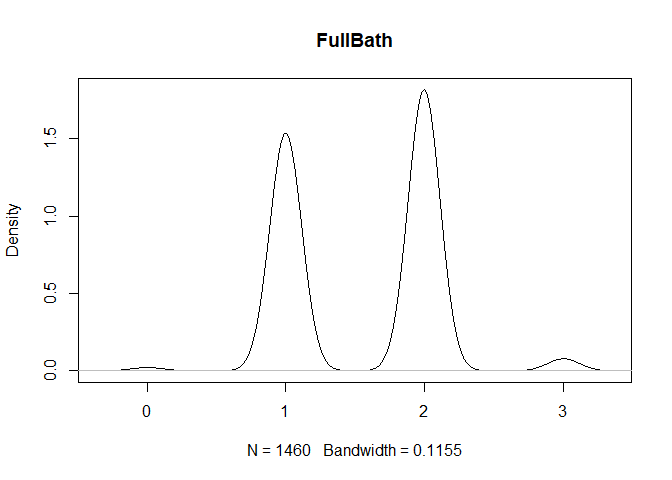

- FullBath: Full bathrooms above grade

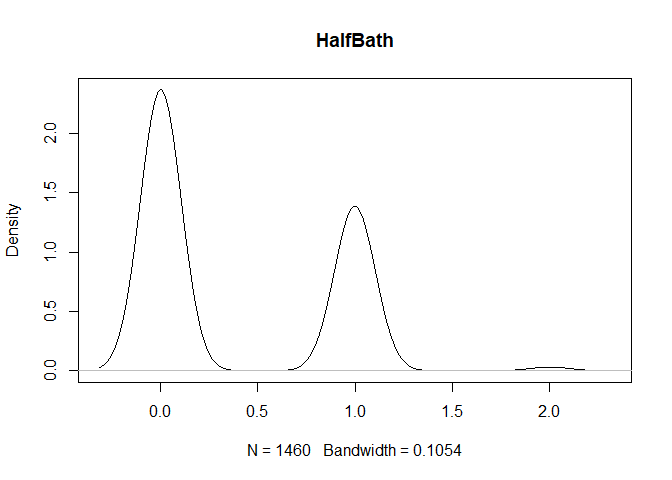

- HalfBath: Half baths above grade

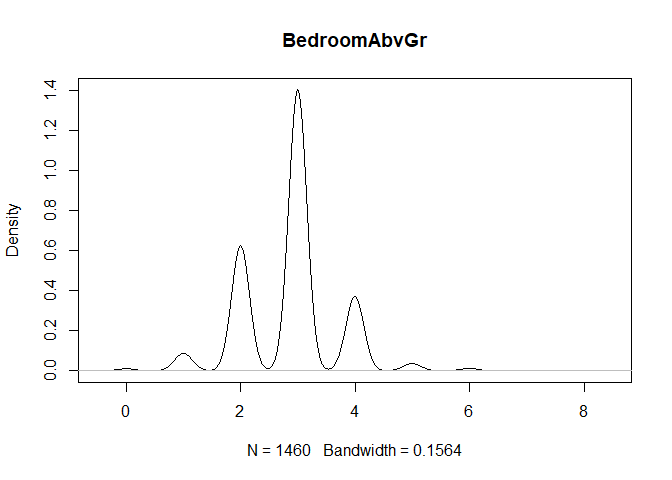

- Bedroom: Number of bedrooms above basement level

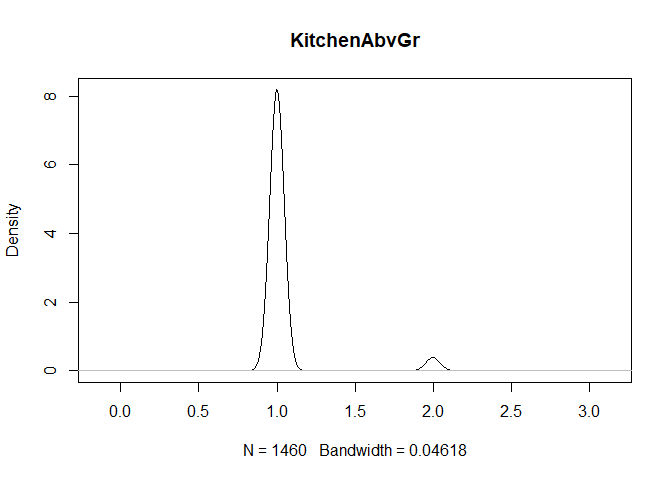

- Kitchen: Number of kitchens

- KitchenQual: Kitchen quality

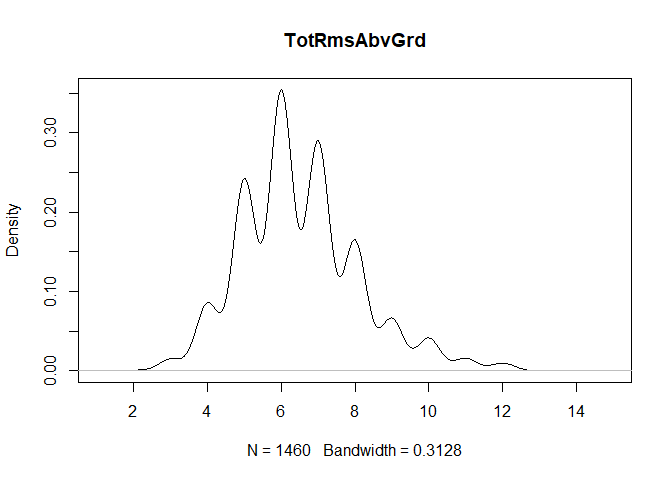

- TotRmsAbvGrd: Total rooms above grade (does not include bathrooms)

