- Background

- Motivation

- Wrangling Customer Data

- Processing & Analyzing the Data

- Model Selection

- Train & Evaluate Models

- HyperParameter Tuning

- Predictions

- CBCV Calculations

- Valuation Comparisons

- Opportunites going forward

- Lessons Learned

- Appendices

- Additional Imagery

- Works cited

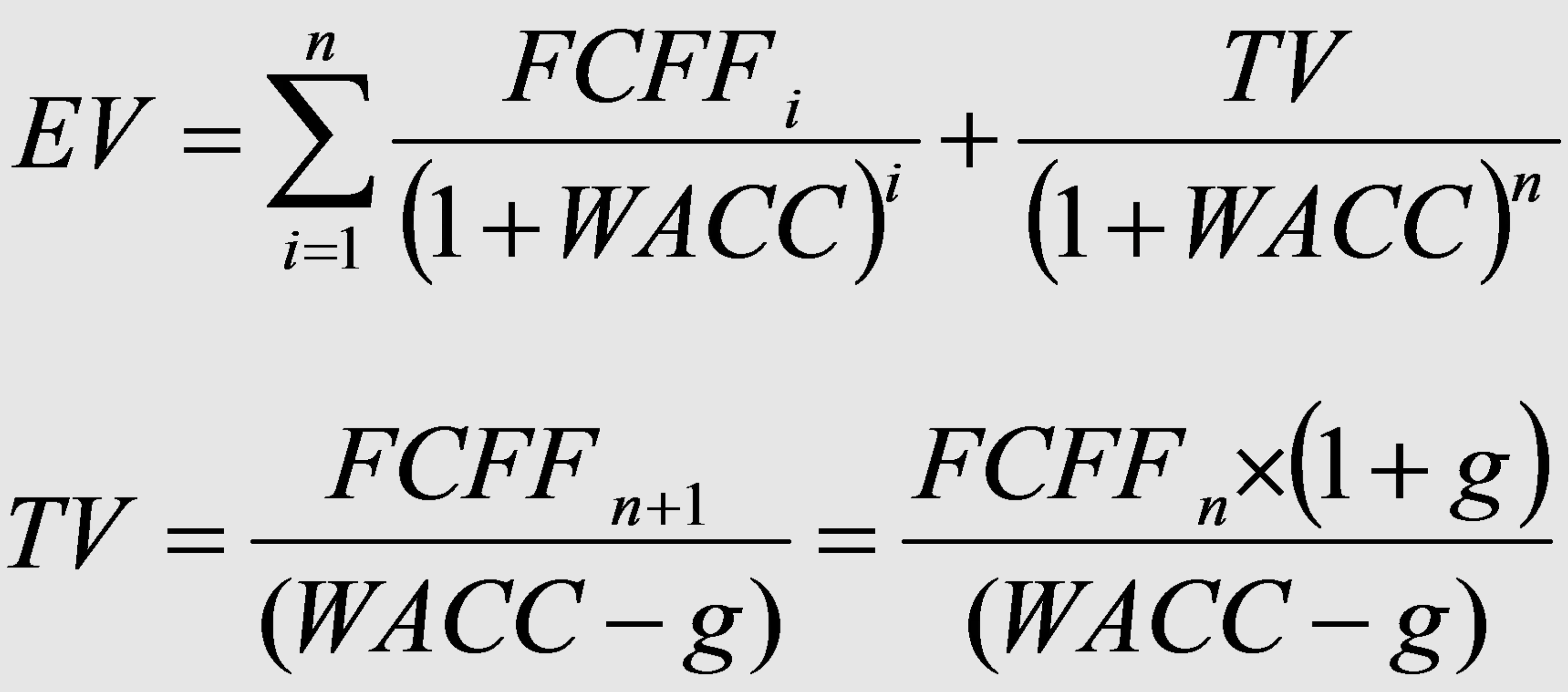

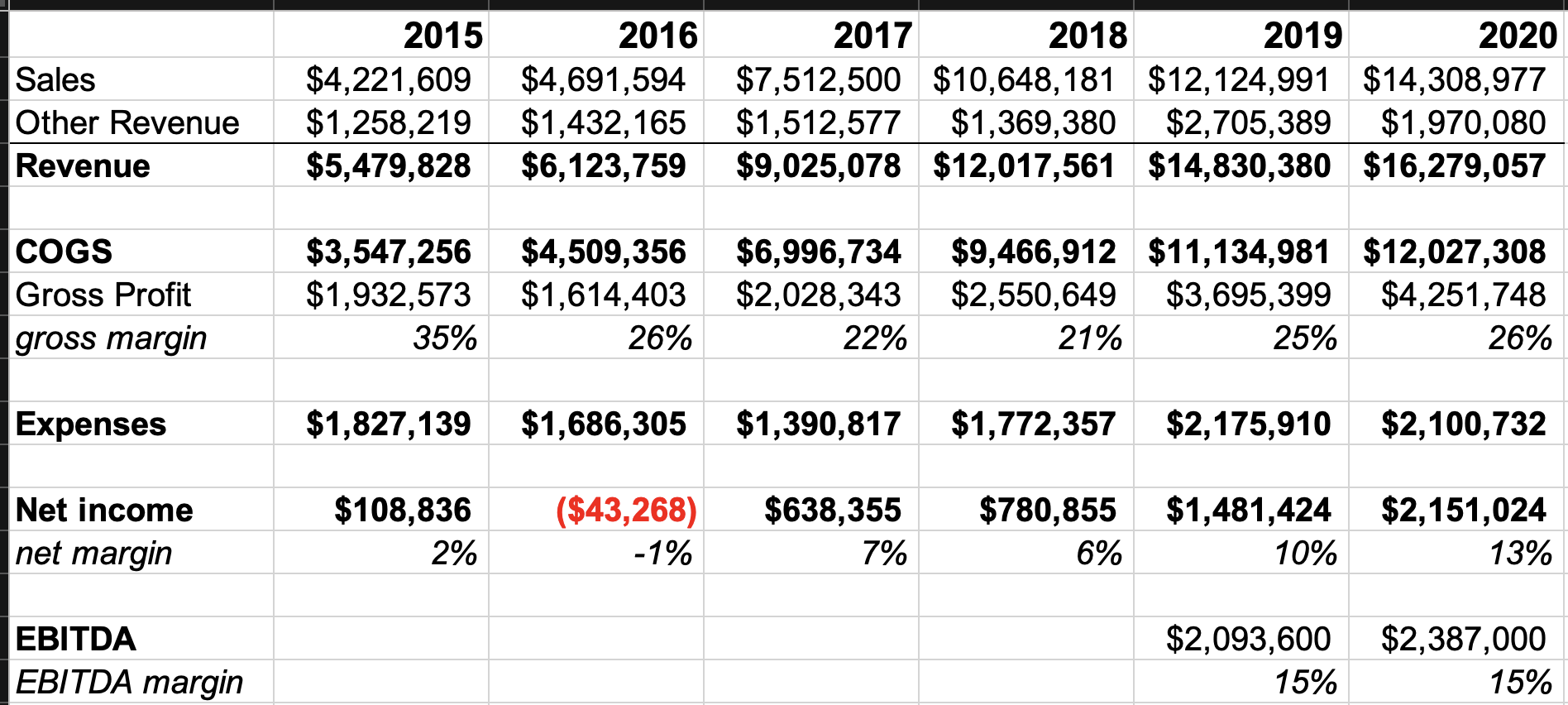

Company valuation traditionally has been calculated two ways

- Discounted Cash Flow (DCF): a frequentist approach to project historical revenues, growth and cashflow numbers forward then discounting them for todays value of money.

