install.packages('tidyquant')

install.packages('fpp2', dependencies=TRUE)

library(tidyquant)

library(fpp2)

library(ggplot2)# Get training data

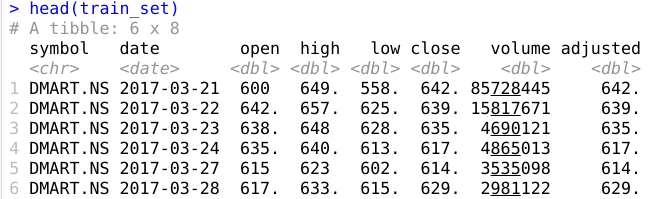

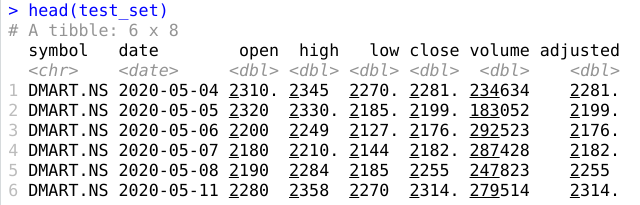

train_set = tq_get('DMART.NS', from='2014-01-01', to='2019-12-31', get='stock.prices')

test_set = tq_get('DMART.NS', from='2020-05-01', to='2020-05-31', get='stock.prices')head(train_set)head(test_set)train_set %>%

ggplot(aes(x = date, y = adjusted)) +

geom_line() +

theme_classic() +

labs(x = 'Date',

y = "Adjusted Price",

title = "[train] DMART price chart") +

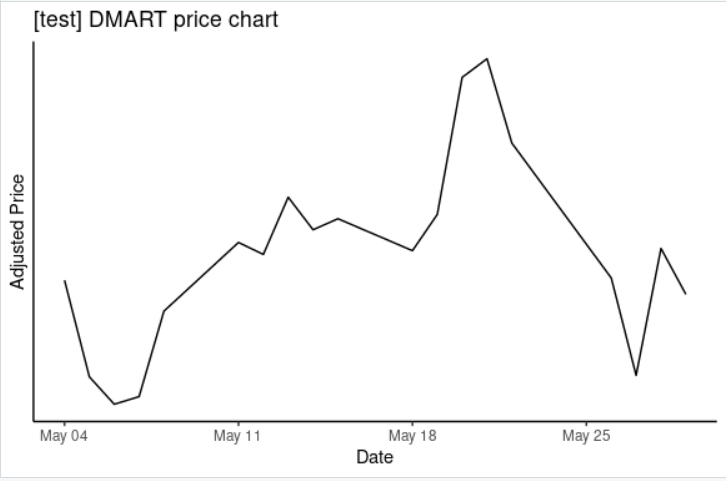

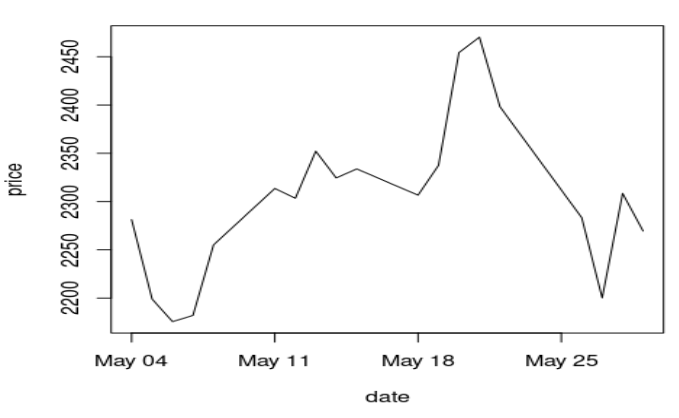

scale_y_continuous(breaks = seq(0,300,10))test_set %>%

ggplot(aes(x = date, y = adjusted)) +

geom_line() +

theme_classic() +

labs(x = 'Date',

y = "Adjusted Price",

title = "[test] DMART price chart") +

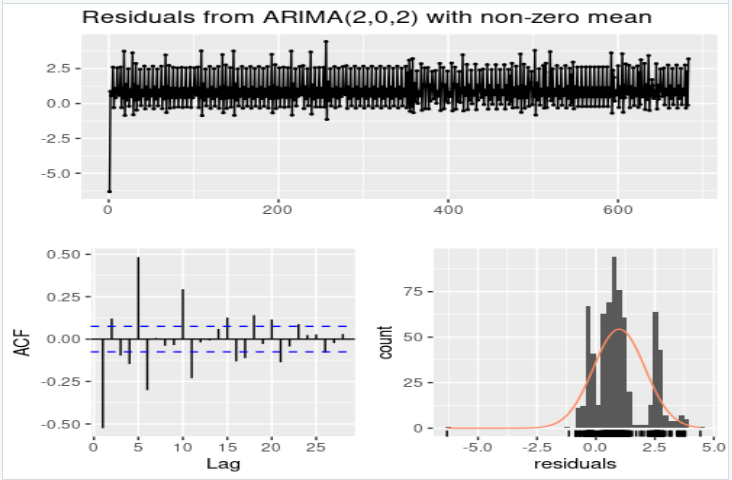

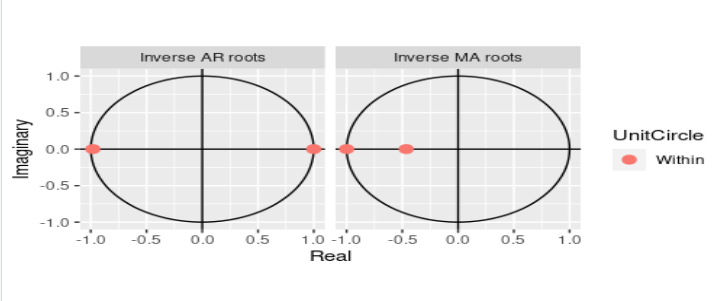

scale_y_continuous(breaks = seq(0,300,10))We are using order 2

train_cleaned = subset(train_set, select = -c(close, high, low, open, symbol, volume))

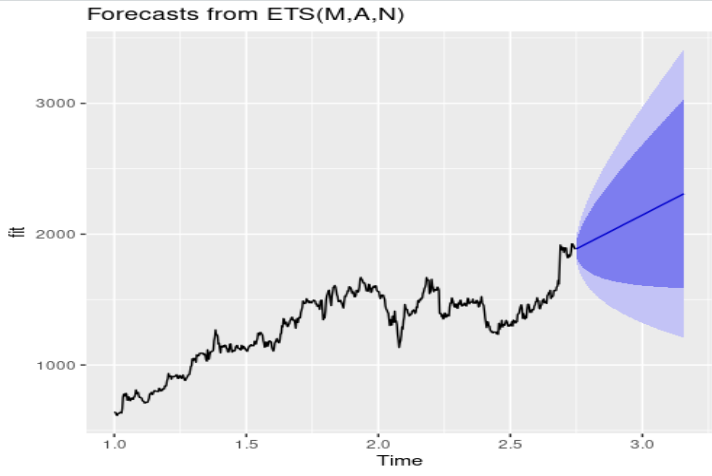

(fit <- data=train_cleaned )autoplot(fit)autoplot(forecast(fit, h=150))Plot of test data

Forecast of fit shows that the price of NSE:DMART potentially lies approximately between 1600 and 3000. Throughout the test period it can be seen that the price lies between 2100 and 2500, which is a subset of 1600-3000.