- Functional: Home functionality rating

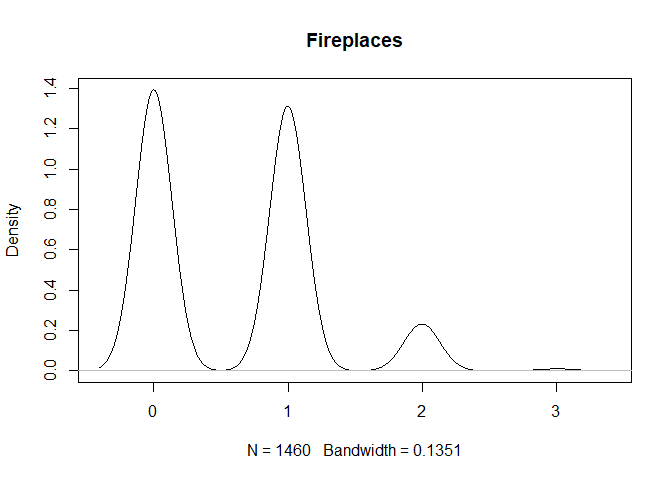

- Fireplaces: Number of fireplaces

- FireplaceQu: Fireplace quality

- GarageType: Garage location

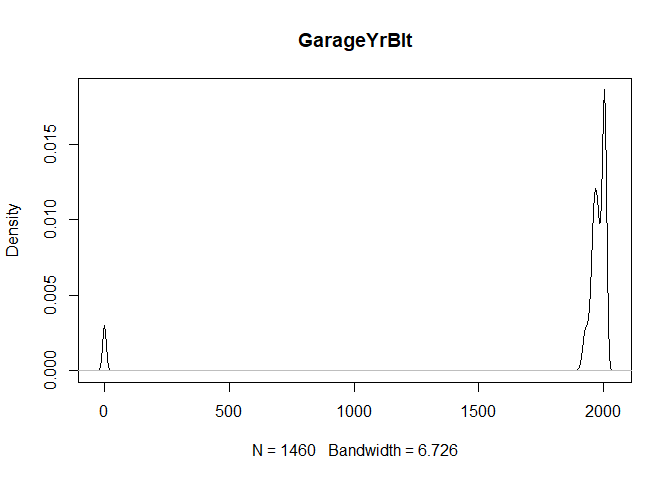

- GarageYrBlt: Year garage was built

- GarageFinish: Interior finish of the garage

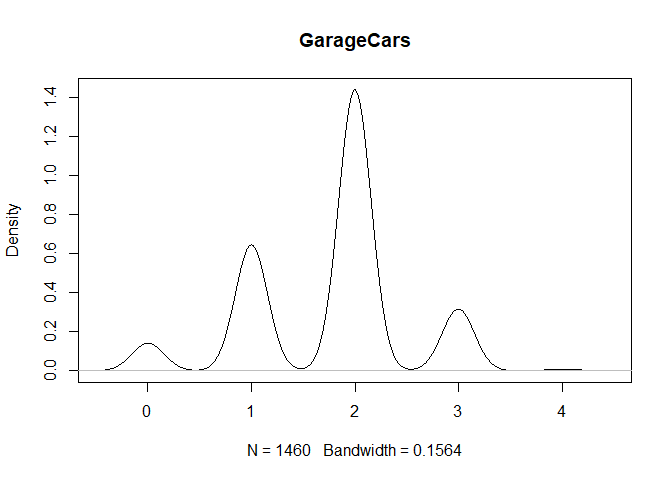

- GarageCars: Size of garage in car capacity

- GarageArea: Size of garage in square feet

- GarageQual: Garage quality

- GarageCond: Garage condition

- PavedDrive: Paved driveway

- WoodDeckSF: Wood deck area in square feet

- OpenPorchSF: Open porch area in square feet

- EnclosedPorch: Enclosed porch area in square feet

- 3SsnPorch: Three season porch area in square feet

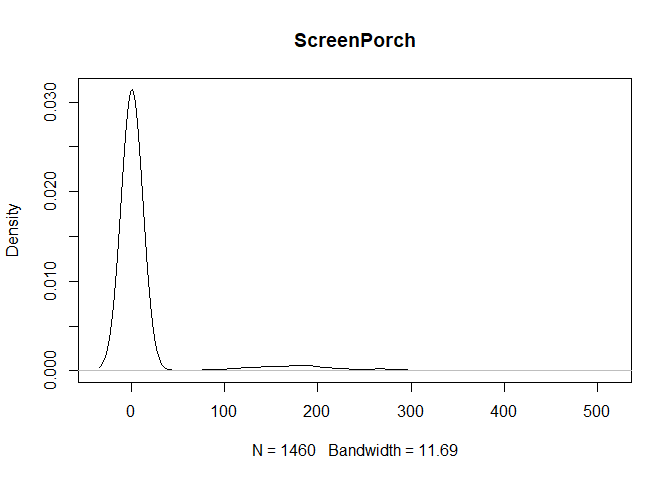

- ScreenPorch: Screen porch area in square feet

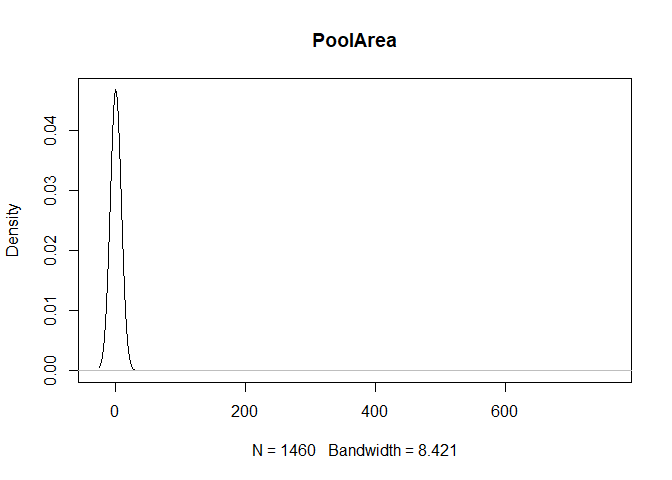

- PoolArea: Pool area in square feet

- PoolQC: Pool quality

- Fence: Fence quality

- MiscFeature: Miscellaneous feature not covered in other categories

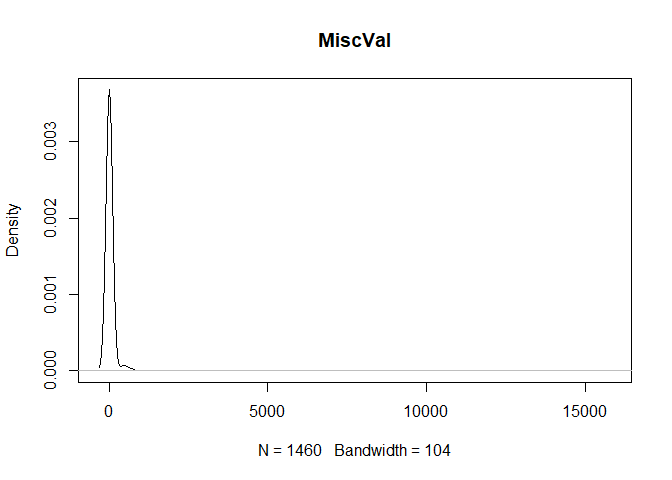

- MiscVal: $Value of miscellaneous feature

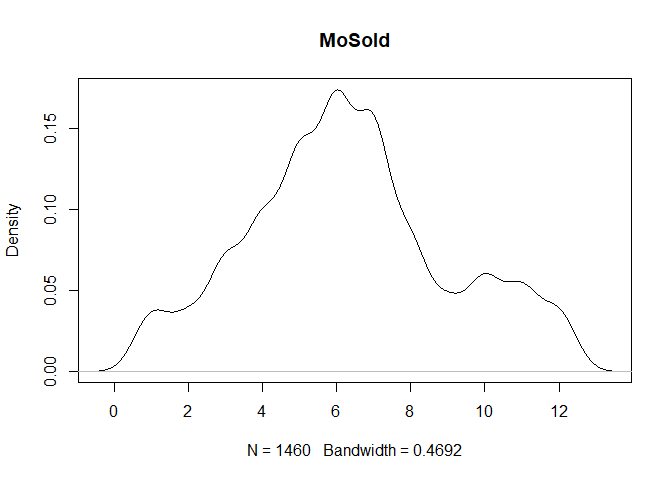

- MoSold: Month Sold

- YrSold: Year Sold

- SaleType: Type of sale

- SaleCondition: Condition of sale

suppressMessages(library(ggplot2))

suppressMessages(library(naniar))## Warning: package 'naniar' was built under R version 3.4.4

