Analyzed multi-year private equity data that consisted of exploring data dimensions, identifying subsets aligning with investment criteria, calculating correlation coefficients, visualizing data through scatter plots and correlation matrices, and performing data transformation for easier interpretation.

- Business Problem

- Data Source

- Methods

- Tech Stack

- Preliminary Analysis

- Quick Analysis of Results

- Installation: Simplify Your Analysis

A private equity firm has amassed a substantial dataset. They need to extract valuable insights from it to inform their investment decisions. However, the dataset is vast and complex, making it challenging to identify meaningful patterns and relationships. They require a comprehensive data exploration and analysis approach to uncover valuable information hidden within the dataset.

The objective of this project is to perform a thorough data exploration and analysis of the private equity dataset to gain a deeper understanding of the investment landscape and to understand how it differs from the current macro-economic climate. By leveraging various techniques such as filtering, correlation coefficient analysis, data visualization, and data transformation, the aim is to extract meaningful insights that can guide our investment strategies.

My goal is to:

- Explore data dimensions and variables, applying filtering techniques to identify subsets aligning with investment criteria and uncover hidden patterns and trends.

- Calculate correlation coefficients using the Pearson method, identifying significant correlations between continuous variables for insights into investment opportunities and risks.

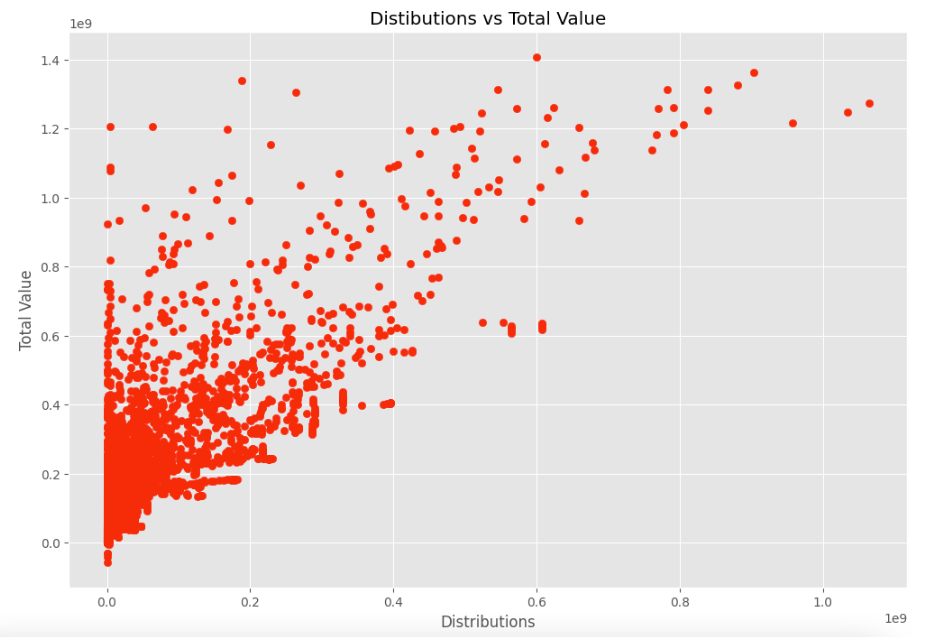

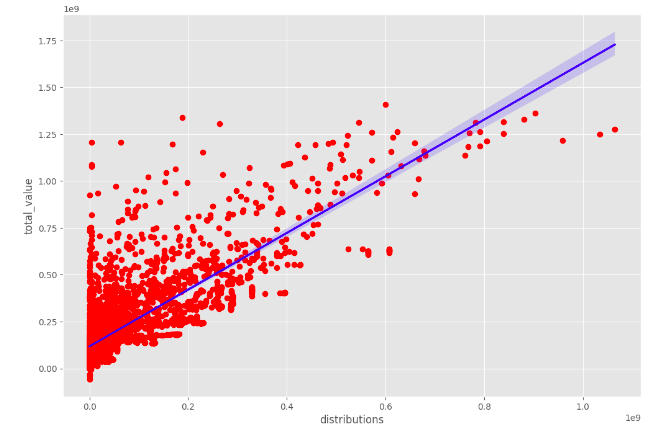

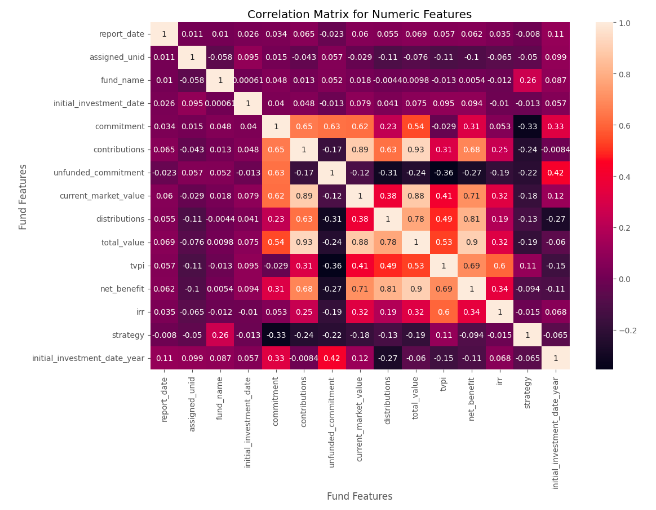

- Visualize data through scatter plots, revealing feature relationships and detecting patterns or outliers. Create a correlation matrix for numeric features to understand interrelationships.