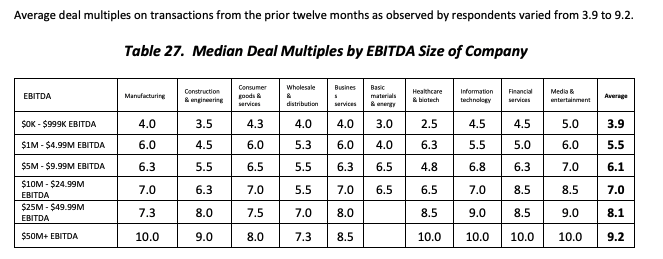

- Market Multiple: similar to pricing a home:

- Home Price = Total SQFT * $ per SQFT from comparable homes that recently sold or are on the market

- Company Valuation = EBITDA * Market Multiple

- See "Median Deal Multiples from Pepperdine's 2020 Middle Market report:

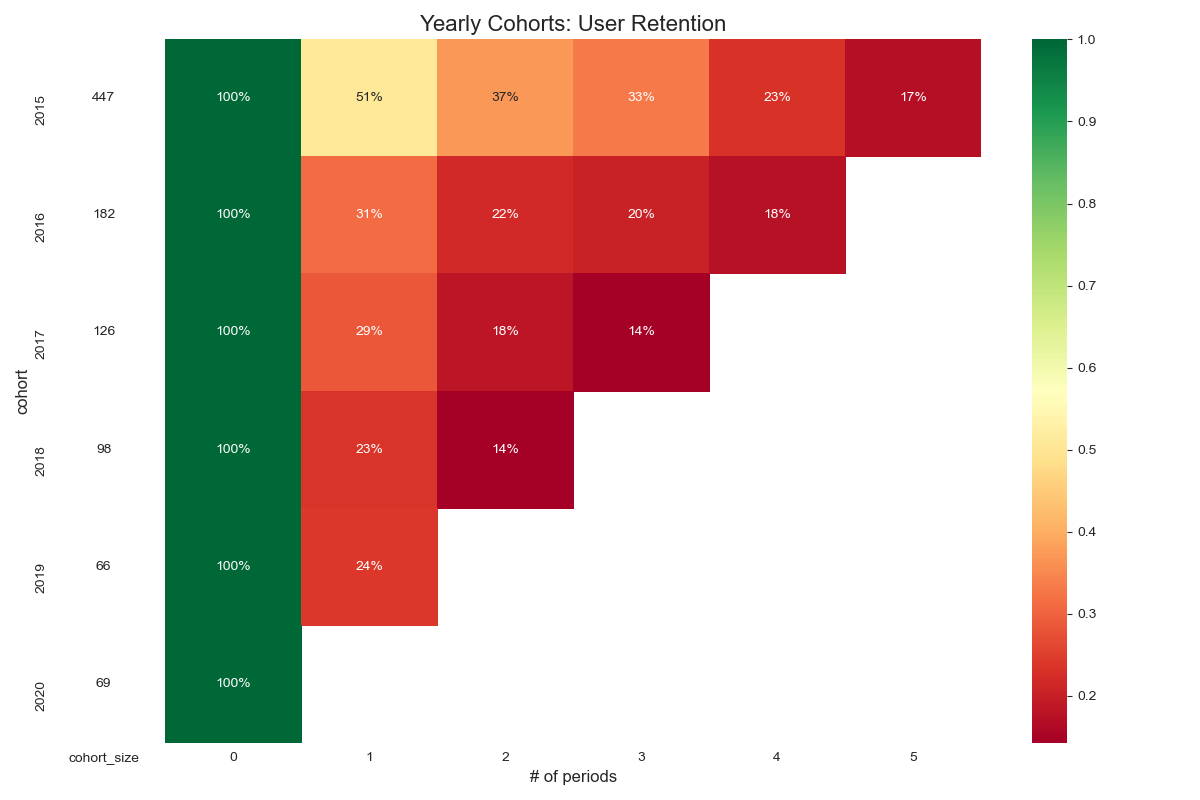

Now With data science we can better predict revenues, growth and cashflows by segmenting customers into cohorts to:

- Model churn and retention rates for each cohort

- Model expected future amount of transactions

- Model expected average sales per transaction

- Model number of new customers per year

- Calculate average profit margin per customer

- Calculate cash flows from customers aka Customer Life Time Values (CLTV)

- Calculate sum of CLTVs by period cohorts to provide Future Cash Flows that can be discounted to todays value

This advanced analytics approach is called Customer-Based Corporate Valution (CBCV) trademarked to Theta Equity Partners, https://www.thetaequity.com/.