suppressMessages(library(dplyr))

suppressMessages(library(gridExtra))## Warning: package 'gridExtra' was built under R version 3.4.4

train <- read.csv("train.csv", stringsAsFactors = FALSE) #using strings as factors=F cos train and test datasets have different factor numbers for some features

test <- read.csv("test.csv", stringsAsFactors = FALSE) #missing sale price#removing saleprice from train dataset

SalePrice <- train$SalePrice

train <- select(train, -SalePrice)

#combining datasets

full <- rbind(train, test)

#fill NA with missing and convert chr columns to factors

for (col in colnames(full)){ #using for loop

if (typeof(full[,col]) == "character"){ #if the type of column = character, then we replace NA with missing

new_col = full[,col] #obtain the character column

new_col[is.na(new_col)] = "missing" #replace NA with missing

full[col] = as.factor(new_col) #change the column to factor

}

}

#separating train data from full

train <- full[1:nrow(train),] #getting back the rows for train

train <- cbind(train, SalePrice)#combining the sale price back to train

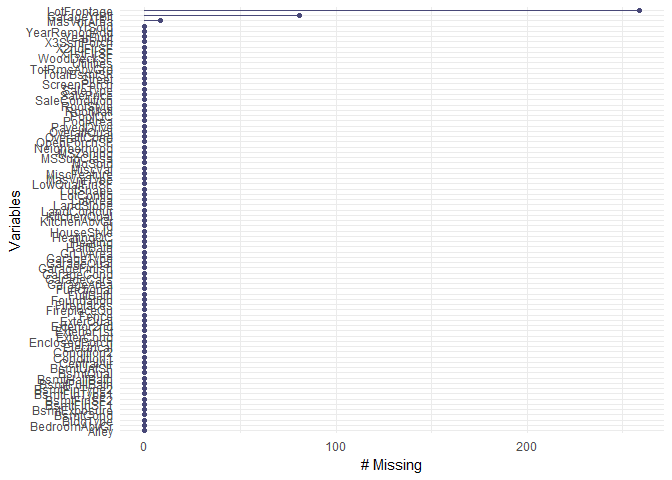

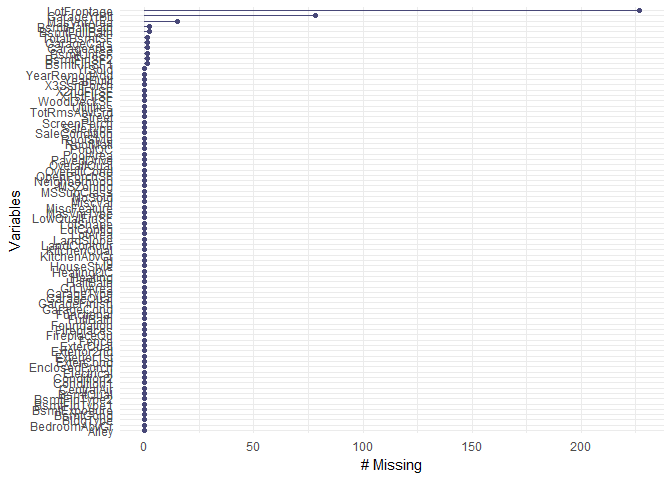

test <- full[(nrow(train)+1):(nrow(full)),]Missing data is visualized using the naniar library and replaced with the integer, -1.