- Perform data transformation, normalizing by converting floating-point values to integers for consistent and comparable analysis. Unstack the correlation matrix for a tabular format, facilitating easier interpretation.

Kaggle link to Private Equity Data Q1 2009 to Q2 2021

- Data Exploration

- Filtering

- Correlation Coefficient

- Pearson Correlation: This method calculates the linear relationship between two continuous variables. It measures the strength and direction of the linear association between the variables, ranging from -1 to 1.

- Data Visualization

- Scatter plots

- Correlation Matrix for Numeric Features

- Data Transformation

- Converting floats to integers to normalize the data

- Unstacking the Correlation Matrix containing Numeric Features

- Google Colab

Performed data transformations as needed, such as converting floating-point values to integers to ensure consistency and ease of comparison across variables. Unstacked the correlation matrix to transform it into a tabular format, enabling easier analysis and interpretation.

Utilized the Pearson correlation coefficient to measure the strength and direction of linear relationships between continuous variables. Identified features that exhibit significant correlations, which can offer insights into potential investment opportunities and risks.

Created visual representations of the data using scatter plots to observe relationships between variables. Visualized the correlation matrix for numeric features to gain a comprehensive overview of interrelationships. This visual exploration can provide initial insights and highlight potential trends or outliers.

- Limited to Two Variables: Scatter plots can only visualize the relationship between two variables at a time. If you have a dataset with multiple variables, you would need to create multiple scatter plots to explore relationships between different pairs of variables.

- Non-linear Relationships: Scatter plots are most effective at capturing linear relationships between variables. They may not accurately represent non-linear or complex relationships, potentially leading to misleading interpretations.

- Lack of Contextual Information: Scatter plots typically focus on the relationship between variables but may lack contextual information such as time, categories, or other factors that could influence the relationship. This limitation can limit the depth of analysis.

- Limited to Numerical Variables: Correlation matrices are primarily used to analyze the relationship between numerical variables. They may not be applicable or informative for categorical or ordinal variables.

- I had assumed by converting the non-numeric objects to numeric data types might help to display a new relationship in the results but the findings did not provide evidence in support of my initial hypothesis.

- Assumes Linear Relationships: Correlation coefficients, such as the Pearson correlation, assume linear relationships between variables. If the relationship is non-linear or the data distribution is not symmetric, the correlation coefficient may not accurately capture the true relationship.

- Lack of Causation: Correlation measures the strength and direction of the relationship between variables but does not establish causation. A high correlation does not necessarily imply a causal relationship, as other confounding factors may be at play.

- Statistical Analysis: I will look to employ a wider range of statistical techniques to explore relationships and patterns in my data. This could include regression analysis, ANOVA (analysis of variance), chi-square tests, time series analysis, clustering algorithms, or predictive modeling.

- Feature Engineering: I may look to create new features or variables from existing data to capture additional insights. Transformations, aggregations, or creating derived variables can provide a deeper understanding of the underlying patterns and relationships in your dataset.

- Data Enrichment: I will look to augment existing dataset with additional relevant data sources to gain a broader perspective. External data, such as economic indicators, demographic information, or industry-specific data, can provide valuable context and enhance the depth of analysis.

- Advanced Machine Learning Techniques: I may consider applying advanced machine learning algorithms to identify complex patterns or make predictions. Techniques such as decision trees, random forests, support vector machines, or neural networks can uncover hidden relationships and generate more accurate predictions.

- Open your web browser and go to the Google Colab homepage at https://colab.research.google.com/.

- Click on "File" > "New notebook" to create a new Colab notebook.

- In the first cell of the notebook, enter the following code to clone the repository:

!git clone https://github.com/ima-projects/Private_Equity_Data_Analysis.git- Run the code cell by clicking on the "Play" button or by pressing "Shift+Enter".

- Once the repository has been cloned, navigate to the cloned repository folder by entering the following code in a new cell to ensure you are in the correct folder:

%cd Private_Equity_Data_Analysis/-

Run the code cell by clicking on the "Play" button or by pressing "Shift+Enter".

-

Import dependencies e.g pandas, numpy, seaborn and matplotlib

-

Run the code cell by clicking on the "Play" button or by pressing "Shift+Enter".

You can now start working with the project in Google Colab. You can open and modify files, run scripts, and execute commands as you would in a local environment.

- Open your web browser and go to the Jupyter website at https://jupyter.org/.

- Click on "Install" to access the installation instructions for Jupyter notebooks. Follow the instructions for your operating system to install Jupyter on your local machine.

- Once Jupyter is installed, open a command prompt or terminal and navigate to the directory where you want to store your notebook files.

- Enter the following command to clone the repository:

git clone https://github.com/ima-projects/Private_Equity_Data_Analysis.git- Navigate to the cloned repository folder by entering the following command in the command prompt or terminal to ensure you're in the correct folder:

cd Private_Equity_Data_Analysis/-

Import or install dependencies e.g pandas, numpy, seaborn and matplotlib

-

Run the Jupyter notebook server by entering the following command in the command prompt or terminal:

jupyter notebook

This will start the Jupyter notebook server and open a web browser window displaying the Jupyter dashboard.

- Click on the notebook file you want to run to open it in a new tab in the web browser.

- In the notebook, you can execute each cell by clicking on it and then clicking on the "Run" button in the toolbar, or by pressing "Shift+Enter".

- You can modify the notebook code and execute it as you see fit.