This repository contains analysis scripts and visualizations based on loan data from the Paycheck Protection Program, a U.S. federal relief scheme for businesses in the wake of the coronavirus pandemic.

See Technical notes for software and methods used.

Warning: This analysis is intended for demonstration and data exploration purposes only.

The Paycheck Protection Program (PPP) provides federal economic relief for the coronavirus pandemic to businesses and non-profits. The program, overseen by the U.S. Small Business Administration, is authorized to fund hundreds of billions of dollars in loans, portions of which may be forgiven if spent on eligible expenses such as payroll. The PPP has been scrutinized over issues such as excluding bankrupt borrowers and loans to nonexistent businesses.

In 2021, data from the program were released after a successful Freedom of Information Act lawsuit. ProPublica maintains a searchable database of more than 11 million loan records. The latest datasets are available from the Small Business Administration website.

Over 11 million loans were approved in the PPP, according to the released data. Only around 2% of loans went to nonprofits including nonprofit organizations, nonprofit child care centers, and 501(c)s.

Industries known to be highly affected by the pandemic, such as healthcare, construction, and hospitality were among the program's most well-represented borrowers. Professional and "other" services were approved for the most loans of any economic sectors.

Links to interactive graphics are also included.

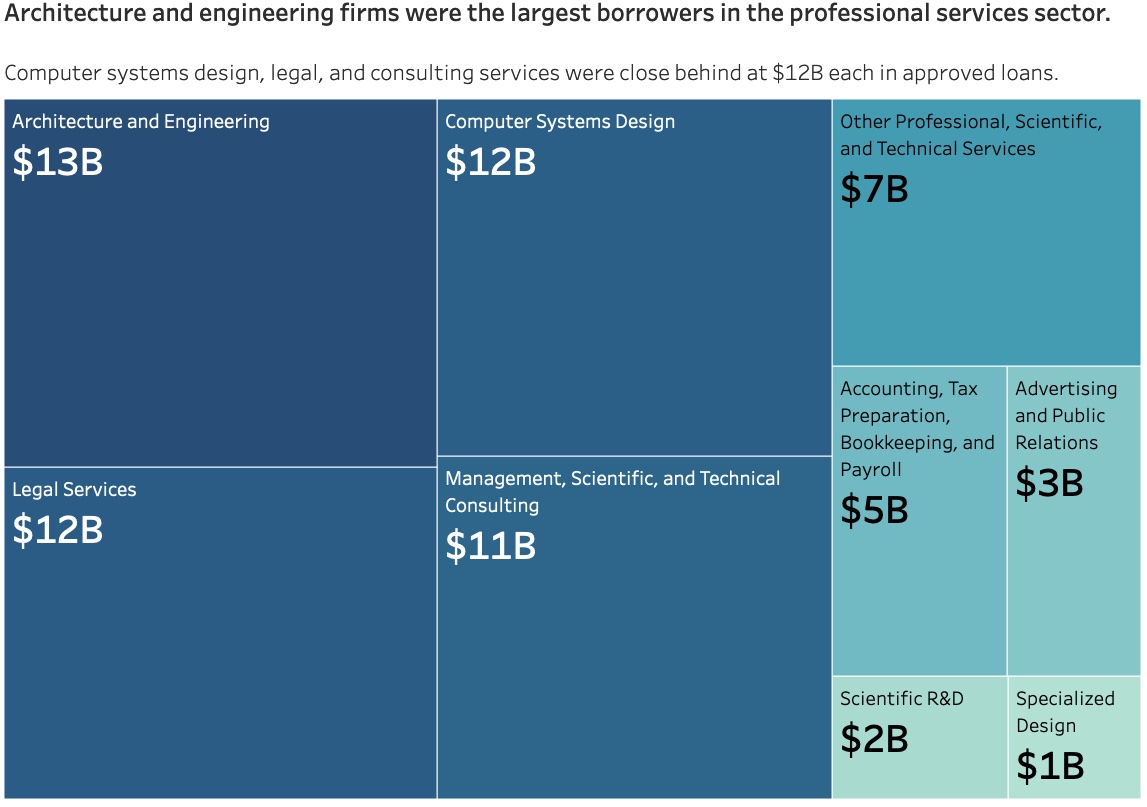

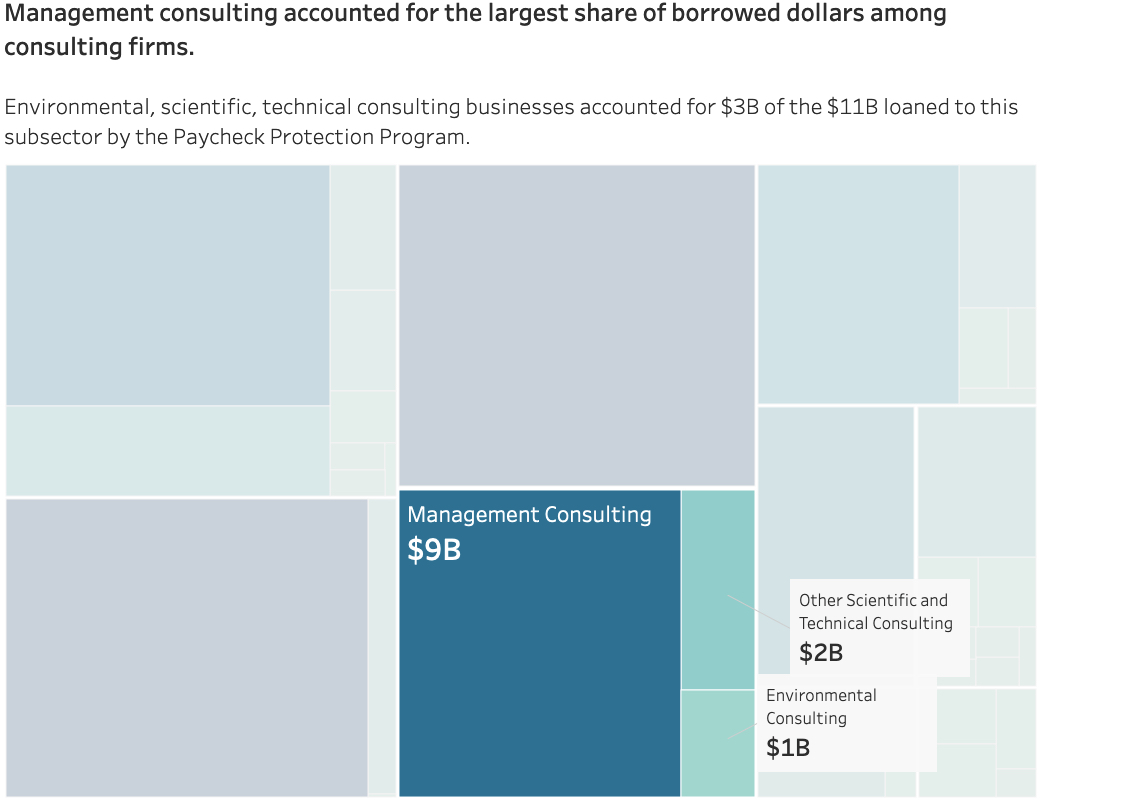

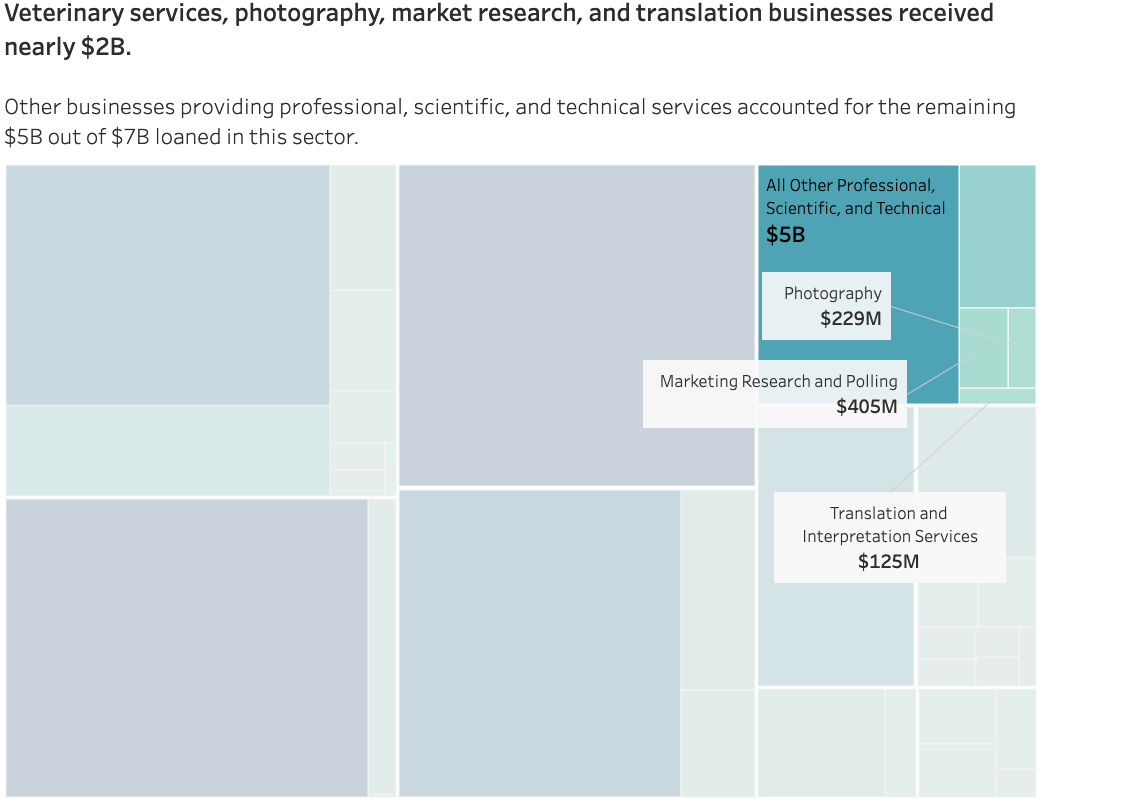

The number of loan dollars received was similar for the professional services sector as for either healthcare or construction. Yet professional services are not well-defined.

As a consultant working in data analysis services, I am interested in exploring loans to businesses in my industry. In the first level of industry classification provided, we still see two broad sectors that could be related to this kind of work.

This analysis was performed in R (see

ppp-foia-analysis.R) using PPP loan data from the

U.S. Small Business Administration and industry classification labels from

the Census Bureau.

Industry labels from 2022 were used. Linkage was checked to ensure that records without industry labels did not have valid industry information provided.

Visualizations were prepared using Datawrapper and Tableau.