#Visualizing missing data

gg_miss_var(train, show_pct = F) + labs("Missing")gg_miss_var(test, show_pct = F) + labs("Missing")#replacing NA values under integer type col with -1

train[is.na(train)] <- -1

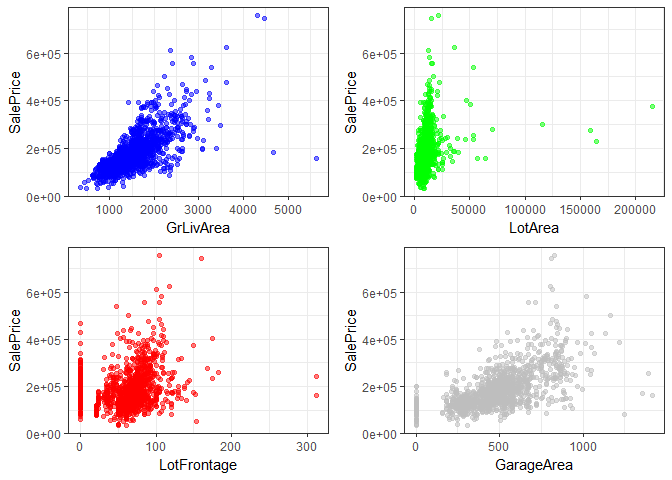

test[is.na(test)] <- -1#EDA - trying to see a relationship between property size/area with sale price

p1 <- ggplot(train, aes(GrLivArea, SalePrice)) + geom_point(alpha = 0.5, color = 'blue') + theme_bw()

p2 <- ggplot(train, aes(LotArea, SalePrice)) + geom_point(alpha = 0.5,color = 'green') + theme_bw()

p3 <- ggplot(train, aes(LotFrontage, SalePrice)) + geom_point(alpha = 0.5,color = 'red') + theme_bw()

p4 <- ggplot(train, aes(GarageArea, SalePrice)) + geom_point(alpha = 0.5,color = 'gray') + theme_bw()

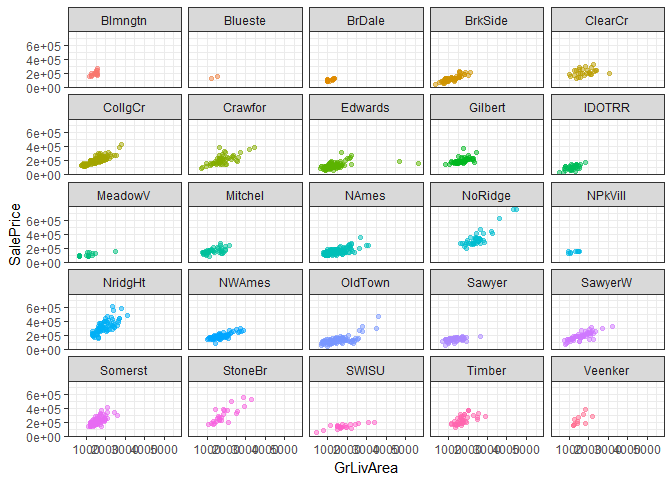

grid.arrange(p1, p2, p3, p4, ncol=2)ggplot(train, aes(GrLivArea, SalePrice)) + geom_point(aes(color = Neighborhood), alpha=0.5) +

scale_x_continuous("GrLivArea") +

scale_y_continuous("SalePrice") +

theme_bw() + facet_wrap( ~ Neighborhood) + theme(legend.position="none")#----------Identifying highly correlated predictors with SalePrice----------#

for (col in colnames(train)){ #start of loop function btw each column

if(is.numeric(train[,col])){ #identify if the column is numeric, else ignore

if( abs(cor(train[,col],train$SalePrice)) > 0.5){ #if the absolute number (i.e. numeric) of the correlation btw each col vs SalePrice > 0.5

print(col) #print out the name of the column if the correlation no. is > 0.5

print( cor(train[,col],train$SalePrice) ) #print out the correlation value

}

}

}## [1] "OverallQual"

## [1] 0.7909816

## [1] "YearBuilt"

## [1] 0.5228973

## [1] "YearRemodAdd"

## [1] 0.507101

## [1] "TotalBsmtSF"

## [1] 0.6135806

## [1] "X1stFlrSF"

## [1] 0.6058522

## [1] "GrLivArea"

## [1] 0.7086245

## [1] "FullBath"

## [1] 0.5606638

## [1] "TotRmsAbvGrd"

## [1] 0.5337232

## [1] "GarageCars"

## [1] 0.6404092

## [1] "GarageArea"

## [1] 0.6234314

## [1] "SalePrice"

## [1] 1

#----------Identifying lowly correlated predictors with SalePrice----------#

for (col in colnames(train)){ #start of loop function btw each column

if(is.numeric(train[,col])){ #identify if the column is numeric, else ignore

if( abs(cor(train[,col],train$SalePrice)) < 0.1){ #if the absolute number (i.e. numeric) of the correlation btw each col vs SalePrice > 0.5

print(col) #print out the name of the column if the correlation no. is < 0.1

print( cor(train[,col],train$SalePrice) ) #print out the correlation value

}

}

}## [1] "Id"