Curiousness to see how the advanced analytics CBCV compares to DCF or Market Multiple valuation approach for a lower middle market company.

Financial engineering has long been the hallmark of investment firms but with the combination of Data Science and the Customer-Based Corporate Valuation (CBCV) approach they have the ability to add "Customer engineering" as another distinguishable charecteristic.

- CBCV approach focuses on the purpose of business, building and retaining customers

- CBCV approach compared to alternative valuation approaches provides a more useful handover from the deal team to the operations team

- CBCV segmentation can be implemented into Customer Relationship Management (CRM) and marketing tools

- CBCV approach emphasis customer service as the long tail customer provide the most value in terms of customer equity and cashflow

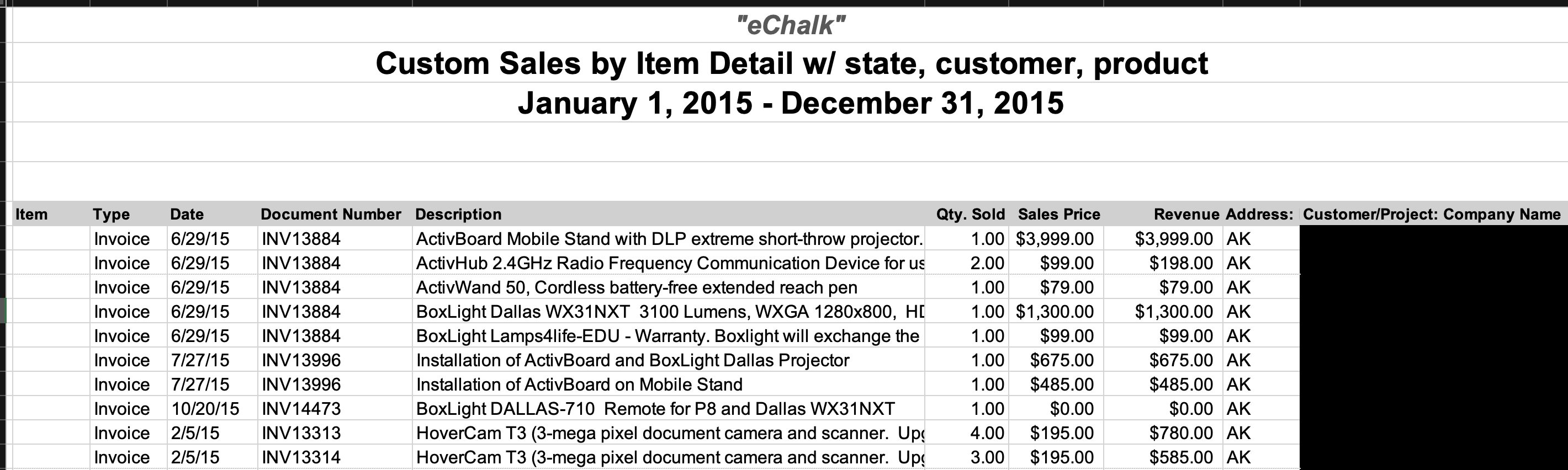

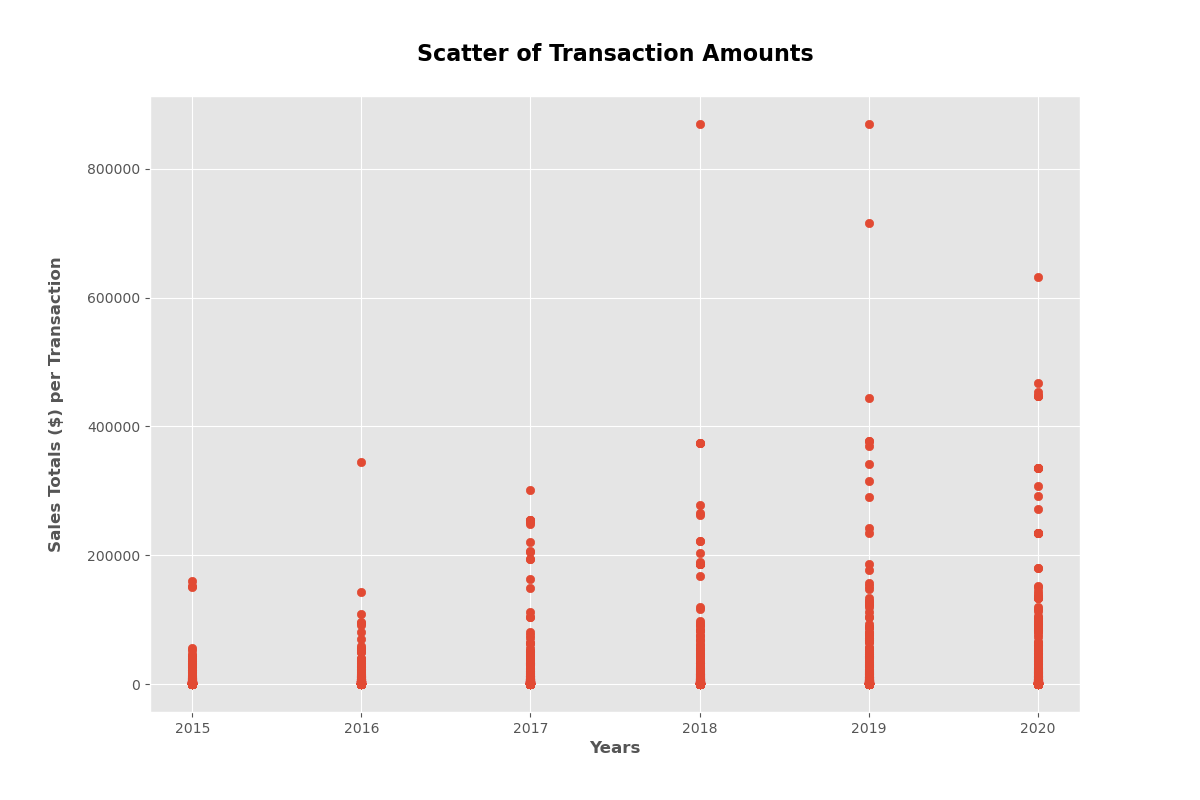