## [1] -0.02191672

## [1] "MSSubClass"

## [1] -0.08428414

## [1] "OverallCond"

## [1] -0.07785589

## [1] "BsmtFinSF2"

## [1] -0.01137812

## [1] "LowQualFinSF"

## [1] -0.02560613

## [1] "BsmtHalfBath"

## [1] -0.01684415

## [1] "X3SsnPorch"

## [1] 0.04458367

## [1] "PoolArea"

## [1] 0.09240355

## [1] "MiscVal"

## [1] -0.02118958

## [1] "MoSold"

## [1] 0.04643225

## [1] "YrSold"

## [1] -0.02892259

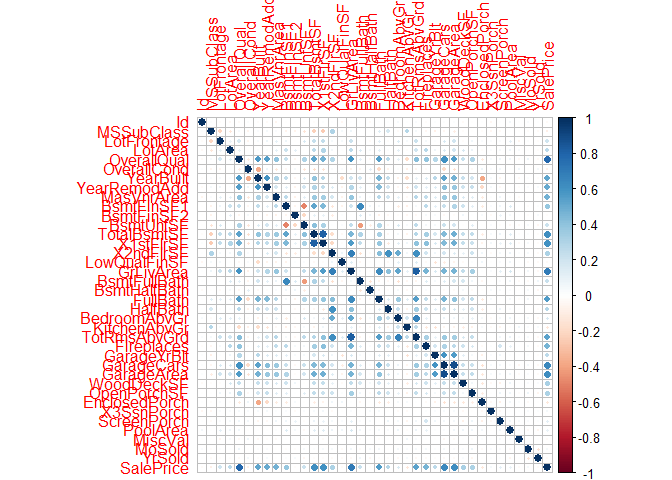

#----------Identifying if the features are correlated to each other-------#

cors = cor(train[ , sapply(train, is.numeric)]) #shows a correlation matrix

high_cor = which(abs(cors) > 0.6 & (abs(cors) < 1)) #identify the positions of high correlation features, counting from col down!

rows = rownames(cors)[((high_cor-1) %/% 38)+1] # %/% = integer division i.e. 5 %/% 2 = 2/ 38 BECAUSE it has 38 col & rows!

cols = colnames(cors)[ifelse(high_cor %% 38 == 0, 38, high_cor %% 38)] #modulus (x mod y) 5%%2 = 1

vals = cors[high_cor]

cor_data = data.frame(cols=cols, rows=rows, correlation=vals)

cor_data #as none of them are >0.9, we dont have to remove any features## cols rows correlation

## 1 GarageCars OverallQual 0.6006707

## 2 SalePrice OverallQual 0.7909816

## 3 BsmtFullBath BsmtFinSF1 0.6492118

## 4 X1stFlrSF TotalBsmtSF 0.8195300

## 5 SalePrice TotalBsmtSF 0.6135806

## 6 TotalBsmtSF X1stFlrSF 0.8195300

## 7 SalePrice X1stFlrSF 0.6058522

## 8 GrLivArea X2ndFlrSF 0.6875011

## 9 HalfBath X2ndFlrSF 0.6097073

## 10 TotRmsAbvGrd X2ndFlrSF 0.6164226

## 11 X2ndFlrSF GrLivArea 0.6875011

## 12 FullBath GrLivArea 0.6300116

## 13 TotRmsAbvGrd GrLivArea 0.8254894

## 14 SalePrice GrLivArea 0.7086245

## 15 BsmtFinSF1 BsmtFullBath 0.6492118

## 16 GrLivArea FullBath 0.6300116

## 17 X2ndFlrSF HalfBath 0.6097073

## 18 TotRmsAbvGrd BedroomAbvGr 0.6766199

## 19 X2ndFlrSF TotRmsAbvGrd 0.6164226

## 20 GrLivArea TotRmsAbvGrd 0.8254894

## 21 BedroomAbvGr TotRmsAbvGrd 0.6766199

## 22 OverallQual GarageCars 0.6006707

## 23 GarageArea GarageCars 0.8824754

## 24 SalePrice GarageCars 0.6404092

## 25 GarageCars GarageArea 0.8824754

## 26 SalePrice GarageArea 0.6234314

## 27 OverallQual SalePrice 0.7909816

## 28 TotalBsmtSF SalePrice 0.6135806

## 29 X1stFlrSF SalePrice 0.6058522

## 30 GrLivArea SalePrice 0.7086245

## 31 GarageCars SalePrice 0.6404092

## 32 GarageArea SalePrice 0.6234314

library(corrplot) ## Warning: package 'corrplot' was built under R version 3.4.4

## corrplot 0.84 loaded

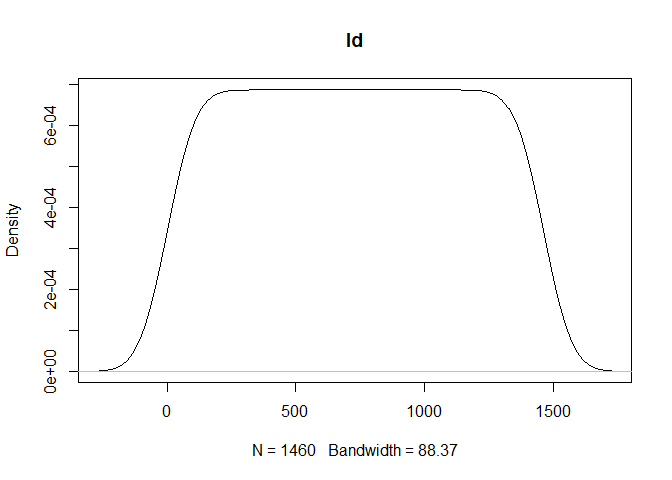

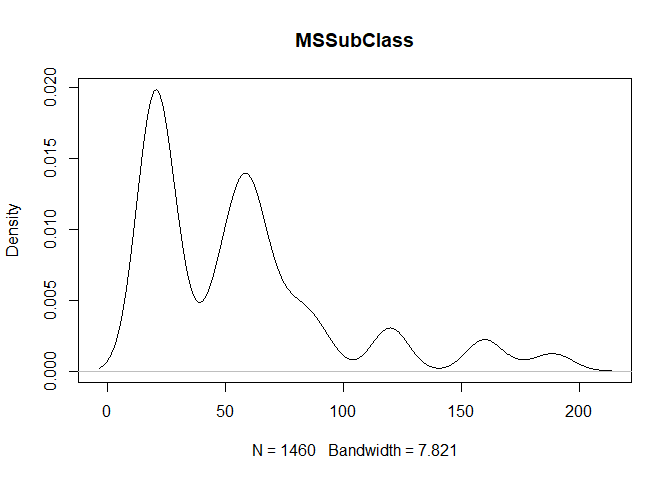

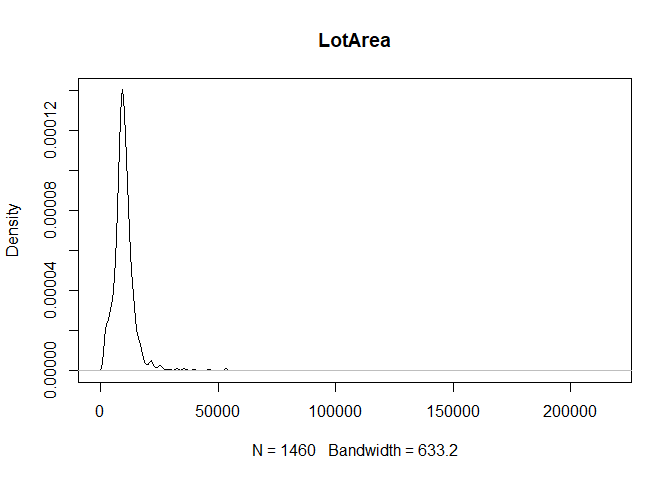

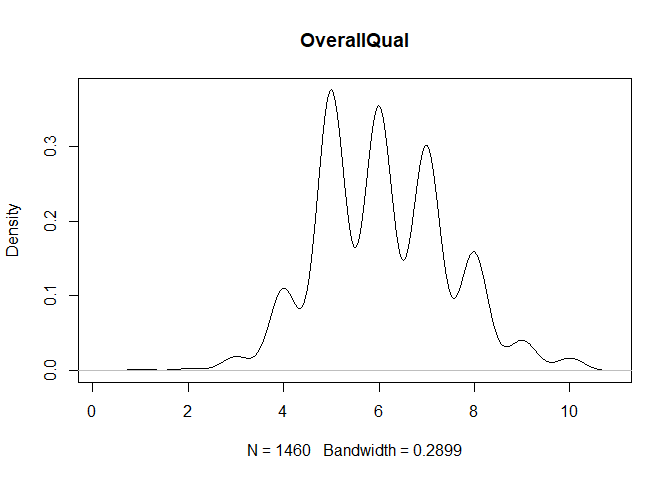

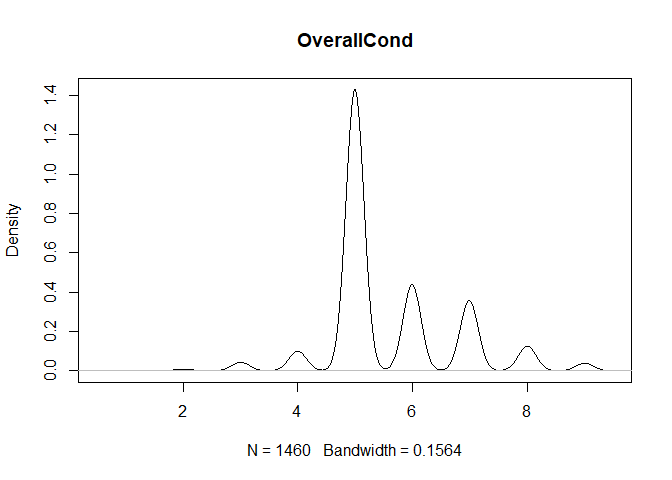

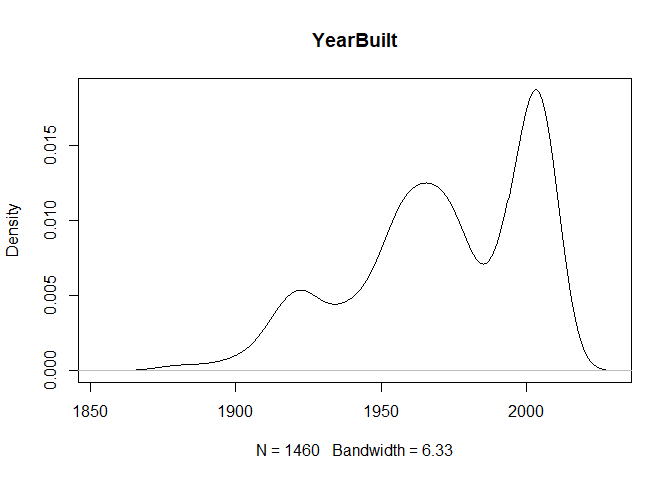

corrplot(cors) #visualize correlation#------Identify outliers for numeric cols-----#