Company: "eChalk" is a supplier and installer of smart school equipment such as "smart boards"

Dataset: 6 years of customer transaction history

Report example:

Company Financials:

- $16,279,057 Revenue (trailing twelve months)

- 26% Gross Profit Margin

- $2,387,000 EBTIDA (trailing twelve months)

- 0.25 WACC

- 0.02 Monthly Discount Rate

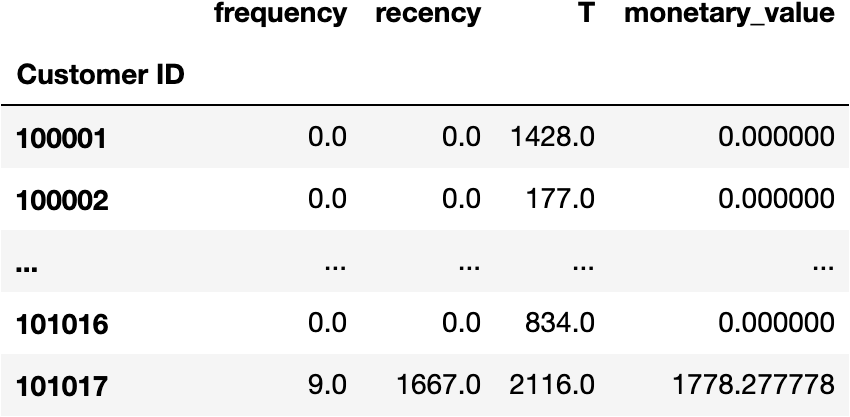

To find CLTV we transform sales data to a RFM dataset:

- Frequency represents the number of repeat purchases the customer has made. This means that it’s one less than the total number of purchases.

- Recency represents the age of the customer when they made their most recent purchases. This is equal to the duration between a customer’s first purchase and their latest purchase. (Thus if they have made only 1 purchase, the recency is 0.)

- T represents the age of the customer in whatever time units chosen (daily, in our dataset). This is equal to the duration between a customer’s first purchase and the end of the period under study.