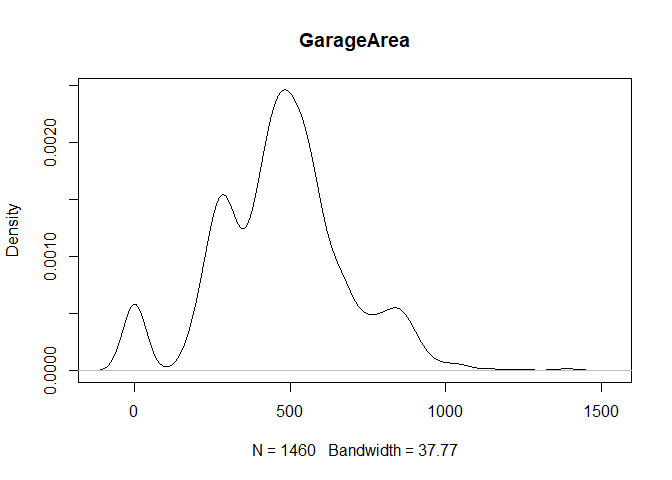

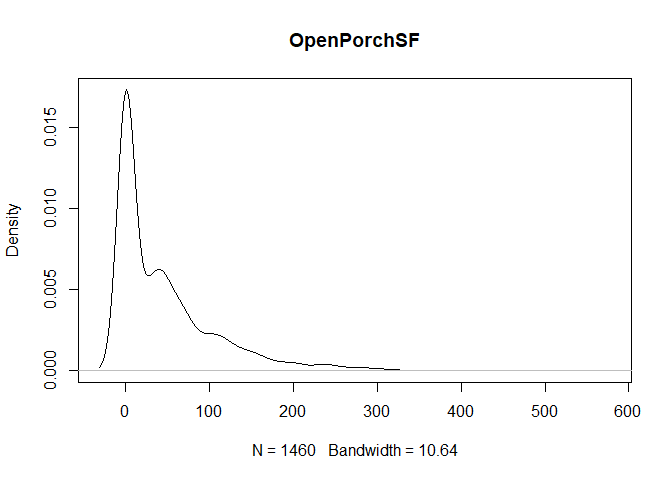

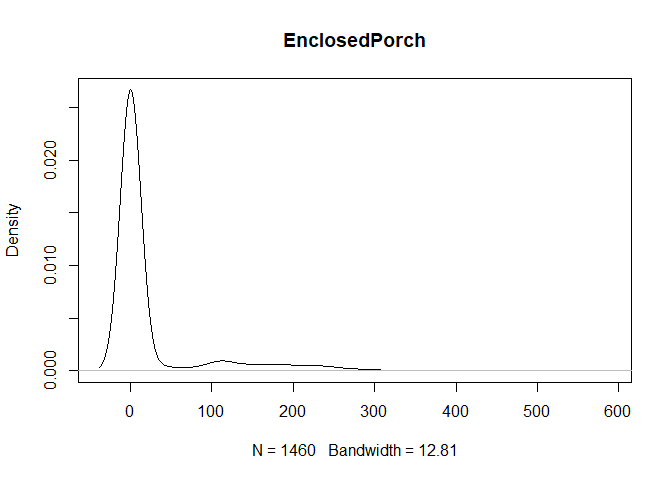

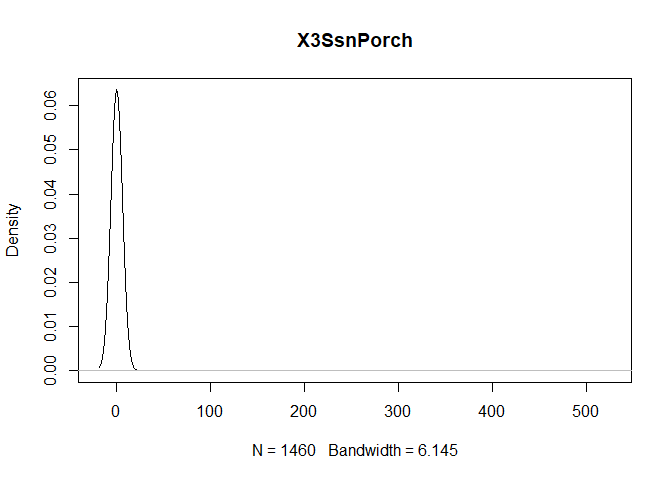

for (col in colnames(train)){

if(is.numeric(train[,col])){

plot(density(train[,col]), main=col)

}

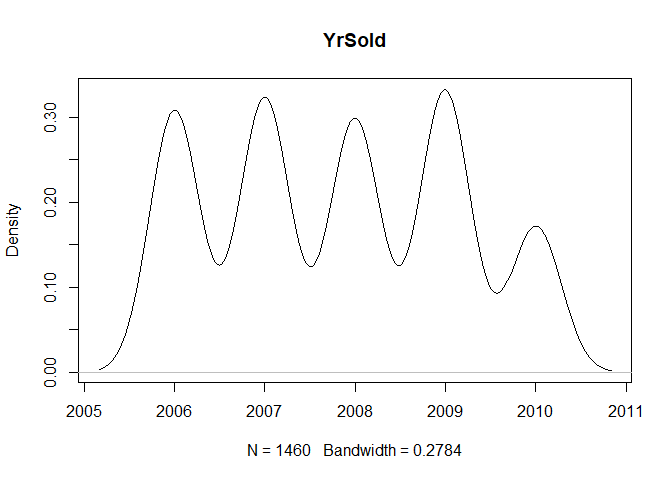

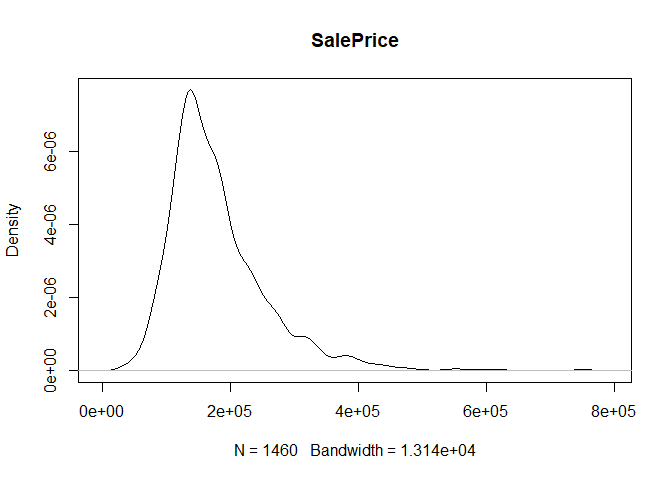

} #data shows that spring and summer sells more houses than winter, and that salepx is right skewed, meaning some houses sell higher than avg# Add variable that combines above grade living area with basement sq footage

train$total_sq_footage = train$GrLivArea + train$TotalBsmtSF

test$total_sq_footage = test$GrLivArea + test$TotalBsmtSF

# Add variable that combines above ground and basement full and half baths

train$total_baths = train$BsmtFullBath + train$FullBath + (0.5 * (train$BsmtHalfBath + train$HalfBath))

test$total_baths = test$BsmtFullBath + test$FullBath + (0.5 * (test$BsmtHalfBath + test$HalfBath))

#removing IDs

train <- select(train, -Id)

test <- select(test, -Id)This is the main aspect of this kaggle competition. I will be using gradient boosted trees, XGBoost, for the model building. There will be tuning parameters as well.

library(caret)## Warning: package 'caret' was built under R version 3.4.4

## Loading required package: lattice

library(Metrics)## Warning: package 'Metrics' was built under R version 3.4.4

library(xgboost)## Warning: package 'xgboost' was built under R version 3.4.4

##

## Attaching package: 'xgboost'

## The following object is masked from 'package:dplyr':

##

## slice

# Create custom summary function in proper format for caret

custom_summary <- function(data, lev = NULL, model = NULL){

out = rmsle(data[, "obs"], data[, "pred"])

names(out) = c("rmsle")

out

}

# Create control object

control <- trainControl(method = "cv", # Use cross validation

number = 5, # 5-folds

summaryFunction = custom_summary

)

# Create grid of tuning parameters

grid <- expand.grid(nrounds=c(100, 200, 400, 800), # Test 4 values for boosting rounds

max_depth= c(4, 6), # Test 3 values for tree depth

eta=c(0.1, 0.05, 0.025), # Test 3 values for learning rate: 0.1, 0.05, 0.025

gamma= c(0.1), #https://xgboost.readthedocs.io/en/latest/parameter.html for explanation

colsample_bytree = c(1),

min_child_weight = c(1),

subsample = c(1))

#training and development of model

xgb_tree_model <- train(SalePrice~., # Predict SalePrice using all features

data=train,

method="xgbTree",

trControl=control, #for cross validation w control

tuneGrid=grid,

metric="rmsle", # Use custom performance metric

maximize = FALSE) # Minimize the metric#Analysis of results

xgb_tree_model$bestTune #tells us the best model, is a tree with depth 4, trained 400 rounds w learning rate 0.1 (eta)## nrounds max_depth eta gamma colsample_bytree min_child_weight

## 4 800 4 0.025 0.1 1 1

## subsample

## 4 1

xgb_tree_model$results #find the RMSLE from the above model here: RMSLE = 0.1327114; the lower the better!## eta max_depth gamma colsample_bytree min_child_weight subsample

## 1 0.025 4 0.1 1 1 1

## 9 0.050 4 0.1 1 1 1

## 17 0.100 4 0.1 1 1 1

## 5 0.025 6 0.1 1 1 1

## 13 0.050 6 0.1 1 1 1

## 21 0.100 6 0.1 1 1 1

## 2 0.025 4 0.1 1 1 1

## 10 0.050 4 0.1 1 1 1

## 18 0.100 4 0.1 1 1 1

## 6 0.025 6 0.1 1 1 1

## 14 0.050 6 0.1 1 1 1

## 22 0.100 6 0.1 1 1 1

## 3 0.025 4 0.1 1 1 1

## 11 0.050 4 0.1 1 1 1

## 19 0.100 4 0.1 1 1 1

## 7 0.025 6 0.1 1 1 1

## 15 0.050 6 0.1 1 1 1

## 23 0.100 6 0.1 1 1 1

## 4 0.025 4 0.1 1 1 1

## 12 0.050 4 0.1 1 1 1

## 20 0.100 4 0.1 1 1 1

## 8 0.025 6 0.1 1 1 1

## 16 0.050 6 0.1 1 1 1

## 24 0.100 6 0.1 1 1 1

## nrounds rmsle rmsleSD

## 1 100 0.1603772 0.01366649

## 9 100 0.1335609 0.01611432

## 17 100 0.1288234 0.01514207

## 5 100 0.1600550 0.01352465

## 13 100 0.1335101 0.01512673

## 21 100 0.1319013 0.01659683

## 2 200 0.1332782 0.01544445

## 10 200 0.1283106 0.01601184

## 18 200 0.1282649 0.01518063

## 6 200 0.1341677 0.01530090

## 14 200 0.1304605 0.01646476

## 22 200 0.1315864 0.01717607

## 3 400 0.1274373 0.01535594

## 11 400 0.1270630 0.01562608

## 19 400 0.1289407 0.01491713

## 7 400 0.1313435 0.01664478

## 15 400 0.1299127 0.01672371

## 23 400 0.1317310 0.01725485

## 4 800 0.1265917 0.01536635

## 12 800 0.1272017 0.01610431

## 20 800 0.1290336 0.01478126

## 8 800 0.1310821 0.01670152

## 16 800 0.1297831 0.01677597

## 24 800 0.1318120 0.01728210

varImp(xgb_tree_model) #identify which predictors are most impt to the model## xgbTree variable importance

##

## only 20 most important variables shown (out of 270)

##

## Overall

## OverallQual 100.0000

## total_sq_footage 89.3618

## total_baths 6.6701

## YearBuilt 5.5404

## LotArea 3.9323

## BsmtFinSF1 3.3930

## X2ndFlrSF 3.2530

## GarageCars 2.8897

## YearRemodAdd 2.7266

## GrLivArea 2.2998

## GarageArea 1.9245

## OverallCond 1.7977

## Fireplaces 1.4501

## TotalBsmtSF 1.2327

## NeighborhoodEdwards 1.1427

## LotFrontage 1.0158

## KitchenQualTA 0.9489

## GarageYrBlt 0.7664

## BsmtUnfSF 0.6924

## KitchenAbvGr 0.6616

test_predictions <- predict(xgb_tree_model, newdata=test)submission <- read.csv("sample_submission.csv")

submission$SalePrice <- test_predictions

head(submission)## Id SalePrice

## 1 1461 127097.6

## 2 1462 162872.7

## 3 1463 185697.5

## 4 1464 187500.6

## 5 1465 187619.8

## 6 1466 177523.4