- Monetary_Value Total amount of Money the Customers has spent

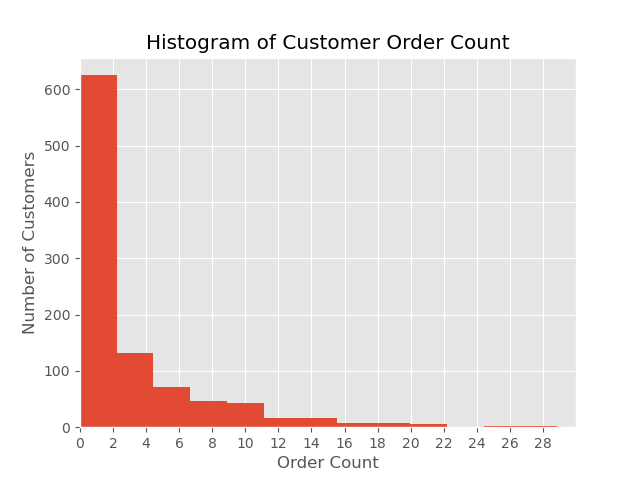

988 unique customers

340 are repeat customers i.e. more than one purchase

34.4% are repeat customers

Transactions per year

avg sales per transaction 6 yrs

avg sales per transaction 2020

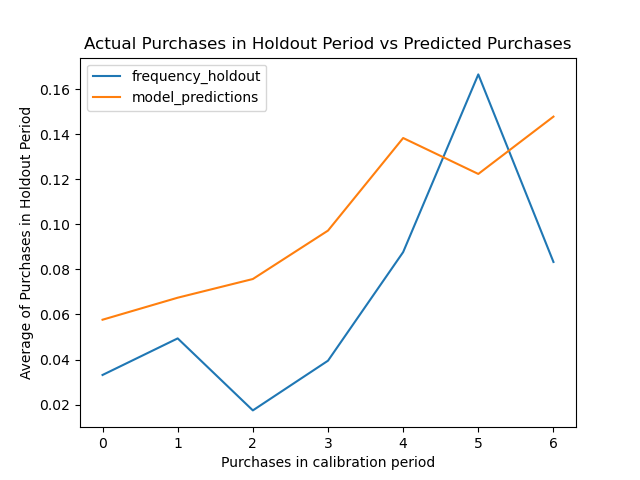

A) To predict Frequency (Number of Transactions) & Recency (Prob Alive)

B) Predict Monetary Value (Avg Sales per Transaction)

C) A * B = Sales/yr in order to forecast sales

- T = days

- time = year

- any additional

- train on 2015-2019

- holdout should be 2020

| Model | Frequency | Recency | Monetary_Value | Output |

|---|---|---|---|---|

| DISCRETE | ||||

| BG/NBD | X | Pred_Txn | ||

| BG/NBD | X | Prob_Alive | ||

| Gamma-Gamma | X | Exp_Avg_Sales | ||

| NON-DISCRETE | ||||

| Pareto/NBD | ||||

| POP+POISSON | ||||

| MBG/NBD | ||||

| TBD | ||||

| BG/BB |

use Cross Validation Grid Search train on training data then evaluate on test data

t =

t =

t =

holdout =

holdout =

Cohorts | Exp. Avg Value of Sales | * | Exp. Txn| * |Retention | = | LTV | * |Profit Margin | = |CLTV | \ | WACC |= |(PV) CLTV

Einstein's quote on 55 minutes of an hour to solve a problem

McCarthy papers

Fader papers

Hardie notes & papers

lifetimes package: https://lifetimes.readthedocs.io/en/latest/index.html

Analytics Vidhya CLTV guide: https://www.analyticsvidhya.com/blog/2020/10/a-definitive-guide-for-predicting-customer-lifetime-value-clv/

Modelling CLTV for Non-Contractual Business with Python: https://towardsdatascience.com/whats-a-customer-worth-8daf183f8a4f

Cohort Analysis: https://towardsdatascience.com/a-step-by-step-introduction-to-cohort-analysis-in-python-a2cbbd8460ea

https://www.kdnuggets.com/2018/05/general-approaches-machine-learning-process.html

https://www.tablesgenerator.com/markdown_tables